Auto Balance Conversion Program

Description

How to fill out Complaint Regarding Trover And Conversion Of Auto By Mechanic?

Creating legal documents from the ground up can occasionally be daunting.

Certain situations may require extensive research and significant financial resources.

If you seek a more straightforward and cost-effective method for producing Auto Balance Conversion Program or other forms without unnecessary complications, US Legal Forms is always available to you.

Our online library of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal matters.

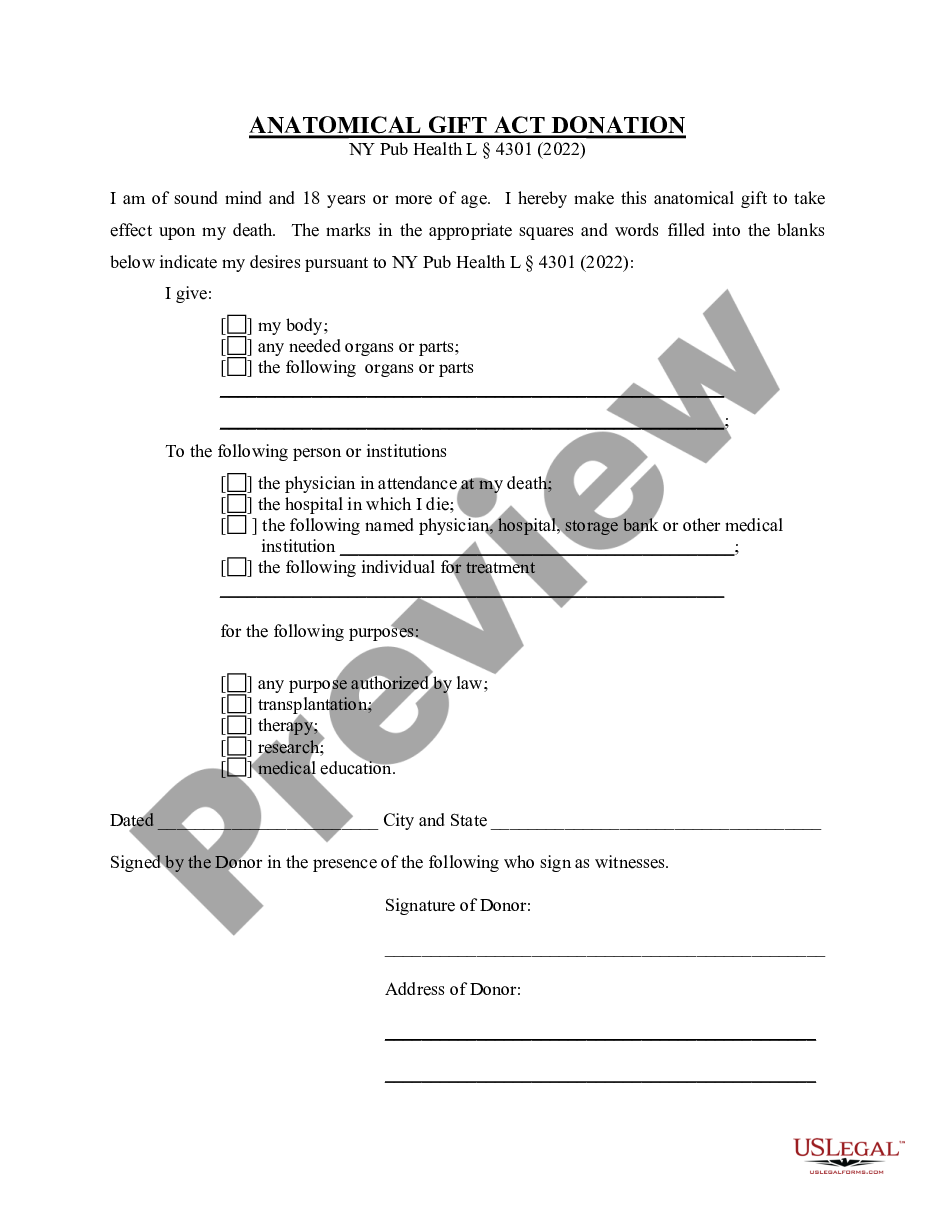

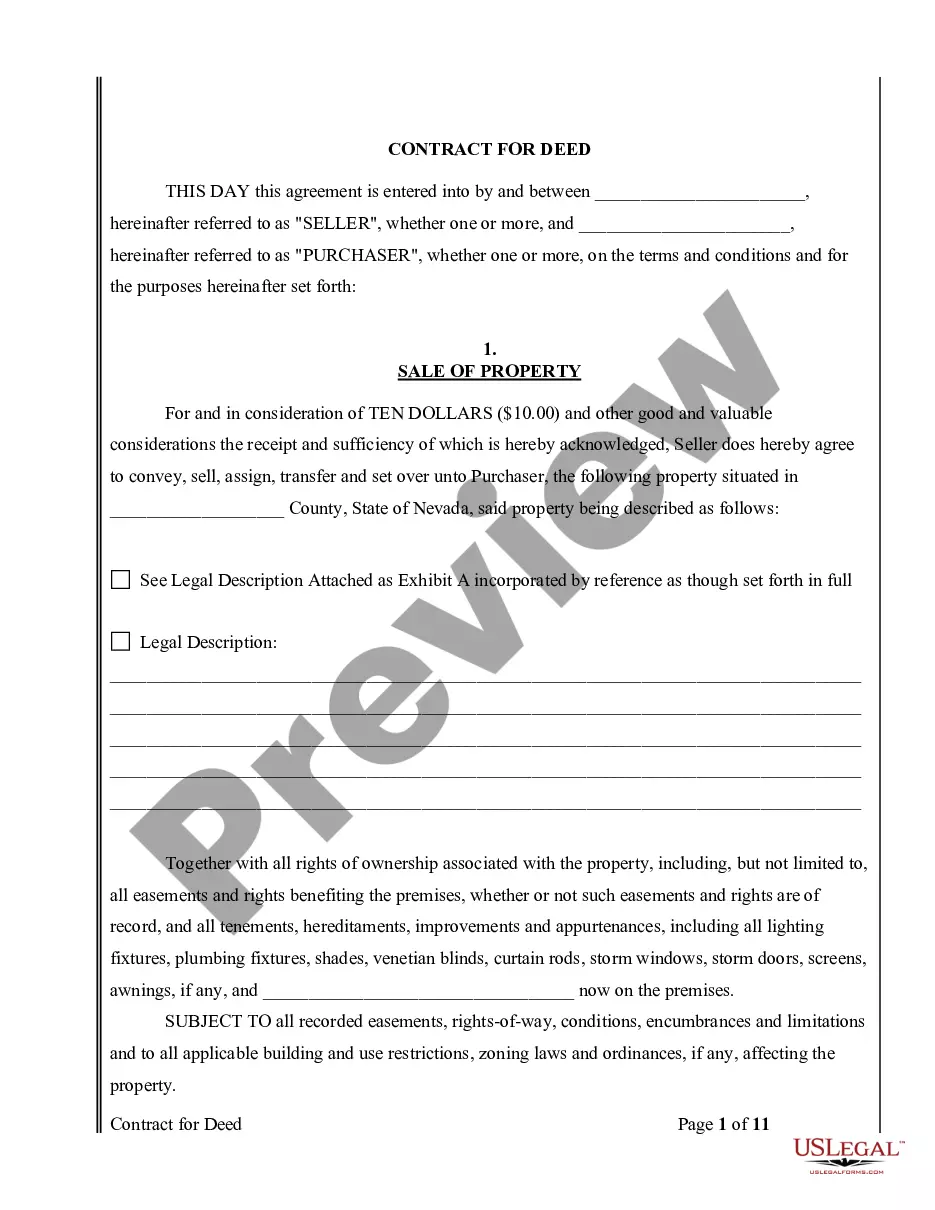

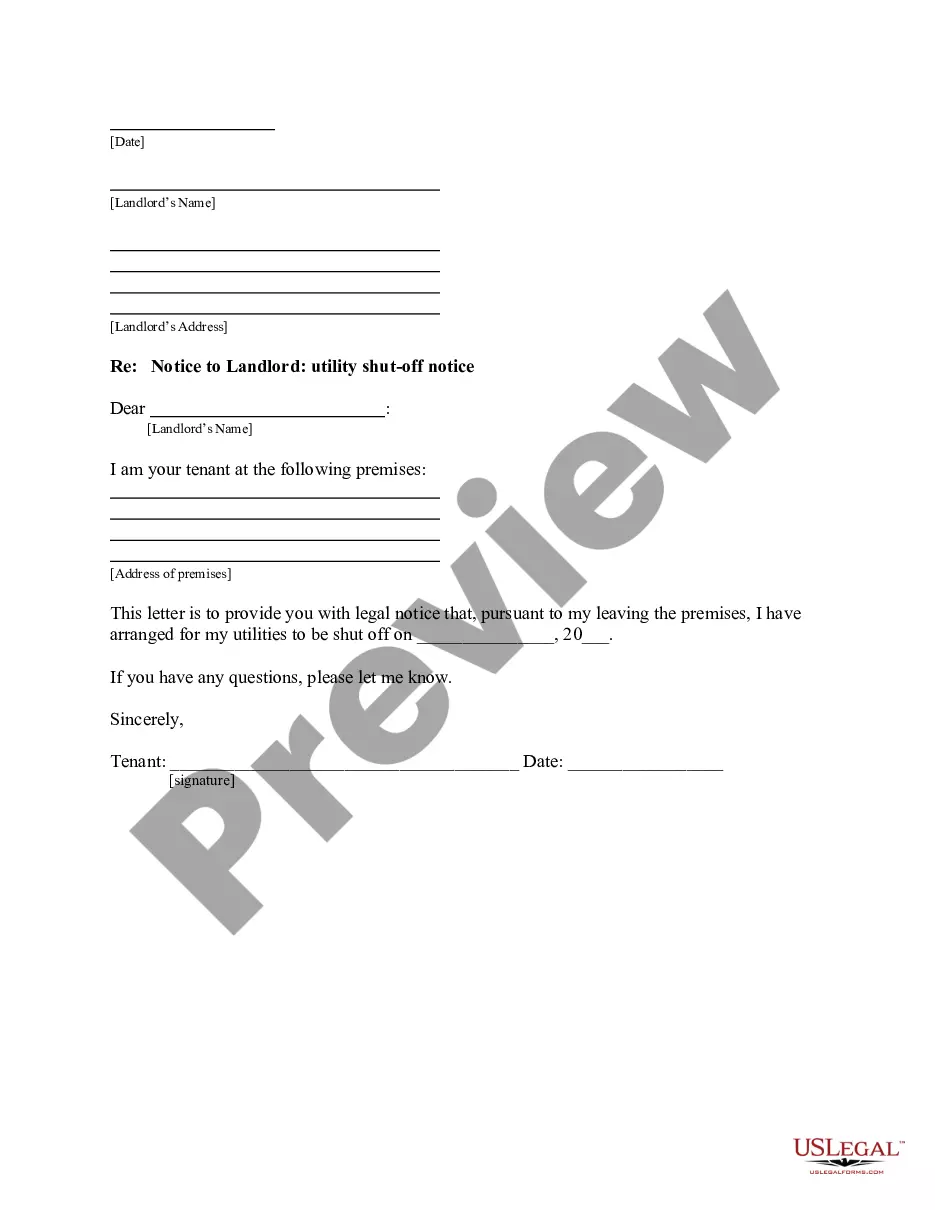

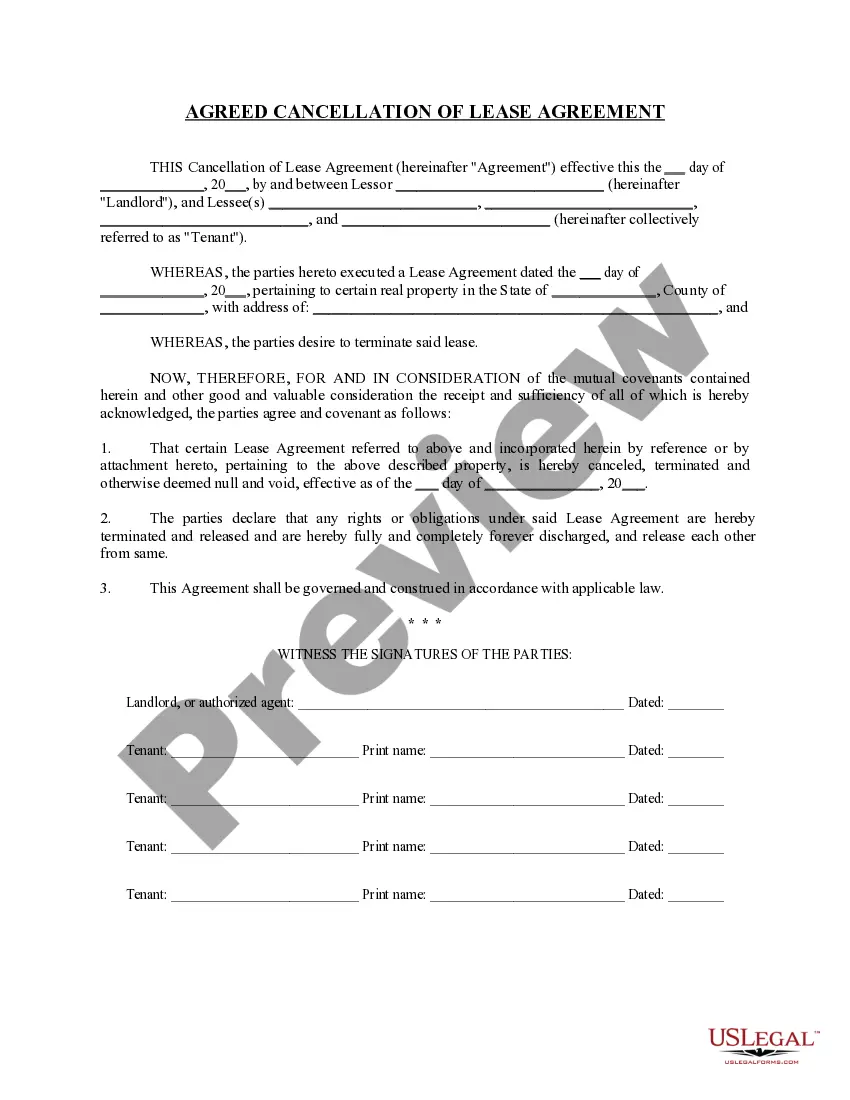

Review the form preview and descriptions to ensure you have identified the form you need. Confirm that the template you choose adheres to the stipulations of your state and county. Select the appropriate subscription tier to acquire the Auto Balance Conversion Program. Download the form, then fill it out, validate, and print it. US Legal Forms enjoys a solid reputation and over 25 years of experience. Join us now and simplify your document management process!

- With just a few clicks, you can promptly obtain state- and county-compliant forms meticulously created for you by our legal professionals.

- Utilize our service whenever you need dependable solutions that allow you to easily locate and download the Auto Balance Conversion Program.

- If you’re already familiar with our website and have set up an account, simply Log In to your account, find the template, and download it, or re-download it at any point from the My documents section.

- Not an account holder? No problem. It only takes a few minutes to register and explore the catalog.

- But before diving into downloading the Auto Balance Conversion Program, please follow these guidelines.

Form popularity

FAQ

Auto balance conversion means adjusting your financial account balances automatically, helping you maintain control without constantly monitoring them. This program simplifies the process of managing your finances by automating necessary conversions based on predefined conditions. With the auto balance conversion program, you gain more freedom to focus on achieving your financial goals.

Auto conversion refers to an automated process where your account settings or balance adjust based on specific criteria and behaviors. This ensures that your financial transactions align with your financial goals without manual intervention. The auto balance conversion program streamlines these adjustments, making it easier for you to manage your finances effectively.

To apply for the UOB auto balance conversion, start by visiting the UOB website or contacting their customer service. You will typically need to provide personal information and details about your current credit card balance. Once your application is approved, the auto balance conversion program can begin, helping you manage your finances more effectively.

To cancel your balance conversion with HSBC, you need to contact their customer service or log into your online banking account. Follow the provided instructions for cancellation, which may include completing a form or confirming your identity. Ensure you understand any potential fees or implications before finalizing the cancellation.

Converting your credit card balance can be an excellent option, especially if you aim to lower your interest costs. The auto balance conversion program can provide a structured payment plan that enhances your budget management. Before making a decision, consider your financial situation and long-term goals to determine if this program fits your needs.

Auto balance conversion is a service that streamlines how you handle your credit card balances. It enables you to convert existing balances into a fixed payment schedule, simplifying your financial management. This program aims to reduce your interest expenditures and support a more organized repayment process.

The auto balance conversion program for HSBC is designed to help customers manage their credit card balances more effectively. This program allows users to convert outstanding balances into monthly installments, providing predictability in payments. By enrolling in this program, you can enjoy better budgeting and financial planning.

Credit card balance conversion allows you to convert your existing credit card balance into a structured payment plan. This program typically involves setting a fixed repayment schedule with lower interest rates. By utilizing an auto balance conversion program, you can simplify your monthly payments and potentially save on interest costs.

A balance conversion plan is a financial strategy that allows you to change your existing credit card balance into an installment payment format. With an auto balance conversion program, you can simplify your repayment process by outlining fixed monthly payments for a set duration. This plan not only aids in managing your debt but can also help improve your credit score over time. If you're interested in exploring this option, platforms like USLegalForms can provide you with the necessary legal documents and guidance.

To convert your BSN credit card to an installment plan, you can start by contacting your bank or financial institution directly. They will provide you with the details of their auto balance conversion program, including the required steps and necessary documentation. This program allows you to spread your payments over a set period, making it more manageable for your budget. Additionally, you can consider using online platforms like USLegalForms to find helpful resources on installment plan agreements.