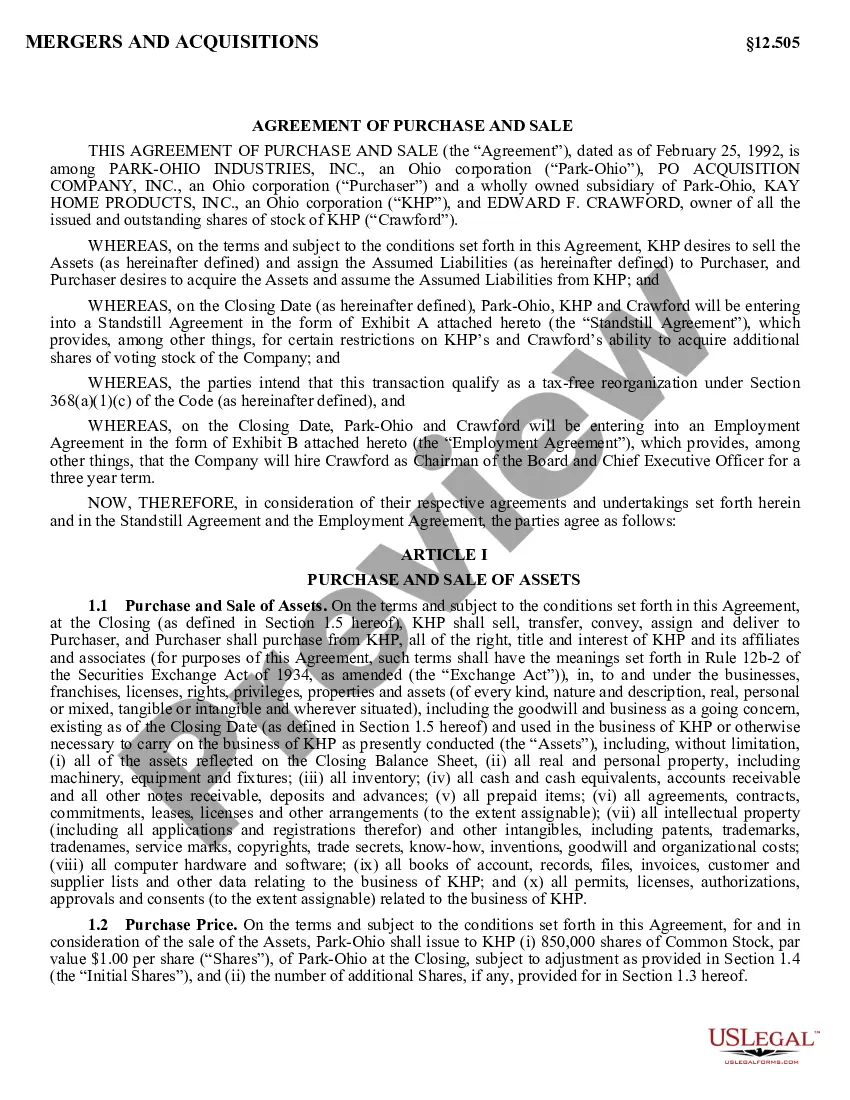

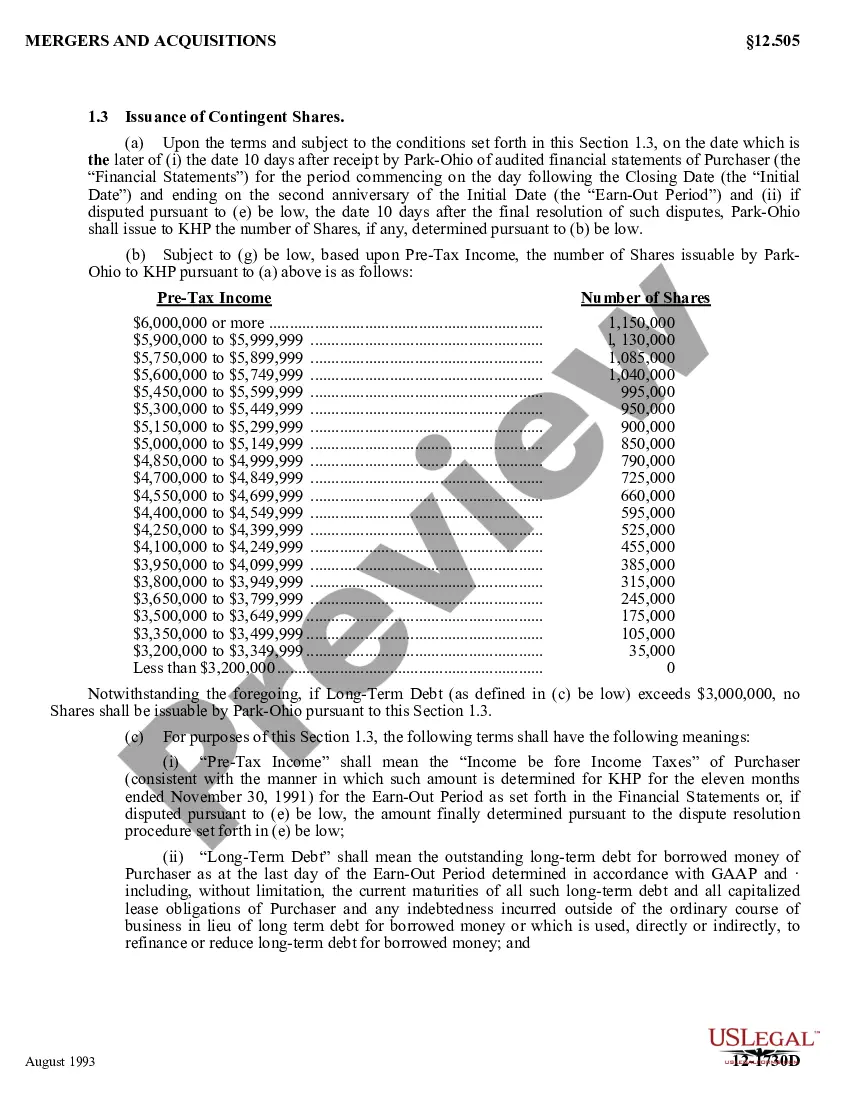

A Sample incorporation form with decimals is a legal document that outlines the process of officially forming a corporation and includes the use of decimal values. Incorporation forms are crucial in establishing a corporation as a separate legal entity from its owners, ensuring liability protection and facilitating various business transactions. Incorporation forms typically require detailed information about the proposed corporation, including its name, purpose, location, and structure. When decimal values are involved, specific sections in the form focus on the allocation of shares or stocks, financial projections, and percentage ownership breakdowns. The incorporation form with decimals may come in various types, each serving a specific purpose or catering to different circumstances. Some of these types include: 1. Stock Allocation Form: This type of incorporation form with decimals is used to outline the allocation of shares or stocks among the owners or shareholders of the corporation. It specifies the decimal values representing ownership percentages, facilitating the division of the corporation's overall ownership structure. 2. Financial Projections Form: Incorporation forms may also require the inclusion of financial projections, which may involve decimal values to represent expected revenue, expenses, profits, and growth rates. These projections help investors and stakeholders evaluate the viability and potential of the corporation. 3. Ownership Breakdown Form: This form focuses on disclosing the percentage ownership breakdown among different shareholders or owners within the corporation. Decimal values are used to represent the precise ownership percentages allocated to each party. 4. Voting Rights Form: Incorporation forms may also include provisions related to voting rights within the corporation. In some cases, decimal values may be used to assign voting power based on the percentage ownership of shares or stocks. 5. Merger or Acquisition Form: If the sample incorporation form involves a merger or acquisition, it may require the use of decimal values to represent the valuation or exchange ratios of the entities involved. These values help determine the equity participation and transaction terms. When completing a sample incorporation form with decimals, it is essential to ensure accuracy and attention to detail. Seek professional advice from attorneys or incorporation experts to guarantee the form is properly filled out and adheres to relevant laws and regulations. In summary, a sample incorporation form with decimals is a comprehensive legal document used to establish a corporation and includes the use of decimal values for purposes such as stock allocation, financial projections, percentage ownership breakdowns, voting rights, mergers, and acquisitions.

Sample Incorporation Form With Decimals

Description

How to fill out Sample Agreement Of Purchase And Sale By Park - Ohio Industries, Inc., PO Acquisition Company, Inc., Kay Home Products, Inc., And Edward F. Crawford?

Getting a go-to place to access the most recent and relevant legal templates is half the struggle of working with bureaucracy. Discovering the right legal documents demands precision and attention to detail, which is why it is very important to take samples of Sample Incorporation Form With Decimals only from reputable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have little to be concerned about. You can access and see all the information concerning the document’s use and relevance for the circumstances and in your state or county.

Consider the listed steps to complete your Sample Incorporation Form With Decimals:

- Make use of the catalog navigation or search field to find your template.

- View the form’s description to see if it matches the requirements of your state and area.

- View the form preview, if available, to make sure the form is the one you are looking for.

- Get back to the search and locate the correct document if the Sample Incorporation Form With Decimals does not suit your needs.

- When you are positive about the form’s relevance, download it.

- When you are an authorized user, click Log in to authenticate and access your picked forms in My Forms.

- If you do not have a profile yet, click Buy now to get the form.

- Choose the pricing plan that fits your requirements.

- Proceed to the registration to finalize your purchase.

- Finalize your purchase by choosing a payment method (bank card or PayPal).

- Choose the document format for downloading Sample Incorporation Form With Decimals.

- When you have the form on your device, you can alter it using the editor or print it and finish it manually.

Remove the hassle that accompanies your legal paperwork. Explore the comprehensive US Legal Forms collection where you can find legal templates, examine their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

Answer ? 1.5 divided by 2 is 0.75.

DECIMAL NUMBERS The decimal point comes after the ones position. The numbers to the right of the decimals represent tenths (0.1), hundreds (0.01), thousands (0.001), and so on down to infinitesimally small numbers. All whole numbers (called integers) have a decimal point at the end.

Hear this out loud PauseDecimal division is similar to dividing whole numbers, but a decimal point is inserted after each decimal place. Mathematicians divide decimals similarly to how they divide whole numbers.

For example: Divide 12 by 0.4. Change the divisor 0.4 to 4 by shifting the decimal point one place to the right. Similarly, after shifting the decimal point 12, we get 120. Thus, 12 ÷ 0.4 = 120 ÷ 4 = 30 .

In Algebra, decimals are one of the types of numbers, which has a whole number and the fractional part separated by a decimal point. The dot present between the whole number and fractions part is called the decimal point. For example, 34.5 is a decimal number.