Instructions Form Schedule C With Tax Return

Description

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

Identifying a reliable location to obtain the latest and suitable legal samples is part of the challenge of navigating bureaucracy. Finding the appropriate legal documents requires accuracy and meticulousness, which is why it is crucial to acquire samples of Instructions Form Schedule C With Tax Return exclusively from trustworthy sources, such as US Legal Forms. An incorrect template will squander your time and postpone the matter you are dealing with. With US Legal Forms, you have minimal concerns. You can access and verify all the details concerning the document's application and relevance for your circumstances and in your jurisdiction.

Follow the steps outlined to complete your Instructions Form Schedule C With Tax Return.

Eliminate the hassle associated with your legal documentation. Explore the extensive US Legal Forms catalog to discover legal samples, assess their relevance to your circumstances, and download them instantly.

- Use the library navigation or search feature to find your template.

- Check the form's details to determine if it meets the specifications of your state and area.

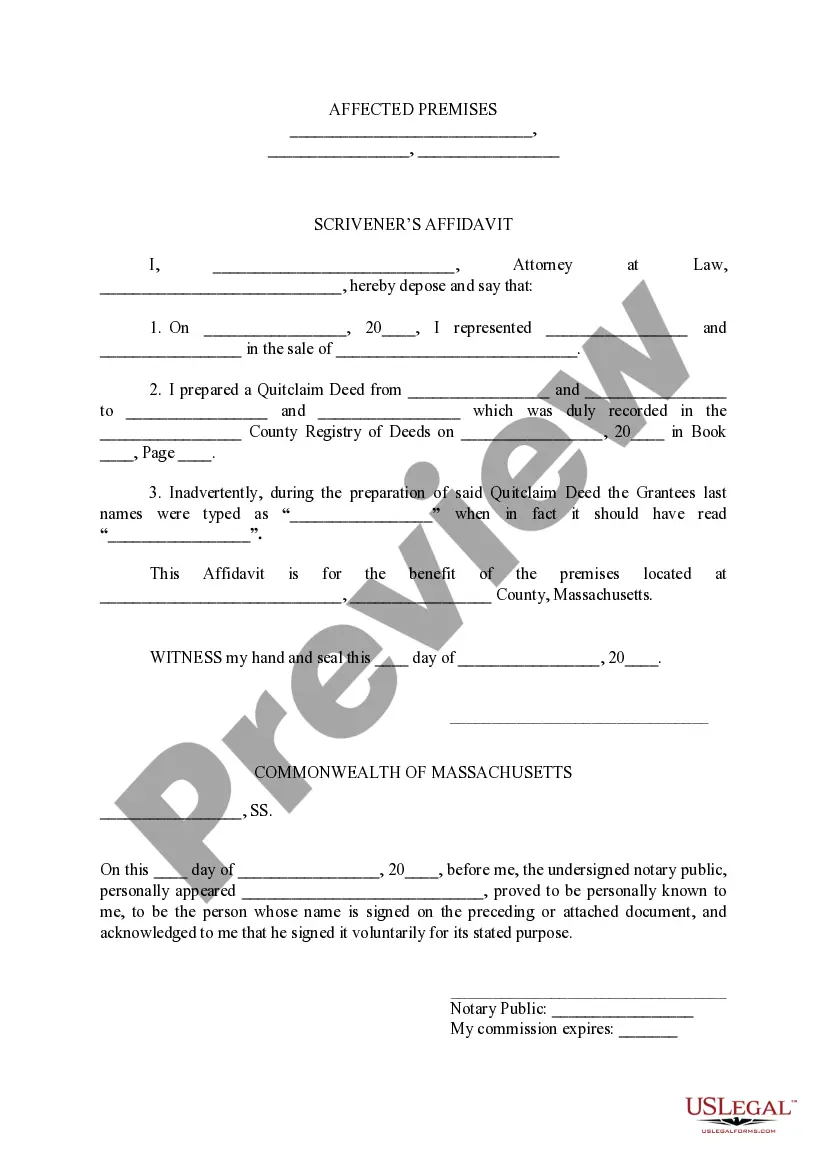

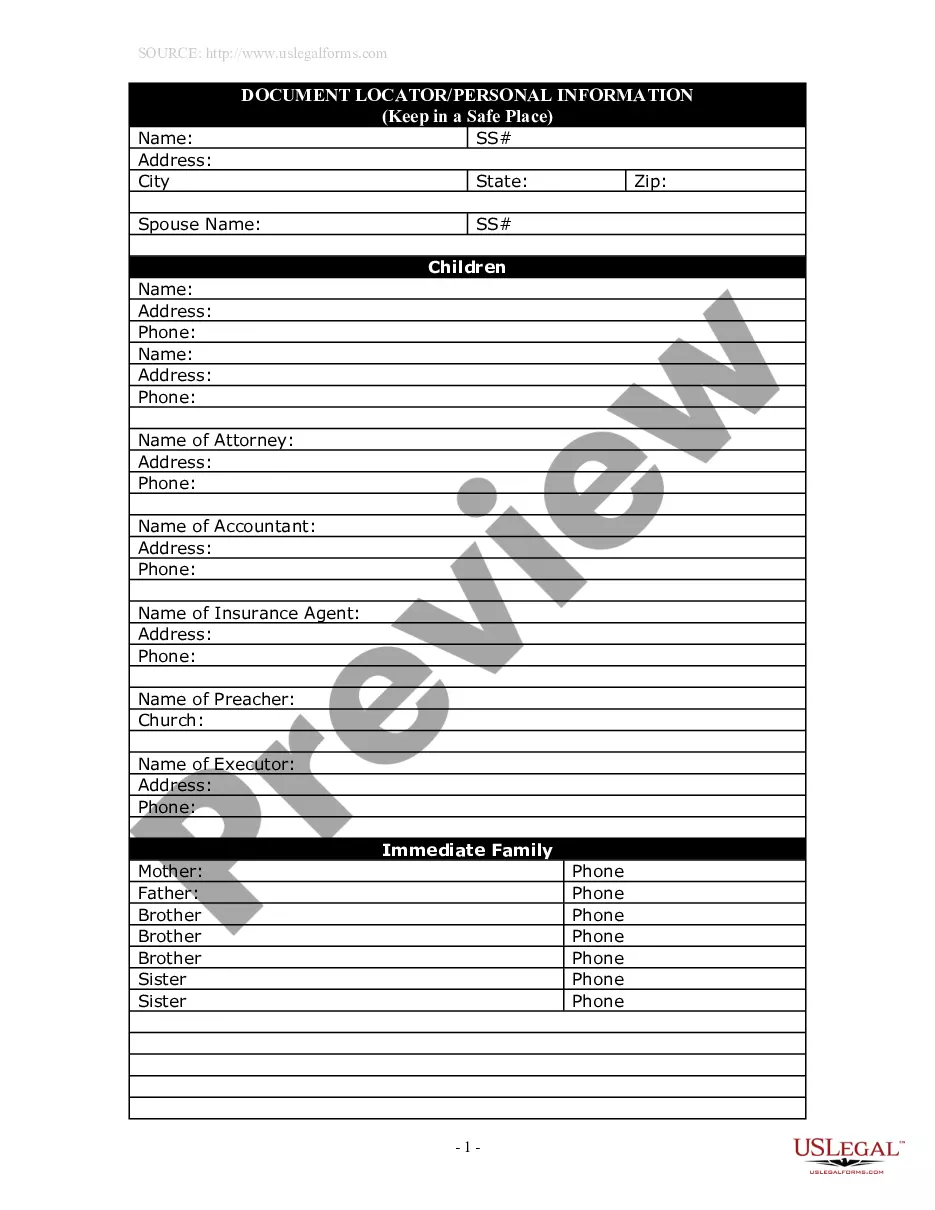

- Review the form preview, if available, to ensure the template is the one you seek.

- Continue the search and find the accurate document if the Instructions Form Schedule C With Tax Return does not meet your specifications.

- If you are confident about the form's applicability, download it.

- When you are a registered user, click Log in to verify and access your chosen templates in My documents.

- If you do not have an account yet, click Buy now to obtain the template.

- Choose the payment plan that fits your needs.

- Proceed to registration to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Instructions Form Schedule C With Tax Return.

- Once you have the form on your device, you can modify it using the editor or print it and complete it manually.

Form popularity

FAQ

Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity.

Steps To Completing Schedule C Step 1: Gather Information. Step 2: Calculate Gross Profit and Income. Step 3: Include Your Business Expenses. Step 4: Include Other Expenses and Information. Step 5: Calculate Your Net Income. If You Have a Business Loss.

Self-employed taxpayers report their business income and expenses on Schedule C. TurboTax can help make the job easier. Use Schedule C to calculate whether your business had a taxable profit or a deductible loss.

Some examples include copyrights, business licenses, domain name fees, property taxes, federal and state taxes, etc. Travel and Meals - Amounts paid for meals and travel in relation to your business.

You add up all of your current expenses on Schedule C and deduct the total from your gross business income to determine your net business income?the amount on which you are taxed.