Notice Exercise Purchase With Bitcoin

Description

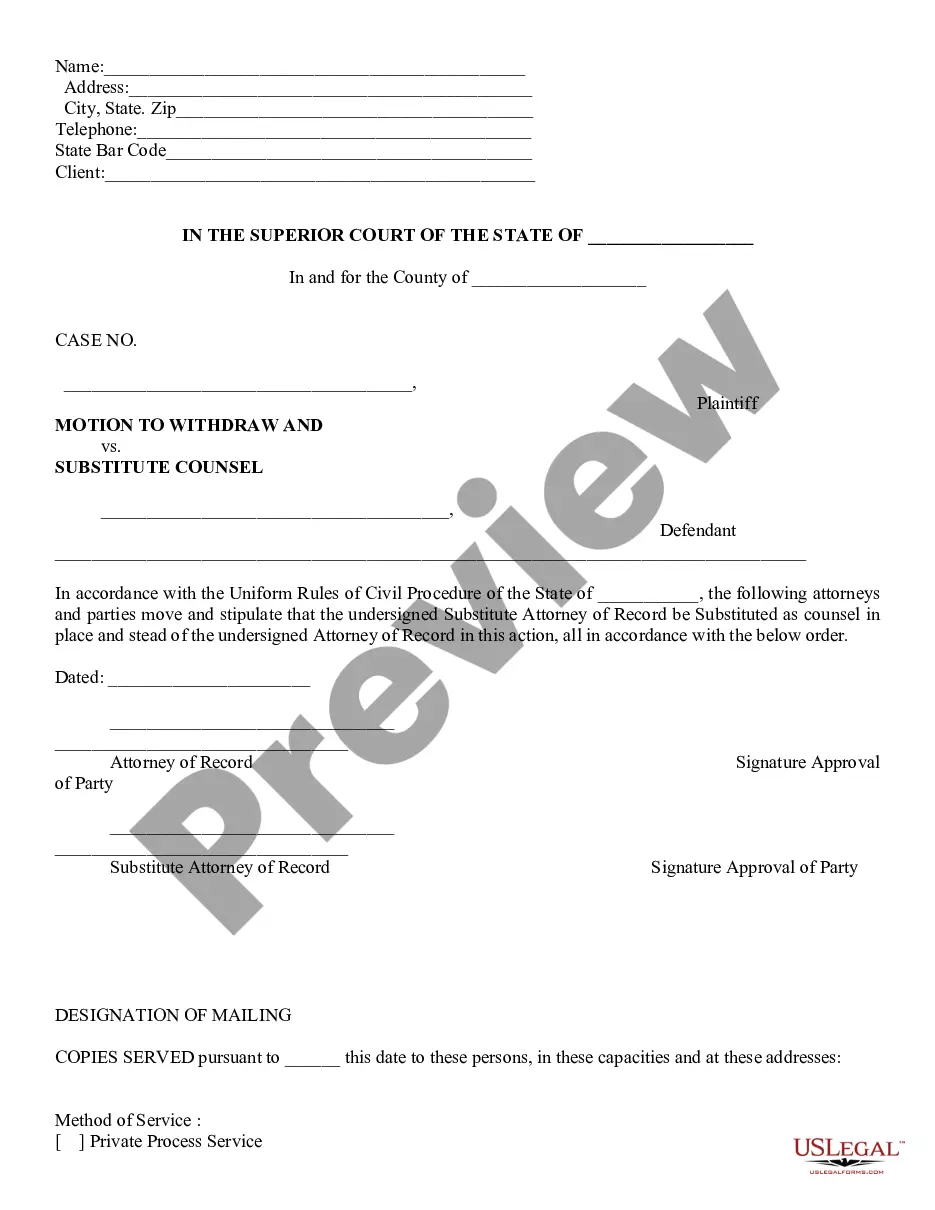

How to fill out Notice Of Election To Exercise Stock Purchase Right And Record Of Stock Transfer?

Legal administration can be daunting, even for seasoned professionals.

When you are interested in a Notice Exercise Purchase With Bitcoin and lack the time to seek out the correct and updated version, the processes can be anxiety-inducing.

US Legal Forms addresses any requirements you may have, from personal to business documents, all in one location.

Utilize advanced tools to complete and manage your Notice Exercise Purchase With Bitcoin.

Here are the steps to follow after accessing the form you require: Verify it is the correct form by previewing it and reviewing its description. Confirm that the sample is acknowledged in your state or county. Select Buy Now when you are ready. Choose a monthly subscription option. Obtain the format you need and Download, complete, sign, print, and send your document. Take advantage of the US Legal Forms online library, backed by 25 years of expertise and reliability. Transform your everyday document management into a straightforward and user-friendly process today.

- Access a valuable repository of articles, guides, and manuals relevant to your circumstances and requirements.

- Conserve effort and time searching for the forms you need, and use US Legal Forms’ enhanced search and Preview feature to locate Notice Exercise Purchase With Bitcoin and obtain it.

- If you have a monthly subscription, Log In to your US Legal Forms account, find the form, and obtain it.

- Check the My documents tab to view the forms you have previously saved and manage your folders as desired.

- If it’s your first time with US Legal Forms, create a free account and gain unlimited access to all platform benefits.

- A robust online form repository can be transformative for anyone wishing to navigate these circumstances effectively.

- US Legal Forms is a market leader in online legal documents, with over 85,000 state-specific legal forms accessible at all times.

- With US Legal Forms, you can access state- or county-specific legal and business documents.

Form popularity

FAQ

The three main ways of paying with crypto include: Pay a merchant who accepts crypto payments. Make a peer-to-peer (P2P) payment from your wallet directly to another wallet. Use a crypto debit card to convert crypto to cash.

The IRS treats cryptocurrency as ?property.? If you buy, sell or exchange cryptocurrency, you're likely on the hook for paying crypto taxes. Reporting your crypto activity requires using Form 1040 Schedule D as your crypto tax form to reconcile your capital gains and losses and Form 8949 if necessary.

Yes, Bitcoin is traceable. Here's what you need to know: Blockchain transactions are recorded on a public, distributed ledger. This makes all transactions open to the public - and any interested government agency.

Educate them on Bitcoin Explain to them that Bitcoin is a decentralized digital currency that is not controlled by any central authority. Provide them with information on the technology behind Bitcoin, such as blockchain, and how it ensures the security of transactions.

Cryptocurrency income could be categorised as capital gains or business income based on whether it's held for investment or trading purposes. ing to tax research and advisory firm Taxmann, you should report such income in 'Schedule VDA' in ITR-2 or ITR-3.