Self Evaluation Examples For Leadership

Description

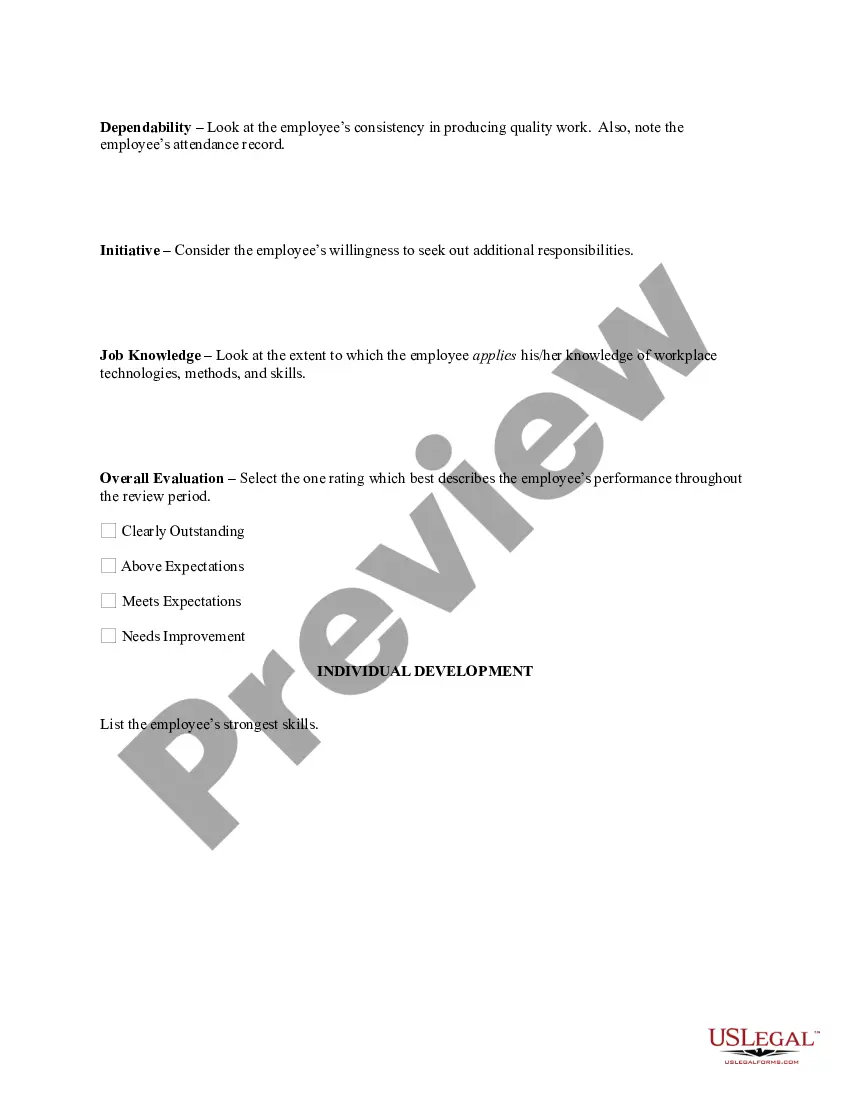

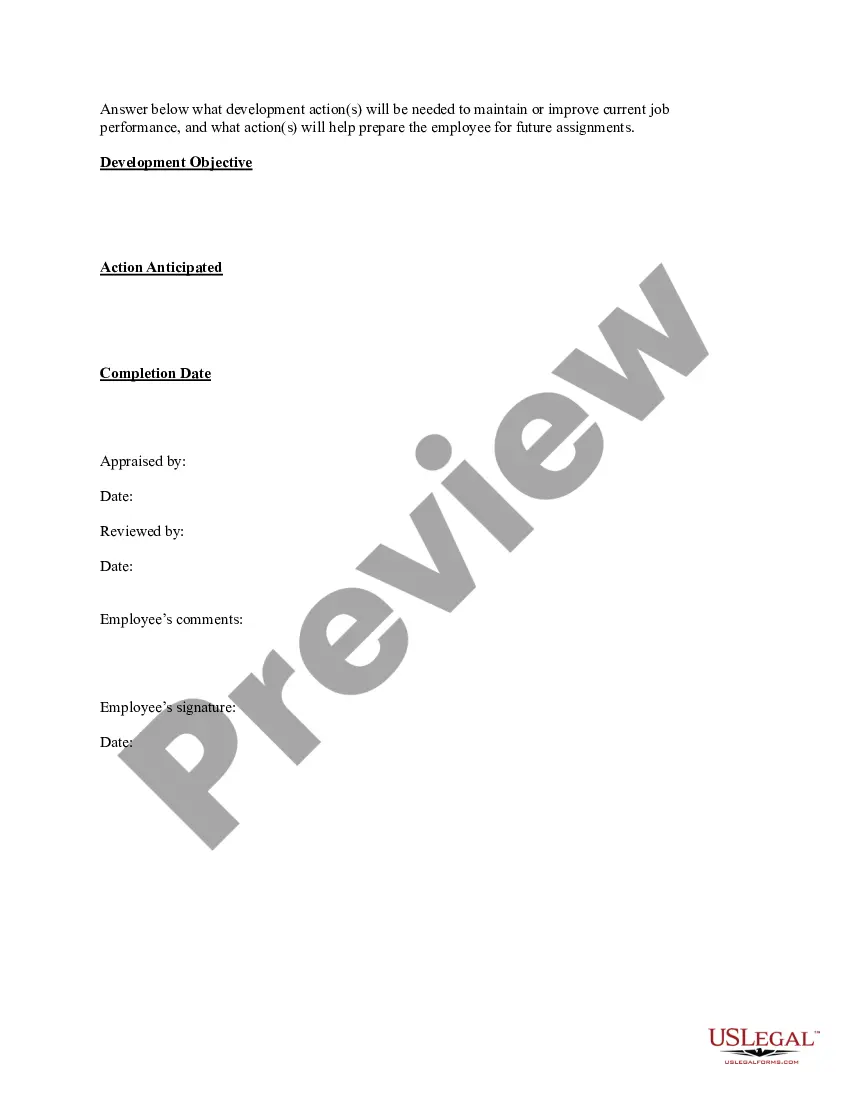

How to fill out Sample Performance Review For Nonexempt Employees?

Utilizing legal document samples that adhere to federal and regional regulations is essential, and the internet provides numerous choices to select from.

However, what is the advantage of spending time searching for the appropriate Self Evaluation Examples For Leadership template online if the US Legal Forms online repository already has such documents gathered in one location.

US Legal Forms stands as the largest online legal archive with more than 85,000 editable templates created by lawyers for various business and personal circumstances.

Review the template using the Preview feature or the text outline to confirm it fulfills your needs.

- They are easy to navigate with all documents organized by state and intended usage.

- Our specialists keep updated with legal changes, ensuring that your form is current and compliant when obtaining a Self Evaluation Examples For Leadership from our site.

- Acquiring a Self Evaluation Examples For Leadership is straightforward and fast for both existing and new users.

- If you have an account with an active subscription, Log In and download the document sample you need in your desired format.

- If you are visiting us for the first time, follow the instructions below.

Form popularity

FAQ

In the state of New Mexico it is formally referred to as a Combined Reporting System (CRS) Identification Number. This number will furnish a business with a unique New Mexico sales tax number, otherwise referred to as a NM Tax ID number.

You can also find printed forms: At your local District Office. See the CONTACT US link at the top of this page. At your local library. Over 100 libraries across the state have ordered supplies of personal income tax forms to make available to the public, or. You can call 1-866-285-2996 to order forms to be mailed.

These 2021 forms and more are available: New Mexico Form PIT-1 ? Personal Income Tax Return for Residents. New Mexico Form PIT-RC ? Rebate and Credit Schedule. New Mexico Form PIT-110 ? Adjustments to New Mexico Income.

A NMBTIN is a unique taxpayer ID issued by the New Mexico Department of Taxation and Revenue. It is used to report withholdings, gross receipt taxes, and any compensation you may receive. This is different from your Federal Employer Identification Number, which is also required for most business types.

If you need assistance, call 1-866-809-2335. Once you're online filing your return, you can also pay online. For no additional charge, you may pay using an electronic check that authorizes the Department to debit your checking account in the amount and on the date you specify.

Obtain Tax ID Numbers In order to obtain an EIN or a FEIN, visit the IRS Application for Employer Identification Number. Register with the New Mexico Secretary of the State Business Services. You may register online at the New Mexico Taxation & Revenue Department website for your CRS registration.

The personal income tax is filed using Form PIT-1, Personal Income Tax Return. If you are a New Mexico resident, you must file if you meet any of the following conditions: You file a federal return; You want to claim a refund of any New Mexico state income tax withheld from your pay, or.

New Mexico Tax Account Numbers If you are already registered with the New Mexico Taxation and Revenue Department,, you can find your CRS Identification Number and filing frequency online or on correspondence from the New Mexico Taxation and Revenue Department.