Commitment Agreement Letter For Loan

Description

How to fill out Commitment Agreement Letter For Loan?

Precisely crafted official documentation is one of the essential assurances for preventing issues and legal disputes, but acquiring it without a lawyer's help might require time.

Whether you need to swiftly locate a current Commitment Agreement Letter For Loan or any other templates for employment, family, or business scenarios, US Legal Forms is always available to assist.

The procedure is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button next to the desired document. Moreover, you can retrieve the Commitment Agreement Letter For Loan at any point, as all the documents ever obtained on the platform are accessible within the My documents section of your profile. Save time and money on preparing official documents. Experience US Legal Forms today!

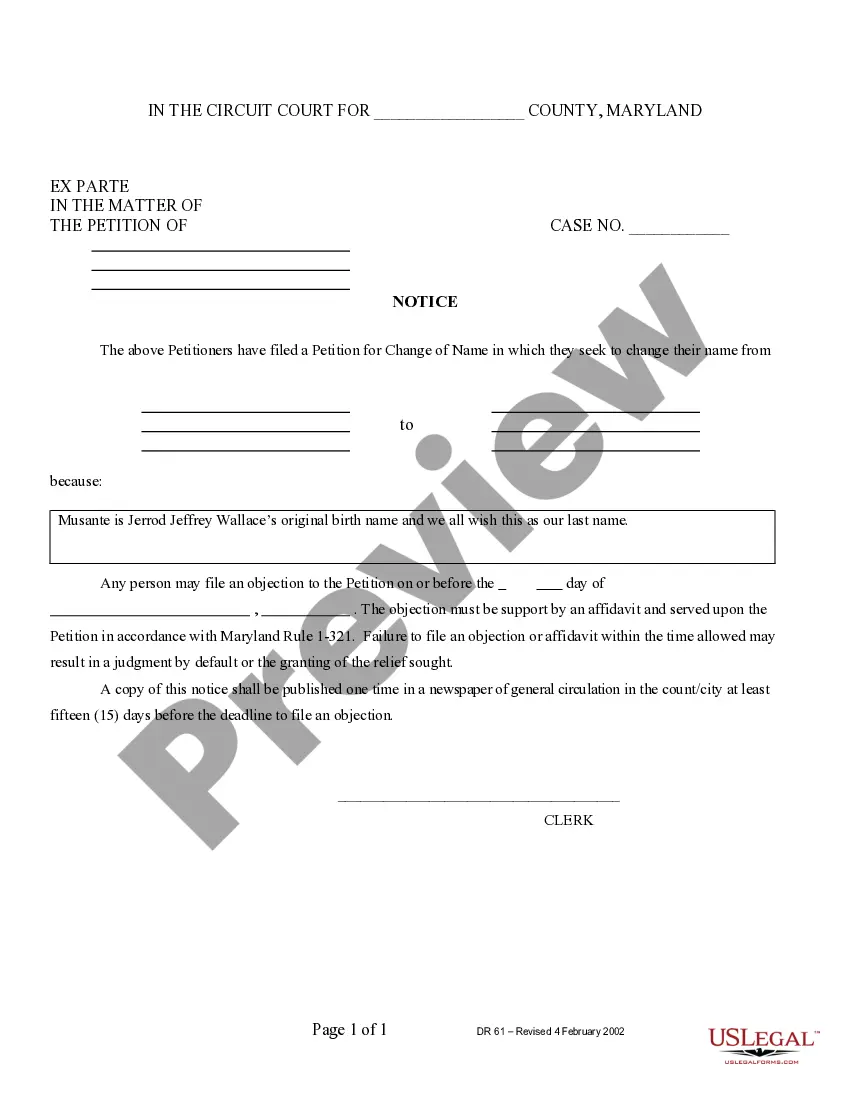

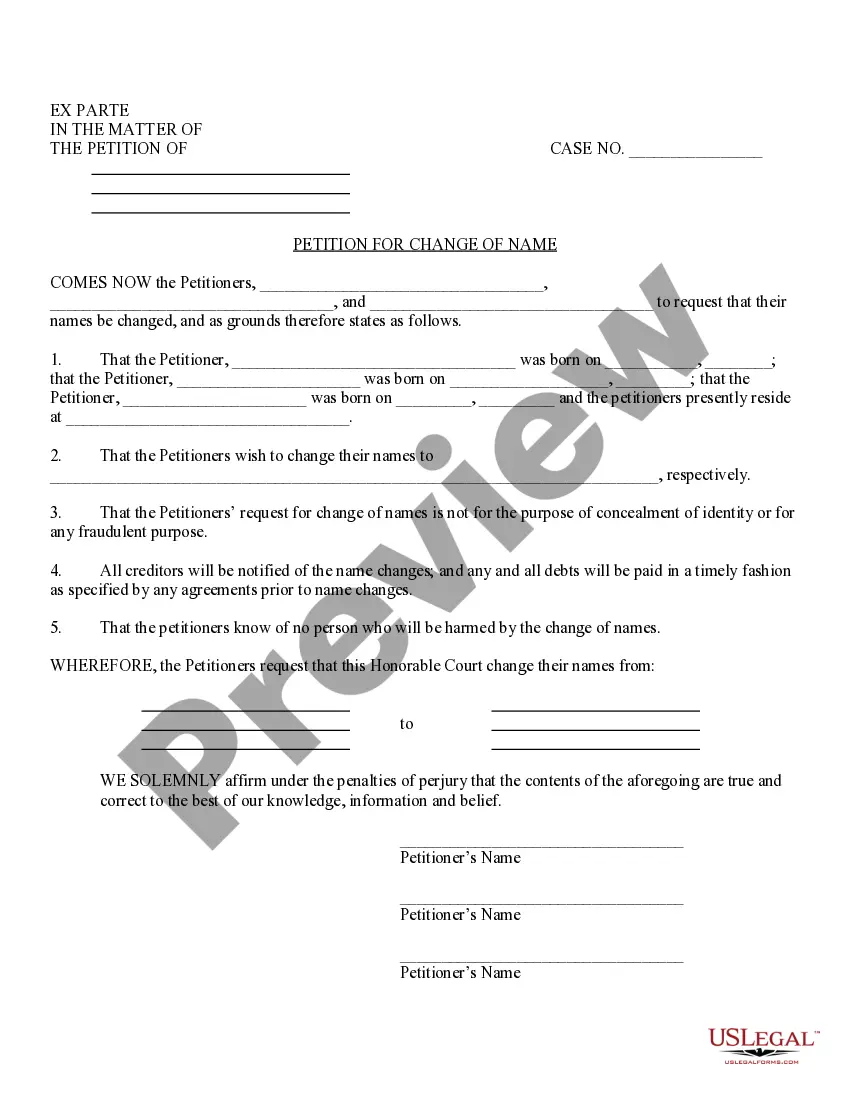

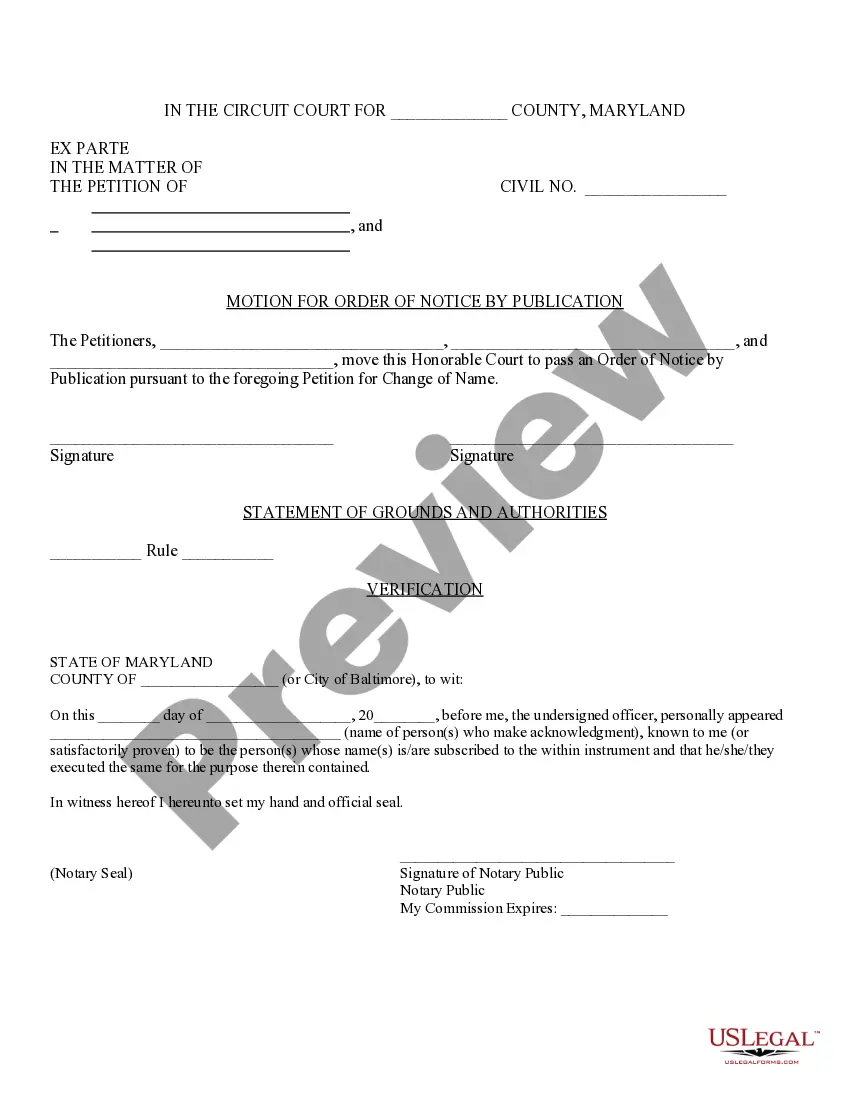

- Verify that the form is appropriate for your situation and location by reviewing the description and preview.

- Search for another example (if required) using the Search bar in the page header.

- Press Buy Now when you find the relevant template.

- Select the pricing plan, Log Into your account or create a new one.

- Choose your preferred payment option to acquire the subscription plan (via a credit card or PayPal).

- Select PDF or DOCX file format for your Commitment Agreement Letter For Loan.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

A mortgage commitment letter is a formal document from your lender stating that you're approved for the loan. Lenders issue a mortgage commitment letter after an applicant successfully completes the preapproval process.

A loan commitment is a formal letter from a lender stating that the applicant has met all of the qualifications for receiving a loan, and that the lender promises a specific amount of money to the borrower.

Once your mortgage commitment letter has been submitted, you've entered the final stage of the mortgage process. The letter is not a final approval, but more so a pledge to the borrower that the mortgage lender will grant the loan if all conditions are met. If there are no loose ends, you should be approved.

A mortgage commitment letter comes from your lender, and it's one of the last steps in the loan approval process. To get a loan commitment, you'll have to fill out your mortgage application and provide supporting documents, including identification, proof of income, asset account statements and rental history.