Texas Business Corporation Act For Small

Description

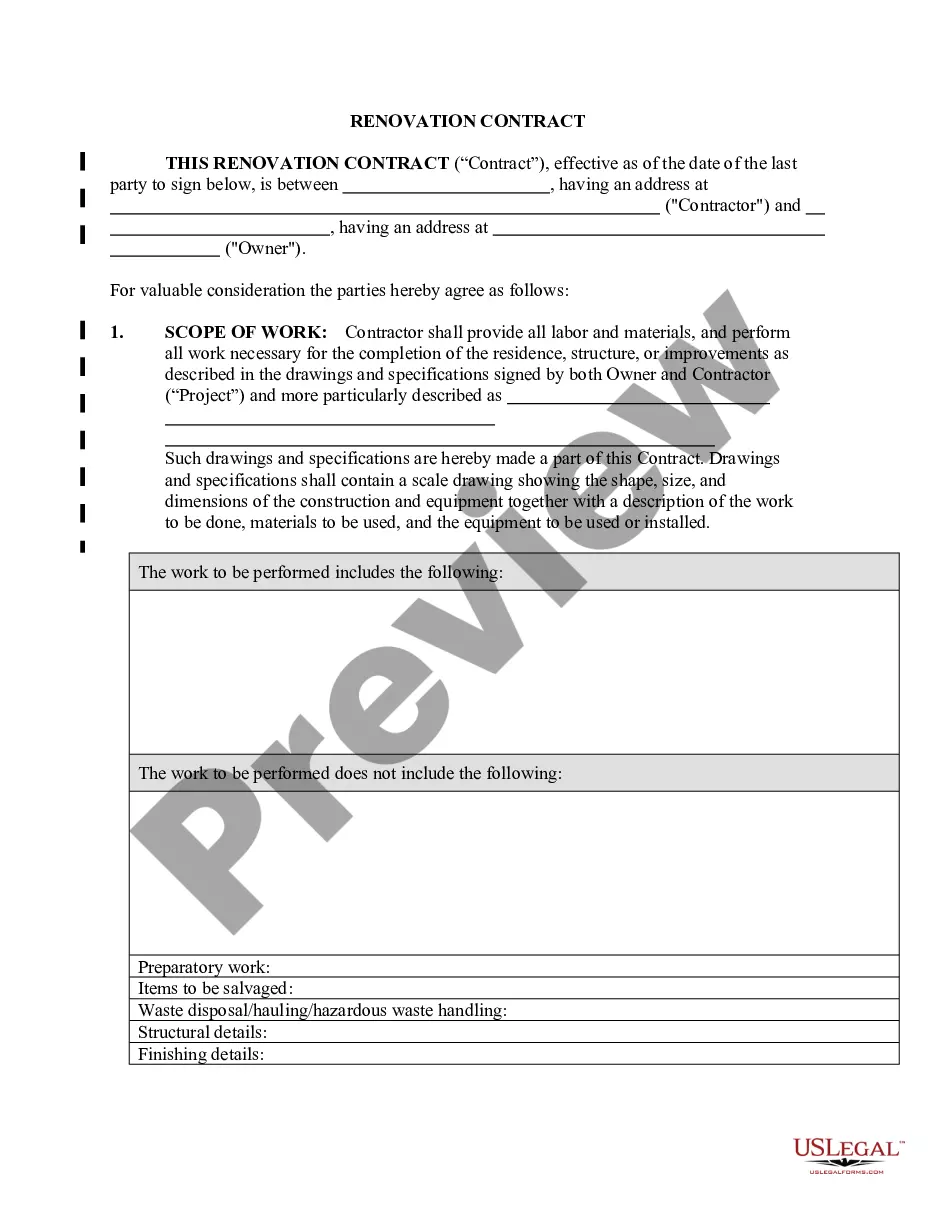

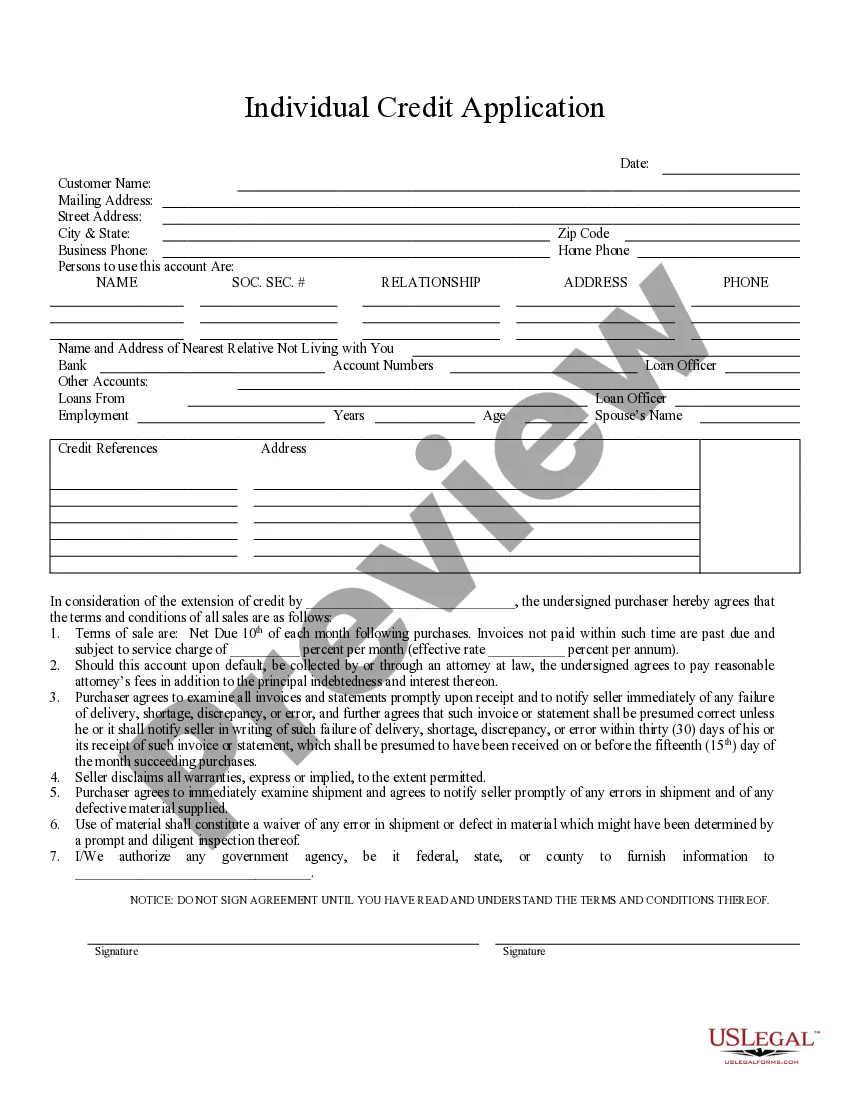

How to fill out Articles 5.11, 5.12 And 5.13 Of Texas Business Corporation Act?

Whether for business purposes or for personal matters, everybody has to handle legal situations at some point in their life. Filling out legal paperwork demands careful attention, starting with selecting the proper form template. For example, when you select a wrong version of the Texas Business Corporation Act For Small, it will be declined once you submit it. It is therefore essential to have a reliable source of legal files like US Legal Forms.

If you need to obtain a Texas Business Corporation Act For Small template, stick to these easy steps:

- Find the sample you need by using the search field or catalog navigation.

- Look through the form’s information to ensure it fits your case, state, and county.

- Click on the form’s preview to see it.

- If it is the incorrect document, get back to the search function to locate the Texas Business Corporation Act For Small sample you require.

- Download the file if it meets your needs.

- If you already have a US Legal Forms account, just click Log in to gain access to previously saved templates in My Forms.

- In the event you do not have an account yet, you can obtain the form by clicking Buy now.

- Choose the correct pricing option.

- Finish the account registration form.

- Choose your transaction method: you can use a bank card or PayPal account.

- Choose the document format you want and download the Texas Business Corporation Act For Small.

- When it is saved, you can fill out the form with the help of editing applications or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you do not have to spend time seeking for the right sample across the web. Utilize the library’s straightforward navigation to get the appropriate template for any situation.

Form popularity

FAQ

Cost to Incorporate in Texas A certificate of formation for a Texas for-profit corporation, for instance, has a $300 filing fee. Texas nonprofit corporations, however, only have to pay a $25 fee.

Again, what the SBA considers a small business can vary depending on your industry. However, the typical range is: Between or below 50 and 1,500 employees AND. Between or below $1 and $41.5 million in annual receipts.

A sole proprietorship is easy to form and gives you complete control of your business. You're automatically considered to be a sole proprietorship if you do business activities but don't register as any other kind of business. Sole proprietorships do not produce a separate business entity.

Start a Texas LLC in 5 Steps Name Your LLC. You need to name your business. ... Hire a Registered Agent. ... File the Texas Certificate of Formation?Limited Liability Company. ... Obtain a Texas LLC Employer Identification Number (EIN) ... Create an LLC Operating Agreement.

The Texas Certificate of Formation will request several pieces of information about your LLC, such as: Entity type and name. Registered agent and registered office. Governing authority (stating whether the LLC is member-managed or manager-managed) Purpose of the business. Initial mailing address.