Chapter 7 Fill Formation Of A Company Notes

Description

How to fill out Discharge Of Joint Debtors - Chapter 7 - Updated 2005 Act Form?

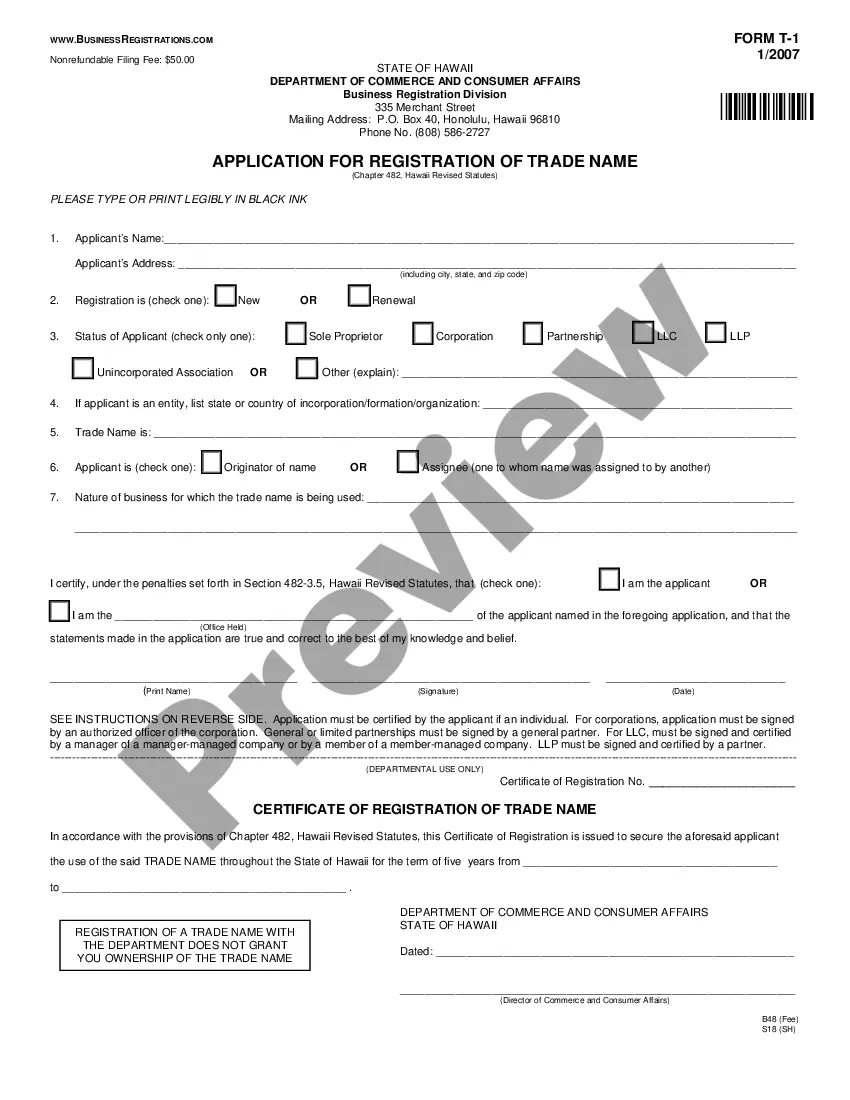

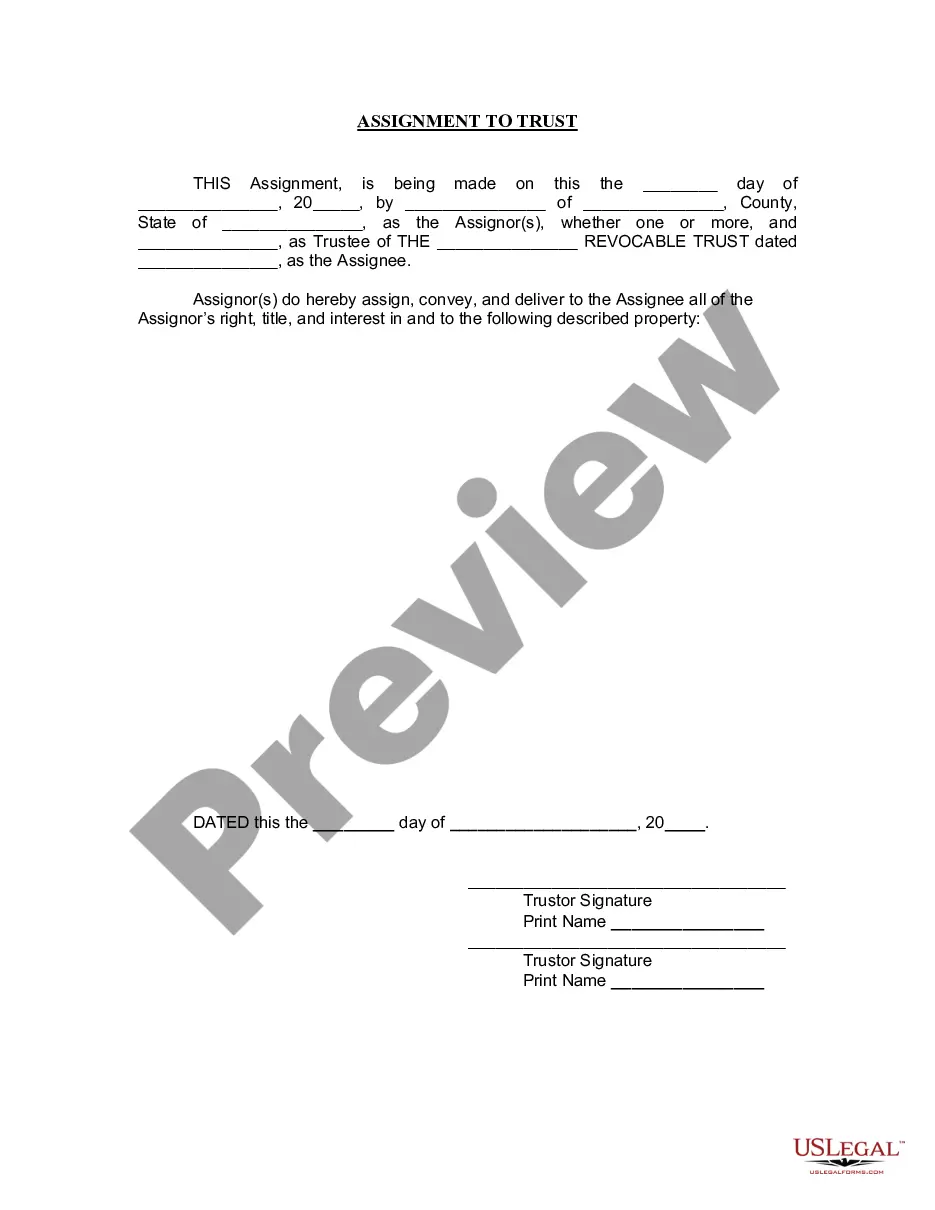

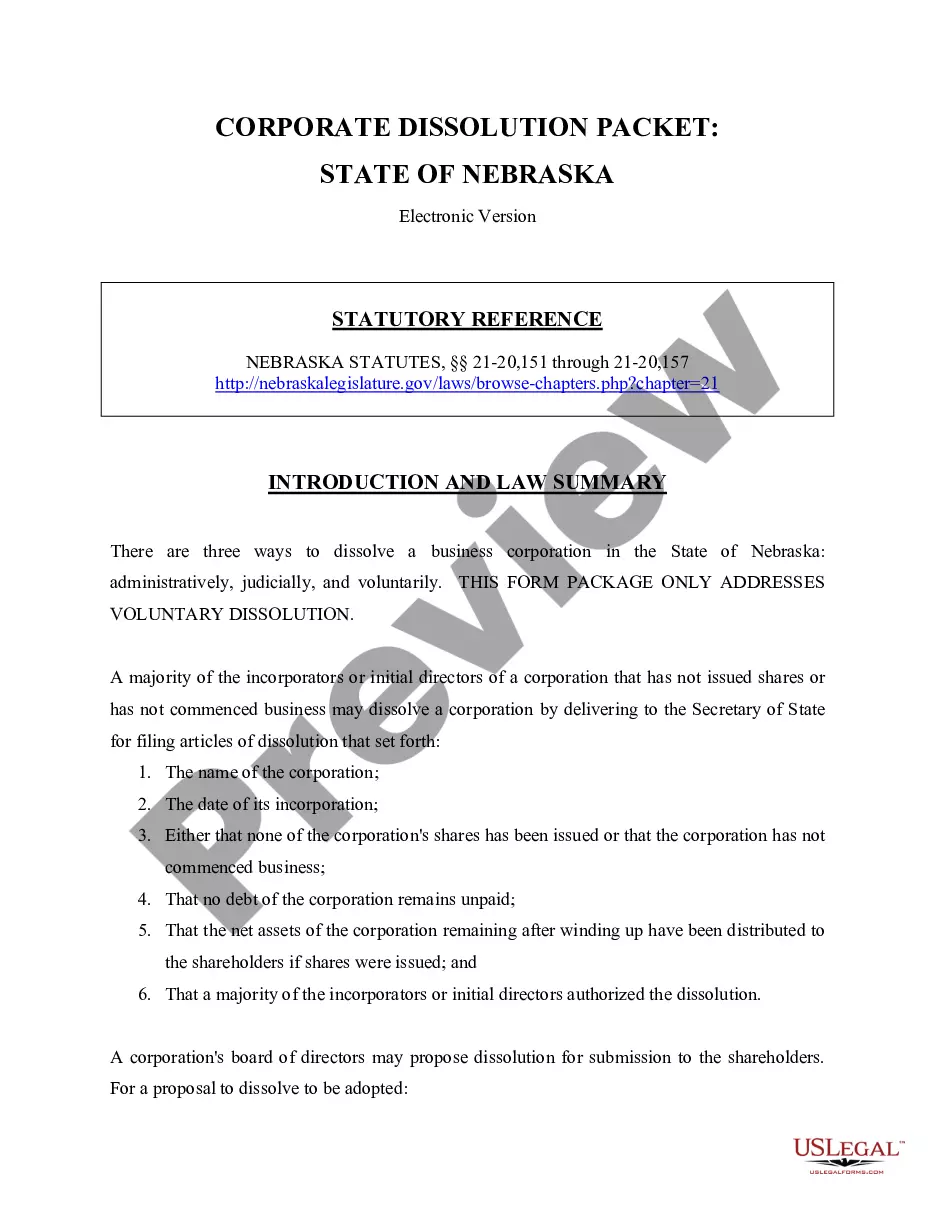

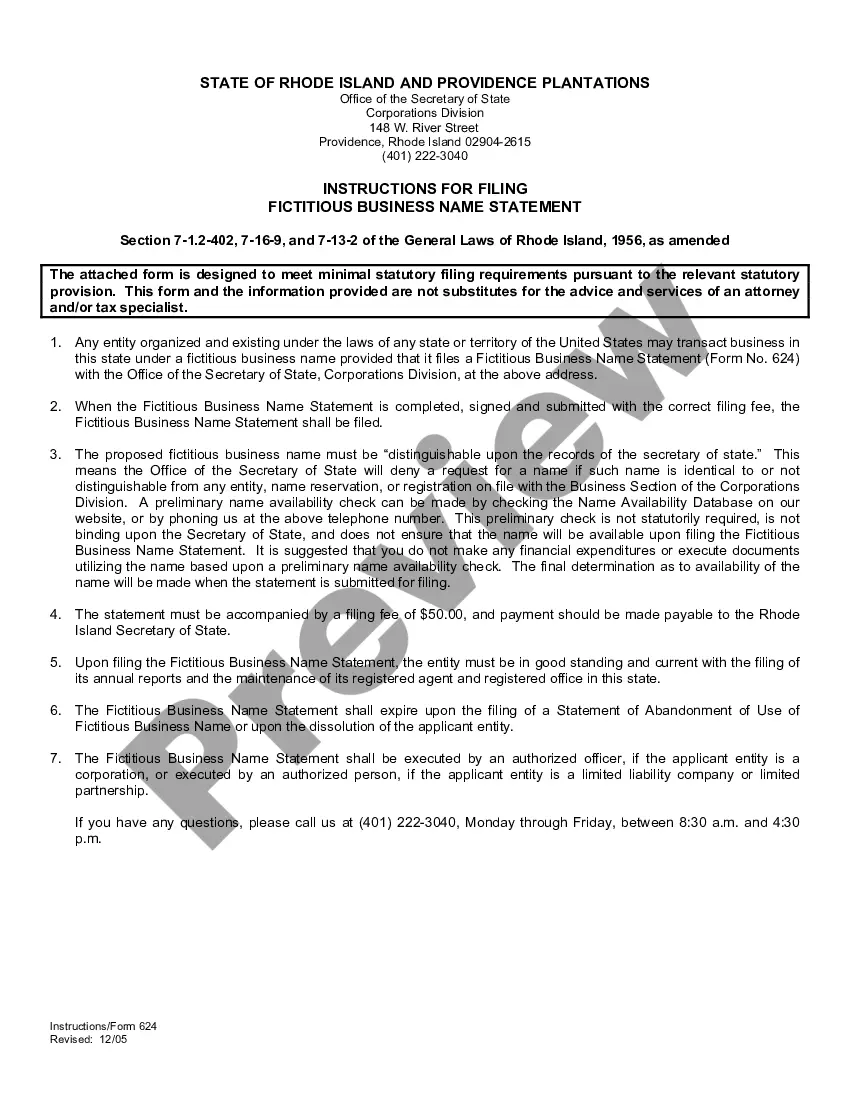

The Chapter 7 Fill Formation Of A Company Notes you see on this page is a reusable legal template drafted by professional lawyers in compliance with federal and local laws and regulations. For more than 25 years, US Legal Forms has provided individuals, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the quickest, most straightforward and most trustworthy way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Chapter 7 Fill Formation Of A Company Notes will take you only a few simple steps:

- Look for the document you need and review it. Look through the sample you searched and preview it or check the form description to verify it suits your needs. If it does not, make use of the search bar to find the right one. Click Buy Now when you have found the template you need.

- Subscribe and log in. Opt for the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Choose the format you want for your Chapter 7 Fill Formation Of A Company Notes (PDF, DOCX, RTF) and download the sample on your device.

- Complete and sign the document. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a eSignature.

- Download your paperwork one more time. Make use of the same document once again anytime needed. Open the My Forms tab in your profile to redownload any previously purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

When a company becomes insolvent, the shares of the company would experience a deep sell-off, bringing the share value down. In such a case, you have two options. You can either sell off your investments to prevent any further decline in their value.

Formal Proof of Claim the debtor's name and the bankruptcy case number. the creditor's information, including a mailing address. the amount owed as of the petition date. the basis for the claim (such as goods or services purchased, a loan or credit card balance, a personal injury or wrongful death award), and.

Examples: Goods sold, money loaned, lease, services performed, personal injury or wrongful death, or credit card. Attach redacted copies of any documents supporting the claim required by Bankruptcy Rule 3001(c). Limit disclosing information that is entitled to privacy, such as health care information.

When you file for Chapter 7 bankruptcy, you will have to complete a form called the Statement of Intention for Individuals Filing Under Chapter 7. On this form, you tell the court whether you want to keep your secured and leased property?such as your car, boat, or home?or let it go back to the creditor.

A Chapter 7 filing is the more nuclear option. It means that the company stops operating and all its assets are put up for sale by a court-appointed trustee, with the proceeds divvied up to the company's debtors in order of the seniority of the debt.