Trust Agreement For Holding Shares

Description

How to fill out Trust Agreement Between Insituform Southeast Corp. And Trustee?

When you need to complete a Trust Agreement For Holding Shares that adheres to your local state's legislation and regulations, there may be numerous options to select from.

There's no need to review each document to verify it satisfies all the legal requirements if you are a US Legal Forms subscriber. It is a reliable service that can assist you in obtaining a reusable and current template on any topic.

US Legal Forms is the largest online repository with a compilation of over 85k ready-to-use forms for business and personal legal situations. All templates are confirmed to comply with each state's standards. Thus, when downloading the Trust Agreement For Holding Shares from our site, you can trust that you possess a legitimate and current document.

Acquiring professionally prepared formal paperwork becomes effortless with US Legal Forms. Additionally, Premium users can also take advantage of the strong integrated solutions for online document editing and signing. Give it a try today!

- Acquiring the necessary template from our platform is remarkably straightforward.

- If you already have an account, just Log In to the system, ensure your subscription is active, and save your selected file.

- Later, you can access the My documents section in your profile and maintain access to the Trust Agreement For Holding Shares at any point.

- If this is your first time using our website, please follow these instructions.

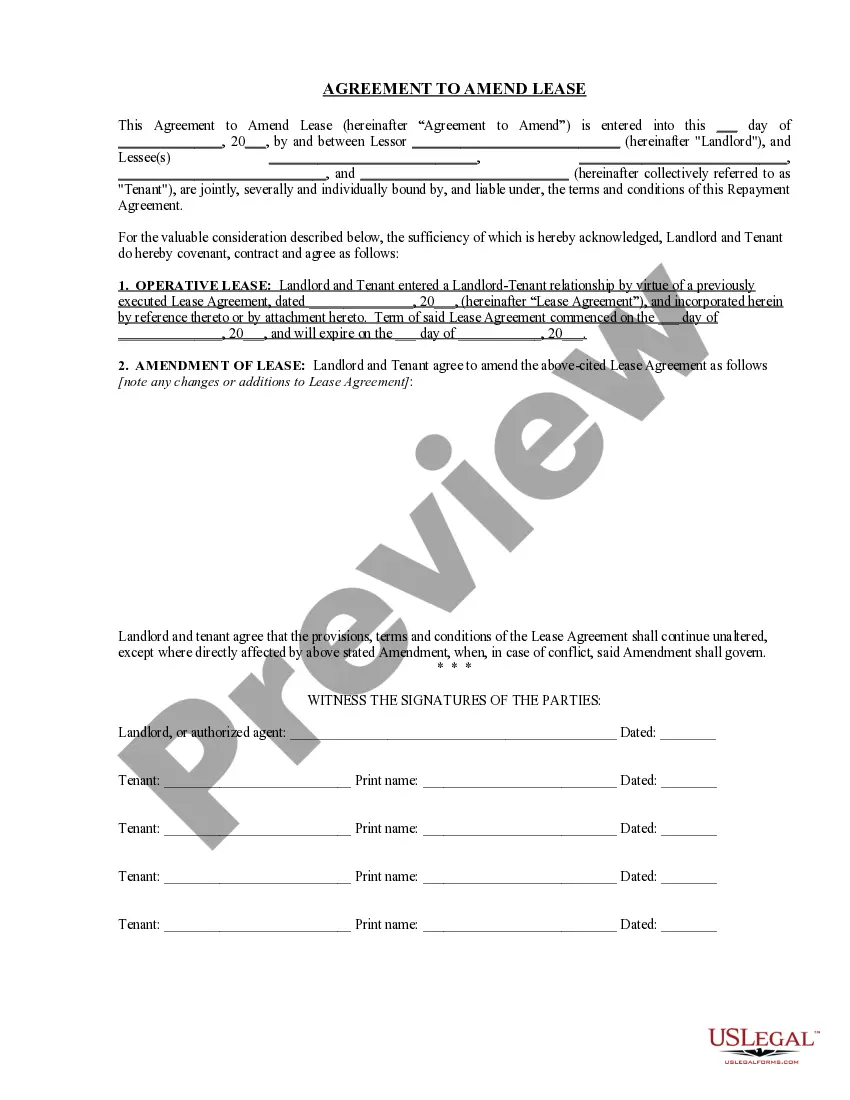

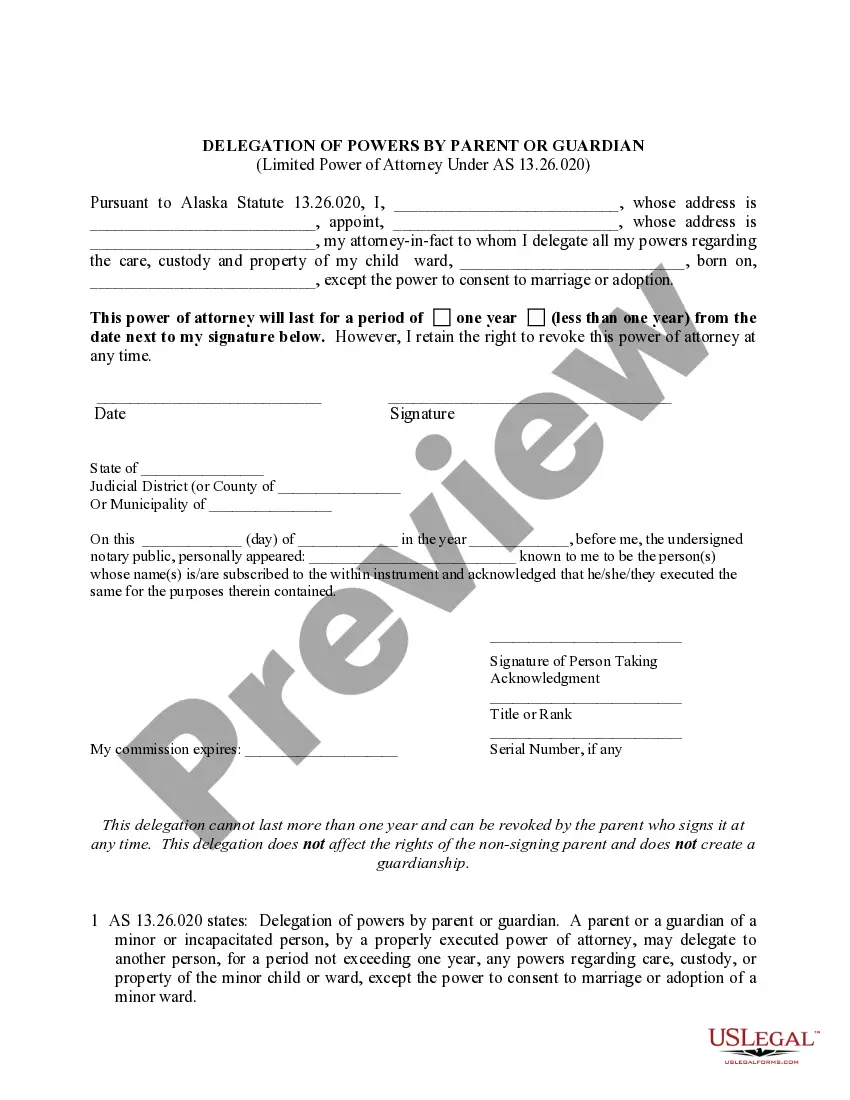

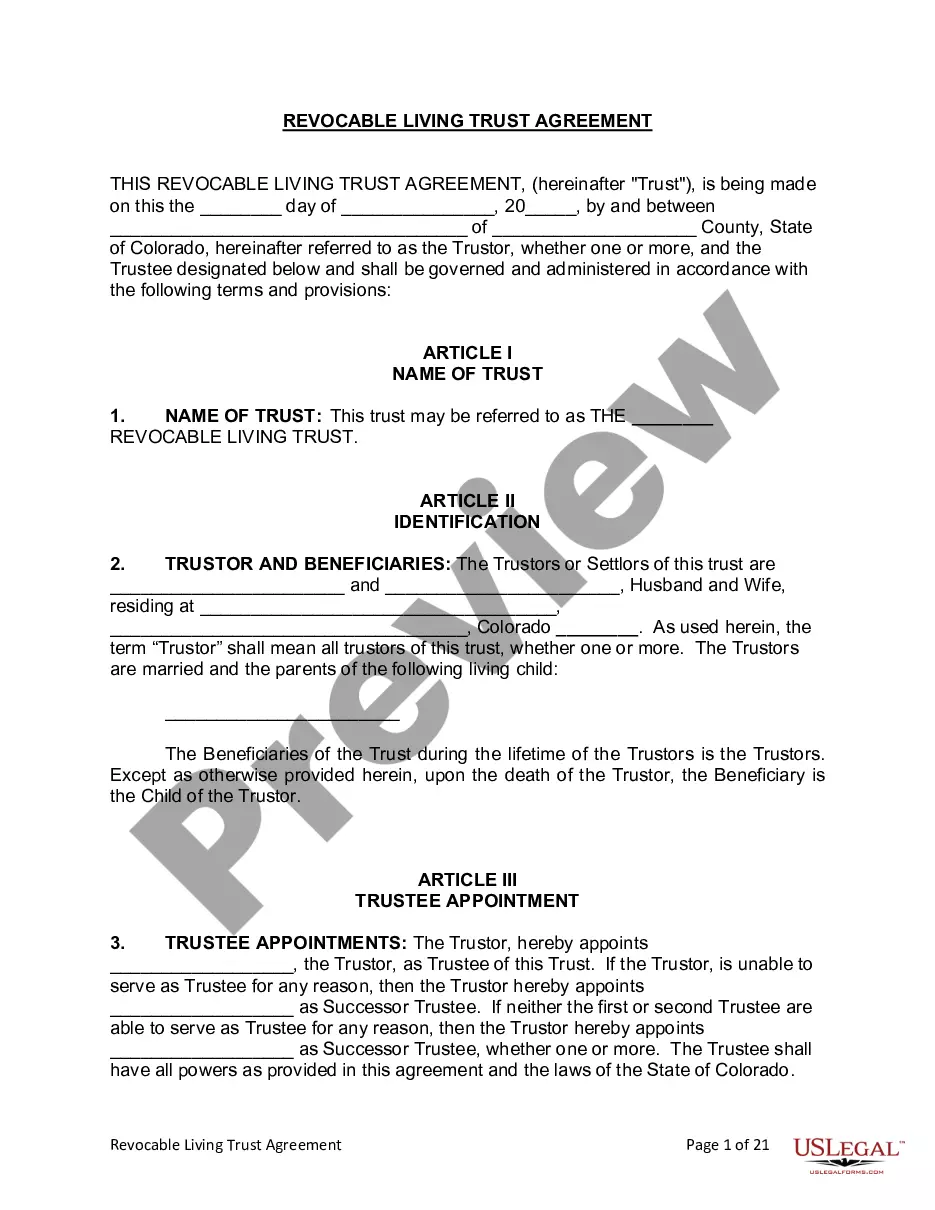

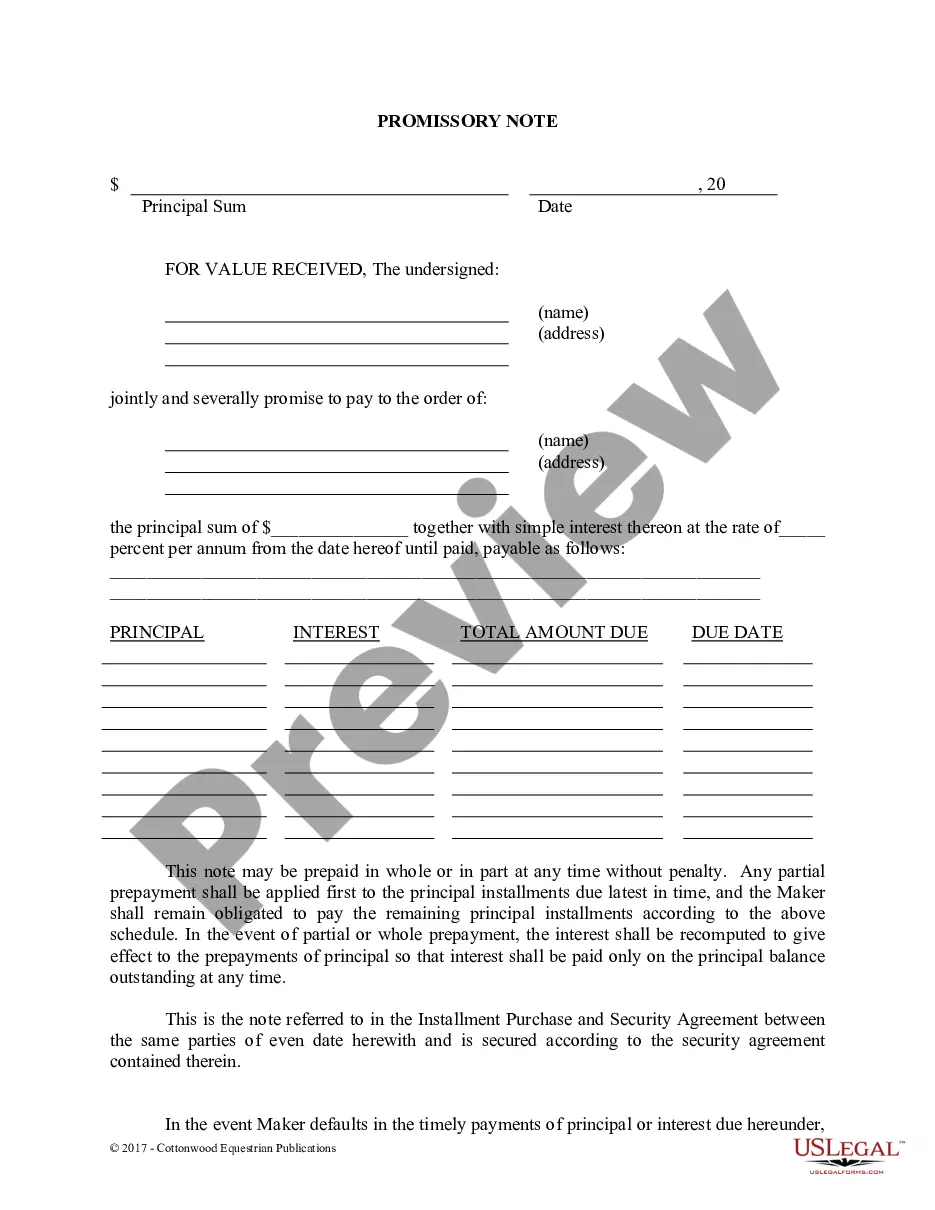

- Review the suggested page and confirm it aligns with your requirements.

- Utilize the Preview mode and examine the form description if available.

- Find another template via the Search field in the header if needed.

- Click Buy Now once you find the suitable Trust Agreement For Holding Shares.

- Select the most appropriate pricing plan, Log In to your account, or create one.

- Complete payment for a subscription (PayPal and credit card options are available).

- Download the template in your preferred file format (PDF or DOCX).

- Print the document or complete it electronically using an online editor.

Form popularity

FAQ

A trust cannot own shares in a company because the law says a trust is not a separate legal person. For example, the 'John Smith Family Trust' cannot own shares or any other property.

Assets can be transferred into the living trust either by a loan or a cash donation. In terms of South African law, a donation to a trust that does not exceed R100 000 within the applicable tax period will be exempt from donations tax (and then levied at 20% once the limit has been exceeded for that tax year).

Singapore does not itself have legislation that permits non-charitable purpose trusts, but it is possible for the shares in a Singapore PTC to be held by a trust in another jurisdiction.

A trust cannot own shares in a company because the law says a trust is not a separate legal person. For example, the 'John Smith Family Trust' cannot own shares or any other property.

Trusts. A Trust is a relationship where one party (the trustee) holds property for the benefit of someone else (the beneficiary). Trusts can exist in a number of ways and for different reasons. Although people often hold shares in companies, other companies and trusts themselves can also be shareholders.