Excempt Position

Description

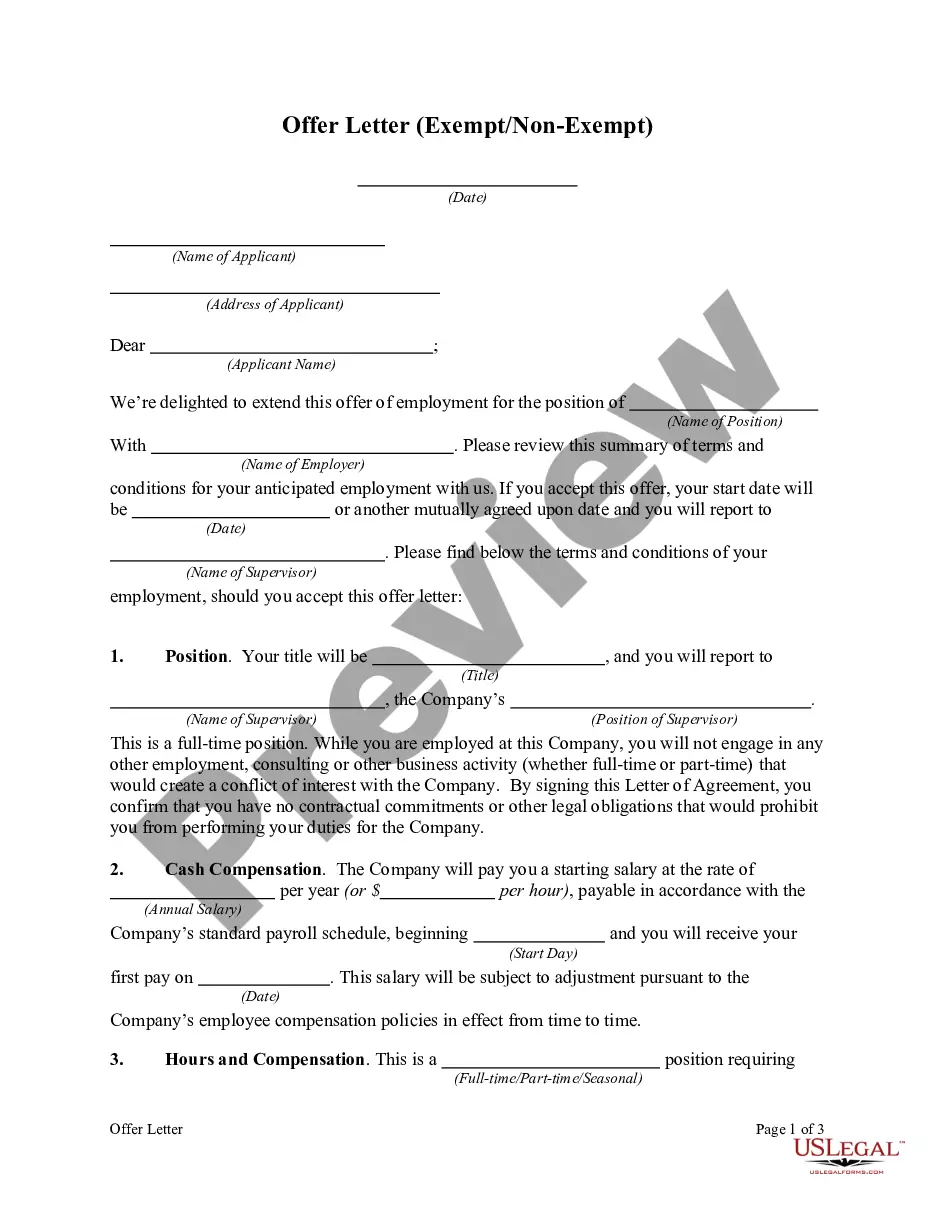

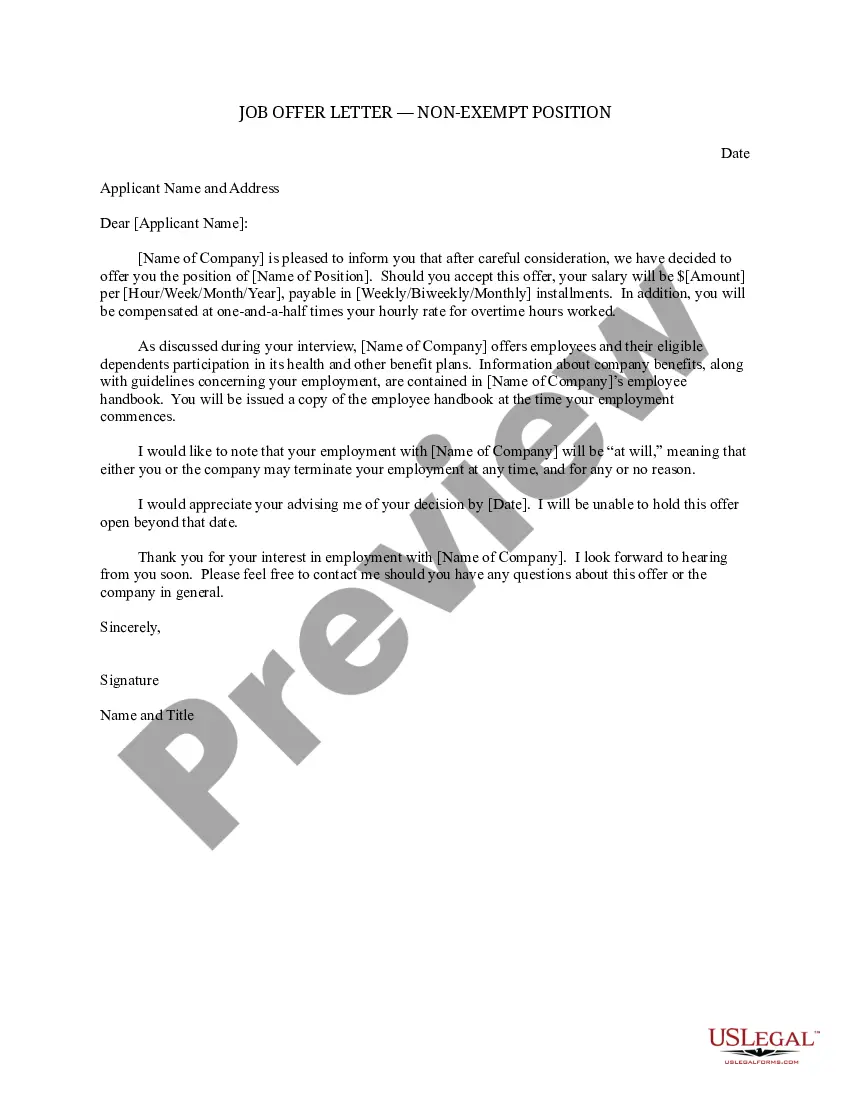

How to fill out Job Offer Letter - Exempt Position - Detailed?

- If you are a returning user, log in to your account. Ensure your subscription is active; if not, renew it as necessary.

- Preview the available forms to confirm you've selected the right document that aligns with your specific jurisdiction.

- If the current form doesn't meet your requirements, use the Search feature at the top to find a better match.

- Once you’ve located the appropriate form, click the Buy Now button. Choose your desired subscription plan—registration is required for full access.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Download the completed form directly to your device and access it anytime through your My Forms menu in your profile.

US Legal Forms is designed to empower both individuals and attorneys to seamlessly execute legal documents. With its extensive library, you can be confident that your forms are accurate and legally compliant.

Take the first step towards handling your legal needs. Start today and access the wealth of resources available at US Legal Forms!

Form popularity

FAQ

Being in an exempt position can offer several benefits, such as the potential for higher salaries and increased job responsibilities. Additionally, exempt employees usually enjoy a greater degree of schedule flexibility. However, keep in mind that these benefits come with the expectation of delivering results without the added compensation of overtime. Assess your priorities to determine if an exempt position aligns with your career aspirations.

Companies themselves are not classified as exempt; it's the specific job positions and their characteristics that determine exemption status. A company must ensure that any exempt positions within it adhere to both federal and state labor laws. For clarity, resources available on the US Legal Forms platform can assist businesses in navigating exemption policies effectively.

An employee is classified as exempt when their role meets specific standards defined by the FLSA, particularly in terms of job duties and salary. Typically, this classification applies to employees in executive, professional, or administrative roles. Knowledge of these criteria can help both employees and employers understand their rights and responsibilities concerning exempt positions.

Employers do not qualify for exemption; rather, it is the job positions within the company that are classified. Employers must comply with regulations concerning employee classifications to ensure they are not violating labor laws. By understanding the criteria for exempt positions, employers can make informed decisions about their workforce’s classification.

You become exempt primarily based on your job responsibilities, especially if your role requires decision-making, strategy development, or supervising others. Furthermore, your salary must meet the required threshold for an exempt position. Understanding the specific duties and responsibilities outlined by the FLSA can provide further insight into your exempt status.

To determine if you qualify for an exempt position, review the job duties and salary associated with your role. The position must meet the FLSA criteria regarding responsibilities and salary thresholds. If you're unsure, using resources such as the US Legal Forms platform can help clarify your status and assist you in understanding the qualifications better.

The minimum salary to be considered for an exempt position varies by state but generally aligns with federal guidelines. As of now, the federal minimum salary threshold is $684 per week or $35,568 per year. However, some states may have higher minimums to qualify as exempt. It's essential to check your state regulations to ensure compliance.

Many employees prefer exempt positions because these roles often provide greater autonomy and flexibility in their work schedules. Additionally, exempt employees may enjoy benefits such as a higher salary and eligibility for bonuses. This can also lead to more opportunities for career advancement and professional development. Exploring exempt positions may be beneficial for your career path.

An exempt position typically includes roles that meet specific criteria outlined by the Fair Labor Standards Act (FLSA). These criteria often involve the nature of the job duties, the salary level, and the level of responsibility. Most often, exempt positions include administrative, professional, or executive roles. If you believe you fall into any of these categories, consider consulting resources available on the US Legal Forms platform.

If you are applying for an exempt position, technically, you do not claim any allowances. Instead, you will mark the appropriate option on your W4 to denote your exempt status. It's essential to double-check the IRS guidelines to ensure that you qualify for this status before proceeding.