Record Absence Form Template With Drop Down Menu

Description

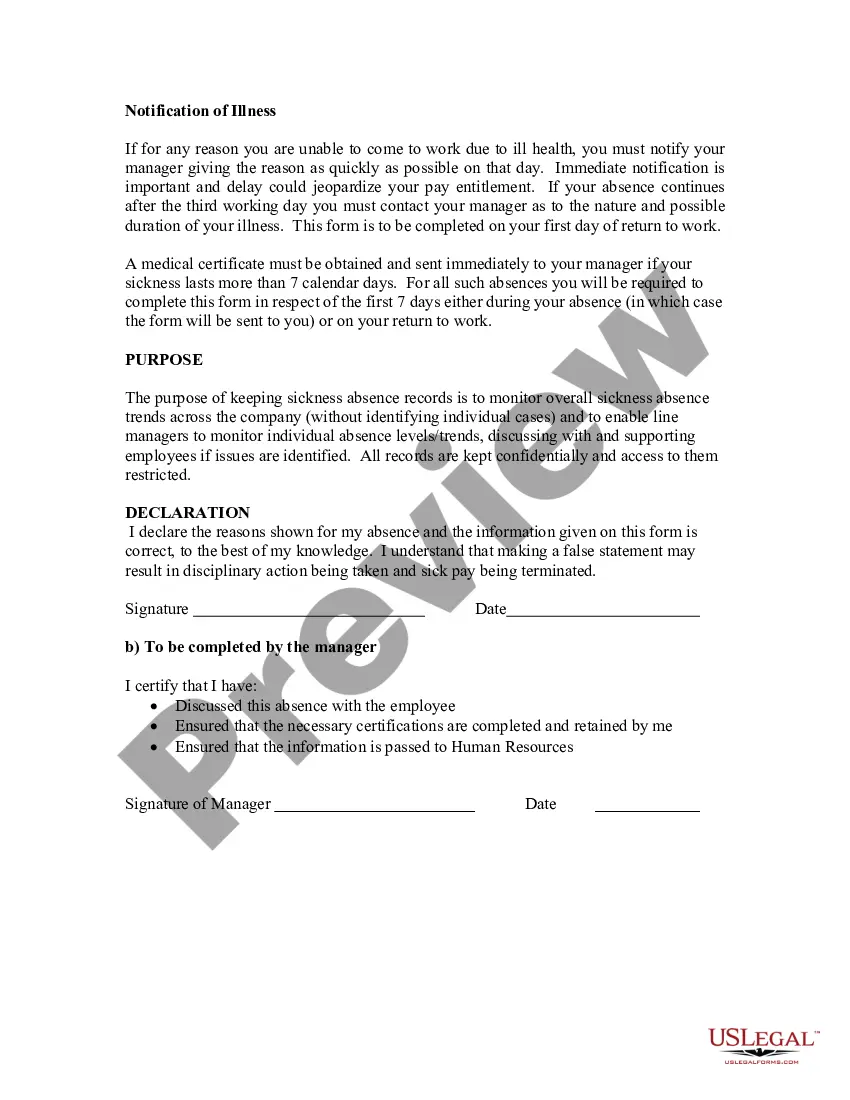

How to fill out Record Of Absence - Self-Certification Form?

Regardless of whether it's for commercial reasons or personal issues, everyone eventually encounters legal matters at some point in their lives.

Filling out legal documents requires meticulous care, beginning with selecting the appropriate form template.

Once downloaded, you can fill out the form using editing software or print it and complete it by hand. With an extensive US Legal Forms catalog available, you won’t waste time searching for the right template online. Utilize the library’s straightforward navigation to locate the appropriate template for any scenario.

- Obtain the template you require through the search box or catalog browsing.

- Review the form’s details to ensure it aligns with your circumstances, state, and county.

- Click on the form’s preview to inspect it.

- If it is the wrong form, return to the search tool to locate the Record Absence Form Template With Drop Down Menu sample you need.

- Download the file if it complies with your specifications.

- If you possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the account registration form.

- Choose your payment method: utilize a credit card or PayPal account.

- Select the document format you prefer and download the Record Absence Form Template With Drop Down Menu.

Form popularity

FAQ

GSA can sell agency surplus, exchange/sale, and forfeited personal property through GSA Auctions or offline sales. GSA provides services that will speed disposal of property and generate greater returns. Nationwide visibility of property to increase interest and competitive sales.

Best for Government Surplus Items GSA Auctions It's an actual government website. Use proxy bidding to indicate your maximum bid. Payments made to the U.S. Department of Treasury at Pay.gov.

When the government no longer needs some equipment, vehicles or other goods anymore, it sells such items. And so GSA Auctions is exactly the way you can purchase such vehicles at a surprisingly affordable price.

Ebay.it is ranked number 1 as the most popular website in the Auctions category in September 2023.

How do you find tax delinquent properties for sale? You could easily just call the county. If you want to find out if there are any liens for unpaid property taxes, you can go into the county records and look at all of that. If you don't know how to do that, you'll probably have to go to the county and learn how.

During this time, the delinquent taxes, interest, and penalties are accumulating until they are all redeemed. At the end of the 5-years for residential properties and 3-years for non-residential commercial properties, if the tax is not redeemed, the TTC has the power to sell the property.

California state tax liens are recorded at the request of various governmental agencies. For questions about a state tax lien, contact the appropriate agency directly: Board of Equalization (916) 445-1122? Employment Development Department (916) 464-2669.

People Who May Not Bid A GSA employee, or a spouse or minor child of a GSA employee, or their agents, may not bid on federal personal property. An employee of another agency may bid if they are not prohibited from doing so by the employing agency's rules or regulations.