Claims Chapter 13 With Car Loan

Description

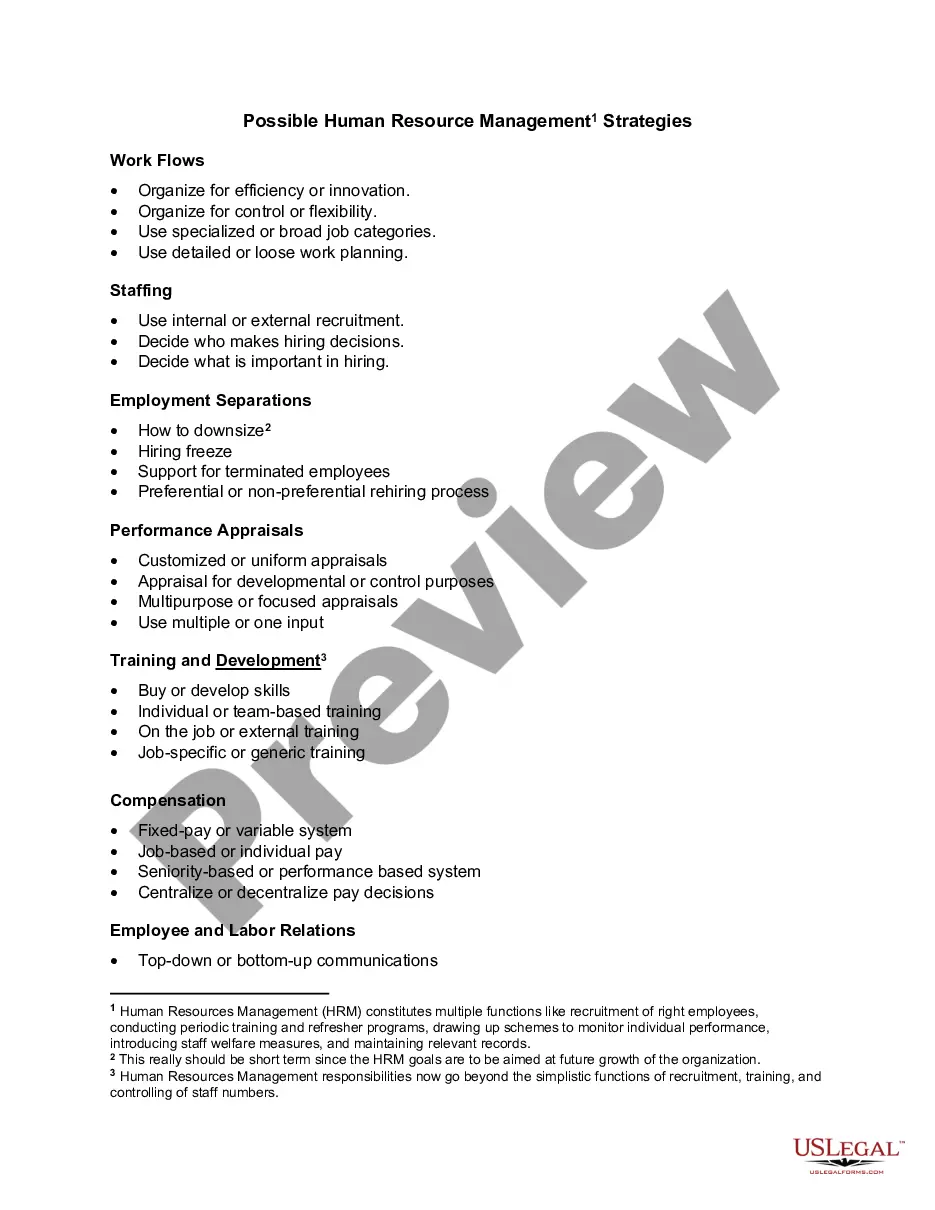

How to fill out List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

Legal document managing may be overpowering, even for knowledgeable experts. When you are interested in a Claims Chapter 13 With Car Loan and don’t get the time to spend looking for the appropriate and updated version, the operations can be stressful. A strong web form catalogue can be a gamechanger for anyone who wants to deal with these situations successfully. US Legal Forms is a industry leader in online legal forms, with more than 85,000 state-specific legal forms accessible to you at any moment.

With US Legal Forms, you are able to:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any requirements you could have, from individual to business documents, all in one place.

- Make use of innovative resources to complete and manage your Claims Chapter 13 With Car Loan

- Gain access to a useful resource base of articles, guides and handbooks and resources related to your situation and requirements

Help save time and effort looking for the documents you will need, and make use of US Legal Forms’ advanced search and Preview feature to locate Claims Chapter 13 With Car Loan and download it. In case you have a monthly subscription, log in for your US Legal Forms profile, search for the form, and download it. Review your My Forms tab to find out the documents you previously downloaded and to manage your folders as you can see fit.

Should it be your first time with US Legal Forms, create an account and have limitless usage of all benefits of the library. Listed below are the steps to take after accessing the form you want:

- Confirm it is the correct form by previewing it and reading its information.

- Be sure that the sample is accepted in your state or county.

- Pick Buy Now once you are ready.

- Choose a subscription plan.

- Find the file format you want, and Download, complete, sign, print and deliver your document.

Enjoy the US Legal Forms web catalogue, supported with 25 years of experience and trustworthiness. Change your day-to-day document administration into a easy and intuitive process today.

Form popularity

FAQ

You'll get the benefit of the reduced balance and interest rate only if you complete your Chapter 13 plan. If the case gets dismissed, the loan will revert to its original terms and the creditor will have the right to collect the total amount owed at the higher interest rate.

In most cases, once you complete your Chapter 13 payment plan, you are relieved from this debt. If your dischargeable debt is secured, you must either continue making your payments on it during your bankruptcy or you can surrender the collateral asset (such as your car).

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

You can get a personal loan while you are still repaying your Chapter 13 bankruptcy plan, but it's difficult. Your trustee court will only allow you to take on new debt if there is a pressing need for you to do so, and if it will help you to make your repayments on time.

Creating a payment plan The goal of the Chapter 13 process is to allow you to keep your possessions, including your car, while paying off your debt. Additionally, if you're behind on payments, the plan will require you to catch up and make timely payments moving forward.