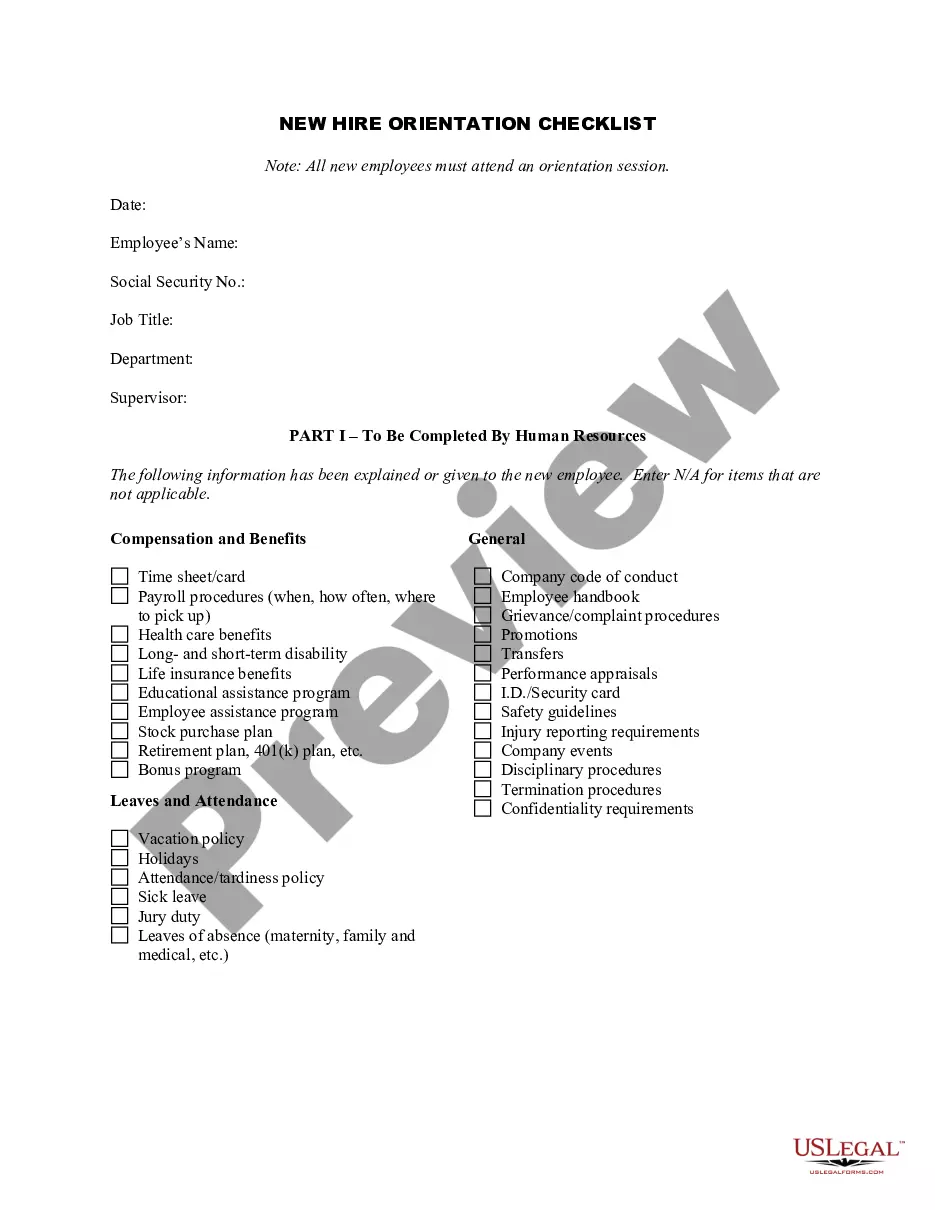

New Hire Checklist With The State

Description

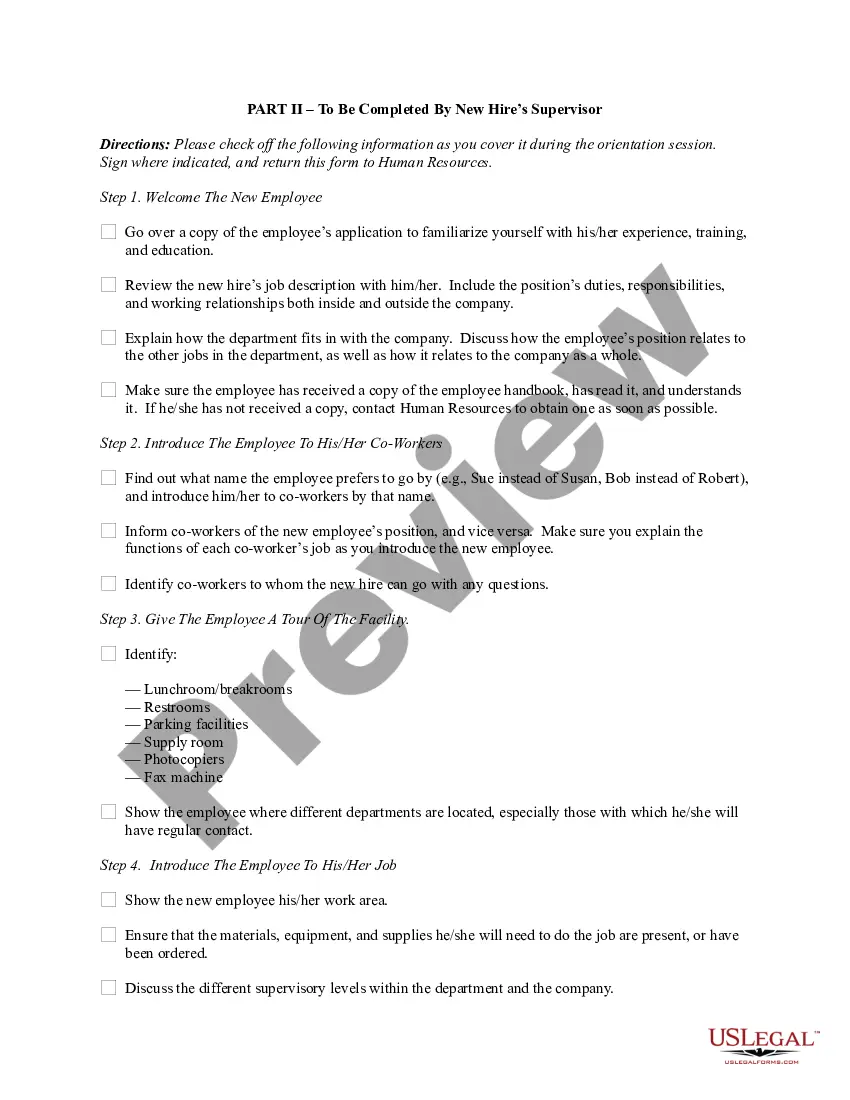

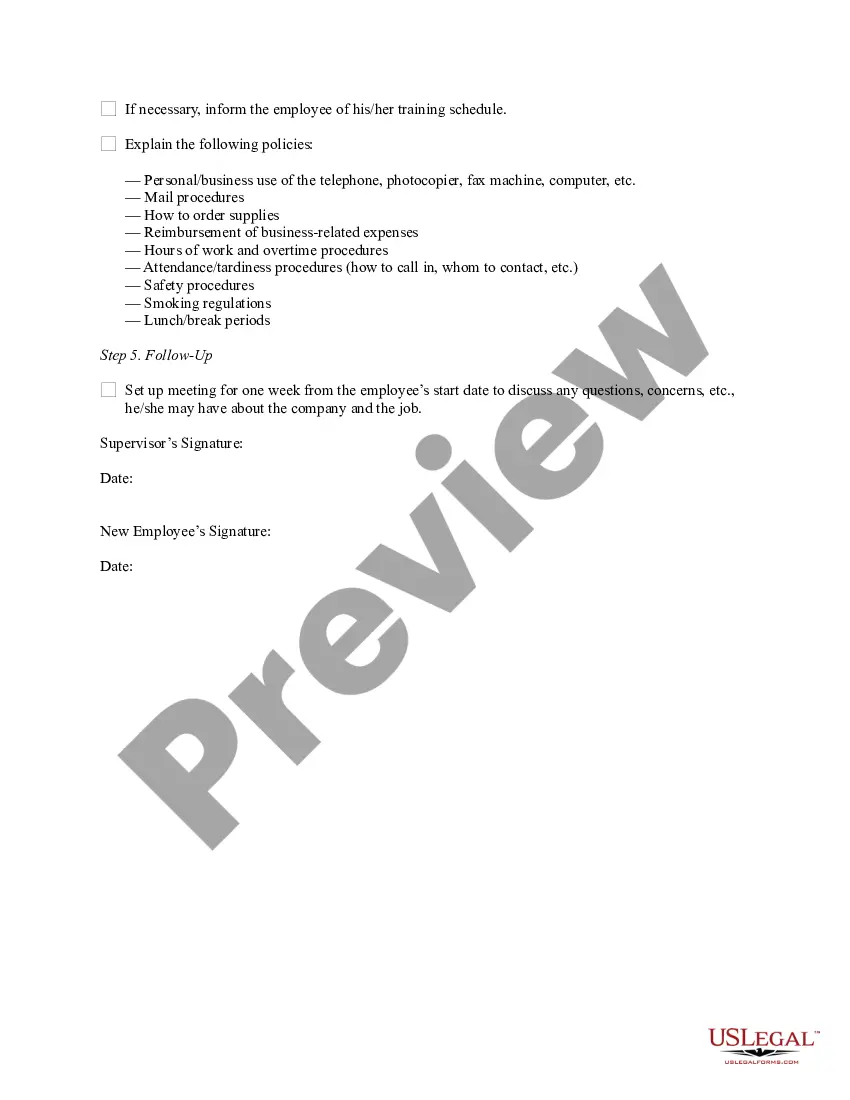

How to fill out New Hire Checklist With The State?

There's no longer a necessity to spend time searching for legal documents to adhere to your local state laws.

US Legal Forms has gathered all of them in one location and simplified their availability.

Our site provides over 85k templates for any personal and business legal situations organized by state and usage area.

Completing legal documents under federal and state laws and regulations is swift and straightforward with our platform. Experience US Legal Forms today to keep your documentation organized!

- All forms are expertly drafted and authenticated for legitimacy, so you can feel assured about obtaining a current New Hire Checklist With The State.

- If you're familiar with our service and already possess an account, ensure your subscription is active before acquiring any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documentation whenever necessary by accessing the My documents tab in your profile.

- If you’ve never utilized our service before, the process will involve additional steps to finish.

- Here’s how newcomers can locate the New Hire Checklist With The State in our catalog.

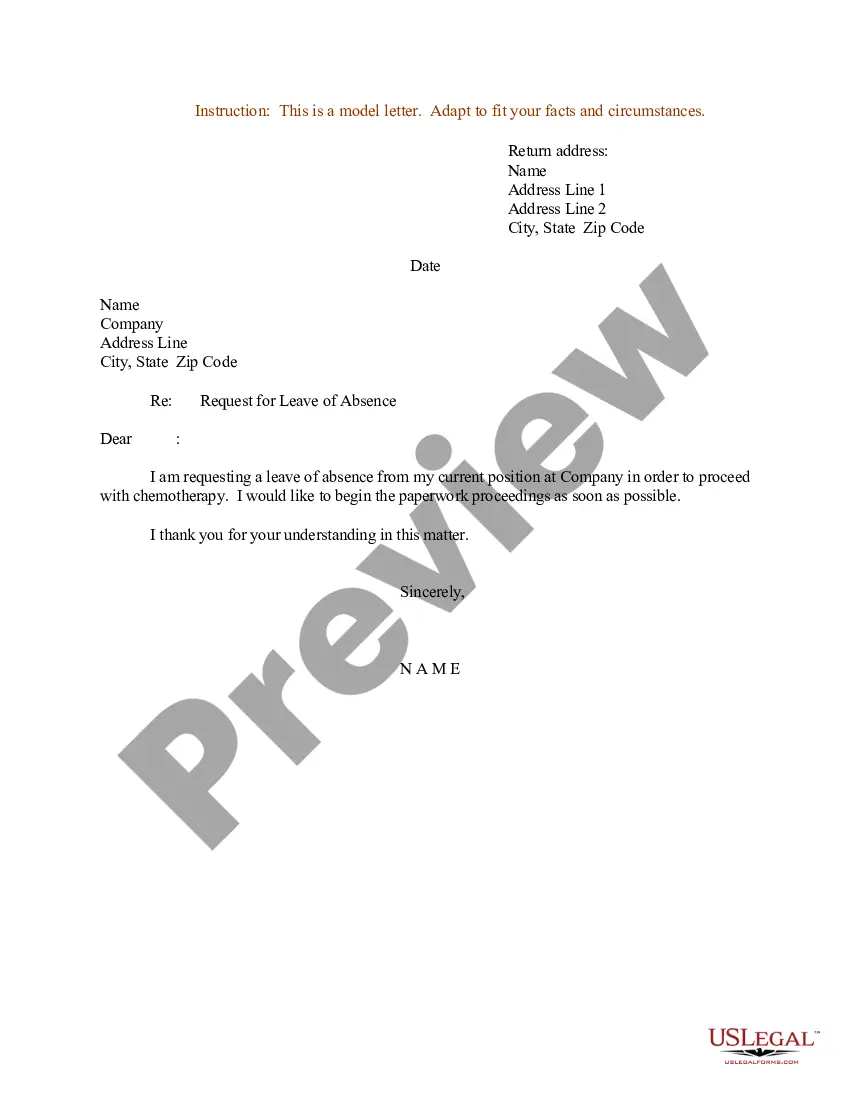

- Inspect the page content closely to confirm it includes the sample you need.

- To do so, leverage the form description and preview options if available.

Form popularity

FAQ

To report new hires to the IRS, you need to complete the Form W-4 for each employee, accurately reflecting their tax status. This form must be included with your state-specific new hire checklist when you submit employee information to your state's workforce agency. Additionally, ensure you follow the deadlines for reporting, typically within 20 days after the hire date. Using a comprehensive new hire checklist with the state can help simplify this process and ensure compliance.

The 5 C's of new hire onboarding are Compliance, Clarification, Culture, Connection, and Check back. First, Compliance ensures all necessary legalities are met, which connects directly to our new hire checklist with the state. Next, Clarification involves clearly defining job roles and expectations. Culture encompasses instilling the company's values in new employees, while Connection fosters relationships within teams. Finally, a Check back encourages ongoing support and feedback, enhancing the onboarding experience.

For new hire reporting, employers typically need to submit the completed W-4 and I-9 forms, along with any state-specific forms dictated by local law. Each state may have additional requirements, so it's wise to consult the new hire checklist with the state. Using a comprehensive platform like USLegalForms can simplify gathering and managing these forms, ensuring you meet all necessary reporting obligations.

Every new employee must complete the W-4 form to determine their federal income tax withholding. Additionally, you should have them fill out the I-9 form to verify their eligibility to work in the United States. Keeping these forms organized and updated is crucial for compliance and efficiency. A new hire checklist with the state can help ensure that no critical paperwork is overlooked during this process.

To efficiently enter a new hire's information into Gusto, you can use the platform’s onboarding features. Simply follow the guided steps to input their details, such as personal information and tax forms. For a smooth experience, refer to the new hire checklist with the state to ensure all required information is collected before starting the process.

New hires generally need to complete several forms upon starting employment. These include the W-4 form for tax information, the I-9 form to confirm eligibility to work in the U.S., and potentially additional state-specific documents. Utilizing a new hire checklist with the state ensures you don’t miss any necessary paperwork.

To hire employees, you will need to prepare some essential paperwork. This typically includes job applications, tax withholding forms, and verification of employment eligibility. Moreover, you should consider using a new hire checklist with the state to ensure compliance with all federal and state regulations.

When starting a new job, bring several important documents. Generally, you will need a government-issued ID, like a driver's license or passport, as well as your Social Security card for tax purposes. Depending on the position and state, additional documents may be required for the new hire checklist with the state.

Typically, you will fill out several key documents when starting with a new employer. These include a W-4 form for tax withholding, an I-9 form to verify your identity, and any state-specific forms required in the new hire checklist with the state. Additionally, you might need to complete direct deposit forms and health insurance enrollment forms.

Yes, you must report new hires to the state. Each state has its own reporting requirements, usually within a certain timeframe after hiring. This is an essential part of the new hire checklist with the state, as it helps enforce child support payments and track employment data.