Security Refund With Foreigners

Description

How to fill out Letter - To Tenant In Response To A Challenge To The Security Deposit Refund?

Managing legal documents and tasks could be a lengthy addition to your schedule.

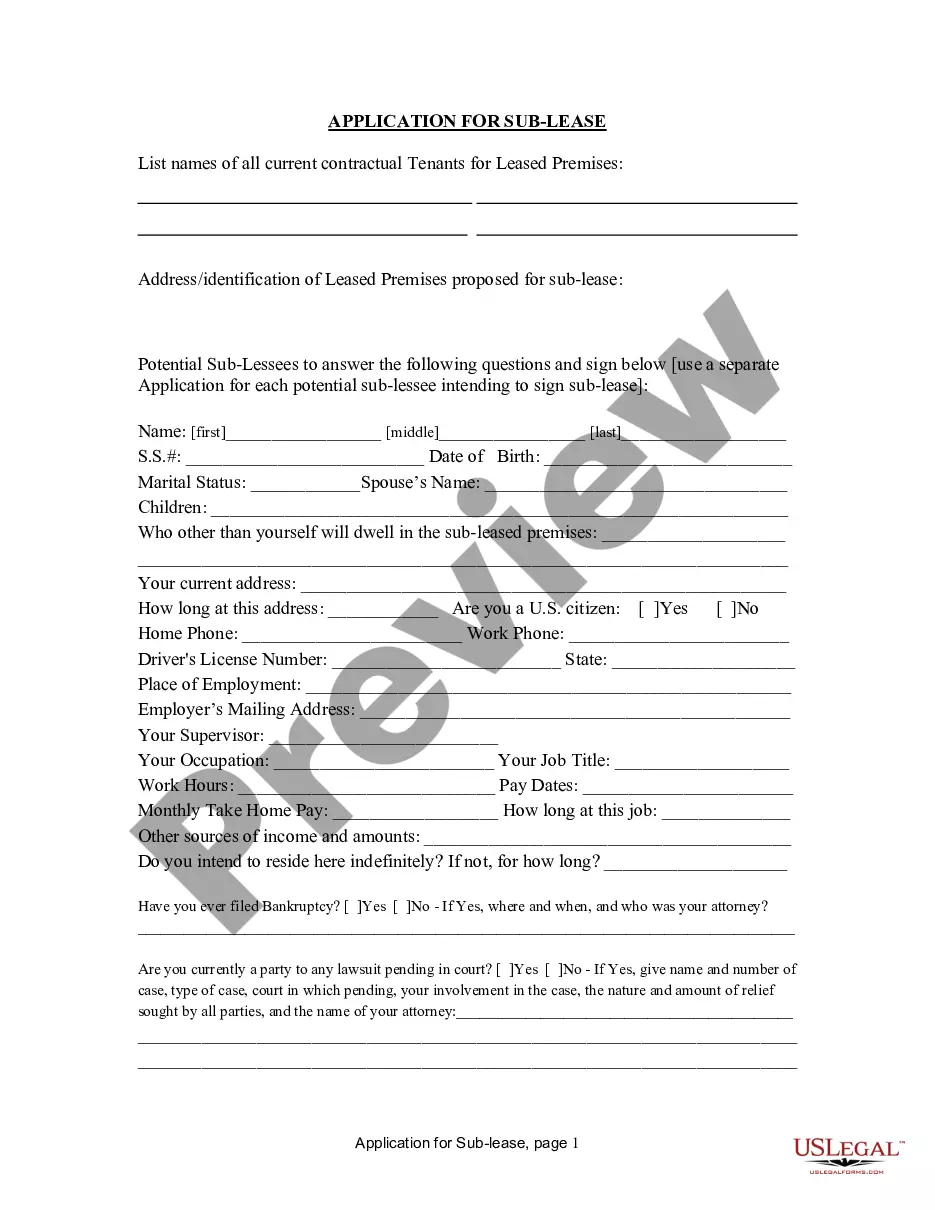

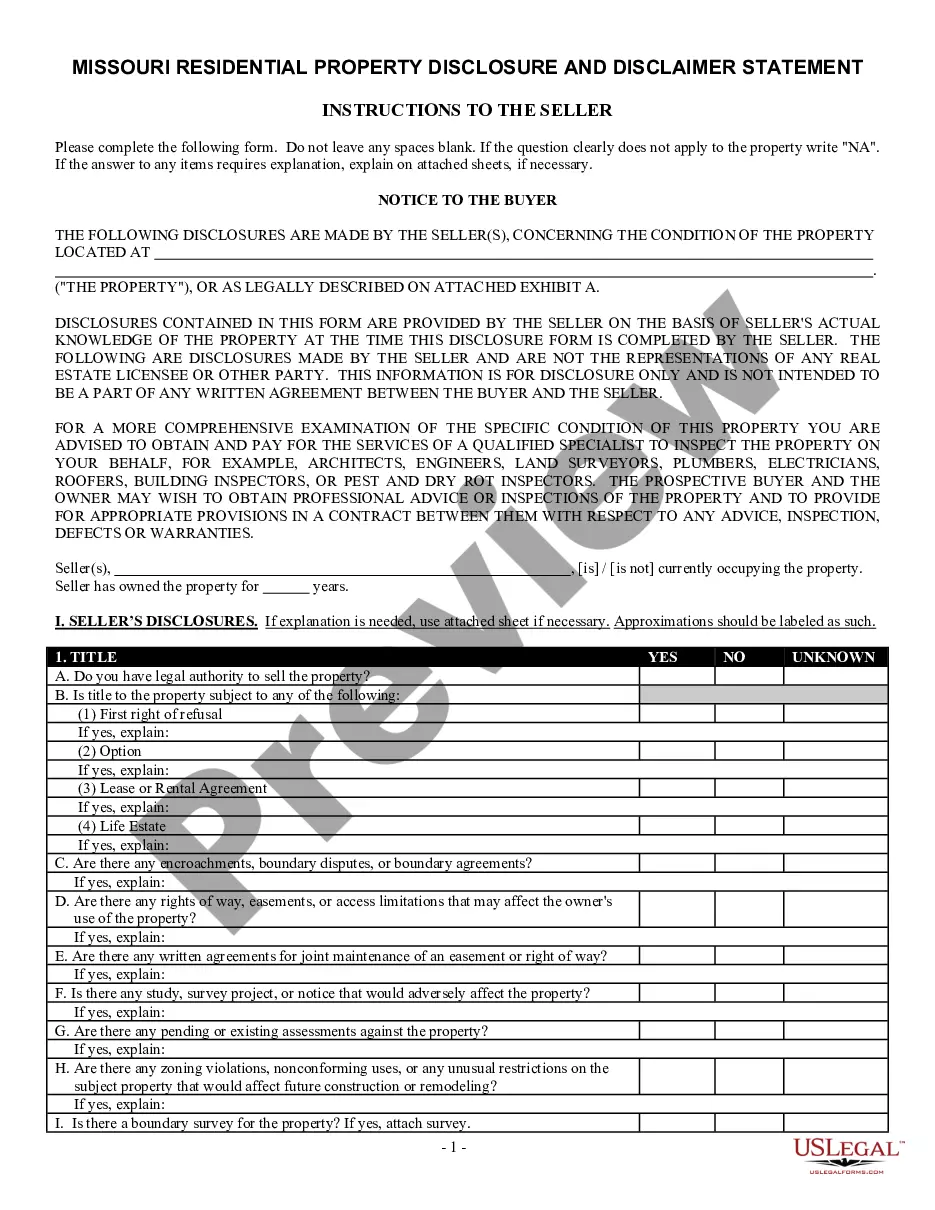

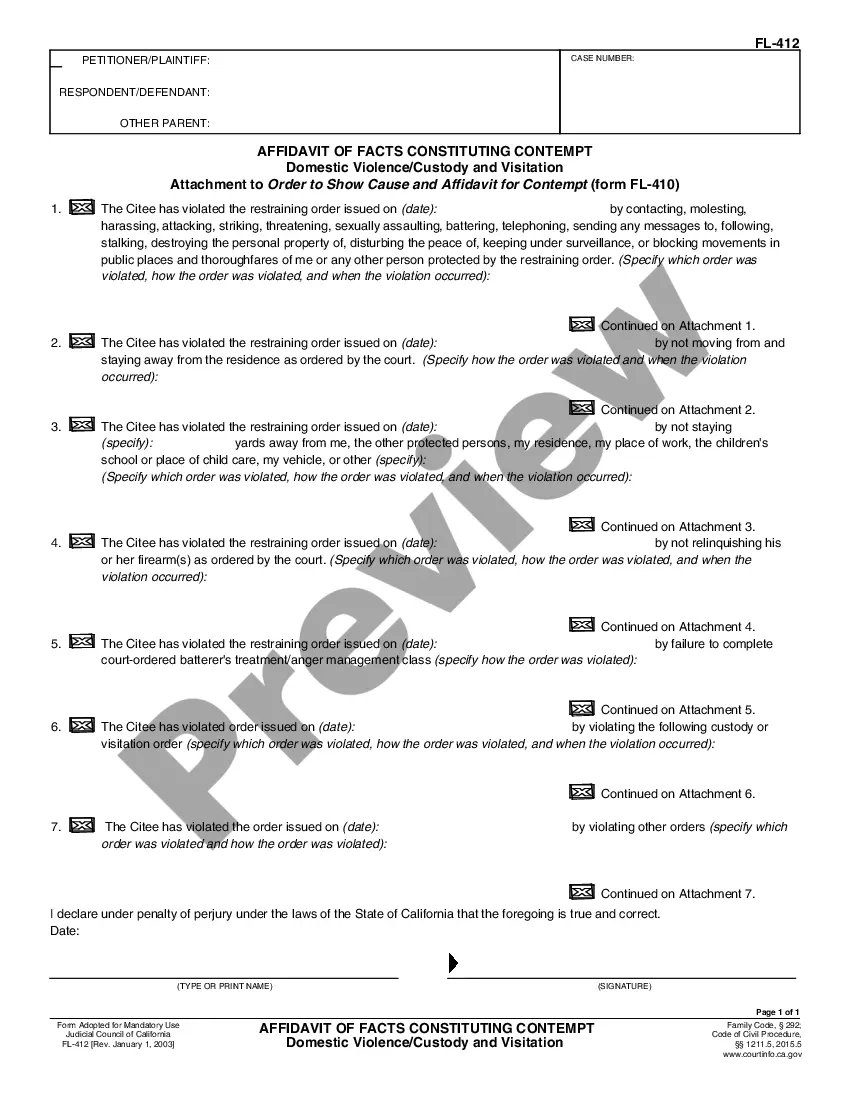

Security Refund With Foreigners and similar forms often necessitate you to locate them and figure out how to fill them out accurately.

Consequently, if you are handling financial, legal, or personal issues, having a detailed and efficient online directory of forms at your disposal will significantly help.

US Legal Forms is the leading online platform for legal templates, featuring over 85,000 state-specific forms and various tools to help you complete your documents effortlessly.

Is this your first time using US Legal Forms? Sign up and create a free account in a few minutes, and you’ll gain access to the form directory and Security Refund With Foreigners. Then, follow the steps below to complete your form: Make sure you have found the correct form using the Review feature and checking the form description. Choose Buy Now when ready, and select the monthly subscription plan that suits you best. Click Download, then complete, eSign, and print the form. US Legal Forms has 25 years of experience assisting users in managing their legal documents. Obtain the form you need now and streamline any process without breaking a sweat.

- Explore the collection of relevant documents available with just one click.

- US Legal Forms offers you state- and county-specific forms available anytime for download.

- Safeguard your document management processes with a high-quality service that allows you to prepare any form in minutes without extra or hidden costs.

- Simply Log In to your account, find Security Refund With Foreigners, and download it instantly from the My documents section.

- You can also access previously downloaded forms.

Form popularity

FAQ

Form 843 is essentially a request for a refund of specific federal taxes, including Social Security tax. It serves as a formal way to communicate with the IRS about any overpayments. For foreigners, understanding this form is crucial to navigating the refund process effectively. US Legal Forms offers resources and guidance that can simplify your understanding and completion of Form 843, making it easier to seek your Security refund with foreigners.

Yes, it is possible to receive a refund on Social Security and Medicare taxes if you have overpaid. This situation often arises for foreigners who may not qualify for certain benefits. Filing Form 843 is the method to request this refund, and using US Legal Forms can help ensure you complete the process correctly. This way, you can confidently pursue your Security refund with foreigners.

Typically, you can expect to wait about 8 to 12 weeks for a refund after filing Form 843. The IRS processes these requests in the order they are received, which can lead to some delays. If you want to ensure a smooth process, consider using US Legal Forms to avoid any mistakes when submitting your form. This can help expedite your request for a Security refund with foreigners.

Form 843 is the application for a refund of certain taxes, including Social Security tax. This form allows individuals, including foreigners, to request a refund when they have overpaid. It is particularly useful for those seeking a Security refund with foreigners. You can find this form on the IRS website, or use US Legal Forms to quickly access it and understand how to fill it out properly.

Yes, foreigners may qualify for a tax refund in the US under certain conditions. If you have overpaid your taxes, you can file for a refund, which is often referred to as a Security refund with foreigners. It’s crucial to have the correct forms and documentation, which US Legal Forms can help you obtain. This makes the process more manageable for those unfamiliar with US tax laws.

To claim a Social Security tax refund, you need to fill out Form 843. This form is essential for requesting a refund of overpaid Social Security taxes. Once you complete the form, submit it along with any supporting documentation to the IRS. Using our platform, US Legal Forms, can simplify this process by providing easy access to the necessary forms and guidance.

The refund request is raised within 30 days from the date of completing online registration on VFS Portal. The refund request is received by us before 2 working days prior to the date of appointment, provided that You have cancelled your appointment on the system.

About refund A refund may be requested by completing the ?Refund Request Form? . After completing the form please print it out, sign it by hand ,and then scan it. The scanned document should be sent to refunds@rtu.lv.

Refund Application Letter I am writing this letter to request a full refund for the clothes I ordered from your store. I had received a lot of reviews which is why I ordered a few cloth materials worth Rs. 20,000 for my painting business. I regret to inform you that I am not satisfied with the materials.

How to request a refund using your receipt number if you have not been automatically refunded Create a new account or log in with our payment service. This is not the same account you used to apply. ... Enter your receipt number in the search box under ?My receipts?. Select ?Request a refund?.