Annual Performance Reviews Sample Comments For Managers

Description

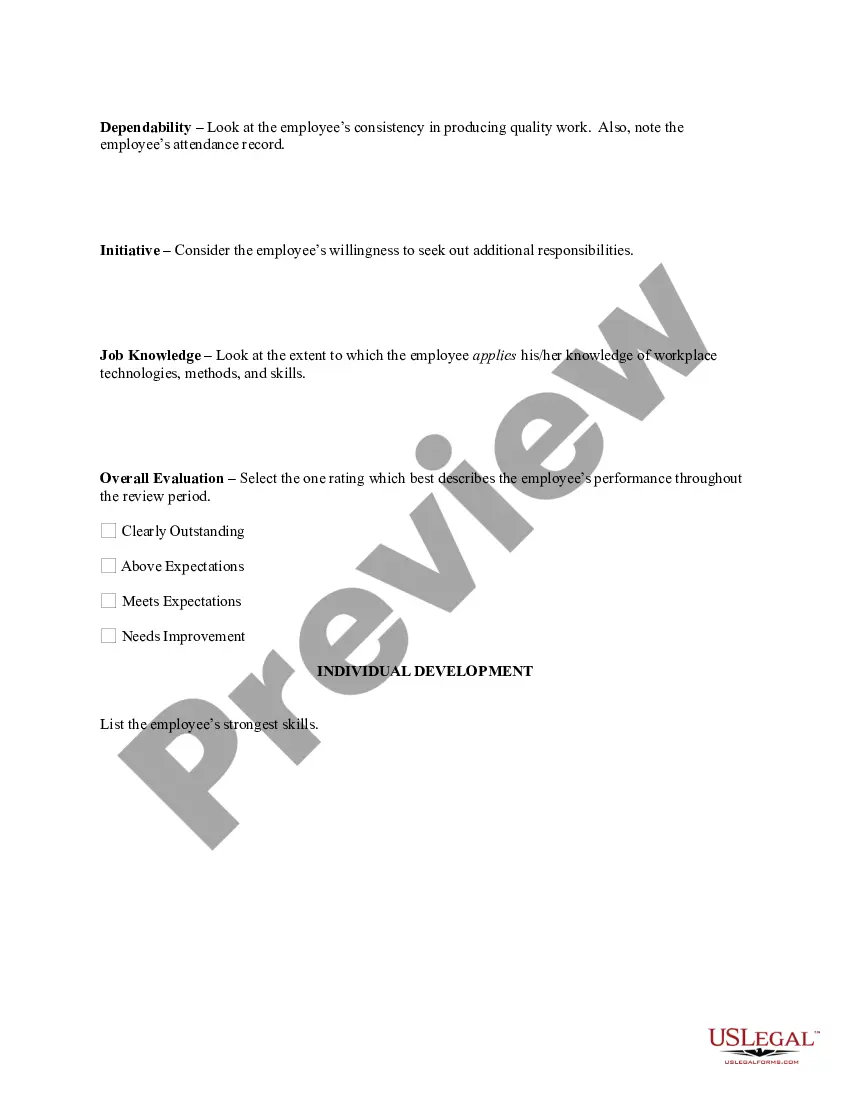

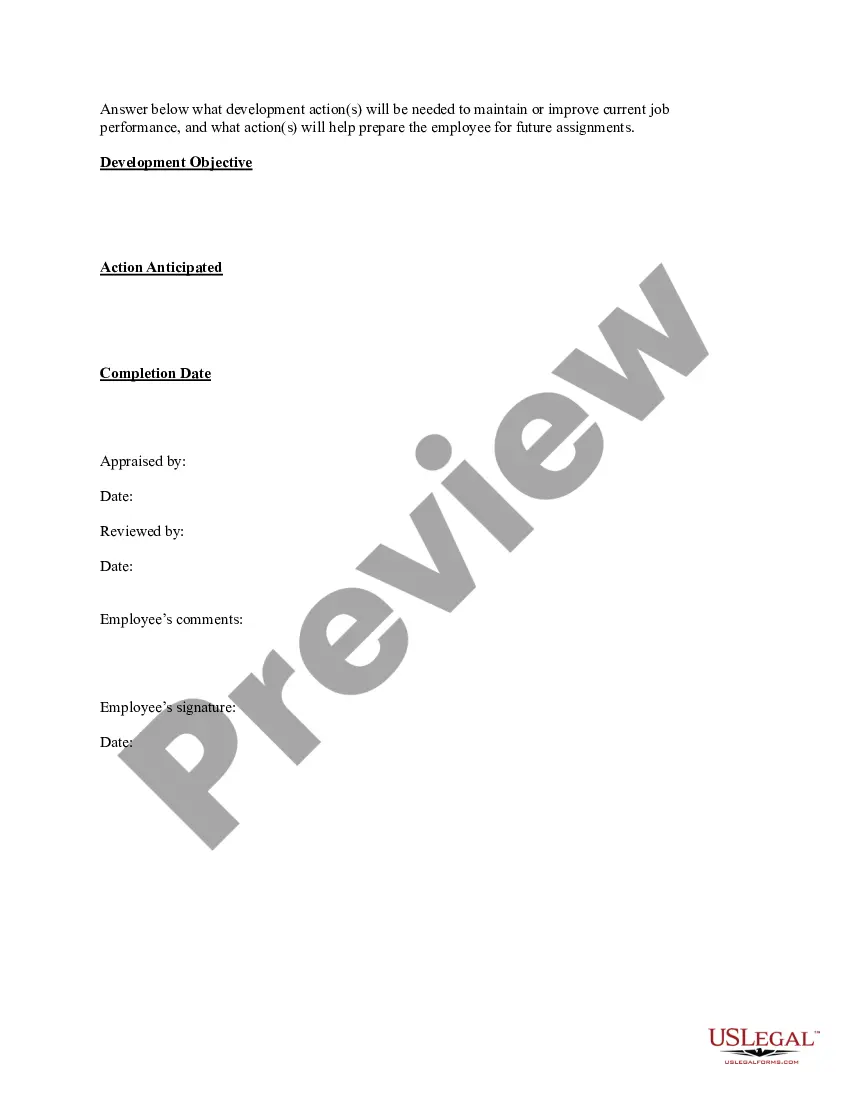

How to fill out Sample Performance Review For Nonexempt Employees?

The Yearly Performance Assessment Example Remarks For Supervisors found on this site is a versatile legal template crafted by expert attorneys in alignment with national and local statutes.

For over 25 years, US Legal Forms has offered people, businesses, and lawyers access to more than 85,000 authenticated, state-specific documents for any commercial and personal situation. It’s the fastest, simplest, and most reliable method to procure the files you require, as the service promises bank-level data security and anti-malware safeguards.

Register with US Legal Forms to have dependable legal templates for every life situation readily available.

- Search for the document you need and examine it.

- Browse the sample you searched and preview it or check the form description to confirm it meets your requirements. If it doesn’t, leverage the search bar to locate the appropriate one. Click Buy Now when you’ve found the template you need.

- Register and Log In.

- Choose the pricing plan that works for you and create an account. Use PayPal or a credit card to make a quick payment. If you already possess an account, Log In and check your subscription to proceed.

- Obtain the editable template.

- Select the format you desire for your Yearly Performance Assessment Example Remarks For Supervisors (PDF, DOCX, RTF) and store the sample on your device.

- Complete and sign the documents.

- Print the template to finish it by hand. Alternatively, utilize an online multifunctional PDF editor to swiftly and accurately fill out and sign your form with an eSignature.

- Download your documents one more time.

- Use the same document again whenever required. Access the My documents section in your profile to redownload any previously saved forms.

Form popularity

FAQ

It costs $300 to form an LLC in Tennessee. This is a fee paid for the Articles of Organization. You'll file this form with the Tennessee Secretary of State. And once approved, your LLC will go into existence.

The Certificate of Limited Partnership may be completed as a PDF file here and submitted to the Business Services Division of the Tennessee Secretary of State. Cost to Form an LP: The state of Tennessee charges a filing fee of $10 to form a limited partnership.

How to form a partnership: 10 steps to success Choose your partners. ... Determine your type of partnership. ... Come up with a name for your partnership. ... Register the partnership. ... Determine tax obligations. ... Apply for an EIN and tax ID numbers. ... Establish a partnership agreement. ... Obtain licenses and permits, if applicable.

Any corporation, limited partnership, limited liability company or business trust chartered/organized in Tennessee or doing business in this state must register with the secretary of state and file annual reports.

Partnership Tennessee is an organization of African Americans from across the state who are leaders in their communities and represent a cross-section of business interests in Tennessee.

After doing so, you'll want to research any local requirements, those enforced by the county or city where you're doing business. Good news, Tennessee doesn't require a ?general? business license at the state-level for Sole Proprietors.

How to form a Tennessee General Partnership ? Step by Step Step 1 ? Business Planning Stage. ... Step 2: Create a Partnership Agreement. ... Step 3 ? Name your Partnership and Obtain a DBA. ... Step 4 ? Get an EIN from the IRS. ... Step 5 ? Research license requirements. ... Step 6 ? Maintain your Partnership.

Two Ways to Start A New Business in Tennessee Define your business concept. Draft a business plan. Choose a business name. Fund your startup costs. Choose a business structure. Register your business with the Tennessee Secretary of State. Get your business licenses. Set up a business bank account.