Restricted Stock Purchase Agreement Format

Description

How to fill out Sample Restricted Stock Purchase Agreement Between Intermark, Inc. And Purchasers?

Whether for business purposes or for individual matters, everyone has to handle legal situations sooner or later in their life. Completing legal documents demands careful attention, beginning from picking the appropriate form sample. For example, when you choose a wrong edition of the Restricted Stock Purchase Agreement Format, it will be turned down when you send it. It is therefore essential to get a trustworthy source of legal documents like US Legal Forms.

If you have to get a Restricted Stock Purchase Agreement Format sample, follow these easy steps:

- Find the template you need using the search field or catalog navigation.

- Examine the form’s information to make sure it suits your situation, state, and county.

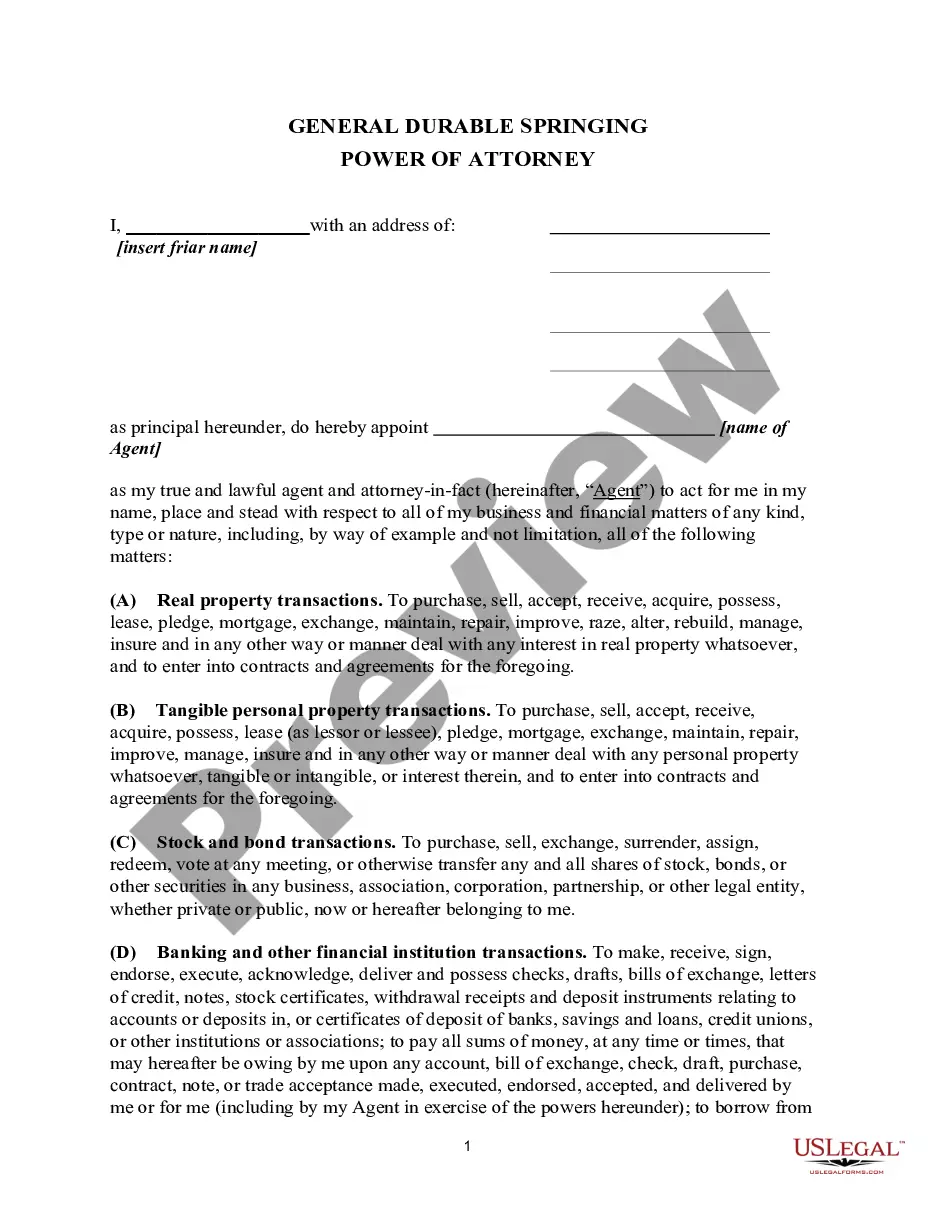

- Click on the form’s preview to view it.

- If it is the incorrect form, go back to the search function to locate the Restricted Stock Purchase Agreement Format sample you need.

- Get the template if it meets your requirements.

- If you have a US Legal Forms account, click Log in to access previously saved documents in My Forms.

- If you don’t have an account yet, you may obtain the form by clicking Buy now.

- Pick the correct pricing option.

- Complete the account registration form.

- Pick your transaction method: use a credit card or PayPal account.

- Pick the document format you want and download the Restricted Stock Purchase Agreement Format.

- Once it is downloaded, you can complete the form by using editing applications or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you never need to spend time looking for the appropriate template across the web. Take advantage of the library’s easy navigation to find the right template for any situation.

Form popularity

FAQ

Simply put: A ROFR provides the non-selling shareholders with a right to either accept or refuse an offer from a selling shareholder after the selling shareholder has received a third party offer for its shares.

A: The most common provisions included in restricted stock purchase agreements are restrictions on when and how stock can be sold or transferred; non-compete agreements; rights of first refusal; and termination clauses which allow either party to terminate the agreement under specified conditions.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

A purchase and sale agreement is used to document the parties' intentions and the terms they have agreed will govern the transaction. You can include specific terms like the product or property, the price of the product or property, conditions for the delivery of the product, and the date of product delivery.

A Share Purchase Agreement generally includes information about: The person selling the shares. The person buying the shares. The number of shares being sold and their value. The company the shares are being transferred from. The number of shares being sold and their value.