Independent Contractor Status With Box Truck

Description

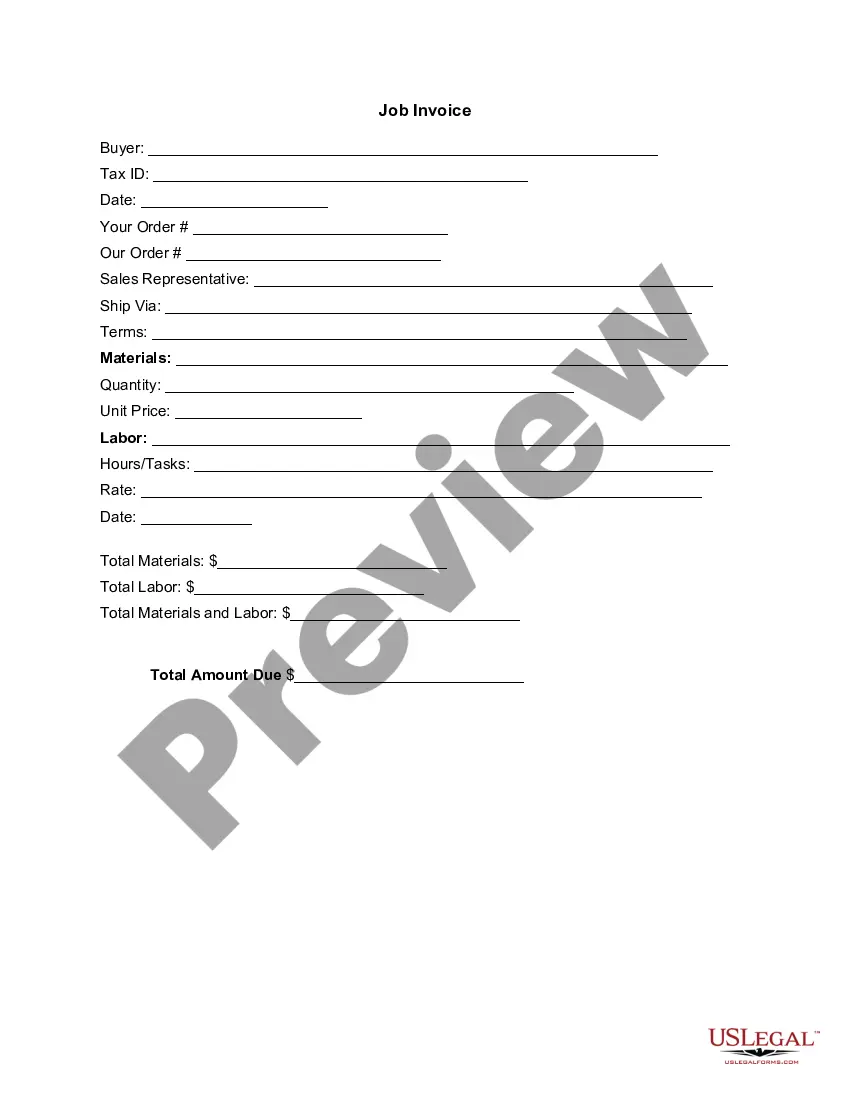

How to fill out Determining Self-Employed Independent Contractor Status?

When you need to complete Independent Contractor Status With Box Truck that aligns with your local state's statutes and regulations, there can be several choices to select from.

There's no need to examine every document to ensure it meets all the legal requirements if you are a US Legal Forms member.

It is a reliable source that can assist you in obtaining a reusable and current template on any topic.

Browse the recommended page and verify it for adherence to your specifications.

- US Legal Forms is the most extensive online repository with a collection of over 85k ready-to-use documents for business and personal legal needs.

- All templates are verified to comply with each state's regulations.

- Thus, when downloading Independent Contractor Status With Box Truck from our platform, you can be assured that you hold a legitimate and up-to-date document.

- Acquiring the necessary template from our platform is incredibly simple.

- If you already have an account, just Log In to the system, ensure your subscription is active, and save the chosen file.

- In the future, you can access the My documents section in your profile and maintain access to the Independent Contractor Status With Box Truck at any time.

- If it's your initial encounter with our library, please follow the instructions below.

Form popularity

FAQ

You can obtain box truck contracts with Amazon by going on Amazon Relay and signing up as a carrier. To get accepted, you will need an active DOT number, a valid MC number, and a carrier entity type that is Authorized for Property and for Hire.

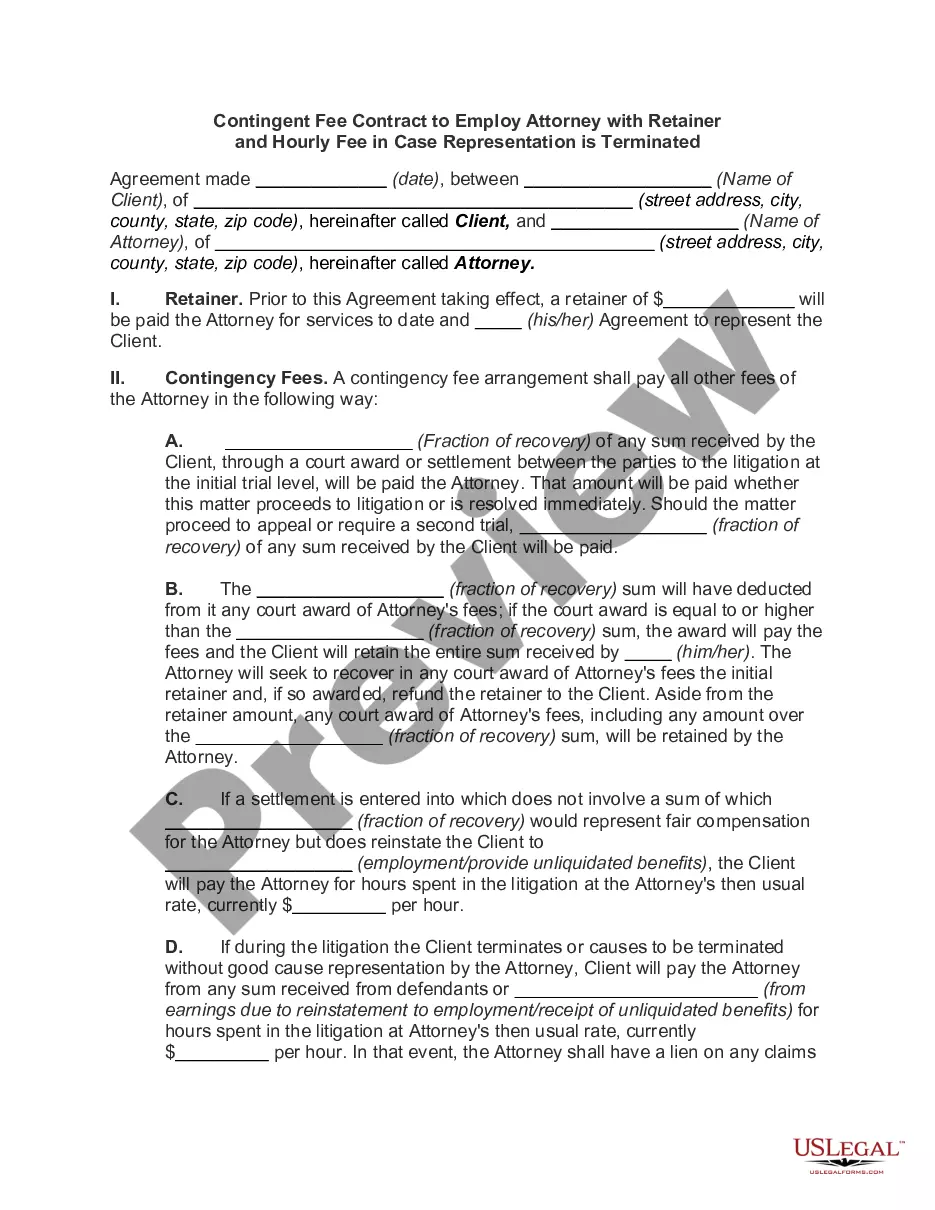

What Is an Independent Contractor Truck Driver? An independent contractor truck driver works for his own business and provides his services to carrier companies. An independent contractor can also be an owner-operator if they have their own truck and equipment, but these can also be leased.

Generally speaking, companies can only classify truck drivers as independent contractors if the truckers have control over how and when they perform their duties.

Thus, trucking companies need not issue Form 1099s to owner-operators that are under lease for freight hauling services. The same rule applies to farmers that make payments in connection with the trucking or hauling of livestock, grain or other farm products - no Form 1099 is required.

In trucking, your 1099 employee would be an owner-operator or an independent contractor. A 1099 employee is not a company driver, so that means you don't provide benefits for them (say, such as health insurance). You also don't take out any government taxes from their pay.