Work Related Order Without Receipts 2022

Description

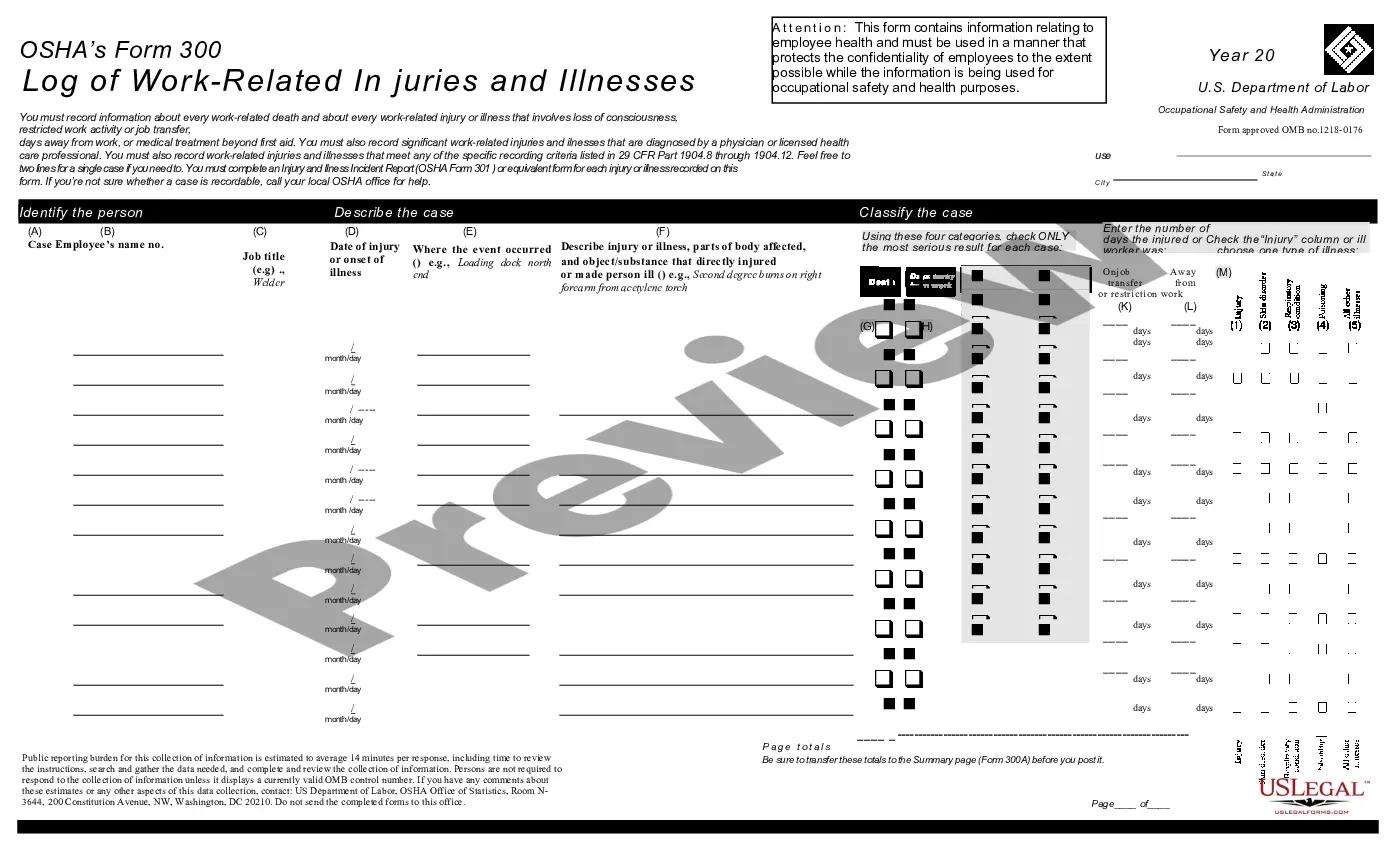

How to fill out Log Of Work Related Injuries And Illnesses (OSHA 300)?

Managing legal paperwork and processes can be a lengthy addition to your entire day.

Work Related Order Without Receipts 2022 and similar documents often require you to search for them and find your way to fill them out correctly.

Thus, whether you are dealing with financial, legal, or personal issues, utilizing a comprehensive and practical online library of forms at your disposal will be highly beneficial.

US Legal Forms is the leading online platform for legal templates, providing over 85,000 state-specific forms and a variety of resources to assist you in completing your documents swiftly.

Is it your first time utilizing US Legal Forms? Register and create an account in just a few minutes, and you’ll gain access to the form library and Work Related Order Without Receipts 2022. Then, follow the steps below to fill out your form: Ensure you have the correct form using the Preview feature and reviewing the form description. Click Buy Now when ready, and select the subscription plan that fits your needs. Click Download, then complete, sign, and print the form. US Legal Forms has 25 years of experience aiding users in managing their legal documents. Find the form you need today and simplify any process effortlessly.

- Explore the collection of relevant documents accessible to you with a single click.

- US Legal Forms offers state- and county-specific forms available for download at any time.

- Protect your document management processes using a premium service that allows you to create any form within minutes with no extra or concealed charges.

- Simply Log In to your account, find Work Related Order Without Receipts 2022, and obtain it immediately in the My documents section.

- You can also retrieve previously downloaded forms.

Form popularity

FAQ

Clothing and uniforms Up to $150 per year can be deducted for work-related laundry clothes that have been purchased. Examples include high-visibility clothing, branded uniforms, and personal safety equipment such as eyewear and boots.

The golden rules of claiming an expense for work You must have paid for it yourself. ... The expense must directly relate to earning your income. ... You must have a record of the expense (usually a receipt).

You have to support business expense claims with a sales invoice, an agreement of purchase and sale, a receipt, or some other voucher that supports the expenditure. If you pay cash for any business expenses, be sure to get receipts or other vouchers. Receipts should include the vendor's name and the date.

There are still ways you can claim for the expense. You should claim all business expenses that are necessary for your business operations. If you do not have a receipt, make sure that you have detailed notes about the transaction. For instance, who you purchased from, the date, the location of the sale, etc.

10 Deductions You Can Claim Without Receipts Home Office Expenses. This is usually the most common expense deducted without receipts. ... Cell Phone Expenses. ... Vehicle Expenses. ... Travel or Business Trips. ... Self-Employment Taxes. ... Self-Employment Retirement Plan Contributions. ... Self-Employed Health Insurance Premiums. ... Educator expenses.