Work Confirmation Letter For Visa

Description

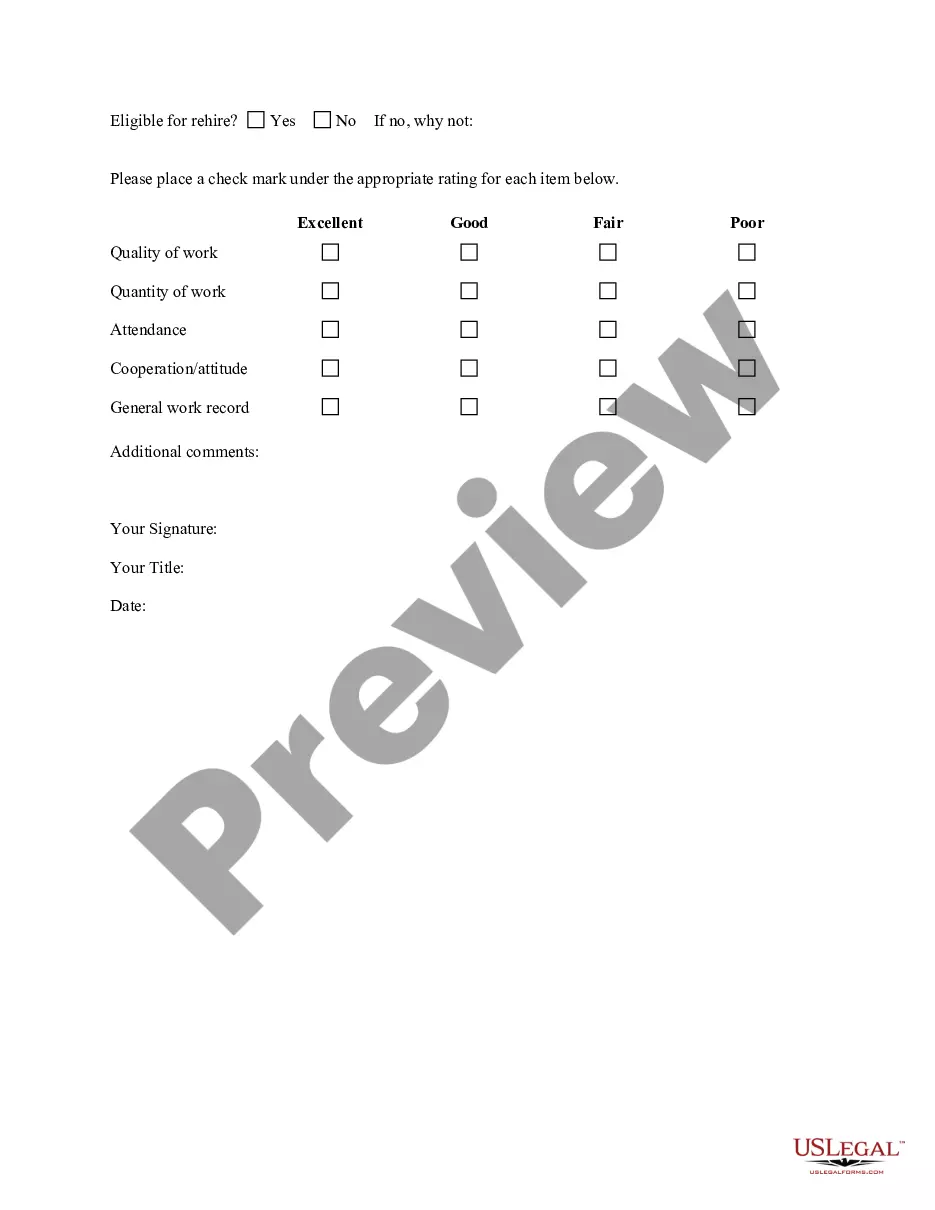

How to fill out Employment Verification Request Letter?

Securing a trusted source to obtain the latest and most pertinent legal templates is a significant part of managing red tape.

Locating the correct legal documents requires care and meticulousness, which is why it's essential to obtain samples of Work Confirmation Letter For Visa solely from dependable providers, such as US Legal Forms.

Once you obtain the form on your device, you can edit it using the editor or print it to complete it by hand. Relieve yourself of the hassles associated with your legal paperwork. Explore the extensive US Legal Forms library where you can find legal templates, verify their suitability for your situation, and download them instantly.

- Utilize the catalog search or search bar to find your template.

- Examine the form's description to ensure it aligns with the specifications of your state and area.

- Check the form preview, if available, to confirm it is the specific document you require.

- Return to the search to find the correct document if the Work Confirmation Letter For Visa does not meet your criteria.

- If you are confident about the form's applicability, download it.

- If you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you do not yet have an account, click Buy now to acquire the form.

- Choose a pricing plan that accommodates your needs.

- Go through the registration process to finalize your purchase.

- Complete your transaction by selecting a payment option (credit card or PayPal).

- Choose the file format for downloading Work Confirmation Letter For Visa.

Form popularity

FAQ

When asking HR for a confirmation letter, it's best to approach them with a polite and clear request. Specify that you require a work confirmation letter for visa purposes to ensure they understand its importance. Include any details they might need to create the letter, such as your role and employment dates.

In addition to articles of organization, Missouri statute requires all limited liability companies to have an operating agreement.

Missouri LLC Formation Filing Fee: $50 The starting cost to form your Missouri LLC is $50 when you file your Missouri Articles of Organization online. If you choose to file by mail, you'll have to pay $105. Filing your Missouri LLC articles with the Secretary of State officially forms your business.

How much does it cost to form an LLC in Missouri? The Missouri Secretary of State charges $50 to file the Articles of Organization online and $105 for paper filings. Online Filers must also pay an additional $1.25. You can reserve your LLC name with the Missouri Secretary of State for $7.

Starting an LLC in Missouri will include the following steps: #1: Draft a Business Plan. #2: Research Your Business Structure Options. #3: Register a Business Name. #4: Appoint a Registered Agent. #5: File Articles of Organization. #6: Obtain an Employer Identification Number (EIN) #7: Draft an Operating Agreement.

As a business owner, it's your responsibility to make sure you have the proper state, federal or local business licenses to operate your Missouri LLC. Some of the associated fees only need to be paid once, while others are ongoing charges.

Let's get started with your first six steps: Decide on your business structure. Register with the Missouri Secretary of State. Obtain an Employer Identification Number (EIN) Register for Missouri business taxes. File paperwork to hire employees. Check for city and county licenses and permits, and obtain industry licenses.

A registered agent may either be an individual who is a resident of Missouri and whose business office is identical with the entity's registered office (an individual may be their own registered agent), or it may be a corporation authorized to transact business in Missouri and which has a business office identical with ...

A business must obtain a sales tax license by registering with the Department of Revenue if it's making sales of tangible personal property and taxable services (such as telephone service and fees paid into places of amusement including but not limited to yoga and fitness centers).