Limited Liability Interest Without Operating Agreement

Description

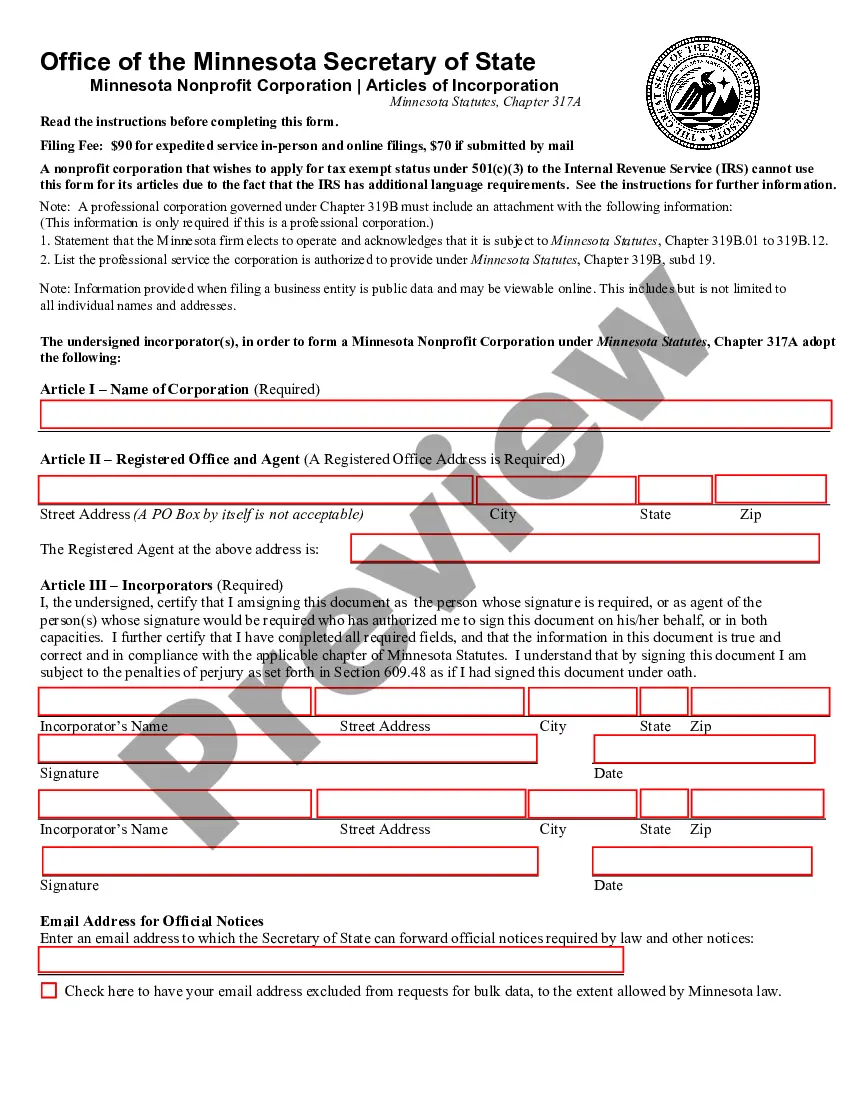

How to fill out Minutes Of A Special Meeting Of The Members Of A Limited Liability Company Authorizing Redemption Of Member's Interest In Limited Liability?

There is no longer any need to spend time searching for legal documents to adhere to your local state statutes.

US Legal Forms has compiled all of them in one location and enhanced their availability.

Our site offers over 85,000 templates for any business and personal legal matters categorized by state and area of application.

Utilize the Search field above to find another template if the current one does not meet your needs.

- All documents are expertly prepared and authenticated for legitimacy, so you can trust in acquiring a current Limited Liability Interest Without Operating Agreement.

- If you are acquainted with our platform and already possess an account, ensure that your subscription is current before obtaining any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all purchased documentation at any time by accessing the My documents section in your profile.

- If this is your first interaction with our platform, the process will involve a few additional steps to complete.

- Here's how new users can acquire the Limited Liability Interest Without Operating Agreement from our catalog.

- Review the page content carefully to ensure it contains the template you require.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

An LLC operating agreement is a document that customizes the terms of a limited liability company according to the specific needs of its members. It also outlines the financial and functional decision-making in a structured manner. It is similar to articles of incorporation that govern the operations of a corporation.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.

Too often, founders rush to form the LLC without having a suitable written operating agreement in place. The operating agreement can state that the members will form an LLC within a certain period or when certain milestones are achieved, and that if those events don't transpire, then the agreement is terminated.

Why do you need an operating agreement? To protect the business' limited liability status: Operating agreements give members protection from personal liability to the LLC. Without this specific formality, your LLC can closely resemble a sole proprietorship or partnership, jeopardizing your personal liability.