Pay Records Online With Venmo

Description

How to fill out Employee Payroll Records Checklist?

Dealing with legal paperwork and operations could be a time-consuming addition to your day. Pay Records Online With Venmo and forms like it typically need you to look for them and understand the best way to complete them effectively. Therefore, regardless if you are taking care of financial, legal, or individual matters, having a thorough and practical online library of forms when you need it will significantly help.

US Legal Forms is the best online platform of legal templates, boasting over 85,000 state-specific forms and a variety of resources to help you complete your paperwork quickly. Discover the library of appropriate papers accessible to you with just one click.

US Legal Forms gives you state- and county-specific forms offered by any moment for downloading. Shield your document management procedures having a high quality service that allows you to make any form within a few minutes without additional or hidden fees. Just log in to the account, identify Pay Records Online With Venmo and acquire it right away in the My Forms tab. You can also gain access to formerly downloaded forms.

Is it the first time making use of US Legal Forms? Sign up and set up an account in a few minutes and you’ll get access to the form library and Pay Records Online With Venmo. Then, stick to the steps below to complete your form:

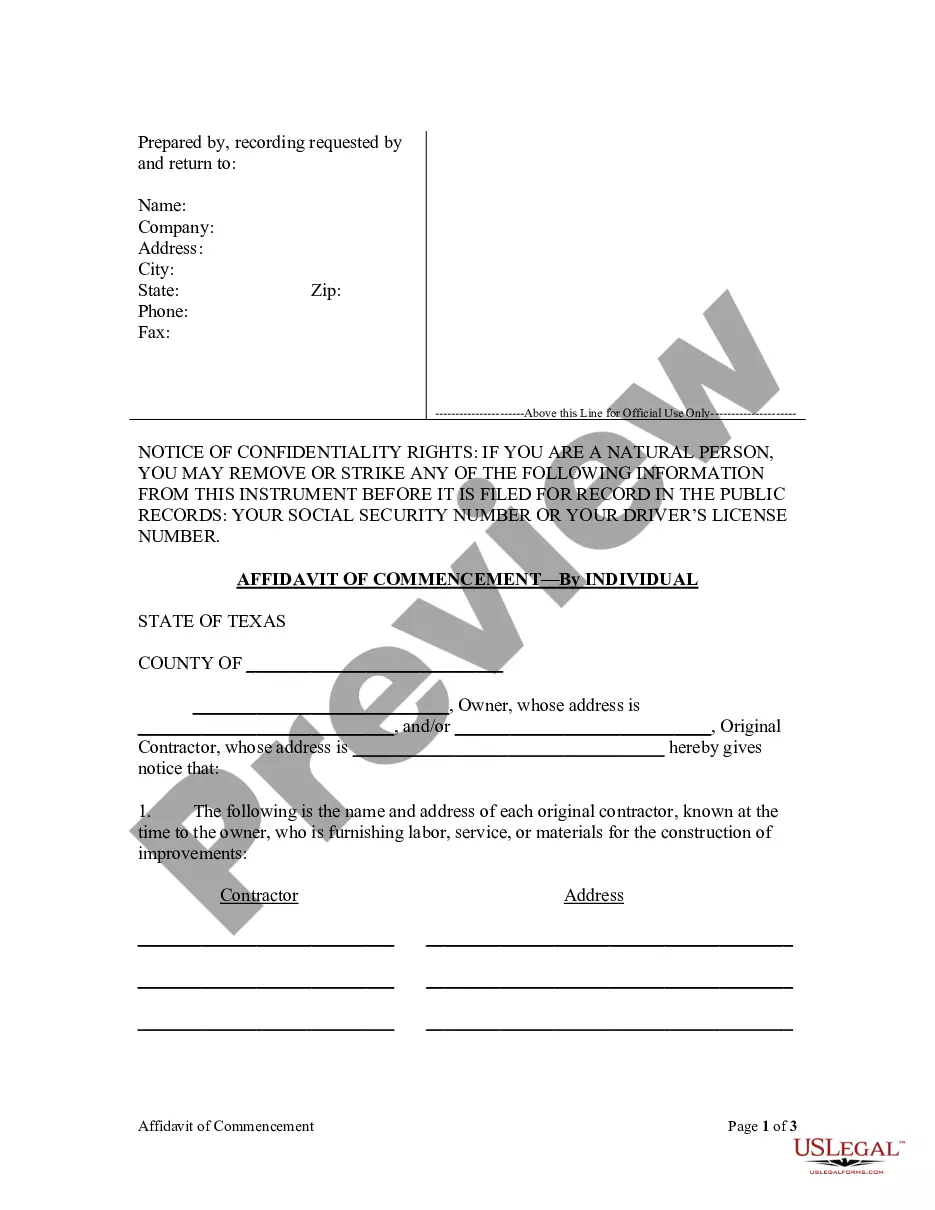

- Make sure you have found the correct form by using the Preview option and looking at the form description.

- Pick Buy Now as soon as ready, and choose the monthly subscription plan that suits you.

- Select Download then complete, sign, and print out the form.

US Legal Forms has twenty five years of experience helping users deal with their legal paperwork. Discover the form you require right now and streamline any process without having to break a sweat.

Form popularity

FAQ

Ks are made available for qualifying users around January 31st and Gains/Losses statements are made available around February 15th. By default, Venmo will issue tax documents to qualifying users electronically. Venmo users who signed up prior to July 22nd, 2022 may also receive tax documents by mail.

When selecting Venmo at checkout on a computer, you'll be presented with a QR code. Scan the QR code with your phone to authorize the payment. Select your payment method. Then proceed with checking out.

K is an income summary sent to anyone who earned a certain amount in business transactions through a payment app like Venmo. For your 2022 taxes, you'll get one from Venmo as long as you: Got paid at least $20,000 through them. Logged at least 200 business transactions.

Supposedly, the reporting change does not apply to personal transfers; however, it may be difficult for these apps to distinguish between personal transactions and business transactions. This could result in 1099-Ks being issued for your personal transactions, even though they are not taxable.

How to Get Venmo Statements? (Venmo Transaction History) YouTube Start of suggested clip End of suggested clip Log into your venmo account. You can log into your venmo account on the venmo app or through a webMoreLog into your venmo account. You can log into your venmo account on the venmo app or through a web browser at venmo.com 2. Select the options statements. In the left corner of your home page click on