Instructions Form Schedule C With F)

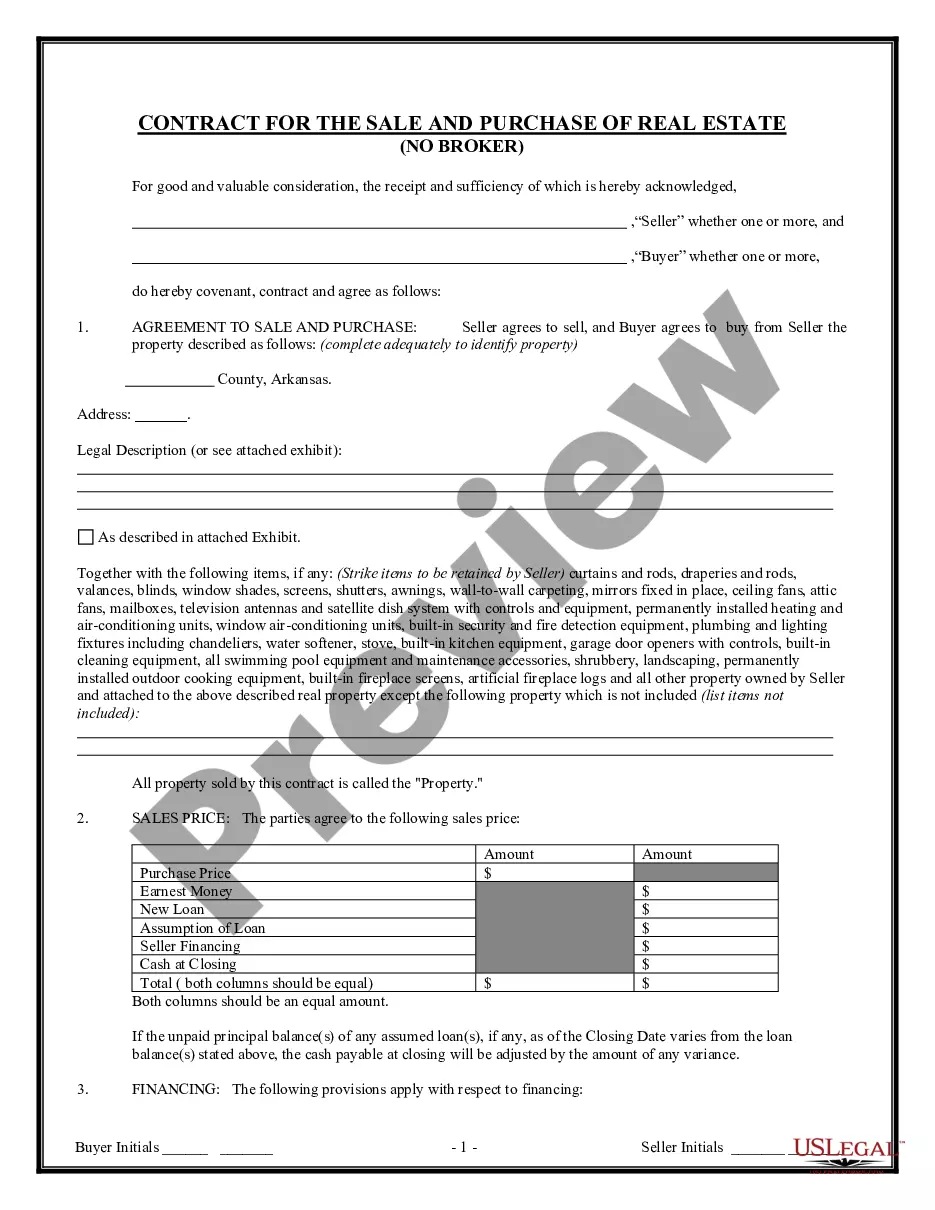

Description

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

Engaging with legal documents and procedures can be a lengthy addition to your day.

Instructions Form Schedule C With F) and similar forms typically necessitate searching for them and figuring out the most efficient way to fill them out successfully.

Consequently, whether you are managing financial, legal, or personal issues, having a detailed and useful online directory of forms readily available will be highly beneficial.

US Legal Forms is the leading online resource for legal templates, boasting over 85,000 state-specific forms and various tools to assist you in completing your documentation effortlessly.

Is it your first experience with US Legal Forms? Sign up and create your account in a few minutes, and you'll gain entry to the form directory and Instructions Form Schedule C With F). Then, follow the steps below to finish your form: Ensure you select the correct form using the Review option and examine the form details. Click Buy Now when ready, and select the monthly subscription plan that fits your needs. Click Download, then complete, eSign, and print the form. US Legal Forms has 25 years of experience assisting clients in managing their legal documents. Obtain the form you need today and enhance any process without exerting too much effort.

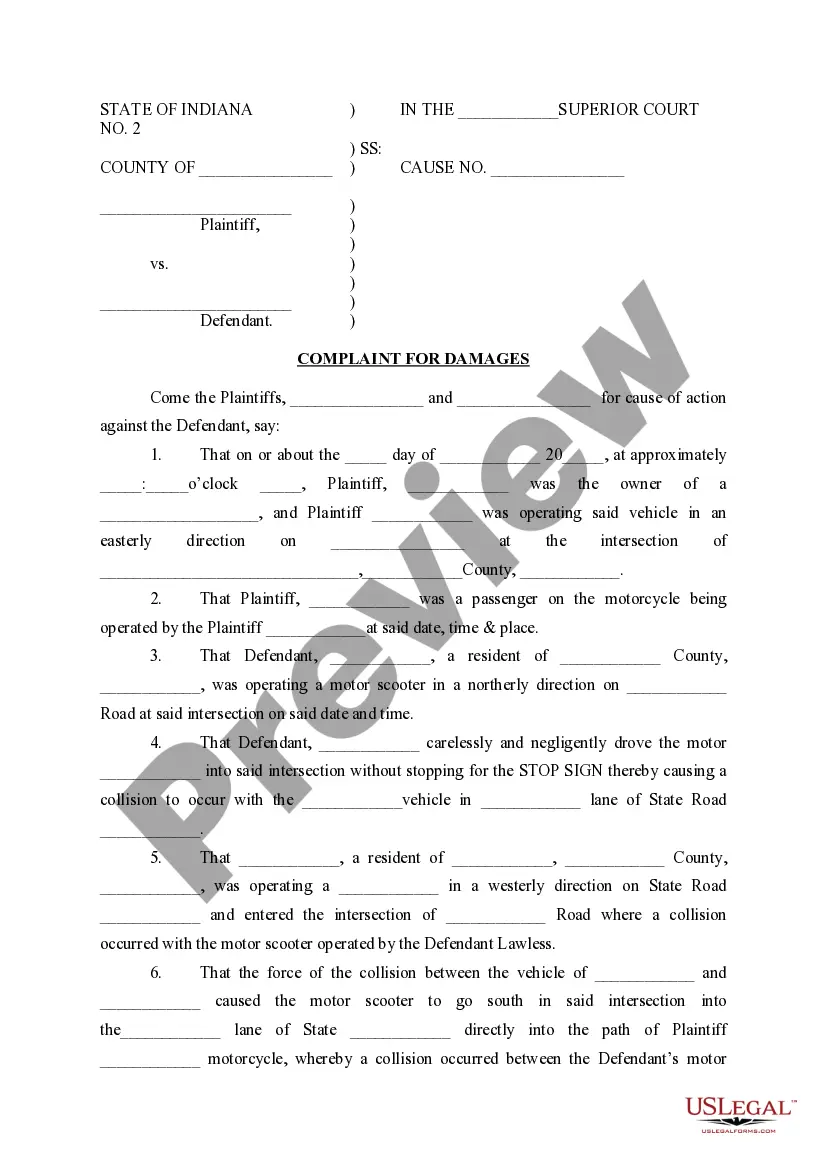

- Explore the collection of pertinent documents accessible with just one click.

- US Legal Forms provides you with state- and county-specific forms available at any time for download.

- Protect your document management processes with a premium service that enables you to assemble any form in minutes without additional or concealed fees.

- Simply Log In to your account, locate Instructions Form Schedule C With F) and obtain it instantly within the My documents section.

- You can also access previously saved forms.

Form popularity

FAQ

The instructions for Schedule F guide you through reporting your farming income and expenses on your tax return. To complete this form accurately, you need to gather details about your farming operations, including sales, costs, and any applicable deductions. By following the instructions for Schedule F, you can ensure that you report your income correctly, maximizing your potential tax benefits. For a streamlined process, consider using US Legal Forms, which provides easy access to the necessary forms and guidance.

Some of the biggest tax mistakes include failing to report all income, overlooking deductions, and misclassifying business expenses. Many individuals also neglect to keep accurate records, which can lead to issues during audits. By being aware of these common pitfalls, you can better prepare for tax season. For detailed Instructions form schedule c with f), uslegalforms offers resources to help you avoid these mistakes.

Filling out a Schedule C form involves detailing your business income and expenses. Start by entering your business name and the type of business you operate. Next, record your total income, followed by listing your expenses in their respective categories. For step-by-step Instructions form schedule c with f), consider using platforms like uslegalforms that provide user-friendly templates and guidance.

Code F on form 1099-C refers to the identification of a debt that has been canceled or forgiven. This code indicates that the cancellation of debt is due to a bankruptcy case. It’s important to report this correctly as it can impact your taxable income. For comprehensive Instructions form schedule c with f), you can find helpful guides that clarify the implications of such codes.

Schedule C and Schedule F serve different purposes in tax reporting. Schedule C is used by sole proprietors to report income and expenses from a business, while Schedule F is specifically for farmers to report their farming income and expenses. Understanding the distinction is crucial for accurate tax filing. For detailed Instructions form schedule c with f), consider using resources that simplify these processes.

Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity.

Write-offs Rather than taking a direct deduction for written-off inventory, you use Schedule C to factor the loss into your COGS. You report your beginning inventory, purchases and direct costs on Part III of Schedule C. After subtracting your ending inventory, the result is the cost of good sold.

For Schedule C filers, at risk means you are using your own money for the business. Only check Box 32a if "All investment is at risk". Check box 32b if "Some investment is not at risk". A loss may only be deducted up to the amount you personally have at risk.

An inventory write-off may be recorded in one of two ways. It may be expensed directly to the cost of goods sold (COGS) account, or it may offset the inventory asset account in a contra asset account, commonly referred to as the allowance for obsolete inventory or inventory reserve.

Inventory at the beginning of the year is reported on Line 35, purchases are reported on Line 36 (with a reminder to subtract the cost of items you withdrew for your own personal use), goods available for sale appears on Line 40, inventory at the end of the year is reported on Line 41, and the result is your cost of ...