What Is An Information Statement

Description

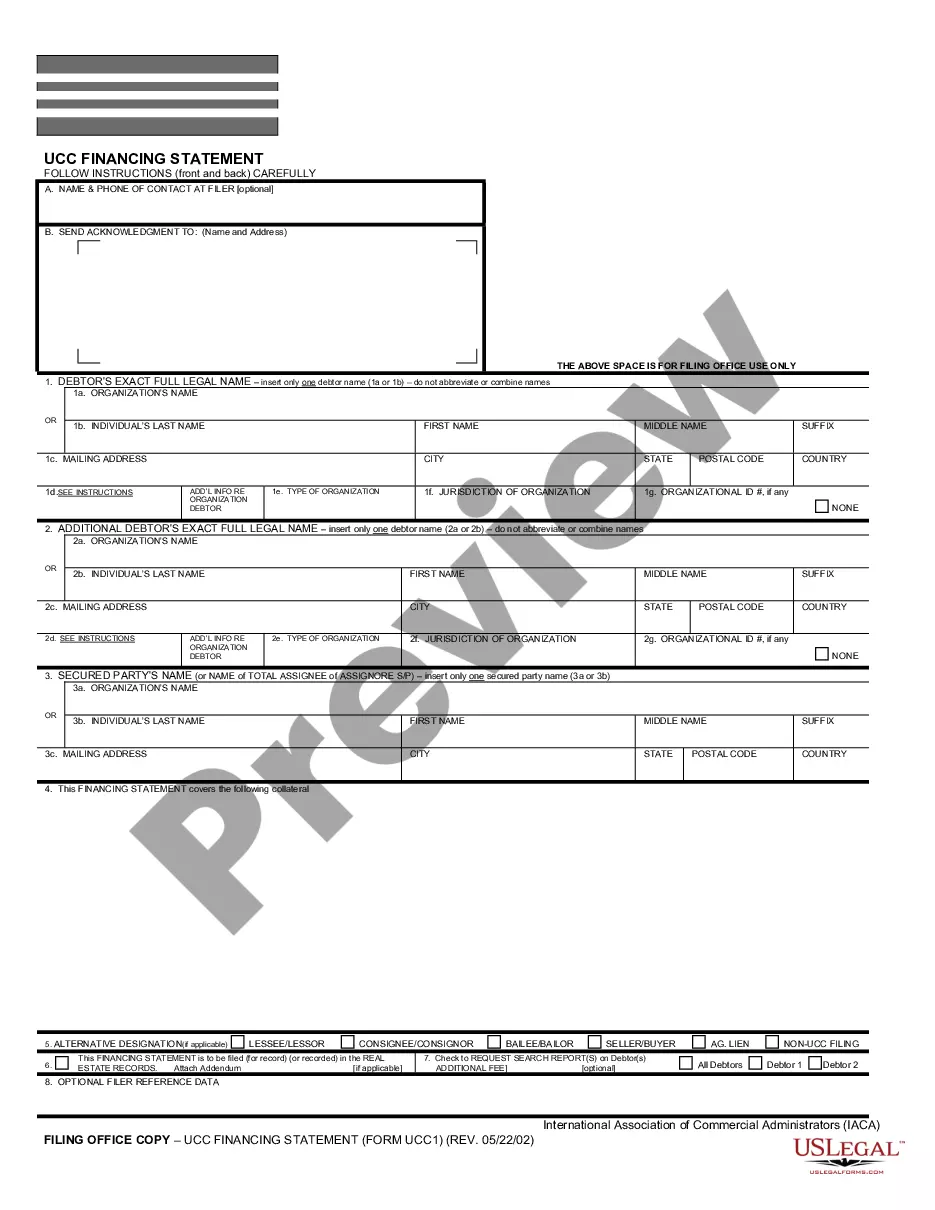

How to fill out Information Statement - Common Stock?

- If you're an existing user, log in to your account and download the desired form directly to your device. Ensure your subscription is active; renew it if necessary.

- For first-time users, start by checking the Preview mode and form description. Confirm that the chosen template meets your requirements and adheres to your local jurisdiction's standards.

- Should you need a different document, utilize the Search tab to locate the appropriate template. If the one you find is suitable, proceed to the next step.

- Click on the Buy Now button to purchase your document and select a preferred subscription plan. Register an account to access the full library of resources.

- Complete your purchase by entering your credit card information or opting for PayPal to finalize your subscription.

- Once done, download your form and save it onto your device. You'll also have access to it anytime from the My Forms section of your profile.

By using US Legal Forms, you can leverage an extensive library with over 85,000 forms, ensuring you find the right template for your specific needs.

Empower your legal journey today—start with US Legal Forms and simplify your document creation!

Form popularity

FAQ

A tax information statement is a document provided to taxpayers to report income and other important financial data to tax authorities. This statement plays a significant role during tax season, ensuring that you have all necessary information for accurate reporting. So when you think about tax season, you might be asking, what is a tax information statement?

An annual information statement is a required filing that businesses submit to provide updated information about their operations and corporate structure each year. This document is crucial for maintaining compliance and keeping stakeholders informed. If you find yourself questioning, what is an annual information statement, it’s essential for your business’s legal health.

If you do not file a statement of information, your company may face penalties and could lose its good standing with the state. This oversight could lead to the suspension of your business operations. Understanding the implications, you might be asking yourself, what happens if I don't file a statement of information?

An example of an information return is the IRS Form 1099. This form is used to report various types of income other than wages, salaries, and tips. If you’re curious about how income details are shared with tax authorities, you might wonder, what is an information return?

An information statement sec refers to a formal document that a company submits to the Securities and Exchange Commission (SEC) that provides essential details about its operations. This document aids in transparency and informs investors about a company's activities. If you're looking to understand corporate finances better, you're likely asking, what is an information statement sec?

The information statement on Schedule 14C is a regulatory filing that companies use to report information to shareholders. It typically accompanies matters like shareholder votes for actions not requiring a formal proxy statement. Understanding this document is vital for investors and stakeholders. By recognizing what is an information statement in this context, you can better appreciate how it impacts corporate governance and shareholder engagement.

An SEC information statement is a document that public companies must file with the Securities and Exchange Commission. This statement provides detailed information about the company, including financial data, operations, and governance. It serves as a crucial tool for investors to make informed decisions. Therefore, knowing what is an information statement can enhance your understanding of company disclosures.

The SEC, or Securities and Exchange Commission, aims to protect investors, maintain fair markets, and facilitate capital formation. It does this by enforcing securities laws and overseeing securities exchanges, brokers, and dealers. Understanding the SEC's purpose is crucial for comprehending the broader financial landscape. Thus, gaining insight into these elements can help you grasp what is an information statement within this regulatory framework.

If a statement of Information is not filed, your LLC could face penalties, including fines and the potential loss of good standing with the state. This negligence may lead to the inability to conduct business legally. Filing this statement provides the necessary updates to state agencies, helping maintain your business's standing. Uslegalforms can assist you with compliance tools to ensure you never miss a filing.

An information statement is a legal document that provides essential details about your LLC, including its management structure and current members. This document ensures transparency and compliance with state laws. By maintaining an up-to-date statement of Information, you promote your business's credibility and integrity. Uslegalforms offers a user-friendly platform to help you prepare and file this document accurately.