Secured Claims In Chapter 13

Description

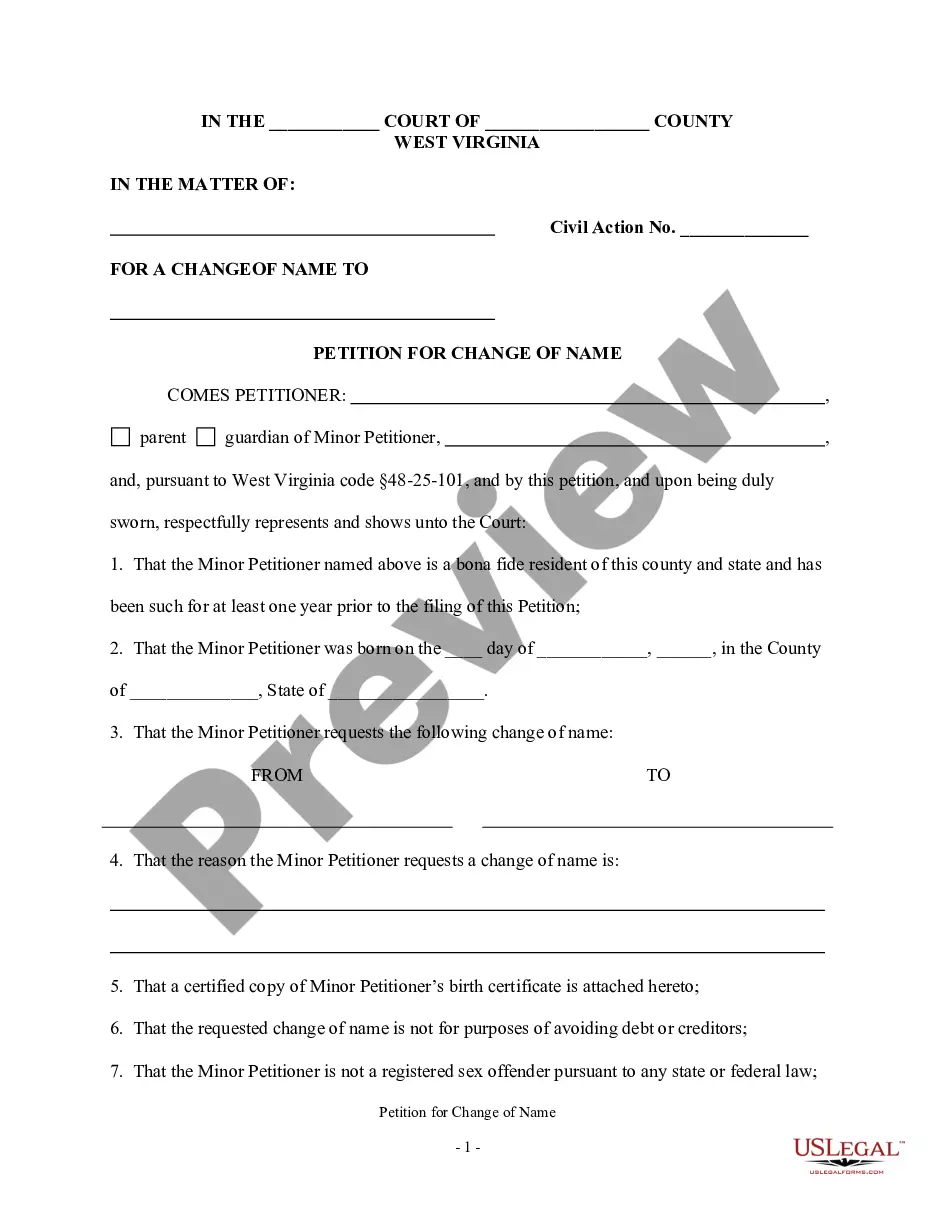

How to fill out List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

Acquiring legal templates that adhere to federal and state statutes is crucial, and the internet provides numerous choices to consider.

However, why squander time searching for the suitable Secured Claims In Chapter 13 example online when the US Legal Forms digital library already consolidates such templates in one location.

US Legal Forms is the largest online legal repository featuring over 85,000 customizable templates crafted by lawyers for any business and personal situation. The documents are easy to navigate, organized by state and intended use.

All documents available through US Legal Forms are reusable. To download and complete previously saved forms, access the My documents section in your account. Experience the most comprehensive and user-friendly legal document service!

- Our experts keep pace with legislative changes, ensuring that your form is current and compliant when you obtain a Secured Claims In Chapter 13 from our platform.

- Procurement of a Secured Claims In Chapter 13 is straightforward and convenient for both existing and new users.

- If you possess an account with an active subscription, Log In and save the document you need in the appropriate format.

- If you are a newcomer to our site, follow the steps below.

- Review the template using the Preview feature or via the text outline to confirm it fulfills your requirements.

Form popularity

FAQ

If an unsecured creditor fails to file proof of claim in Chapter 13, they typically forfeit their right to receive any payment through the bankruptcy process. This situation allows you to focus on repaying secured claims in Chapter 13 without the added burden of unsecured debts. Additionally, it simplifies your repayment plan, as you will not need to account for those creditors. To ensure a smooth process, consider utilizing US Legal Forms for guidance on managing your claims effectively.

A secured proof of claim is a legal document that a creditor files in a bankruptcy case to establish the right to receive payment from the debtor. This document outlines the amount owed to the creditor and is tied to a specific asset, such as a car or home. In the context of secured claims in chapter 13, these claims allow creditors to retain their rights to the collateral while the debtor restructures their payment plan. Understanding secured claims is crucial for both debtors and creditors, as it influences the repayment process during bankruptcy.

In Chapter 13, secured debt can be managed through a repayment plan. Debtors may keep their property while making payments on the secured claims in Chapter 13, often at a reduced amount. This plan allows you to catch up on missed payments and restructure your debts over a period of three to five years. Utilizing platforms like US Legal Forms can help you create a solid plan tailored to your financial situation.

Yes, secured creditors must file a proof of claim in a Chapter 13 case to receive payments. This document establishes their entitlement to repayment based on the secured claims in Chapter 13. If they do not file, they may not receive compensation for the debt owed. Therefore, it is important for both debtors and creditors to understand this requirement to ensure a smooth bankruptcy process.

Secured Claims For example, when you buy a car and finance it, you allow the lender to hold title to your vehicle until the loan is paid in full. Some loans are secured involuntarily, generally by operation of law.

Understanding Secured Claims If you don't pay a secured debt, the creditor can take the collateral and sell it to obtain payment. If you file a Chapter 13 and intend to keep the property securing the loan, you must stay current on the payments while paying off any arrearages over the repayment plan period.

A secured claim is a financial obligation for which there is collateral to guarantee the payment of a debt. The collateral can be most any type of property, such as real estate, business inventory and personal goods. With most secured claims, the debtor voluntarily pledges an interest in property to the creditor.

Unlike unsecured debt, secured debt (e.g. mortgages and car loans) must be made current under Chapter 13 plans, if foreclosure of the house or repossession of the collateral is to be avoided.