Llc Specific Loan Forgiveness

Description

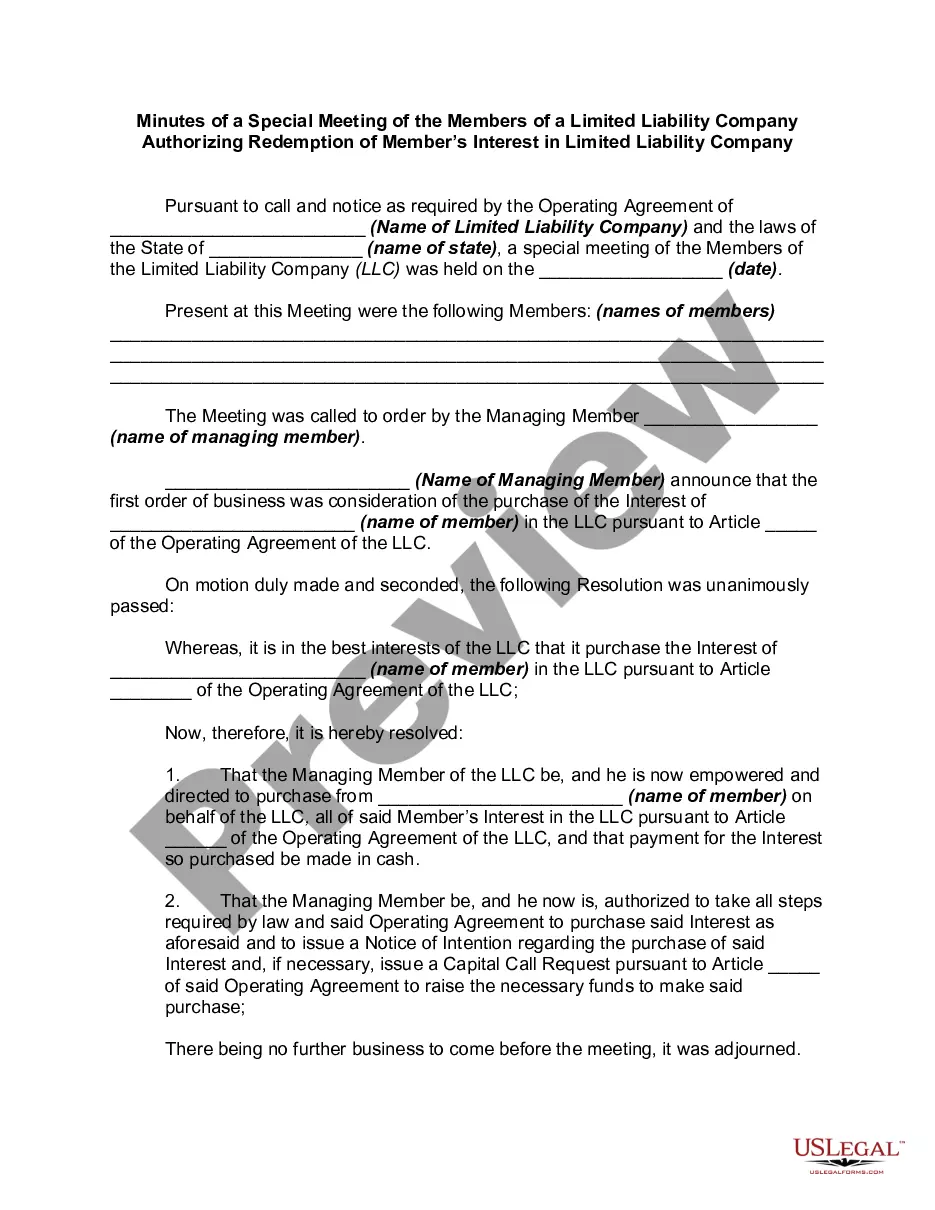

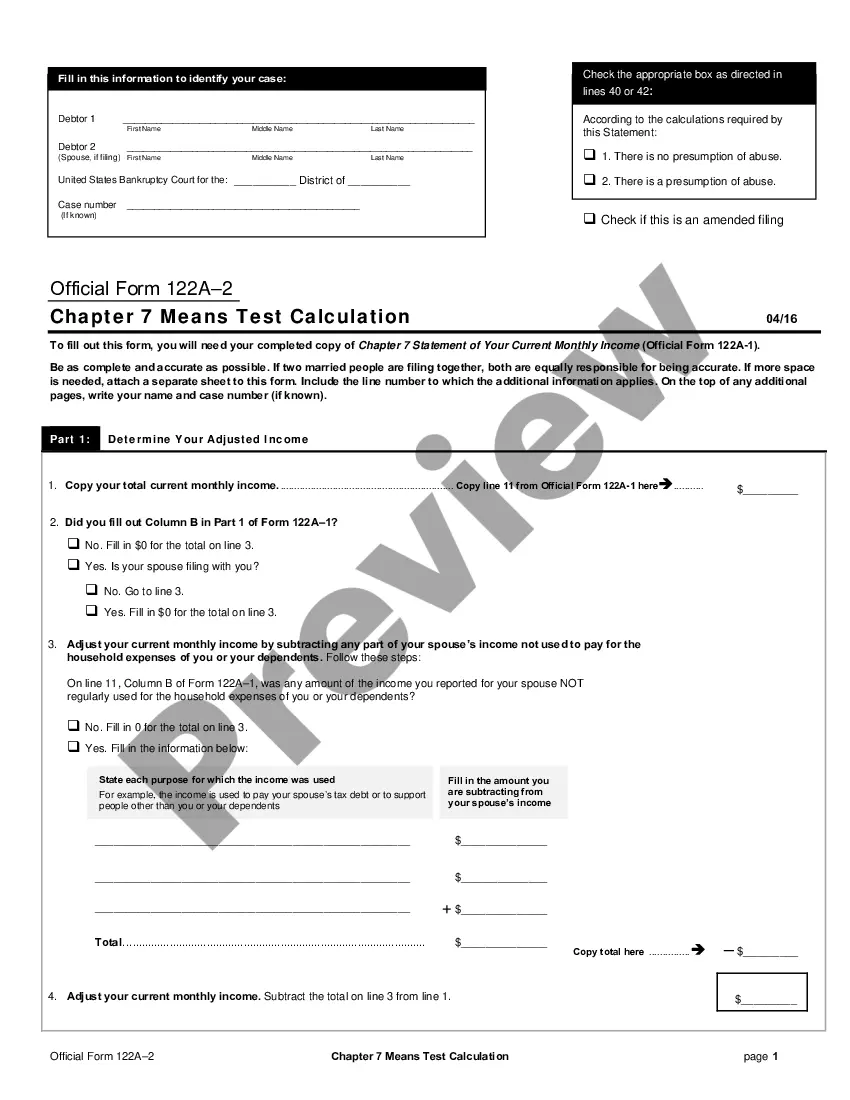

How to fill out Resolution Of Meeting Of LLC Members To Make Specific Loan?

Managing legal paperwork and tasks can be a lengthy addition to your schedule.

Llc Specific Loan Forgiveness and similar forms frequently require you to search for them and find the most effective way to complete them.

Thus, whether you are handling financial, legal, or personal issues, having a thorough and efficient online collection of forms readily available will greatly assist you.

US Legal Forms is the leading online platform for legal templates, providing over 85,000 state-specific documents and various tools to help you fill out your paperwork with ease.

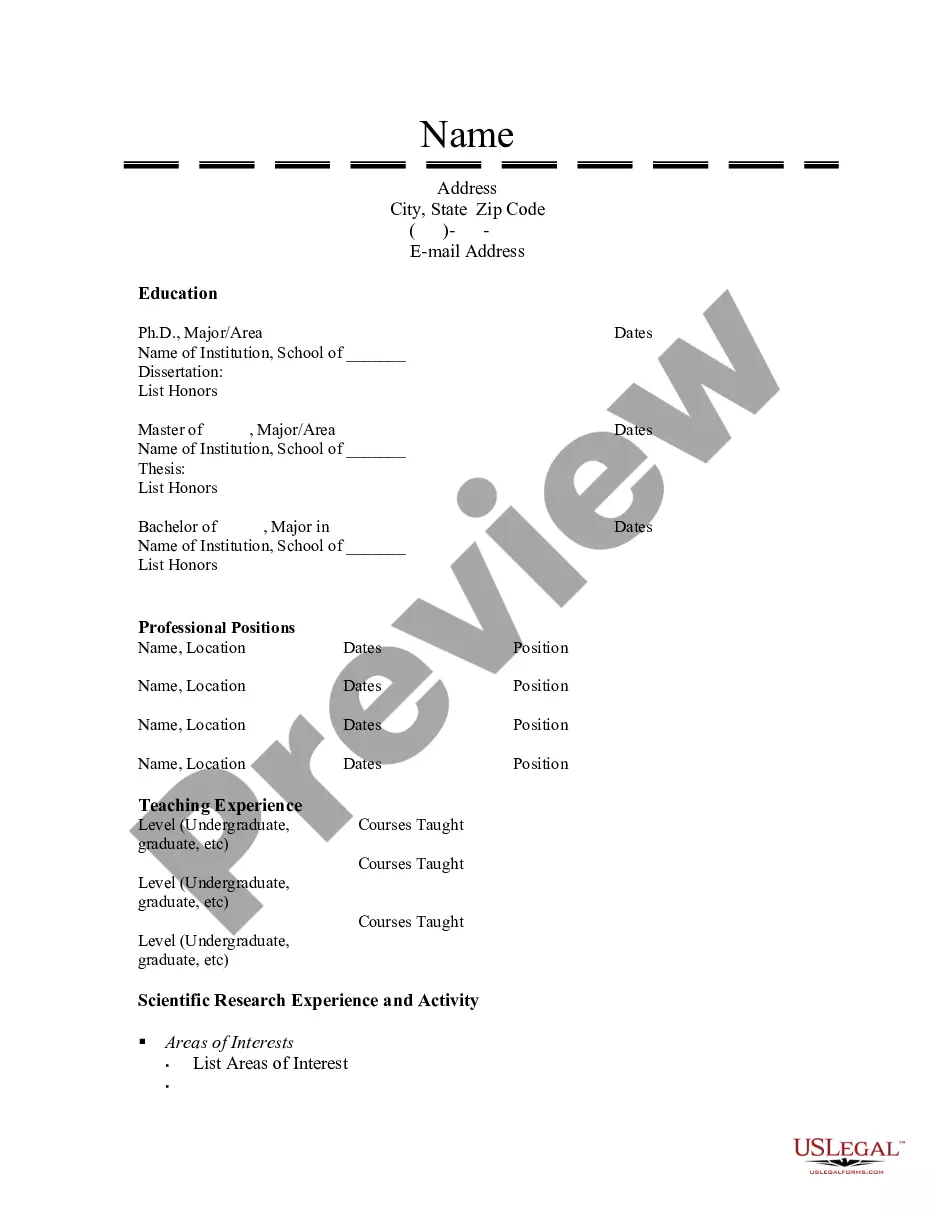

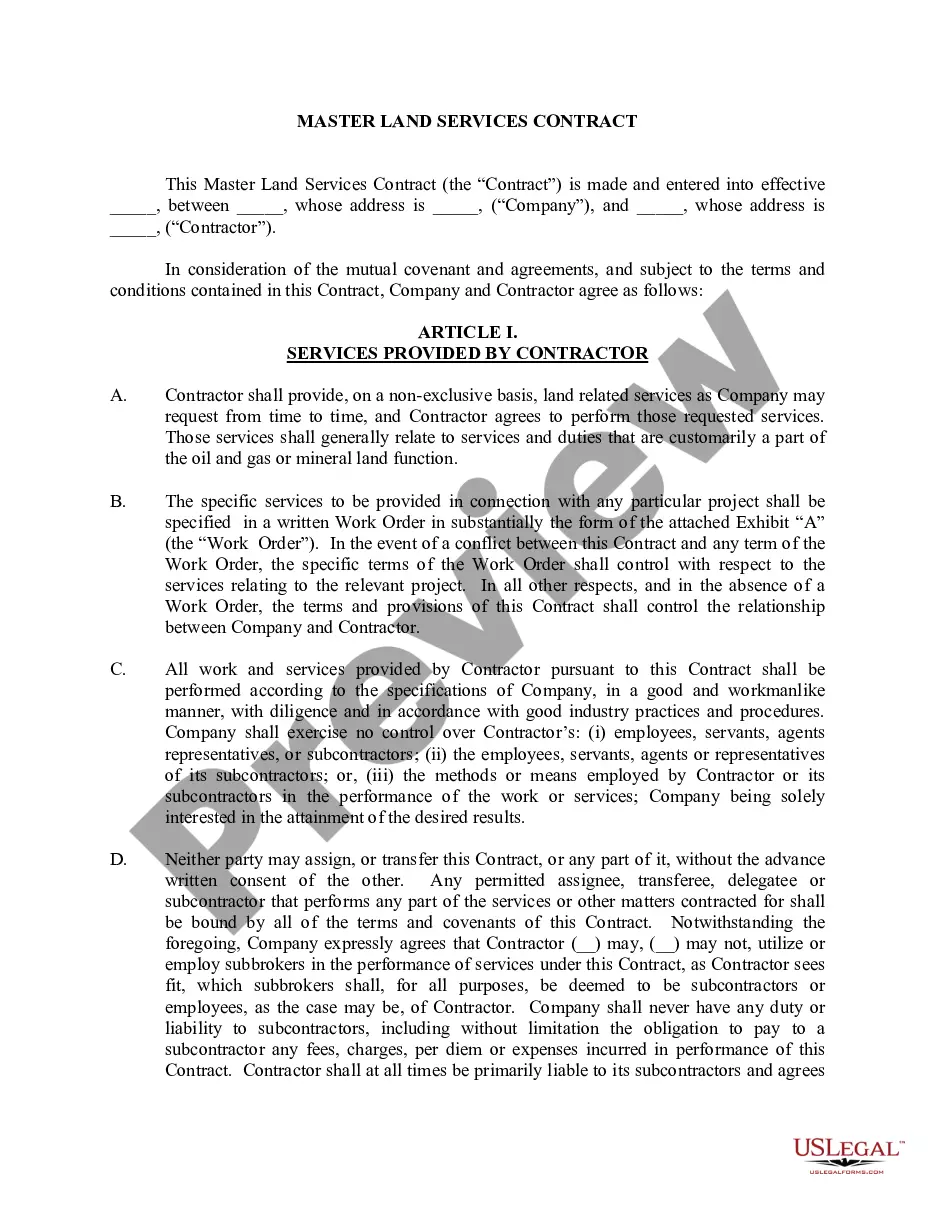

Is it your first time using US Legal Forms? Sign up and create your account in a few moments to access the form library and Llc Specific Loan Forgiveness. Then, follow the instructions below to complete your document: Ensure you have the correct form by using the Review feature and checking the form description. Choose Buy Now when ready, and select the subscription plan that suits you best. Click Download, then fill out, eSign, and print the form. US Legal Forms boasts 25 years of experience assisting users in managing their legal documents. Find the form you need today and streamline any process effortlessly.

- Browse the collection of relevant documents available with just one click.

- US Legal Forms provides you with state- and county-specific forms available for download at any time.

- Protect your document management processes by using a premium service that enables you to prepare any form in just a few minutes without extra or concealed fees.

- Simply Log In to your account, locate Llc Specific Loan Forgiveness and obtain it directly from the My documents section.

- You can also retrieve previously saved forms.

Form popularity

FAQ

Forgiveness of PPP loan proceeds should be recorded as income from continuing operations, as a separate line item. of loan forgiveness from the U.S. government is received.

Forgiven PPP loan proceeds is reported on Schedule M-3, page 2 as Other income (loss) items with differences. For an S-Corporation, forgiven PPP loan proceeds are also reported on: Schedule K, line 16b. Schedule K-1, Box 16B.

And if you're doing that instead of taking income out to avoid taxes, again, the IRS might take issue with the approach. Yes, an LLC can use its profits to pay off the owner's personal loans or student loans, and the owner can choose not to take a standard income.

Whether you have made 120 qualifying payments, or not, you should fill out and submit the PSLF form annually or whenever you change employers. Otherwise, you'll have to submit PSLF forms for each employer you worked for all at once.

Student Loan Debt Relief Visit StudentAid.gov/debtrelief to learn more about the actions President Biden announced following the decision and find out how this decision impacts you.