Schedule C Form Sample With Payment

Description

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

It's clear that you can't instantly become a legal authority, nor can you swiftly understand how to draft the Schedule C Form Sample With Payment without possessing a specific set of expertise.

Drafting legal documents is a labor-intensive task that demands particular education and abilities. So why not entrust the creation of the Schedule C Form Sample With Payment to the experts.

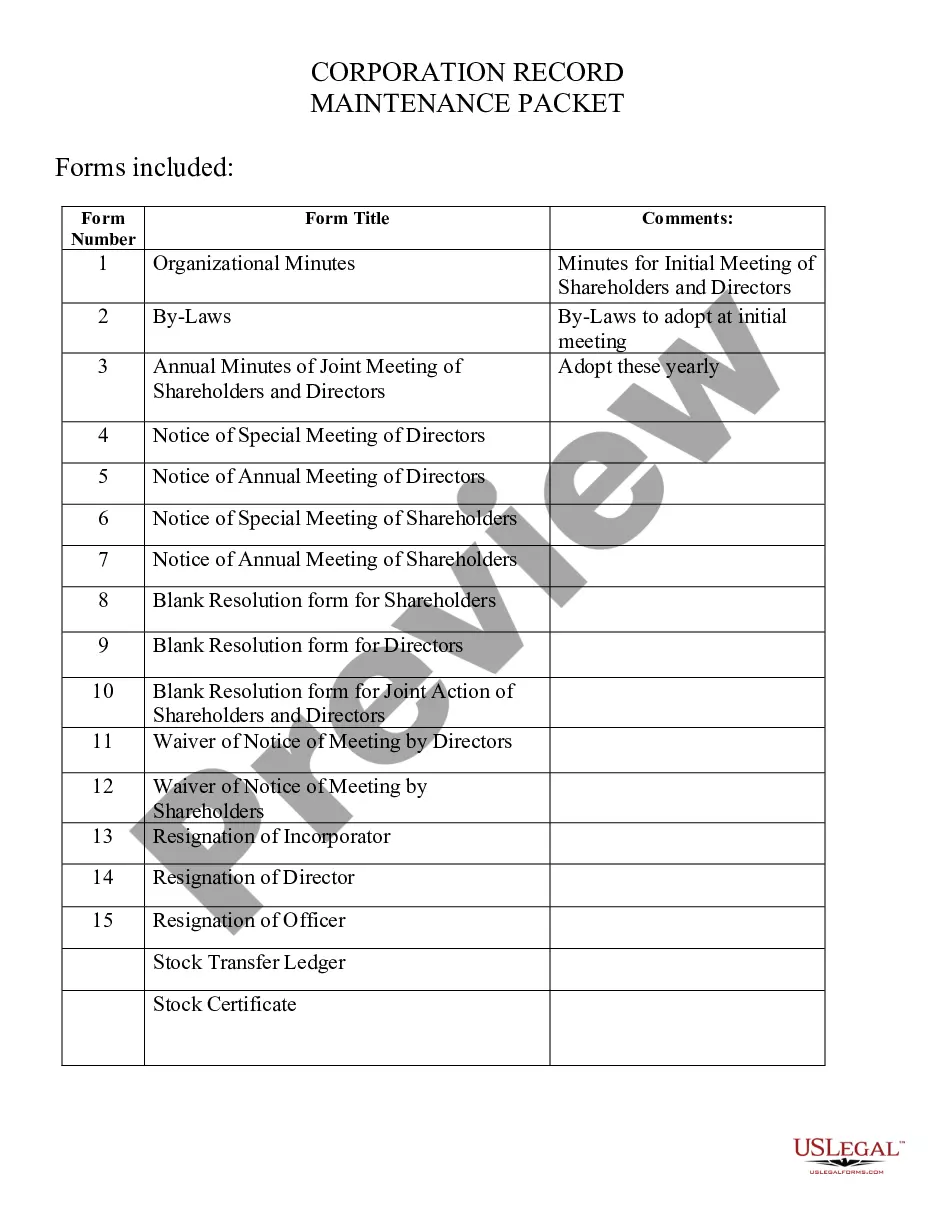

With US Legal Forms, one of the largest repositories of legal documents, you can discover anything from court forms to templates for internal communication.

If you need a different template, simply restart your search.

Create a free account and choose a subscription plan to acquire the form. Click Buy now. Once the payment is completed, you can access the Schedule C Form Sample With Payment, fill it out, print it, and send it to the relevant individuals or organizations. You can regain access to your forms from the My documents section at any time. If you are a returning customer, just Log In, and find and download the template from the same section. Regardless of the nature of your documents—whether financial, legal, or personal—our website has you covered. Try US Legal Forms today!

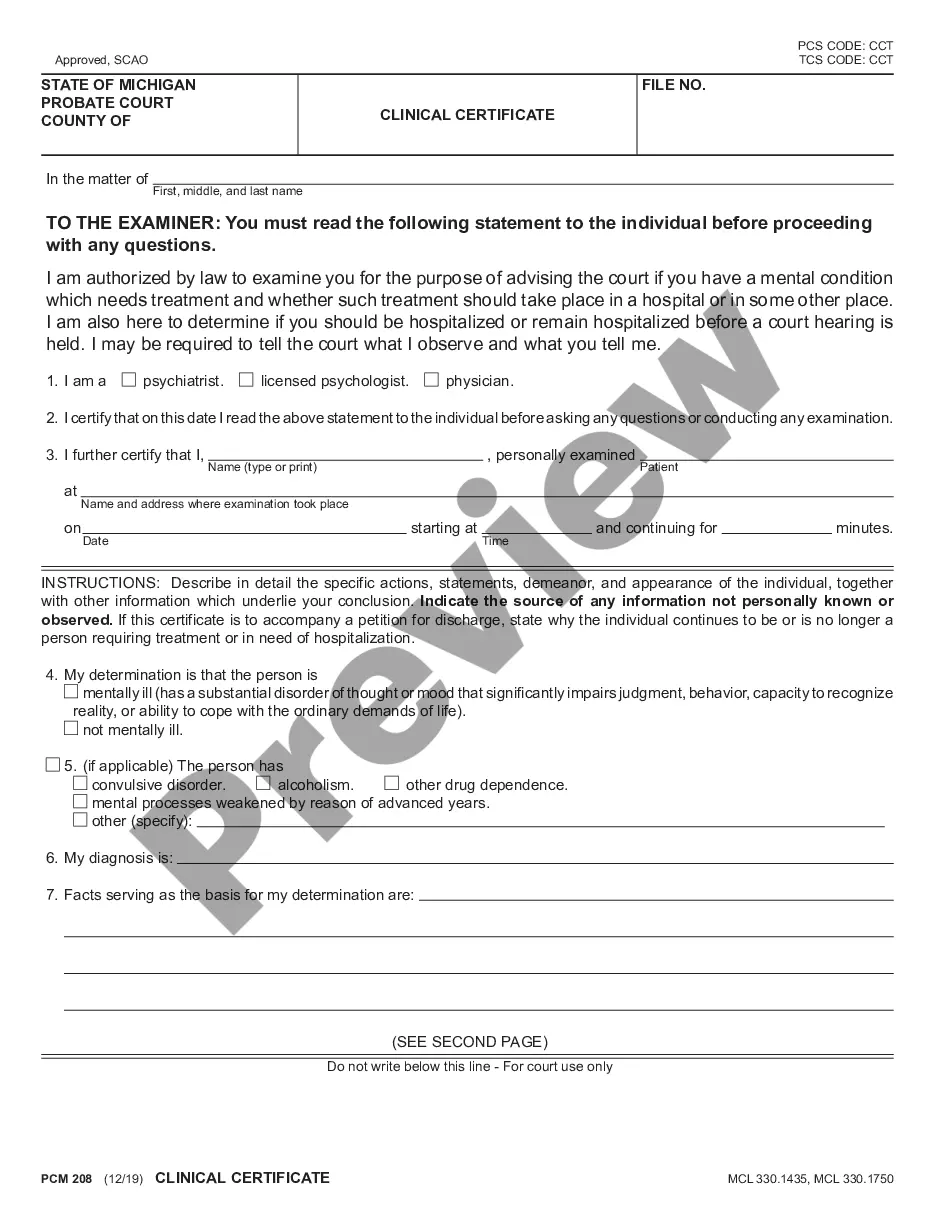

- We recognize how important compliance and adherence to federal and state regulations are.

- That's why, on our platform, all forms are tailored to specific locations and are current.

- Start by visiting our website to obtain the form you need in just minutes.

- Locate the document you require using the search feature at the top of the page.

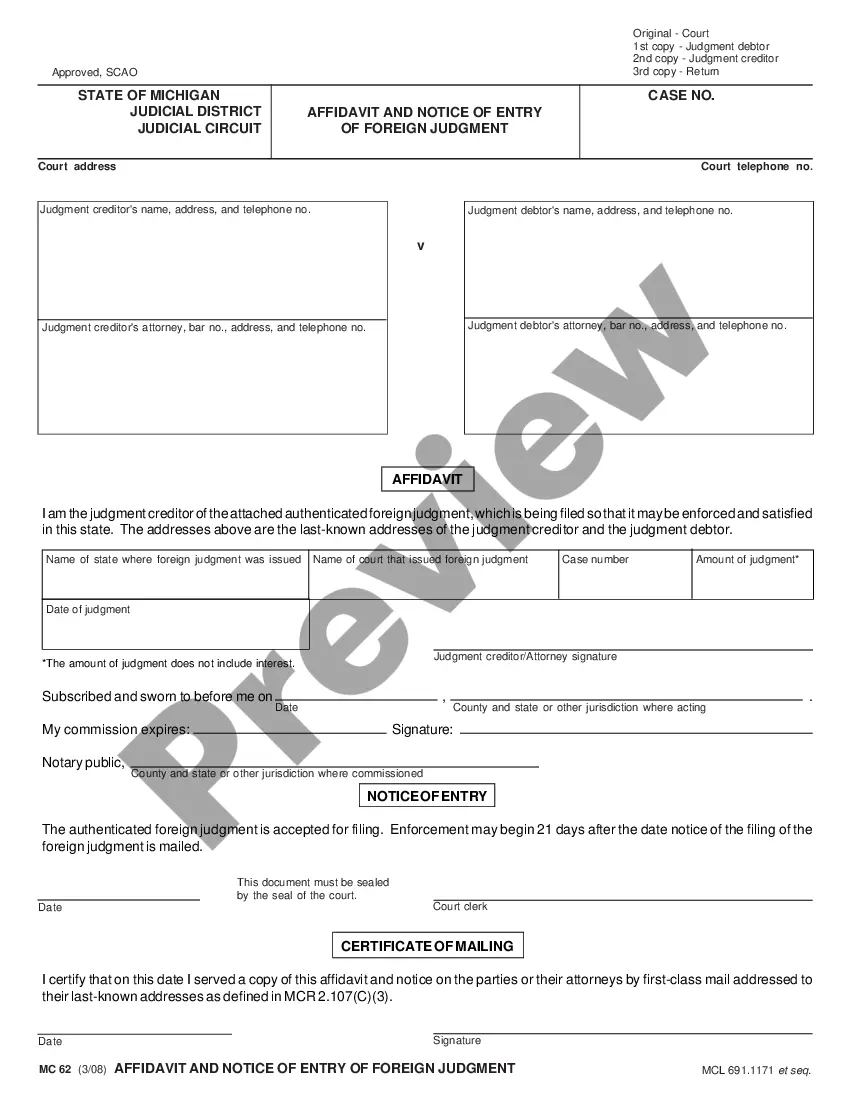

- Preview it (if available) and review the supporting details to see if the Schedule C Form Sample With Payment is what you are looking for.

Form popularity

FAQ

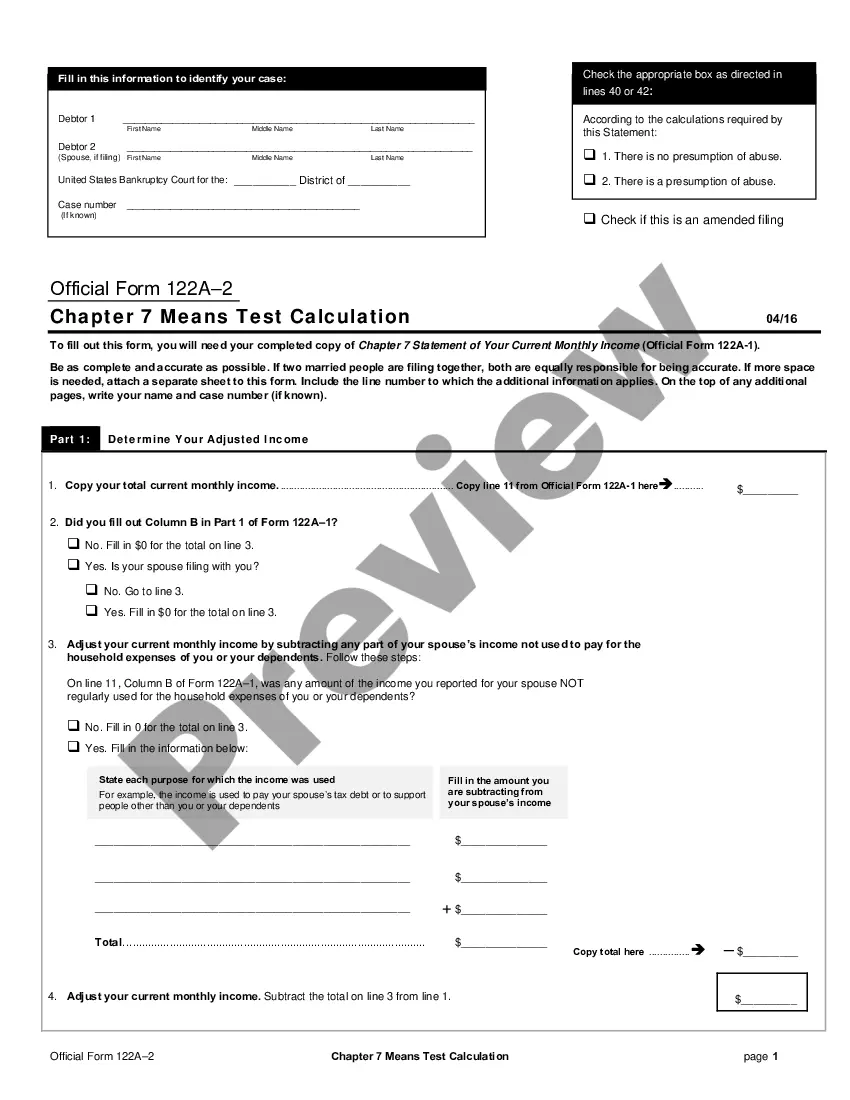

Steps To Completing Schedule C Step 1: Gather Information. Step 2: Calculate Gross Profit and Income. Step 3: Include Your Business Expenses. Step 4: Include Other Expenses and Information. Step 5: Calculate Your Net Income. If You Have a Business Loss.

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit. You are involved in the activity with continuity and regularity.

?I only earned X amount, so I don't have to file? You must report all income and losses from your sole proprietorship or single-member LLC by filing Schedule C. There is a minimum threshold for paying tax on your self-employment income ($400)?but no minimum for reporting any loss or profit on your business.

When it comes to sole proprietorships, the draw method is your only option; you are not legally able to pay yourself a salary. During taxation, the IRS looks at what is left over after deducting expenses on Form 1040 Schedule C. This is considered your profit, which the IRS views as your personal income.

The sole proprietor can decide his payment based on expenses made and the tax. In the initial phase, the owner must keep less amount for himself until his business is firmly established. He can then go on increasing the self-payment with time.