Exampt Position

Description

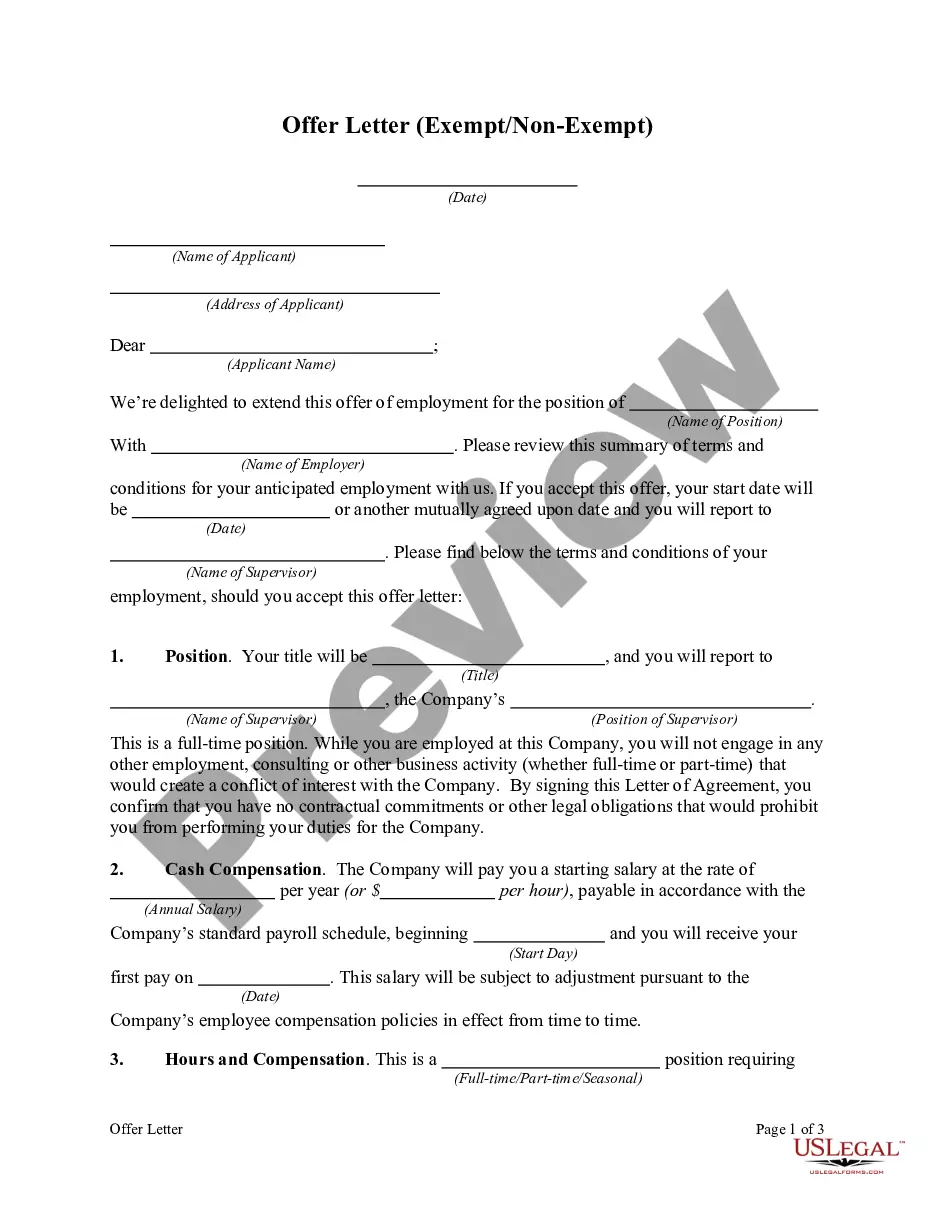

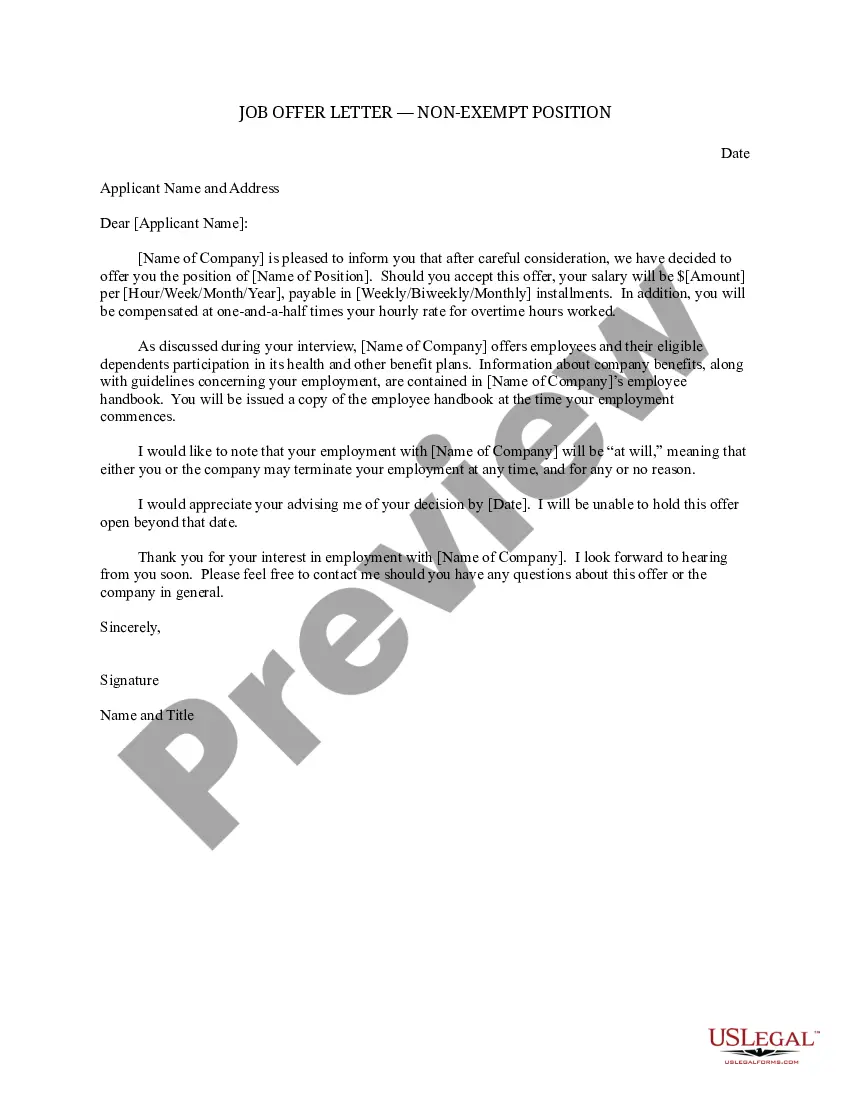

How to fill out Job Offer Letter - Exempt Position - Detailed?

- If you are an existing user, log in to your account and check your subscription status before downloading your required form by clicking the Download button.

- For new users, begin by reviewing the Preview mode and detailed description of the forms to ensure you select the right one based on your needs and local jurisdiction requirements.

- If the form does not meet your expectations, utilize the Search tab to find another document that better suits your needs.

- After finding the right form, click the Buy Now button and select your desired subscription plan. You’ll need to create an account to access the library.

- Enter your payment information, whether it’s credit card details or PayPal, and finalize your purchase.

- Once purchased, download the form to your device. You can always find it later in the My Forms section of your profile.

US Legal Forms empowers users by offering a comprehensive library filled with more form options than competitors, making legal processes hassle-free.

Start maximizing your legal documentation experience today! Access US Legal Forms and take the first step toward securing your legal needs.

Form popularity

FAQ

Being an exempt employee can have its advantages and drawbacks. One main benefit of an exempt position is the potential for a higher salary with no hourly cap, allowing for a more predictable income. However, you should also be aware that exempt positions may come with increased responsibilities and longer hours. Ultimately, the value of being an exempt employee depends on your career goals and work-life balance priorities.

To become exempt from filing taxes, you must meet specific IRS criteria, which include not owing income taxes in the previous year and anticipating the same for the current year. If you believe you qualify, file the appropriate forms to indicate your status. Utilize the US Legal Forms platform for guidance and resources to help navigate the process.

To qualify for filing exempt, you must not owe any federal income tax in the previous year and expect none in the current year. This includes having a low income or specific circumstances that reduce your tax liability. Always verify your qualifications and consider consulting a tax professional.

You can maintain an exempt position as long as your tax circumstances remain unchanged and you meet IRS criteria. However, you should be cautious and monitor your financial status to avoid penalties. If you mistakenly claim exempt, you may face underpayment penalties later.

The IRS guidelines for exempt employees state that individuals must have no federal tax liability in the previous year and expect none for the current year to qualify for the exempt position. Review these guidelines carefully to ensure you comply. Regularly check your tax situation, so you do not mistakenly claim an exempt status.

Yes, you can change your taxes to exempt by submitting a new W-4 to your employer. However, be sure you meet the IRS criteria for claiming an exempt position. If your financial situation changes, you may need to adjust your tax status again.

To file exempt on a job, fill out the W-4 form and select the exempt position option. Ensure you provide this form to your employer, as it determines how much tax is withheld from your paycheck. It's crucial to review your eligibility for this status before filing.

To change your tax status to exempt, you will need to complete a new W-4 form provided by your employer. Indicate your desire to claim the exempt position by writing 'Exempt' on the form. Make sure to consult the IRS guidelines to confirm that you meet the requirements.

The number of allowances you should claim for exempt depends on your individual tax situation. Those with fewer deductions might benefit from higher allowances, while others might prefer lower numbers for tax withholding. Knowing your financial landscape will help you decide the right allowances to fit your exempt position. If you're uncertain, resources like uslegalforms can provide useful calculators and detailed explanations.

To answer the question 'Are you exempt from withholding?', evaluate your tax circumstances first. If you truly qualify for an exempt position based on IRS guidelines, then you can confirm your exempt status confidently. It's crucial to understand the implications of your response for future tax filings. Should you need detailed help, uslegalforms has resources to guide you through this process.