Issuance Stock With Withdrawal

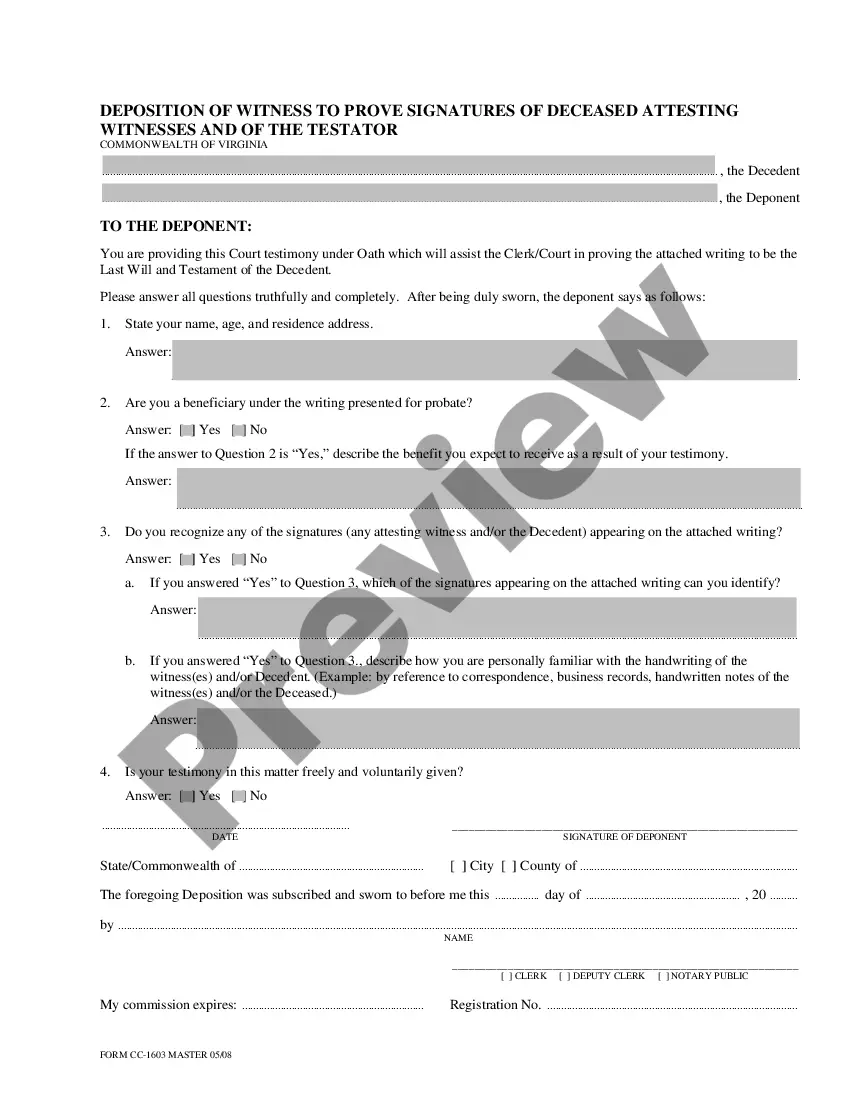

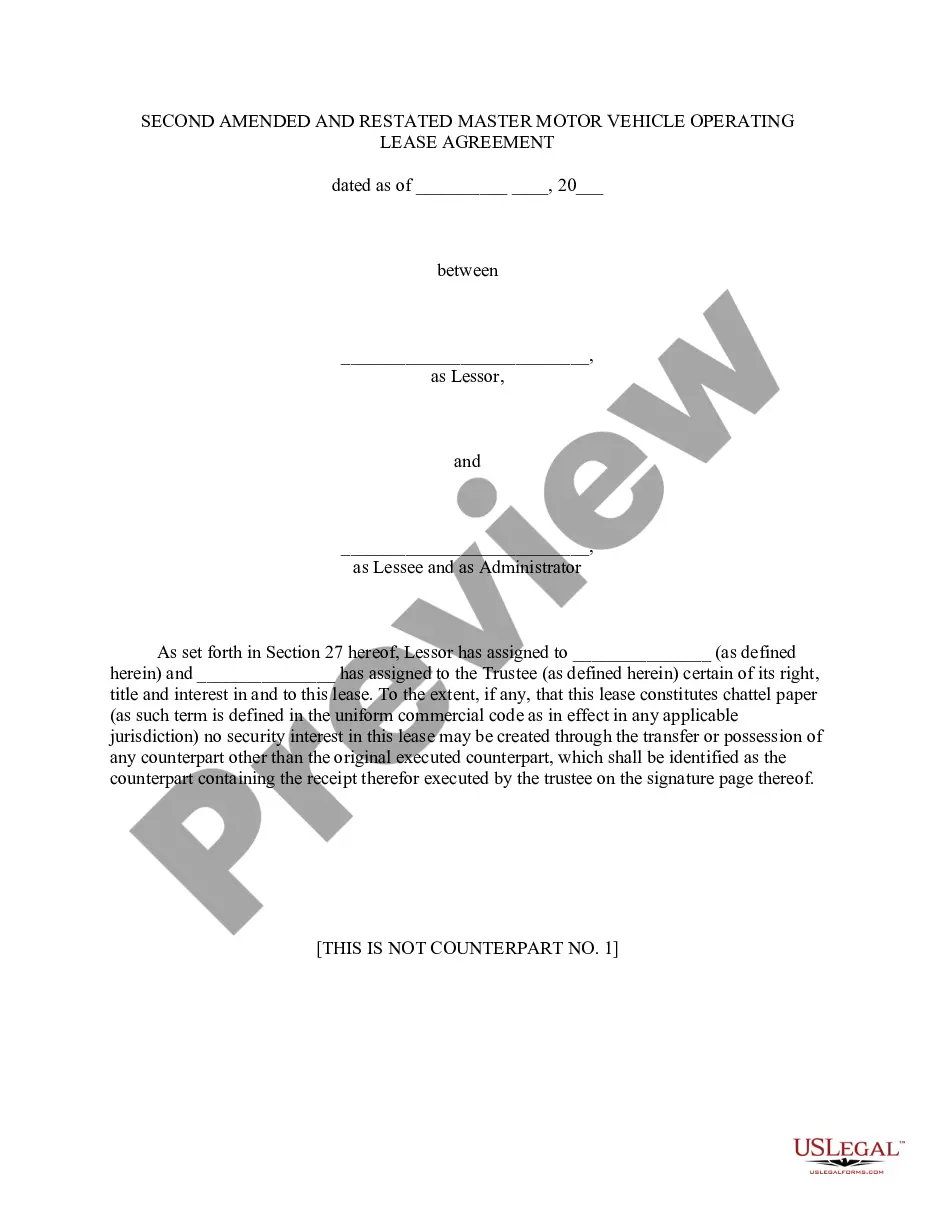

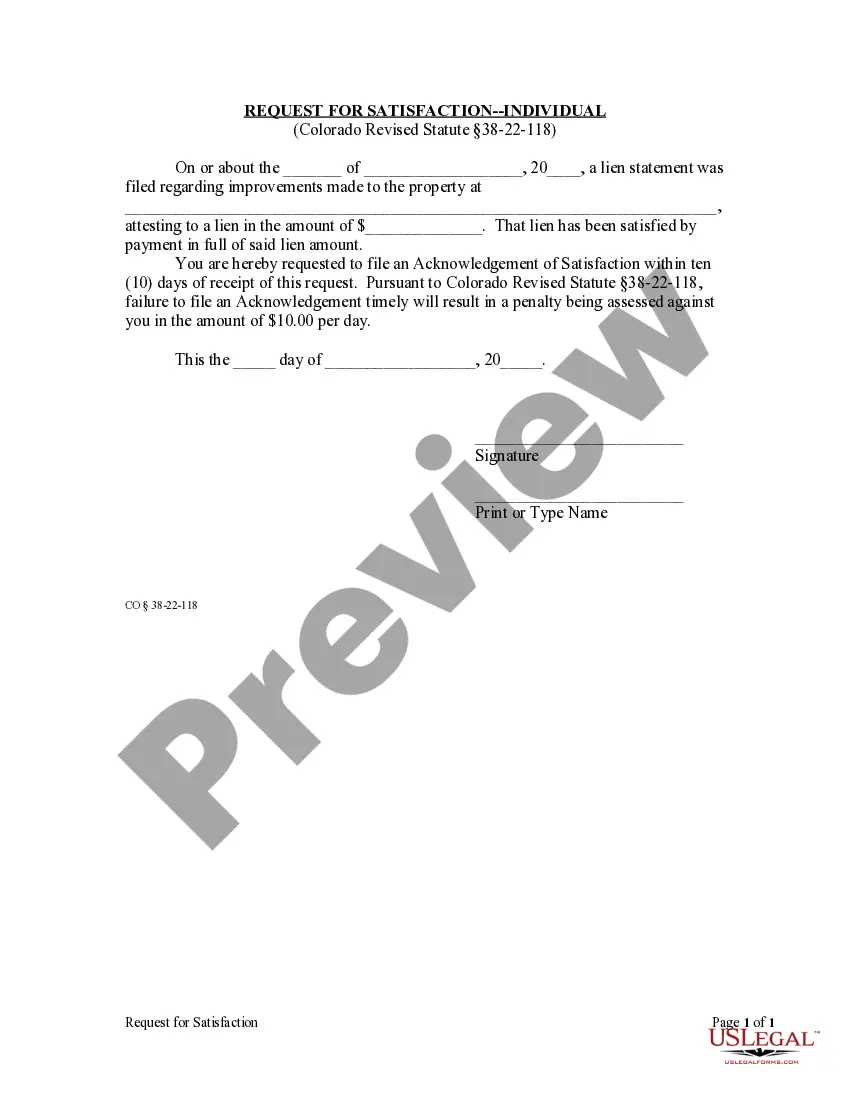

Description

How to fill out Issuance Of Common Stock In Connection With Acquisition?

Whether for commercial reasons or personal affairs, everyone must encounter legal circumstances at some point in their lives.

Completing legal documents necessitates meticulous attention, beginning with selecting the correct template.

Once downloaded, you can fill out the form using editing software or print it to complete it by hand. With a vast US Legal Forms library available, you won't waste time looking for the correct template online. Take advantage of the library’s user-friendly navigation to find the appropriate form for any circumstance.

- Obtain the template you require by utilizing the search bar or browsing the catalog.

- Review the description of the form to confirm it suits your situation, state, and locality.

- Click on the form’s preview to inspect it.

- If it is the wrong document, return to the search option to find the Issuance Stock With Withdrawal sample you need.

- Download the file when it aligns with your requirements.

- If you possess a US Legal Forms account, simply click Log in to access your saved documents in My documents.

- If you haven't established an account yet, you can retrieve the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Select your payment method: utilize a credit card or PayPal account.

- Opt for the file format you desire and download the Issuance Stock With Withdrawal.

Form popularity

FAQ

Simply log in to your trading account via your stock broker's trading app or website. Go to the fund section, check for the available funds. There are two options there: one for adding funds and one for withdrawing funds. As per the total balance you have, you can withdraw or sell equity if required.

Factors influencing the decision to withdraw IPO Several factors might make a company reconsider its decision of an IPO. These can include market scenarios, internal corporate matters, and the timing of regulatory approval.

Withdrawn Shares means those Shares to be Transferred which were removed from sale under the Offer by the Accepting Shareholder that has withdrawn its acceptance of the Offer as provided in Item 5 ?Withdrawal Rights of Accepting Shareholders? in Section ?Formal Elements of the Offer?. Sample 1.

A withdrawal plan is a financial plan that allows a shareholder to withdraw money from a mutual fund or other investment account at predetermined intervals. Often, this type of plan is used to fund expenses during retirement. However, it may be used for other purposes as well.

Even if you don't take the money out, you'll still owe taxes when you sell a stock for more than what you originally paid for it. When tax time rolls around, you'll need to report those capital gains on your tax return.