Farm For Lease

Description

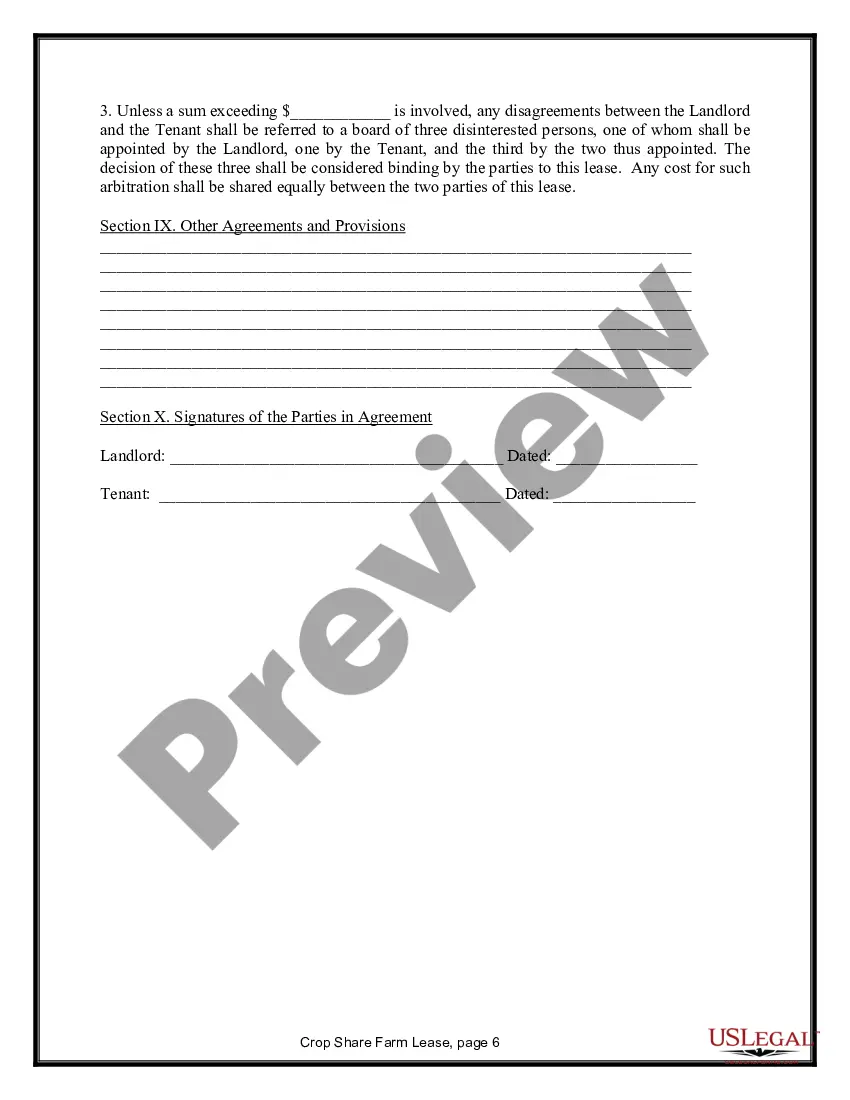

How to fill out Farm Lease Or Rental - Crop Share?

How to discover professional legal documents that adhere to your state's regulations and prepare the Farm For Lease without consulting an attorney.

Numerous services online provide templates for various legal scenarios and formal requirements. However, it might take some time to ascertain which of the available samples fulfill both your use case and legal obligations.

US Legal Forms is a distinguished service that assists you in finding official documents drafted in accordance with the most recent updates in state law, enabling you to save on legal fees.

If you do not have a US Legal Forms account, follow the guide below: Review the webpage you have accessed and verify if the form meets your requirements. To do this, utilize the form description and preview options if available. Search for an alternate template in the header specifying your state if needed. Click the Buy Now button once you identify the appropriate document. Choose the most suitable pricing plan, then Log In or preregister for an account. Select your payment method (by credit card or via PayPal). Modify the file format for your Farm For Lease and click Download. The obtained templates remain in your possession: you can always revisit them in the My documents section of your profile. Join our collection and prepare legal documents independently like a seasoned legal expert!

- US Legal Forms is not just an ordinary web directory.

- It comprises over 85k validated templates for different business and personal situations.

- All documents are categorized by region and state to facilitate a quicker and simpler search process.

- Furthermore, it collaborates with robust tools for PDF modification and eSignature, enabling users with a Premium subscription to swiftly finalize their paperwork online.

- Acquiring the required documents requires minimal effort and time.

- If you already possess an account, Log In and confirm that your subscription is current.

- Download the Farm For Lease using the corresponding button adjacent to the document name.

Form popularity

FAQ

The correct option is d): Form 4835 Reason: It is because form 4835 is used in order to report the farm rental incomes, which are completely based on various crops and other livestock produced by the tenants.

If you're a traditional farmer who raises crops or livestock, you're considered a self-employed business person and you would file using Schedule F, Profit or Loss From Farming.

If you were the landowner (or sub-lessor) and did not materially participate (for self-employment tax purposes) in the operation or management of the farm, use Form 4835 to report farm rental income based on crops or livestock produced by the tenant.

Form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (PAL) for the current tax year and to report the application of prior year unallowed PALs.