Domestic Partnership União Estável

Description

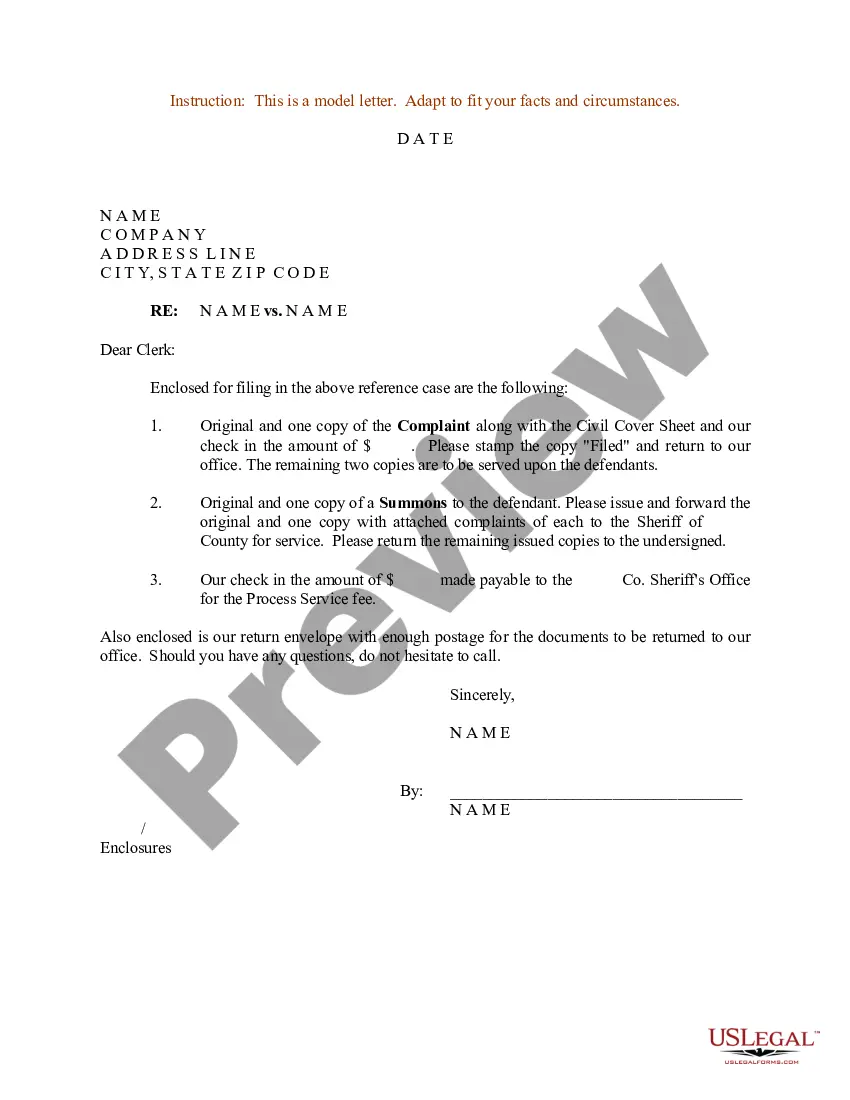

How to fill out Termination Of Domestic Partnership?

- If you are an existing user, log in to your account and download the required form template by clicking on the Download button. Ensure your subscription is current; if not, renew it as per your plan.

- For new users, start by reviewing the Preview mode and form descriptions to confirm you select the correct document that aligns with your local legal requirements.

- If the form does not meet your needs, utilize the Search tab above to explore other templates. Once you find the right fit, proceed to the next step.

- Purchase the document by clicking on the Buy Now button and choose a subscription plan that suits you. Registration for an account is necessary to access additional resources.

- Finalize your purchase by entering your payment details or using PayPal for subscription payment.

- Download your form and save it on your device. You can always access it later in the My Forms section of your profile.

With US Legal Forms, individuals and attorneys can efficiently prepare legal documents using an extensive library consisting of over 85,000 fillable forms. The platform not only provides a broader selection than competitors but also connects users with premium experts for guidance in form completion.

Ensure your legal documents are accurate and sound. Start today by exploring the resources provided by US Legal Forms!

Form popularity

FAQ

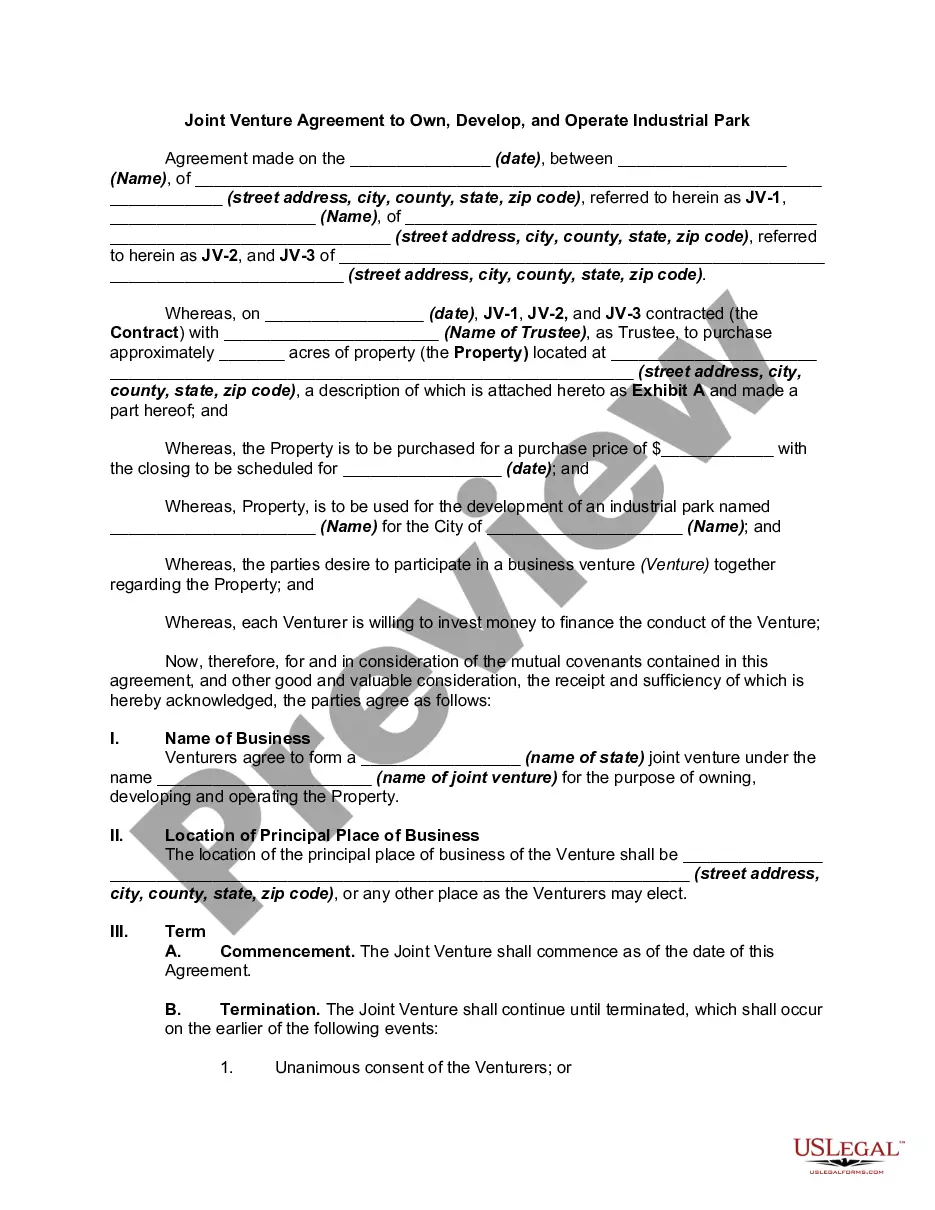

Your girlfriend may count as a domestic partner if your relationship meets specific criteria, such as living together, sharing financial responsibilities, and maintaining a committed bond. However, this definition can vary based on state laws and insurance policies. It's important to understand the legal aspects to ensure you both benefit from the recognition of your relationship. For assistance in determining whether your relationship qualifies as domestic partnership união estável, uslegalforms is an excellent resource.

Whether your girlfriend can be on your health insurance largely depends on your insurance provider's policies regarding domestic partners. Many insurers recognize a domestic partnership união estável, allowing coverage for your partner as a dependent. It’s essential to review your plan’s guidelines to confirm eligibility. For personalized advice on health insurance options, uslegalforms provides the necessary resources to help you navigate this process.

The duration of cohabitation required to file for a domestic partnership varies by state, commonly ranging from a few months to several years. Most states emphasize that you must live together in a committed, intimate relationship. It’s vital to check local regulations as they dictate specific criteria for establishing a domestic partnership união estável. If you’re looking for clarity, uslegalforms offers detailed guidance tailored to your circumstances.

In the US, a domestic partner is defined as an individual who shares a long-term, committed relationship with another person, often similar to marriage but without legal formalization. The requirements can vary by state, typically focusing on cohabitation, emotional commitment, and financial interdependence. To understand how these criteria apply to you, researching local laws is crucial. For comprehensive resources, uslegalforms can help clarify what domestic partnership união estável means in your area.

In the context of the IRS, a domestic partner is typically someone with whom you have a committed relationship, who shares your home, and whom you treat as a spouse. To qualify, you both must also meet certain requirements, such as sharing financial responsibilities. It is essential to understand that the IRS may not recognize all domestic partnerships in the same way, especially when it comes to filing taxes. If you're uncertain, consider visiting uslegalforms for guidance on how to navigate domestic partnership união estável in tax situations.

Domestic partnership status signifies that you are recognized as partners under the law, often providing you with specific legal rights and responsibilities. In the context of domestic partnership união estável, this status can affect areas such as taxation, medical decisions, and property ownership. It's essential to understand this status to protect your rights and ensure your interests are met. If you need guidance navigating these details, USLegalForms can provide helpful resources to streamline the process.

Being in a domestic partnership união estável means you share a committed relationship with another person, often similar to marriage but without the legal designation. This arrangement typically involves emotional and financial responsibilities, and it recognizes your mutual support and commitment. Couples in a domestic partnership may enjoy various legal benefits, such as health insurance coverage and inheritance rights. Understanding these aspects can help you make informed decisions about your relationship.

To claim domestic partnership união estável for insurance, begin by checking your provider's requirements. You often must complete specific forms and provide proof of your relationship, such as shared bills, joint bank accounts, or a domestic partnership certificate. Additionally, ensuring that both partners are listed on the insurance policy is critical. Platforms like USLegalForms can guide you in obtaining the necessary documentation to streamline this process effectively.

A domestic partnership união estável is often exemplified by couples who live together and share an emotional and financial bond without being legally married. For instance, two individuals may cohabit, share expenses, and make joint decisions, thereby qualifying for benefits typically reserved for married couples. They might pool their incomes to buy a home or care for children together. Such partnerships can provide similar rights and benefits to those in traditional marriages.

Claiming your domestic partner on your taxes can be straightforward if you understand the rules surrounding domestic partnership união estável. Start by ensuring that both you and your partner meet the IRS criteria for domestic partnership; this typically involves cohabitation and sharing financial responsibilities. When filing your taxes, you’ll need to decide whether to file jointly or separately, which can affect your overall tax liability. For assistance and guidance tailored to your situation, consider using US Legal Forms to access resources and forms specifically relating to domestic partnership união estável.