Cobra Notice For Open Enrollment

Description

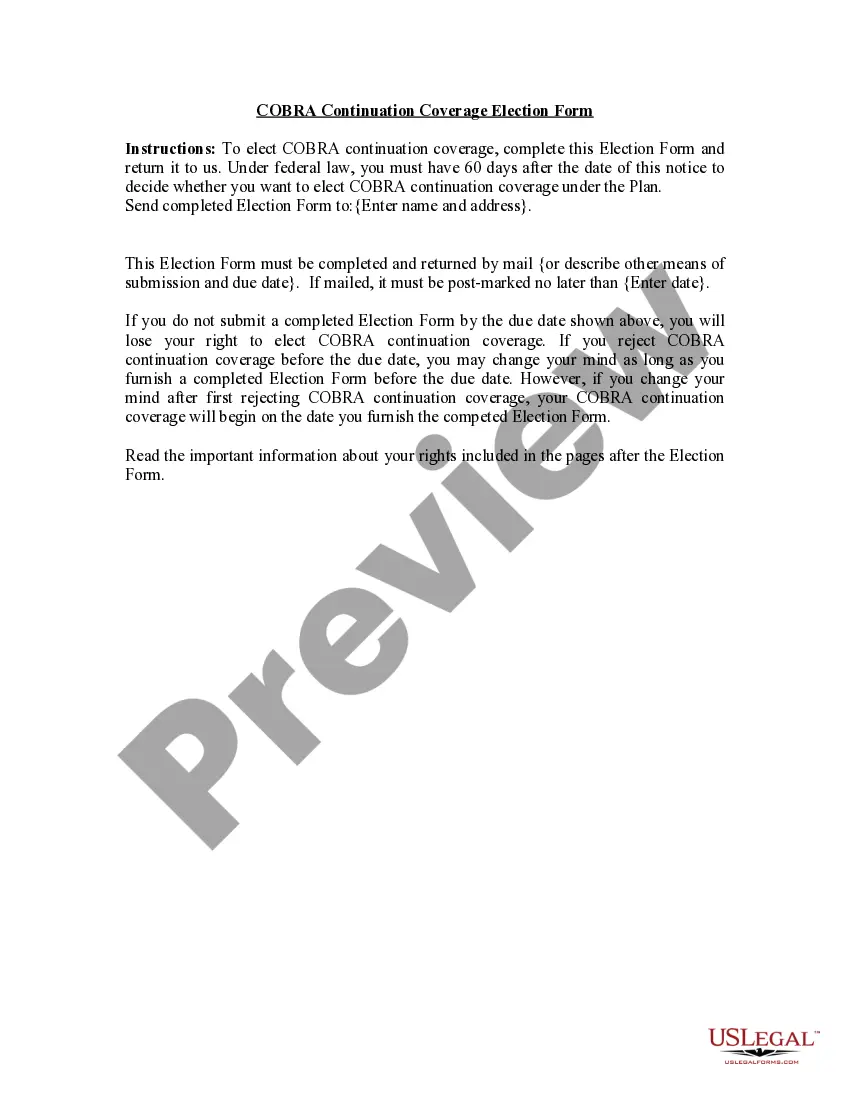

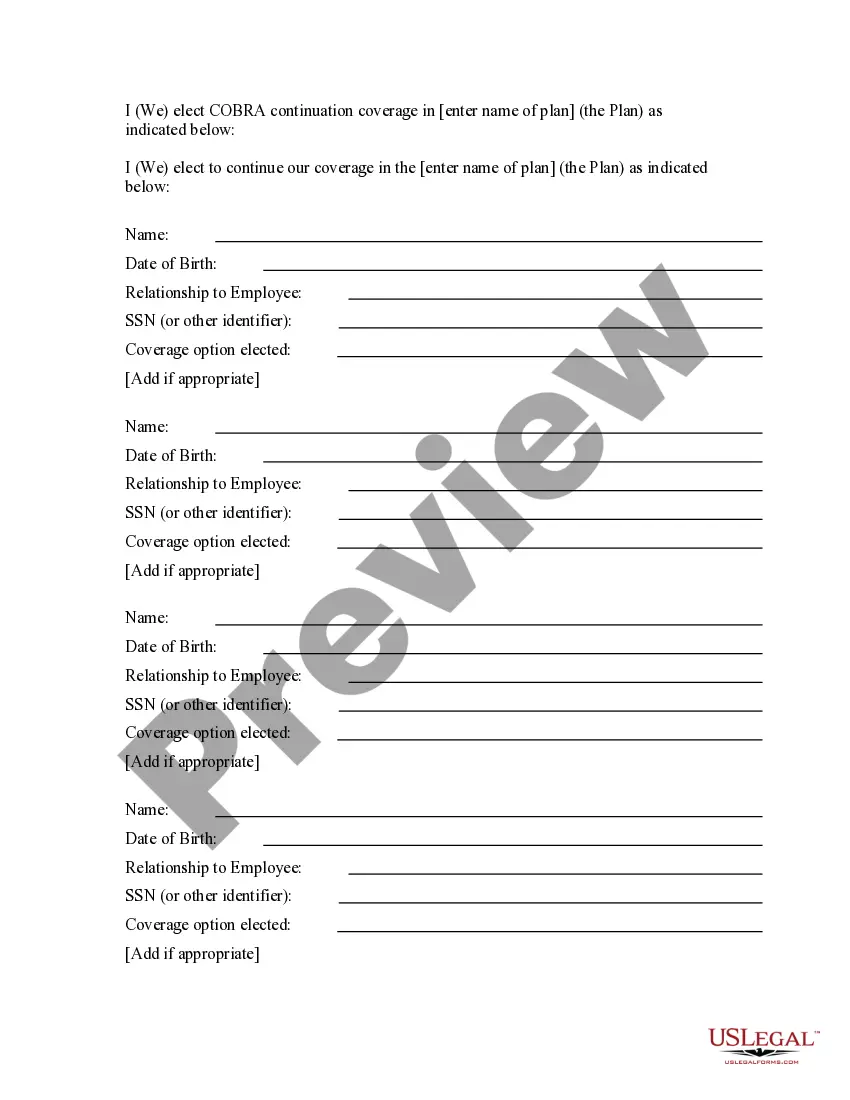

How to fill out COBRA Continuation Coverage Election Notice?

What is the most reliable service to obtain the Cobra Notice For Open Enrollment and other updated versions of legal documents? US Legal Forms is the solution! It's the largest collection of legal forms for any situation.

Every template is professionally prepared and confirmed for adherence to federal and local laws and regulations. They are organized by area and state of application, making it easy to find the one you require.

US Legal Forms is an excellent choice for anyone needing to handle legal documentation. Premium members can enjoy additional benefits, such as the ability to complete and sign previously saved documents electronically at any time using the integrated PDF editing tool. Discover it today!

- Experienced users of the platform only need to Log In to the system, verify their subscription status, and click the Download button next to the Cobra Notice For Open Enrollment to retrieve it.

- Once saved, the template is accessible for future use within the My documents section of your profile.

- If you do not have an account with our library, here are the steps you need to follow to create one.

- Form compliance validation. Before obtaining any template, you must confirm that it satisfies your use case requirements and the regulations of your state or county. Review the form description and utilize the Preview feature if it is available.

Form popularity

FAQ

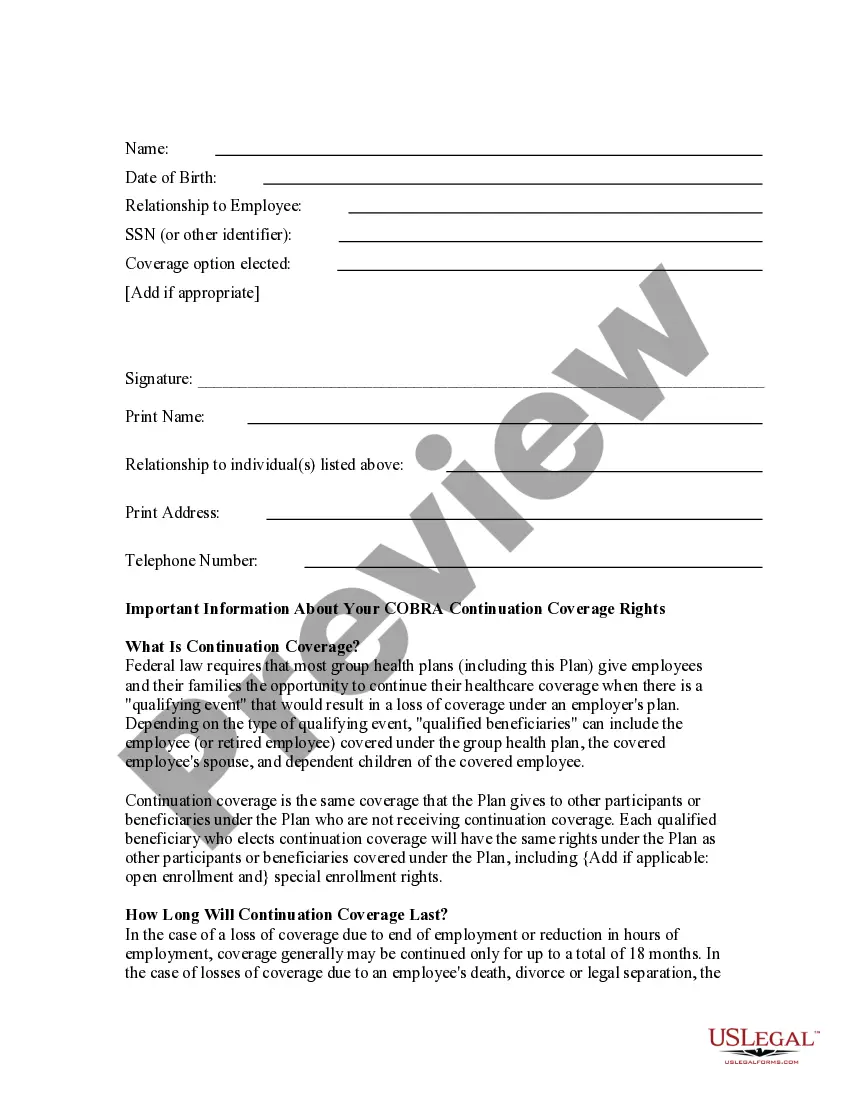

If an employer does not send a COBRA notice for open enrollment, employees may miss the opportunity to continue their health insurance coverage after leaving their job. This oversight can lead to unexpected medical expenses and a lack of access to necessary healthcare. Additionally, the employer could face penalties for failing to comply with COBRA regulations. To avoid these issues, using platforms like US Legal Forms can help ensure that you generate and send the appropriate COBRA notices in a timely manner.

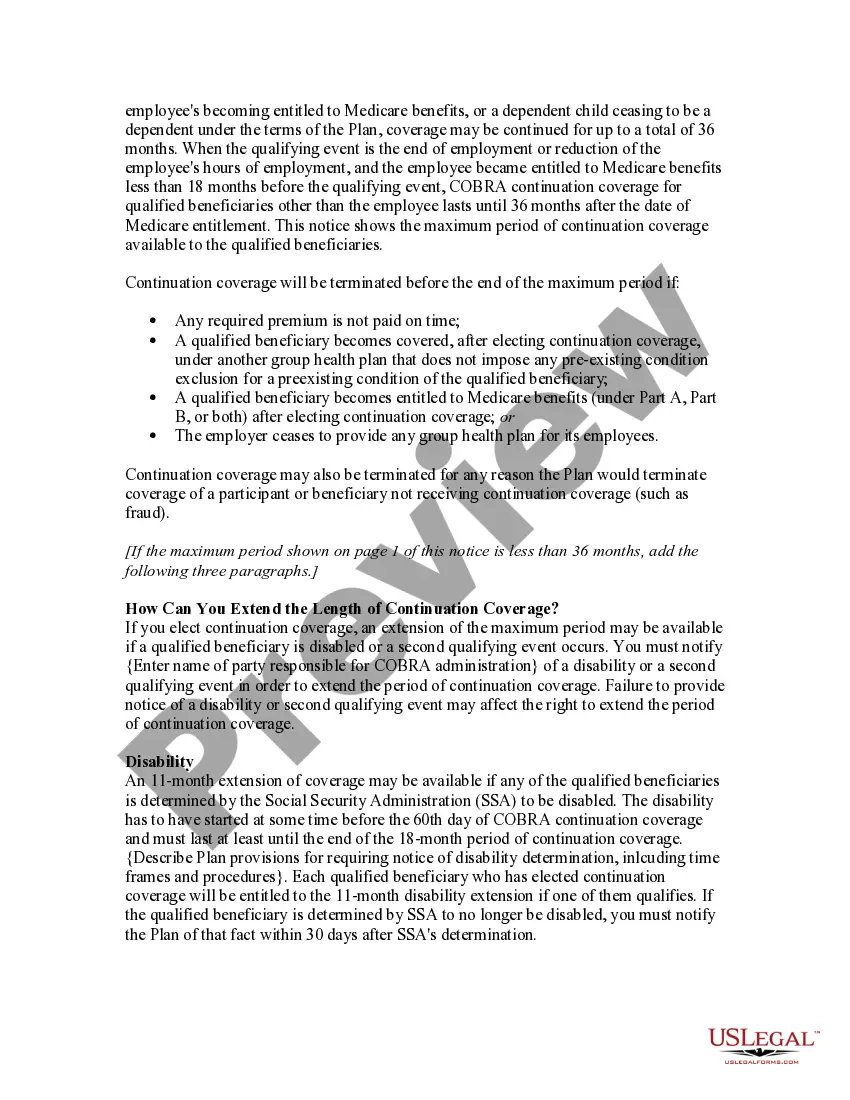

COBRA coverage does not start immediately; it typically begins after you submit your enrollment form and premium payment. Once enrolled, your coverage will be retroactive to the date of your qualifying event. The COBRA notice for open enrollment will clarify these details, so you understand when your benefits take effect. Being aware of these timelines can help you avoid gaps in coverage.

A COBRA notice for open enrollment should be sent within 14 days after a qualifying event, such as job loss or reduced hours. This notice ensures that you receive all necessary information to make choices about continuing your coverage. Timely delivery is crucial to give you enough time to respond appropriately. Be attentive to the details in this notice for your coverage options.

COBRA does not have a traditional open enrollment period like standard health plans. Instead, your COBRA notice for open enrollment provides specific enrollment periods triggered by qualifying events. During these times, you can enroll, maintain, or transition your coverage. Understanding this aspect can help you make informed decisions about your healthcare.

The 60-day COBRA loophole refers to the time frame for enrolling after receiving the COBRA notice for open enrollment. Even if you miss the initial sign-up period, you may still qualify if you act within 60 days of your qualifying event. This loophole ensures that you don’t lose your coverage unexpectedly. Paying attention to your notification is vital to benefit from this provision.

During open enrollment, COBRA allows eligible individuals to continue their health insurance after leaving employment. You receive a COBRA notice for open enrollment, informing you of your rights and options. It’s crucial to understand this notice, as it outlines how to maintain your coverage. This ensures you can seamlessly transition between plans without losing protection.

To initiate COBRA coverage, start by reviewing the COBRA notice for open enrollment provided by your employer. This document outlines the steps to elect coverage after employment ends. After you follow the instructions, including any payment information, your COBRA coverage will begin, allowing you to maintain your health benefits.

COBRA open enrollment allows you to make choices regarding your health insurance after your job ends. You will receive a COBRA notice for open enrollment detailing your eligibility and options. During this period, you can enroll in COBRA or switch to another health plan, ensuring you choose the best option for your needs.

Setting up a COBRA plan typically involves receiving a COBRA notification from your employer. This notification will include instructions on how to elect coverage. To get started, follow the guidelines provided in the COBRA notice for open enrollment and make sure to act quickly to secure your benefits.

You can drop your COBRA coverage during open enrollment, but you often need to do this within a specific timeframe. This allows you to switch to a different plan that may better suit your needs. Make sure to review the COBRA notice for open enrollment carefully to understand your options and any deadlines involved.