Performance Appraisal Example In Hrm

Description

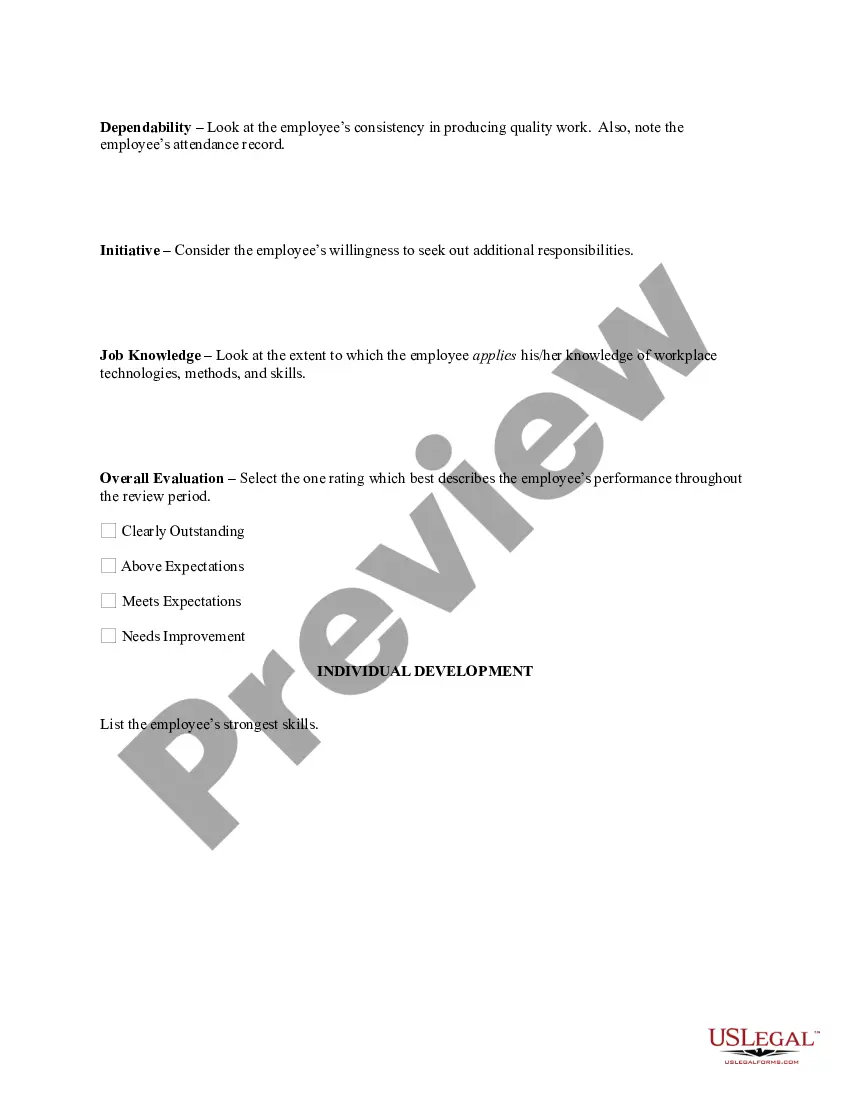

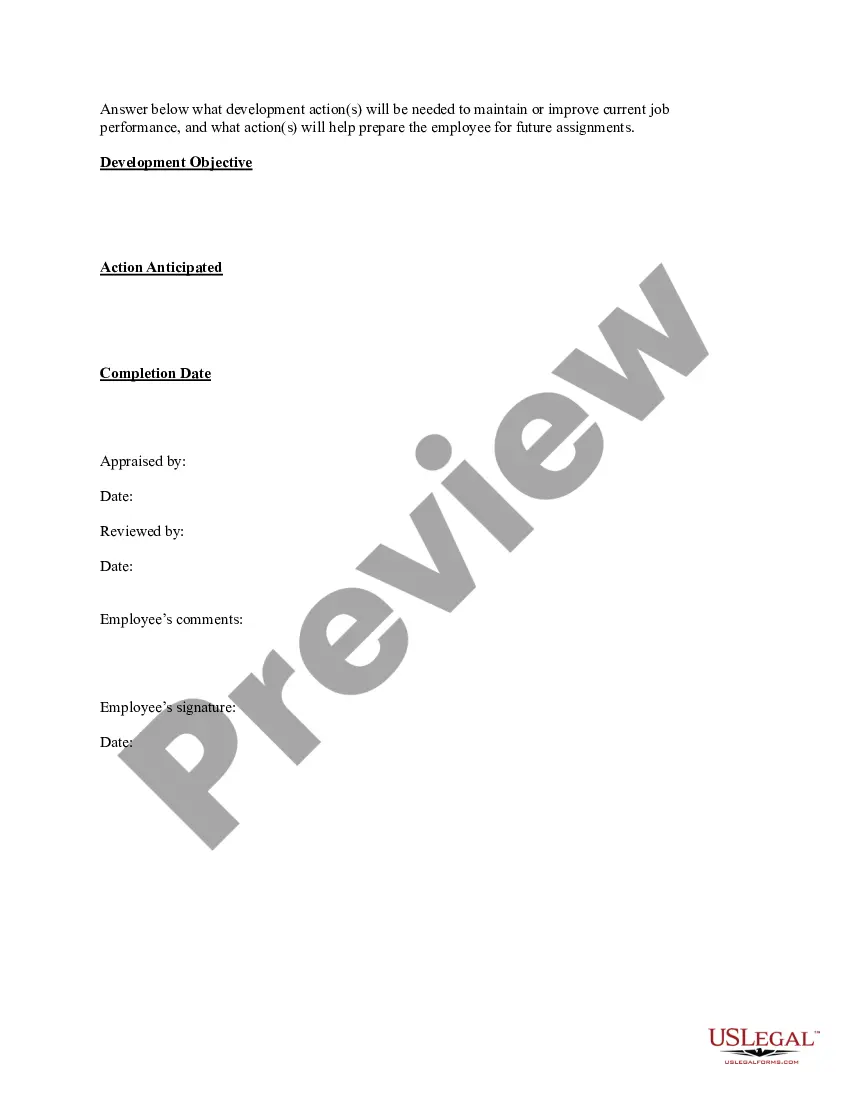

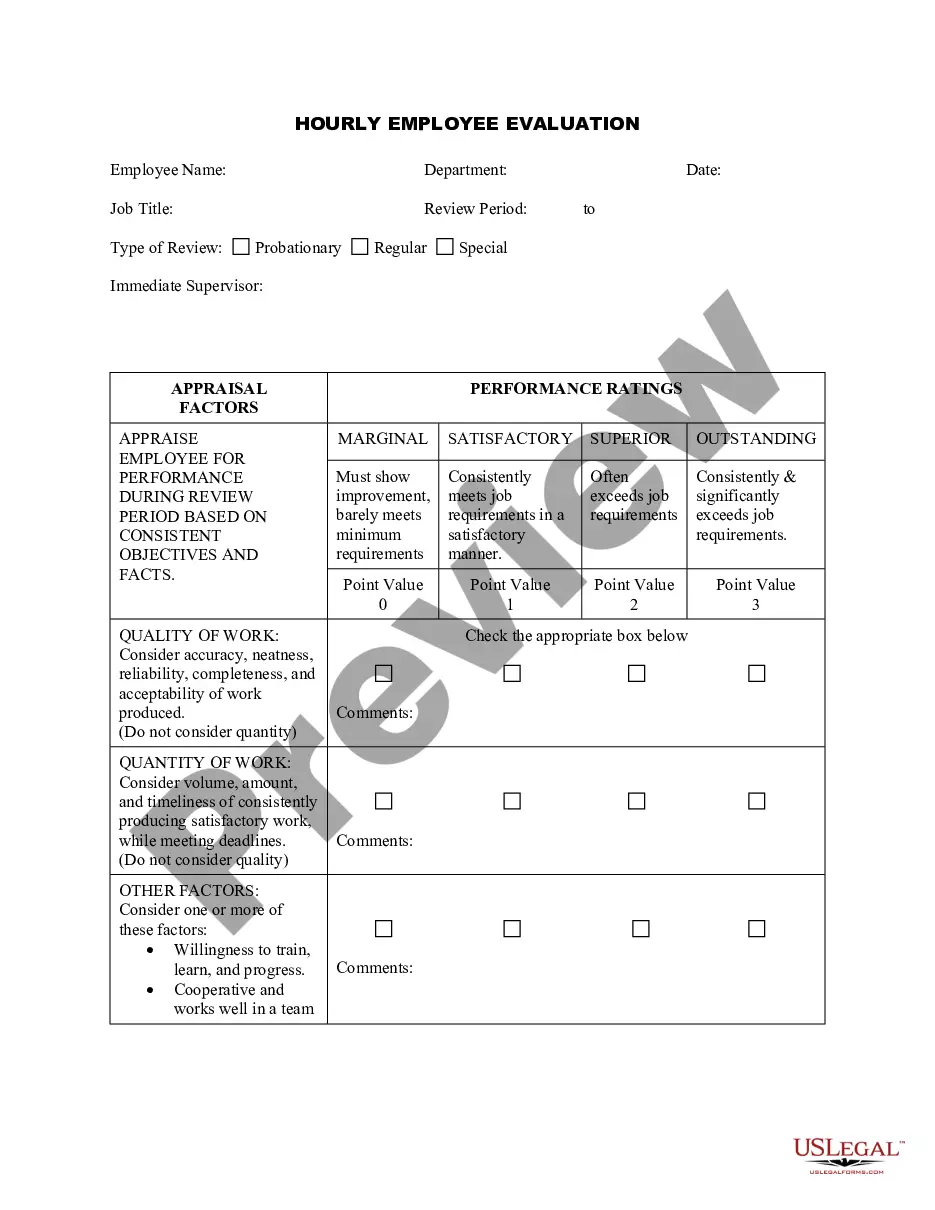

How to fill out Sample Performance Review For Nonexempt Employees?

Identifying a reliable source to acquire the most updated and suitable legal templates is a significant part of navigating bureaucracy.

Determining the appropriate legal documents necessitates precision and meticulousness, which is why it is crucial to obtain Performance Appraisal Example In Hrm samples exclusively from trustworthy providers, such as US Legal Forms. An incorrect template can squander your time and hinder your current situation.

Remove the stress associated with your legal documentation. Browse through the extensive US Legal Forms library where you can discover legal templates, evaluate their applicability to your situation, and download them instantly.

- Utilize the catalog navigation or search feature to find your sample.

- Examine the form’s description to ensure it meets the stipulations of your state and area.

- Review the form preview, if available, to confirm the form aligns with what you need.

- Return to the search and locate the correct document if the Performance Appraisal Example In Hrm does not meet your needs.

- Once you are confident in the form’s applicability, download it.

- If you are a registered user, click Log in to verify your identity and access your selected templates in My documents.

- If you lack an account, click Buy now to acquire the template.

- Choose the pricing plan that suits your needs.

- Proceed to register to complete your purchase.

- Finalize your purchase by selecting a payment option (credit card or PayPal).

- Select the file format for downloading Performance Appraisal Example In Hrm.

- Once you have the form on your device, you can edit it using the editor or print it and complete it manually.

Form popularity

FAQ

If you have minor children, you need a will to designate their guardians. If the cost of establishing and maintaining a trust is reasonable in relation to your assets and goals, a trust generally can settle your estate more quickly than a will and can provide confidentiality for trust assets.

You'll likely spend a few hundred dollars at most. Additionally, this method is less expensive than hiring an attorney, but DIY estate planning also presents some risks. If you'd rather hire a lawyer, you'll likely spend at least $1,000. This could be a less risky approach than DIY planning, but it'll cost you more.

To make a living trust in Pennsylvania, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

To make a living trust in Pennsylvania, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

A will is important to avoid having your estate distributed in ance with Pennsylvania's laws. A living trust can essentially operate as a vault to hold several types of assets that you transfer into it. Both wills and living trusts have advantages for their creators and their beneficiaries.

A revocable trust and living trust are separate terms that describe the same thing: a trust in which the terms can be changed at any time. An irrevocable trust describes a trust that cannot be modified after it is created without the beneficiaries' consent.

Limitations: Requires adherence to trust document's instructions on asset assignments. Joint assets, including certain IRAs and retirement plans, cannot be placed into a one-person trust. No complete tax avoidance: Total avoidance of taxes is rarely possible with living trusts, though there may be ways to reduce them.

The cost of setting up a trust in Pennsylvania varies depending on the complexity of the trust and the attorney's fees. A basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts can cost several thousand dollars more.