Name Change Maryland Withholding

Description

Form popularity

FAQ

To change your Maryland state tax withholding, you need to complete a new MW507 form and submit it to your employer. This informs them of any adjustments in your allowances or personal information that may affect your withholding amount. Ensure you review your financial situation regularly, especially after life changes. Platforms like USLegalForms can provide helpful templates for ensuring your forms are completed correctly.

The employee withholding certificate for Maryland, often referred to as the MW507, helps employers determine the correct amount of state tax to withhold from your paycheck. This certificate requires you to report your personal information, including your filing status and number of allowances. Completing this accurately is vital for managing your tax obligations. For assistance in filling out forms, USLegalForms offers valuable templates and guidance.

Determining the number of exemptions to claim in Maryland depends on your individual financial situation and family size. Generally, you should consider claiming one exemption for yourself and additional exemptions for qualified dependents. However, claiming too many exemptions may result in a tax bill later on. Use resources like USLegalForms to evaluate your specific circumstances and make an informed choice.

Personal exemptions on the Maryland tax form reduce your taxable income, potentially lowering your tax liability. As of recent updates, individuals can claim exemptions for themselves and their dependents. Knowing how many exemptions to claim is essential for effective tax planning. For personalized guidance, you might explore services provided by USLegalForms.

Filling out the Maryland MW507 form involves providing your personal information, including your name, address, and Social Security number. Next, indicate your total number of allowances and whether you want additional withholding. Finally, submit your completed form to your employer so they can adjust your withholding accordingly. If you need help, USLegalForms offers step-by-step resources to help you understand the process.

Claiming exemption from withholding in Maryland can be beneficial if you anticipate not owing any state income tax for the year. However, it is crucial to meet specific criteria to avoid penalties. By carefully reviewing your tax situation and considering factors such as income and deductions, you can make an informed decision. USLegalForms can guide you in checking your eligibility for exemption.

The application for tentative refund of withholding in Maryland allows taxpayers to request a refund of over-withheld income taxes. You typically file this when you believe your employers have withheld more than necessary. This form is essential for ensuring that you receive your full earnings back when you do your yearly tax return. For assistance, consider platforms like USLegalForms to simplify the process.

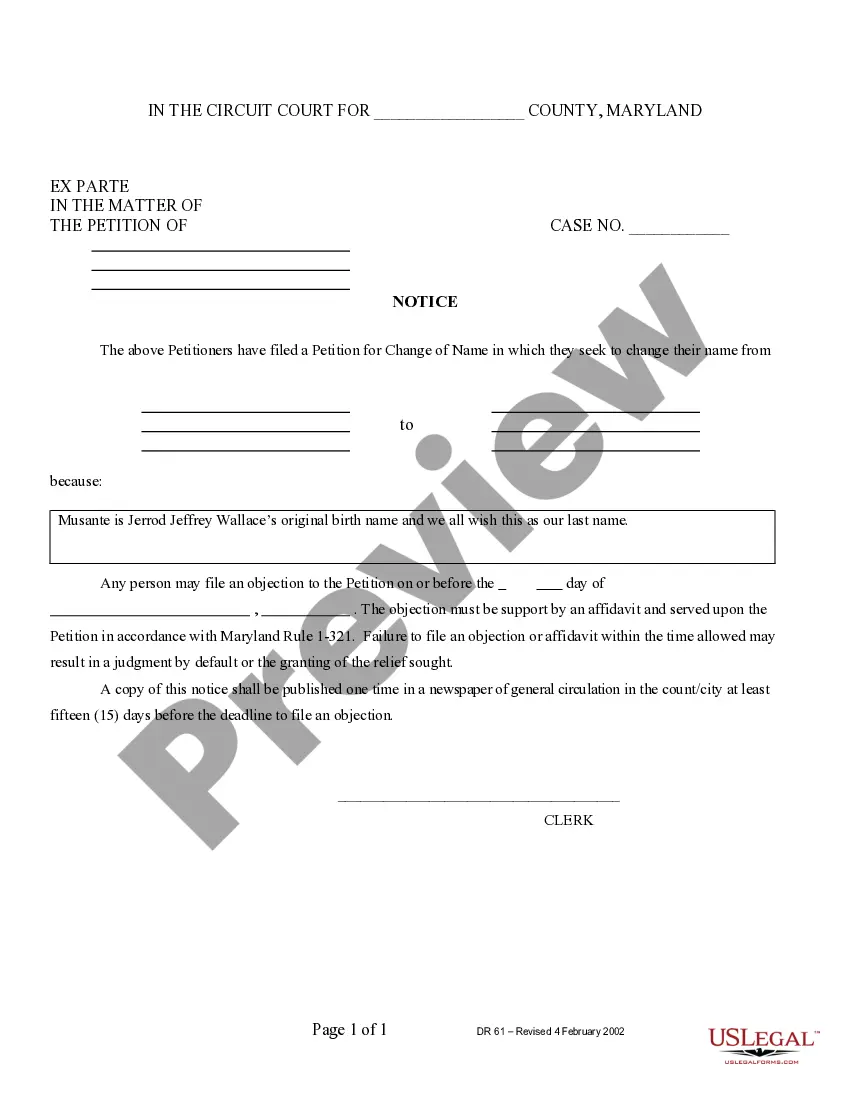

To legally change your name in Maryland, you must file a petition with the local court. After completing the required forms, you will need to attend a hearing where a judge will review your request. If granted, you will receive a name change certificate, which is crucial for updating your Maryland withholding records. For assistance in navigating this process, consider utilizing services like US Legal Forms for easy form handling and information.

To obtain a copy of your name change certificate in Maryland, you can contact the Maryland Department of Health. They provide the necessary documentation to prove your legal name change. This certificate is essential, especially when updating your Maryland withholding information and other important records. If you need help, platforms like US Legal Forms can provide guidance on how to request this document efficiently.

You can change your withholding by submitting an updated MW507 form to your employer. This form allows you to indicate your new desired withholding amount. Additionally, if you've recently undergone a name change, be sure to inform your employer to update your records promptly. This way, your Maryland withholding will be accurate and reflective of your current situation.