Performance Evaluation Forms For Nonprofits

Description

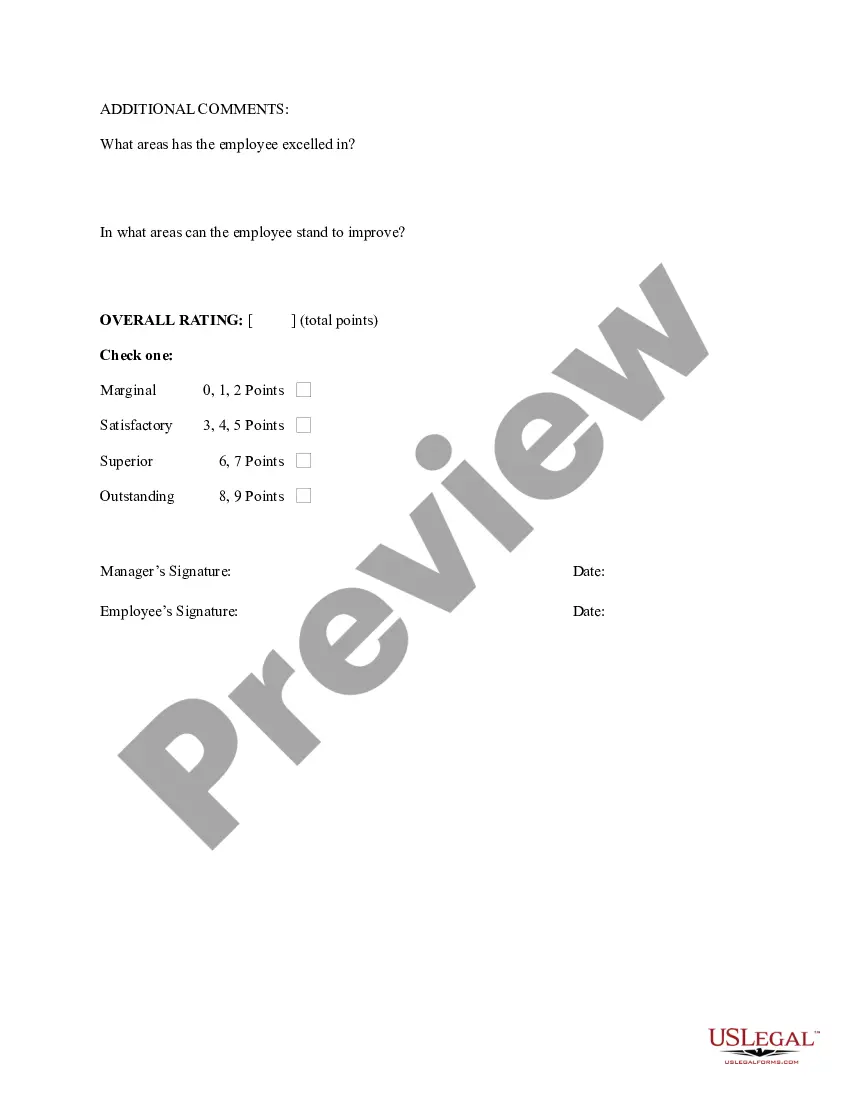

How to fill out Hourly Employee Evaluation?

Finding a reliable source for the most up-to-date and suitable legal templates is a significant part of navigating bureaucracy.

Identifying the correct legal documents requires accuracy and meticulousness, which is why it's essential to obtain samples of Performance Evaluation Forms For Nonprofits solely from trustworthy providers, such as US Legal Forms. An incorrect template can waste your time and delay your current situation.

Eliminate the hassles that come with your legal documentation. Explore the extensive US Legal Forms catalog to locate legal templates, assess their applicability to your situation, and download them instantly.

- Utilize the library navigation or search box to find your template.

- Examine the information of the form to ensure it meets the specifications of your state and locality.

- Check the form preview, if available, to confirm the form is indeed the one you seek.

- Return to the search to find the suitable document if the Performance Evaluation Forms For Nonprofits does not fulfill your needs.

- If you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you don’t have an account yet, click Buy now to acquire the form.

- Select the pricing option that fits your requirements.

- Proceed to the account setup to complete your purchase.

- Finalize your transaction by choosing a payment method (credit card or PayPal).

- Select the format to download Performance Evaluation Forms For Nonprofits.

- Once you have the form on your device, you can edit it with the editor or print it and fill it out manually.

Form popularity

FAQ

Performance review questions for a CEO should revolve around leadership, vision, and results. Common questions include inquiries about strategic initiatives, financial performance, and stakeholder engagement. These inquiries should aim to assess not only past performance but also future readiness. Tools like performance evaluation forms for nonprofits can help frame these questions effectively.

Other helpful resources are on DOR's website. Contact Center hours are 9 a.m. ? 4 p.m., Monday through Friday. (617) 887-6367 or (800) 392-6089 (toll-free in Massachusetts).

The general rule is that an estate has to be probated within 3 years of when the decedent died. However, this deadline doesn't apply to: A voluntary administration. Determining heirs.

As a rule, gifts of a set amount of money in a will should be paid out within a year of death. If the executor isn't able to pay the legacy within that time, the beneficiaries will be entitled to claim interest.

Contact Us For all departments (857) 368-4636. Toll Free (877) 623-6846. TTY (857) 368-0655.

What is Supplemental Probate and Family Court Rule 401? Rule 401 addresses financial statements and provides that within 45 days from service of the divorce summons, spouses must exchange complete and accurate financial statements detailing their assets, liabilities, income and expenses.

If not so resolved, any will probated informally becomes final, and if there is no such probate, the status of the decedent as intestate is finally determined, by a statute of limitations which bars probate and appointment unless requested within three years after death.

Massachusetts has a short one-year statute of limitations for asserting claims against a decedent's estate. The one-year period commences on the date of death, and before the period expires, the creditor must file a lawsuit and serve the fiduciary with process.

If the estate is already closed, MA law allows a person to file forms with the probate court to have the estate reopened. If a loved one has passed and you discover a new asset, seek advice from a qualified probate attorney who can help.