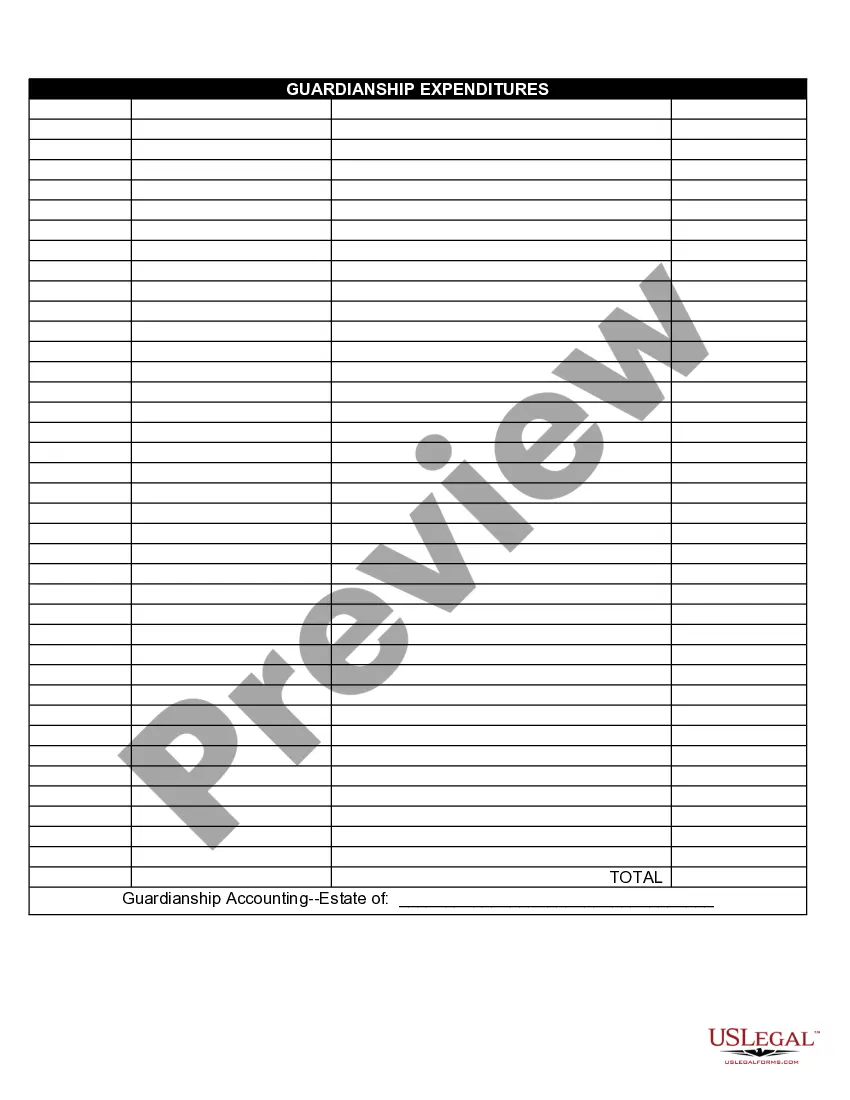

Name Amount Estate Formula

Description

How to fill out Guardianship Expenditures?

It’s no secret that you can’t become a law professional immediately, nor can you figure out how to quickly prepare Name Amount Estate Formula without having a specialized background. Creating legal forms is a long process requiring a certain education and skills. So why not leave the creation of the Name Amount Estate Formula to the professionals?

With US Legal Forms, one of the most comprehensive legal document libraries, you can find anything from court paperwork to templates for internal corporate communication. We understand how crucial compliance and adherence to federal and state laws and regulations are. That’s why, on our website, all forms are location specific and up to date.

Here’s start off with our website and obtain the document you require in mere minutes:

- Discover the form you need by using the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to determine whether Name Amount Estate Formula is what you’re looking for.

- Start your search again if you need a different form.

- Register for a free account and choose a subscription option to buy the form.

- Choose Buy now. Once the payment is complete, you can get the Name Amount Estate Formula, complete it, print it, and send or mail it to the designated individuals or organizations.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your paperwork-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

If you sell the inherited property, you are liable for 50% tax of the capital gain (subject to lifetime maximums) Capital gains are calculated by subtracting the fair market value at the time of acquisition from the current sale price.

How to Determine Estate Value Figure out how much everything is worth. That includes real estate, vehicles, insurance policies, personal items and anything else your loved one owned. Subtract the value of any assets that don't have to go through probate. ... Carry out the simplified probate process.

Generally, the Gross Estate does not include property owned solely by the decedent's spouse or other individuals. Lifetime gifts that are complete (no powers or other control over the gifts are retained) are not included in the Gross Estate (but taxable gifts are used in the computation of the estate tax).

Gross estate includes essentially all substantially valuable property owned by the person at death, including real estate, cash, stocks, life insurance, jewelry, furniture, and owed debts.

Like many people, you may not have considered this before and so may be left wondering what your 'estate' actually consists of and how you are supposed to put a value on it. To find out how much your estate is worth you need to calculate the value of your assets, then minus your liabilities.