Stock Agreement Shareholders For Startups

Description

How to fill out Amended Stock Exchange Agreement By SJW Corp, Roscoe Moss Co, And RMC Shareholders - Detailed?

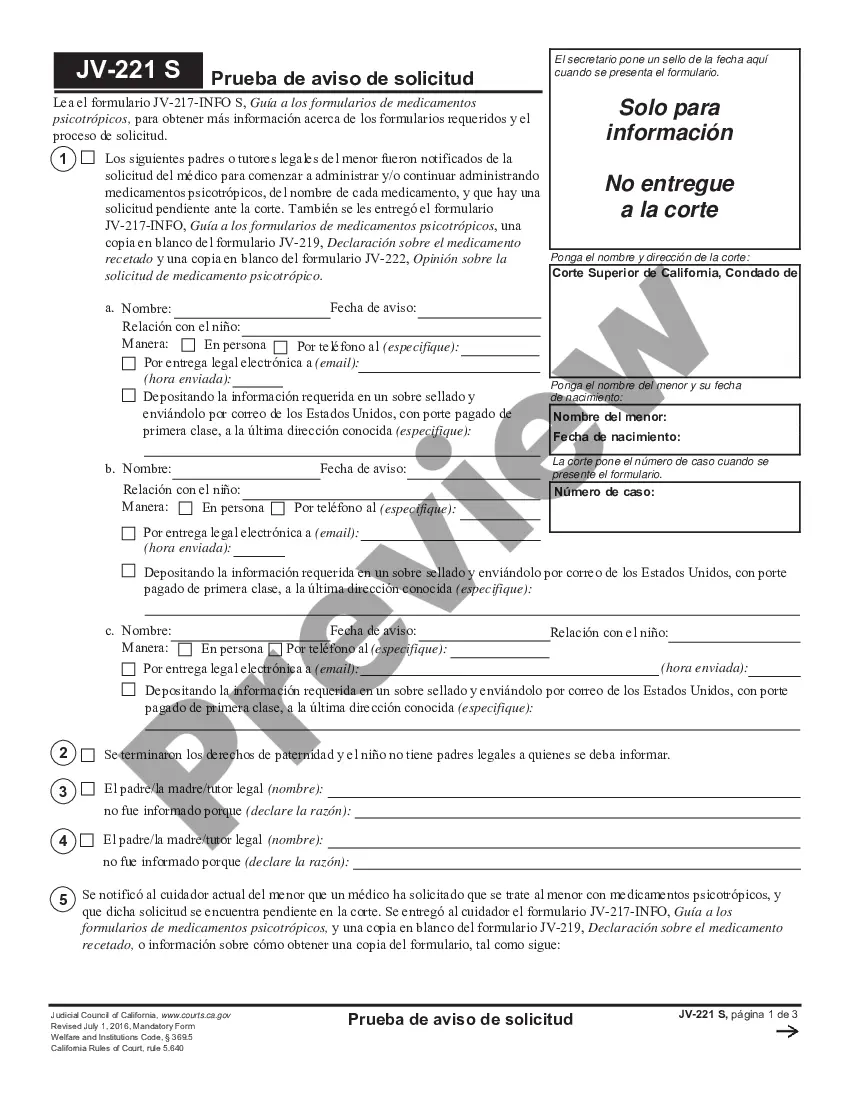

Whether for business purposes or for individual matters, everyone has to deal with legal situations sooner or later in their life. Filling out legal paperwork needs careful attention, beginning from picking the correct form sample. For example, if you select a wrong version of the Stock Agreement Shareholders For Startups, it will be rejected when you submit it. It is therefore important to get a dependable source of legal documents like US Legal Forms.

If you need to get a Stock Agreement Shareholders For Startups sample, stick to these simple steps:

- Find the sample you need by using the search field or catalog navigation.

- Examine the form’s description to make sure it matches your situation, state, and county.

- Click on the form’s preview to see it.

- If it is the incorrect document, get back to the search function to locate the Stock Agreement Shareholders For Startups sample you need.

- Get the template if it matches your requirements.

- If you already have a US Legal Forms account, simply click Log in to gain access to previously saved files in My Forms.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your transaction method: you can use a credit card or PayPal account.

- Select the document format you want and download the Stock Agreement Shareholders For Startups.

- After it is saved, you can complete the form with the help of editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you do not need to spend time searching for the appropriate sample across the web. Utilize the library’s simple navigation to get the correct template for any occasion.

Form popularity

FAQ

Essentially, startup equity describes ownership of a company, typically expressed as a percentage of shares of stock. On day one, founders own 100%. If you have more than one founder, you can choose how you want to share ownership: 50/50, 60/40, 40/40/20 ,etc.

A shareholders agreement is an agreement among the holders of shares in the startup corporation. In general, such agreements address the following matters: Election of the board: Shareholders agreements often provide specific shareholders or groups of shareholders with the right to elect directors of the corporation.

Up to this point, generally speaking, with teams of less than 12 people, the average granted equity for startup employees is 1%. This number can be as high as 2% for the first hires, and in some circumstances, the first hire(s) can be considered founders and their equity share could be even greater.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ...

As a startup with more than one shareholder, it is important that you put in place a formal shareholders agreement to protect from unforeseen and future issues between shareholders that may affect the running of the business.