Sample Letter For Refinancing Of Loan With Interest

Description

How to fill out Sample Letter For Refinancing Of Loan With Interest?

Individuals often link legal documentation with complexities that only an expert can manage. In some respects, this is accurate, as creating a Sample Letter For Refinancing Of Loan With Interest requires significant expertise concerning the subject matter, including state and county legislation.

However, with US Legal Forms, the process has become much simpler: a comprehensive online library of pre-made legal forms for every life and business scenario tailored to state laws is now available to everyone.

US Legal Forms provides over 85,000 current forms categorized by state and usage area, making it easy to search for a Sample Letter For Refinancing Of Loan With Interest or any other specific template in just minutes. Existing registered users with an active subscription must Log In to their account and click Download to access the form. New users will first need to register for an account and subscribe before they can store any documentation.

All templates in our collection are reusable: once obtained, they remain saved in your profile. You can access them at any time via the My documents tab. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe now!

- Review the page content thoroughly to ensure it meets your requirements.

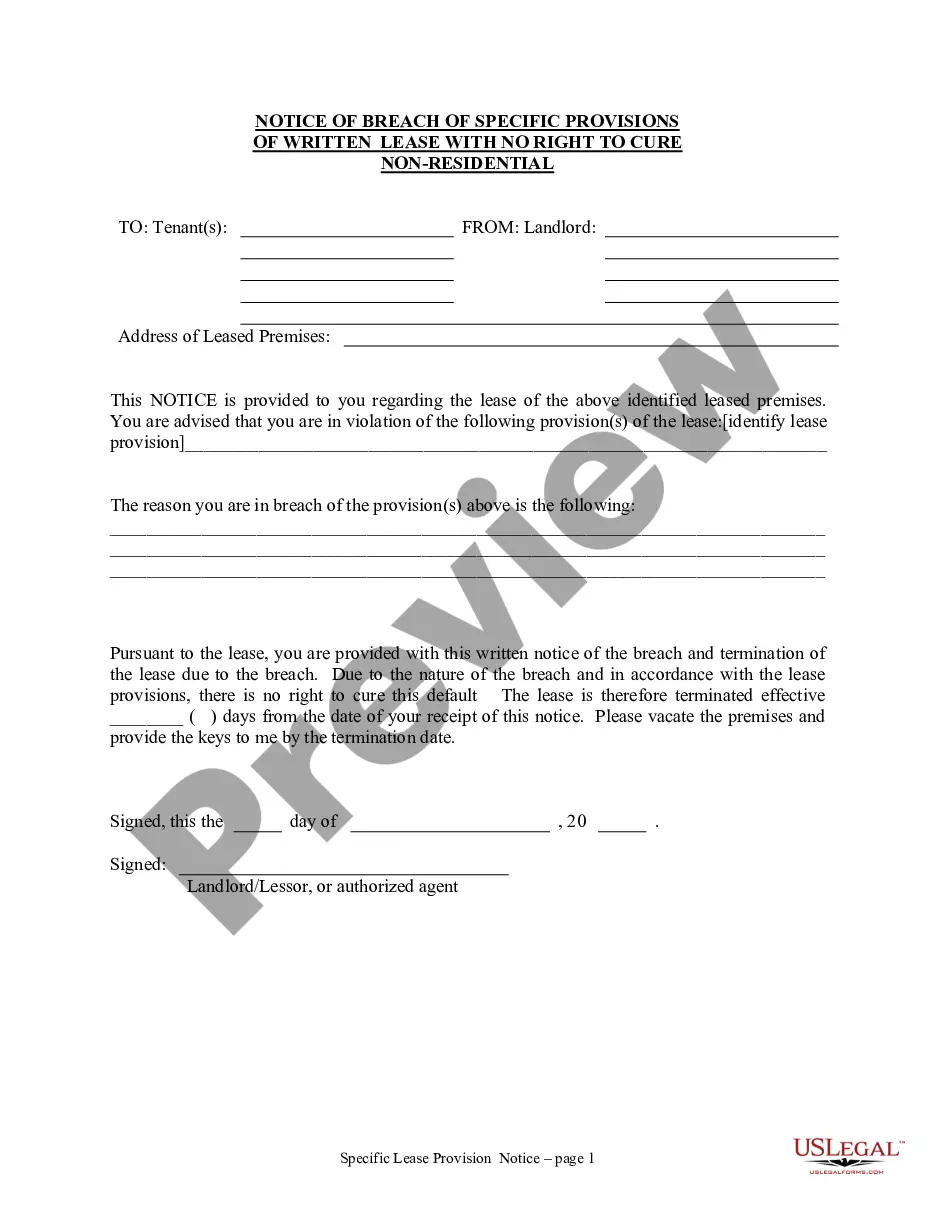

- Examine the form description or confirm it via the Preview option.

- If the previous sample doesn't fit your needs, locate another one using the Search field in the header.

- Press Buy Now once you discover the appropriate Sample Letter For Refinancing Of Loan With Interest.

- Select a pricing plan that aligns with your needs and budget.

- Create an account or Log In to advance to the payment section.

- Complete your payment using PayPal or your credit card.

- Choose the file format and click Download.

- Print your document or upload it to an online editor for a quicker completion.

Form popularity

FAQ

I hereby undertake to repay the loan to you in equal and consecutive monthly payments, as of the month of , of the year . I am aware that you agree that I may be eligible, at any time and from time to time, to pay off any balance of said loan, all or part thereof.

The key to writing a great letter of explanation is to keep it short, simple and informative. Be clear and write with as much detail as you can since someone else will need to understand your situation. Avoid including irrelevant information or answers to questions the underwriter didn't ask.

A letter of explanation for a cash-out refinance does what its name implies. It explains to the lender why you want to take some cash out while you're refinancing. There are many other types of letters of explanation that lenders might request.

How to write a letter of explanationThe lender's name and address.Your name and your application number.The date you're submitting the letter and expected closing date (if you know it)A short statement that helps an underwriter fully understand your situation in regards to the reason for concern.More items...?

Include a reference to the mortgage agreement you have signed with the letter recipient, certify your intent to seek cash-out refinance, explain why do you choose to obtain money this way instead of taking out an additional loan, and indicate your contact information.