Chapter 7 Fill Form 2a

Description

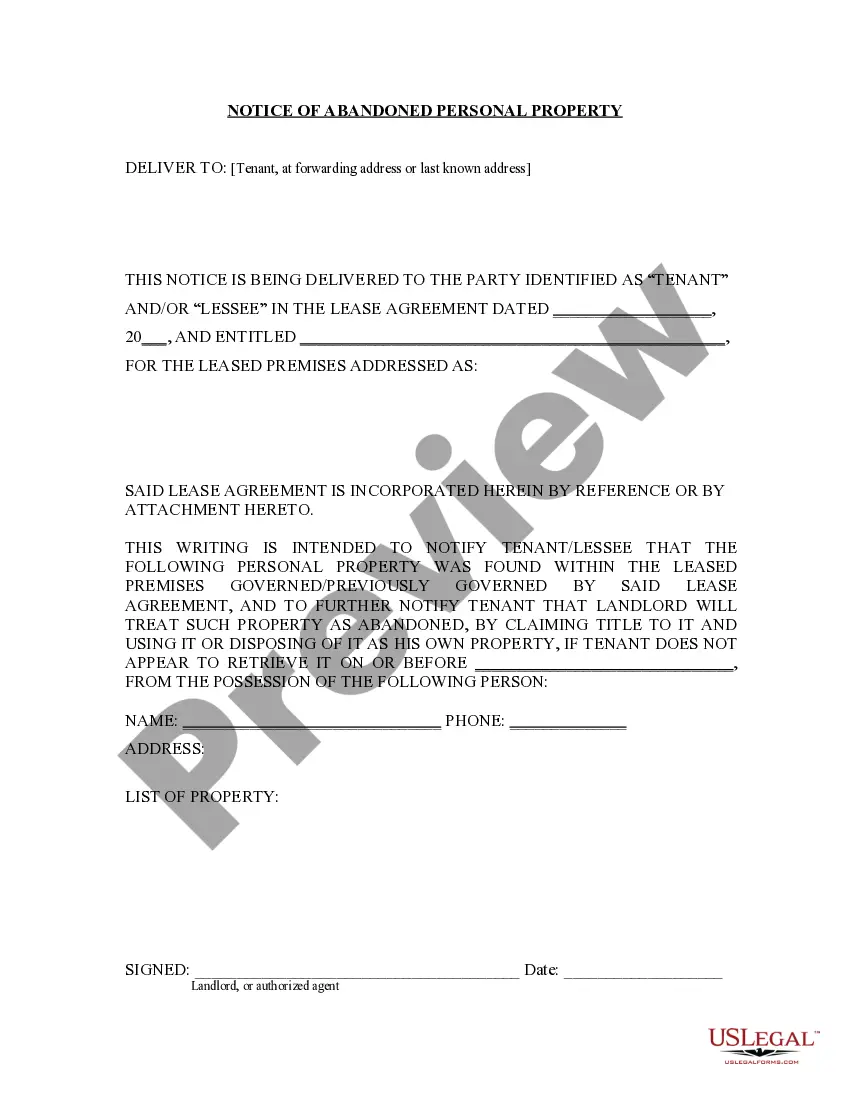

How to fill out Discharge Of Joint Debtors - Chapter 7 - Updated 2005 Act Form?

Dealing with legal documents and processes can be a lengthy addition to your overall day.

Chapter 7 Fill Form 2a and similar forms often require you to search for them and comprehend the best method to fill them out accurately.

Consequently, if you are handling financial, legal, or personal issues, utilizing a comprehensive and functional online library of forms at your disposal will significantly help.

US Legal Forms is the leading online platform for legal templates, boasting over 85,000 state-specific forms and various resources that will assist you in completing your documents swiftly.

Is this your first time using US Legal Forms? Sign up and create an account in a few minutes and you’ll gain access to the form library and Chapter 7 Fill Form 2a. Then, follow the steps below to complete your form: Ensure you have the correct form by using the Preview feature and reviewing the form details. Select Buy Now once ready, and choose the monthly subscription option that suits your requirements. Opt for Download then fill out, sign, and print the form. US Legal Forms has twenty-five years of expertise assisting clients in managing their legal documents. Acquire the form you need today and streamline any process effortlessly.

- Browse the collection of relevant documents accessible to you with just one click.

- US Legal Forms provides state- and county-specific forms available for download at any time.

- Safeguard your document management processes with top-notch support that enables you to assemble any form in minutes without any additional or concealed fees.

- Simply Log In to your account, find Chapter 7 Fill Form 2a, and obtain it instantly from the My documents section.

- You can also retrieve previously saved forms.

Form popularity

FAQ

You may hear it called a ?liquidation? bankruptcy because your trustee can liquidate, or sell off, an nonexempt property. This might sound scary but rest assured that most Chapter 7 filers do not lose any property because their property is protected by exemptions.

Examples of nonexempt assets that can be subject to liquidation: Additional home or residential property that is not your primary residence. Investments that are not part of your retirement accounts. An expensive vehicle(s) not covered by bankruptcy exemptions.

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.

Calculation of Current Monthly Income: To begin the means test, debtors calculate their current monthly income, which equates to twice the gross income earned in the six months leading up to the bankruptcy filing.

The means test is calculated by comparing the debtor's average income for the past six months (current monthly income), annualized, to the median income for households of the same size in the debtor's state of residence.