Exempt Asset For Medicaid Eligibility Purposes

Description

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

Whether for commercial reasons or personal matters, everyone encounters legal issues at some stage in their life.

Filling out legal documents requires meticulous attention, beginning with selecting the correct template.

Select the document format you desire and download the Exempt Asset For Medicaid Eligibility Purposes. Once downloaded, you can fill out the form using editing software or print it to complete manually. With a vast US Legal Forms catalog available, you won't need to waste time searching for the right sample online. Utilize the library’s straightforward navigation to find the correct template for any situation.

- For instance, if you select the incorrect version of an Exempt Asset For Medicaid Eligibility Purposes, it will be rejected upon submission.

- It is thus crucial to have a trustworthy source of legal documents such as US Legal Forms.

- If you need to obtain a sample of Exempt Asset For Medicaid Eligibility Purposes, follow these simple instructions.

- Access the needed sample by utilizing the search field or catalog browsing.

- Review the form’s description to ensure it corresponds with your situation, state, and county.

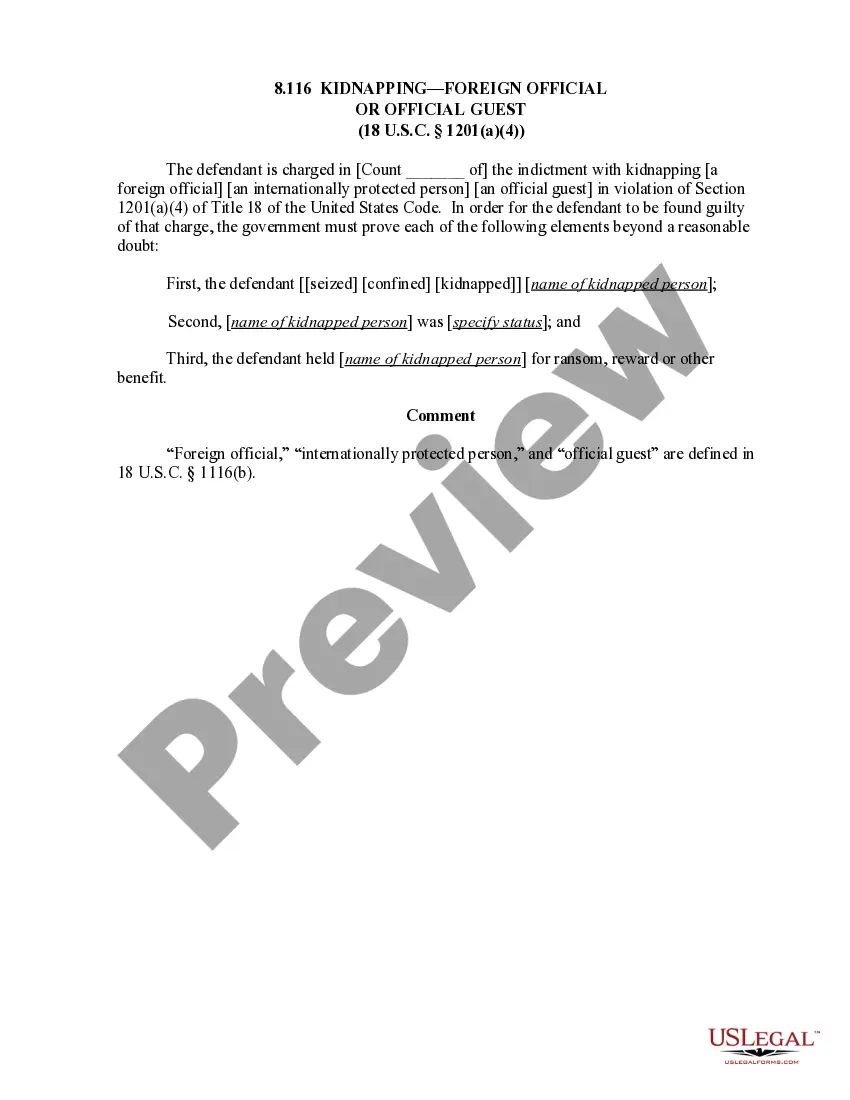

- Click on the form’s preview to evaluate it.

- If it is the wrong form, return to the search tool to find the Exempt Asset For Medicaid Eligibility Purposes sample you require.

- Download the file once it meets your needs.

- If you possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Select your payment method: use a credit card or PayPal account.

Form popularity

FAQ

For example, a person's primary home is exempt from their total assets as long as they live in the home or intend to return to the home if he/she is in a nursing home, and the home equity interest is below $955,000. In short, owning a home typically will not disqualify you from Medicaid.

Definitions. Parents of Dependent Children: Eligibility levels for parents are presented as a percentage of the 2023 FPL for a family of three, which is $24,860. Other Adults: Eligibility limits for other adults are presented as a percentage of the 2023 FPL for an individual, which is $14,580.

Some resources do not count toward the $2,000 monthly resource limit. These include household goods and personal effects, burial funds or prepaid contract up to $5,000; burial space items (casket, vault, plot, marker, opening and closing of grave); one car if used by the household member.

For example, couples can keep their primary residence, one vehicle, and the value of regular household goods and furnishings without those values counting toward their Medicaid resources. In some cases, medical equipment, jewelry, and other items may also be considered exempt.