Cobra Timeline Chart For Power Bi

Description

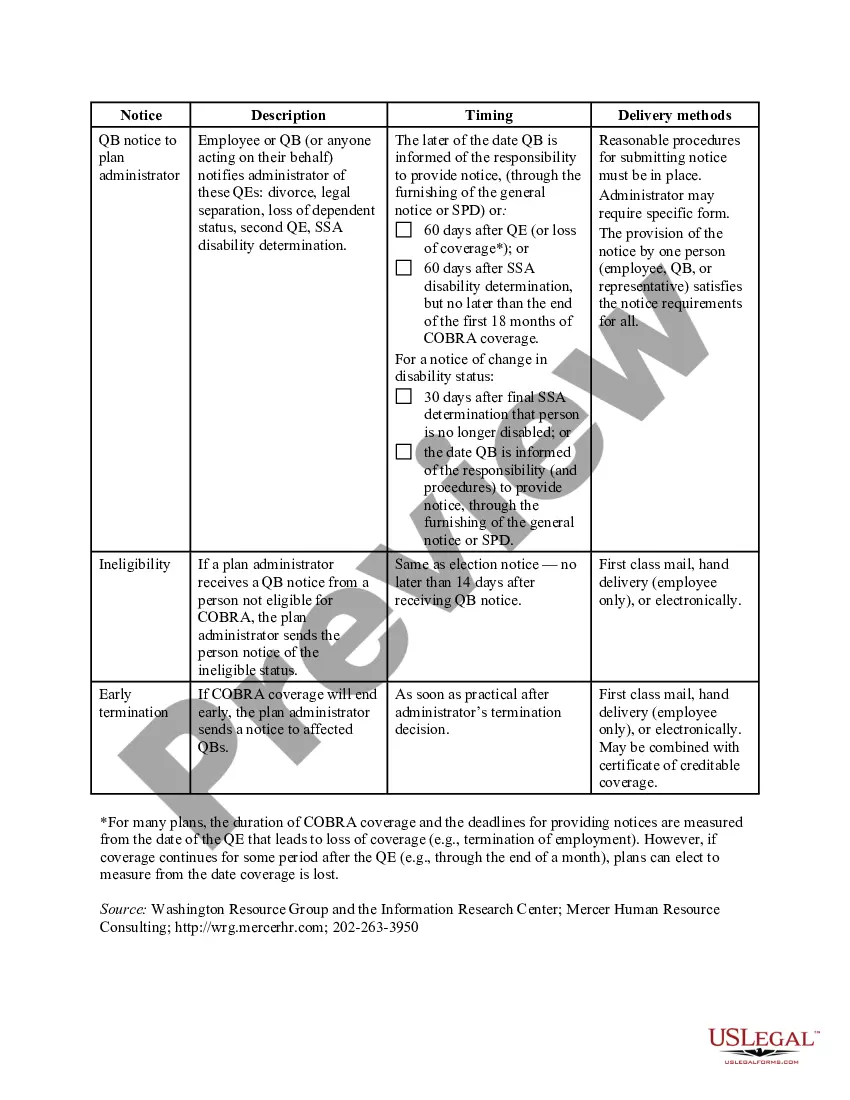

How to fill out COBRA Notice Timing Delivery Chart?

The Cobra Timeline Chart For Power Bi present on this page is a reusable legal template prepared by expert attorneys in accordance with federal and local statutes and regulations.

For over 25 years, US Legal Forms has supplied individuals, companies, and legal practitioners with more than 85,000 validated, state-specific forms for any business and personal event. It’s the fastest, most straightforward, and most dependable method to acquire the documents you require, as the service assures bank-grade data security and anti-malware safeguards.

Subscribe to US Legal Forms to access verified legal templates for all of life’s situations at your fingertips.

- Search for the document you require and verify it.

- Browse through the file you looked for and preview it or review the form description to confirm it meets your requirements. If it doesn’t, use the search bar to find the suitable one. Click Buy Now when you have found the template you need.

- Register and Log In.

- Choose the pricing plan that works for you and set up an account. Use PayPal or a credit card for a quick transaction. If you already have an account, Log In and check your subscription to continue.

- Acquire the fillable template.

- Select the format you want for your Cobra Timeline Chart For Power Bi (PDF, DOCX, RTF) and save the file on your device.

- Complete and sign the forms.

- Print the template to finish it by hand. Alternatively, use an online multi-functional PDF editor to quickly and accurately complete and sign your form with an eSignature.

- Redownload your documents as needed.

- Access the My documents tab in your profile to retrieve any previously saved forms.

Form popularity

FAQ

The Fair Credit Reporting Act (FCRA), a federal law, requires this.

§ 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs). A CRA is an entity that assembles and sells credit information and financial information about individuals.

They have also taken steps to remove all medical collections under $500. This last step went into effect on April 11, 2023, and with this change, it's estimated that roughly half of those with medical debt on their reports will have it removed from their credit history.

CLAIM: A new law passed by Congress ?allows you to permanently remove any negative debt? from your credit report that is over two years old. AP'S ASSESSMENT: False. The law referenced in the video to support that claim, the Fair Credit Reporting Act, has been around since 1970.

In addition, all consumers are entitled to one free disclosure every 12 months upon request from each nationwide credit bureau and from nationwide specialty consumer reporting agencies. See .consumerfinance.gov/learnmore for additional information.

The FCRA requires agencies to remove most negative credit information after seven years and bankruptcies after seven to 10 years, depending on the kind of bankruptcy.

If more than two years have tolled since the violation of the FCRA, then any cause of action as to that specific violation may be prescribed.

Federal Legislative Activity in 2023 Amend Section 604(c) of the FCRA to address the treatment of pre-screening report requests. Section 604(c) governs the furnishing of reports in connection with credit or insurance transactions that are not initiated by the consumer. [1]