Bank Insolvency

Description

How to fill out Sample Letter For Written Acknowledgment Of Bankruptcy Information?

- If you are a returning user, log in to your account and download your desired form template by selecting the Download button. Confirm that your subscription is active; if not, follow the prompts to renew it according to your payment plan.

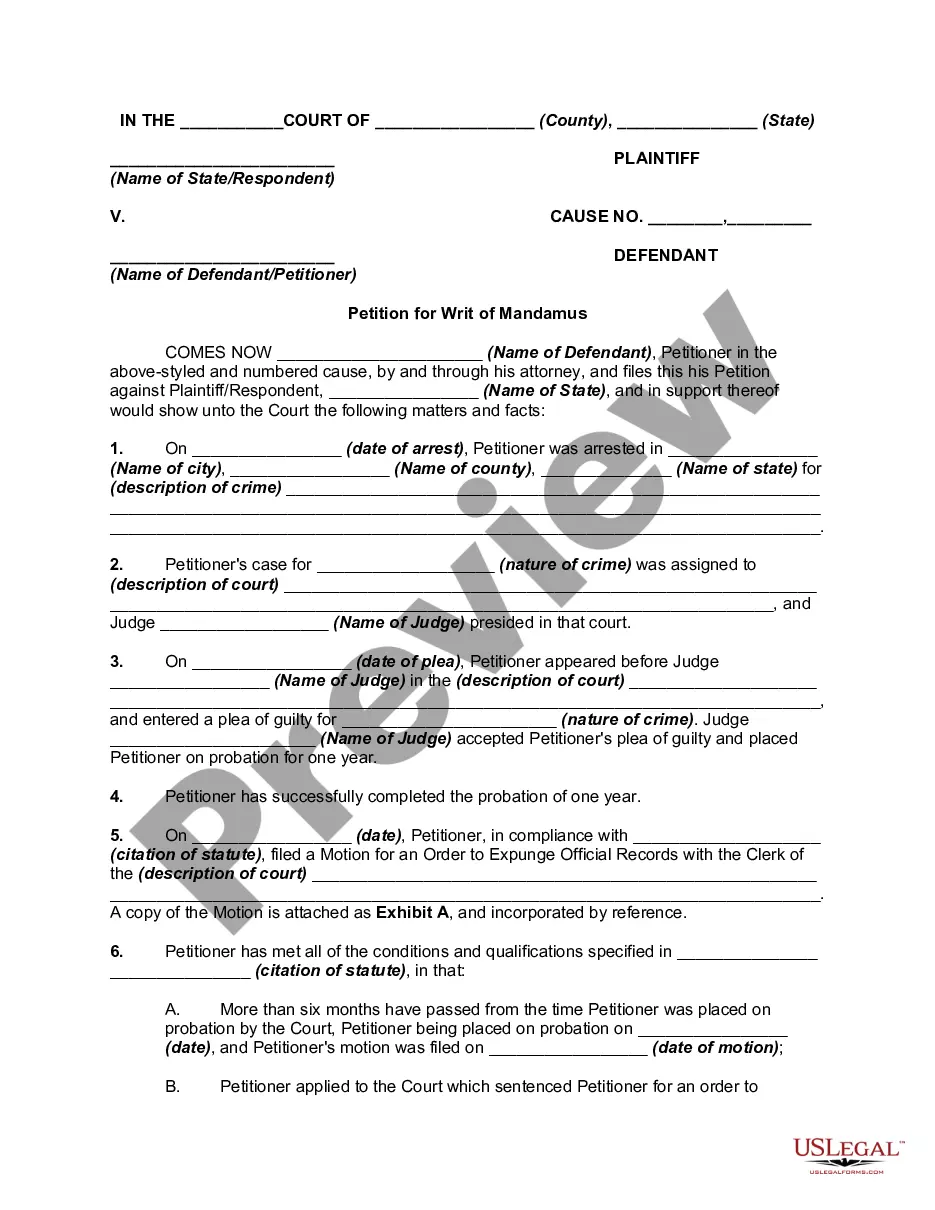

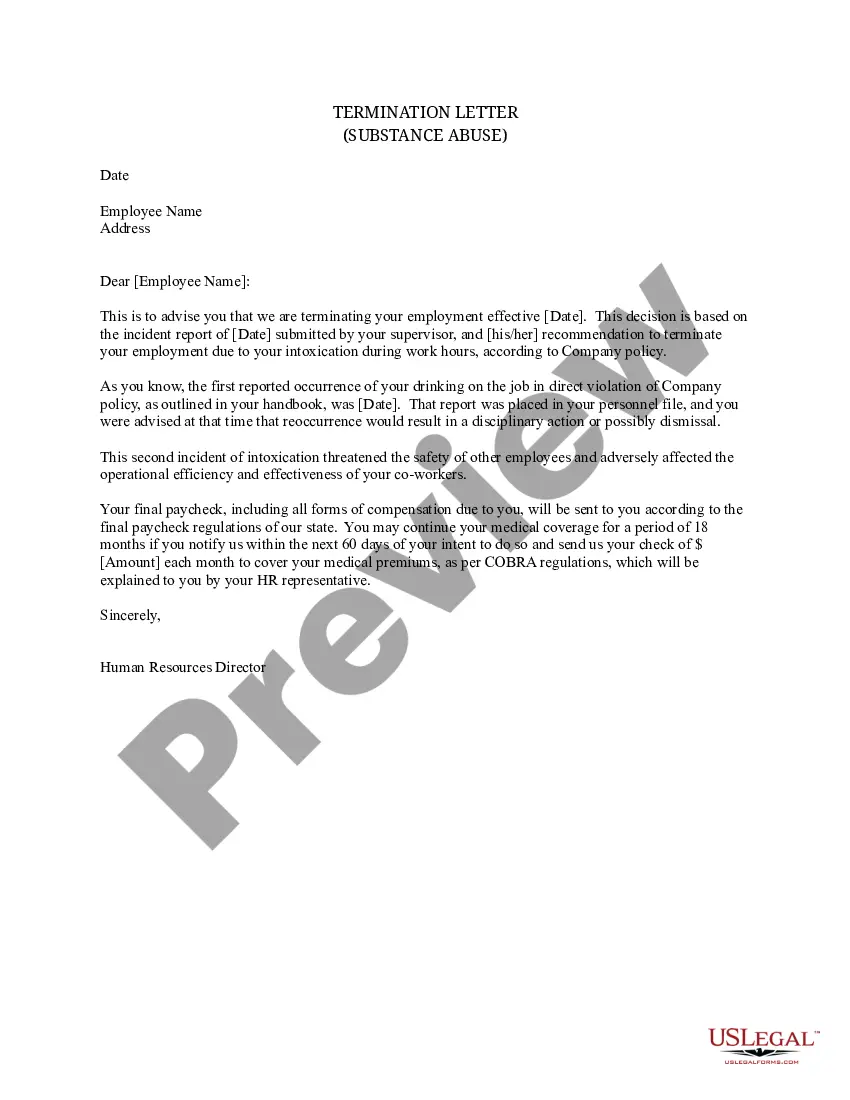

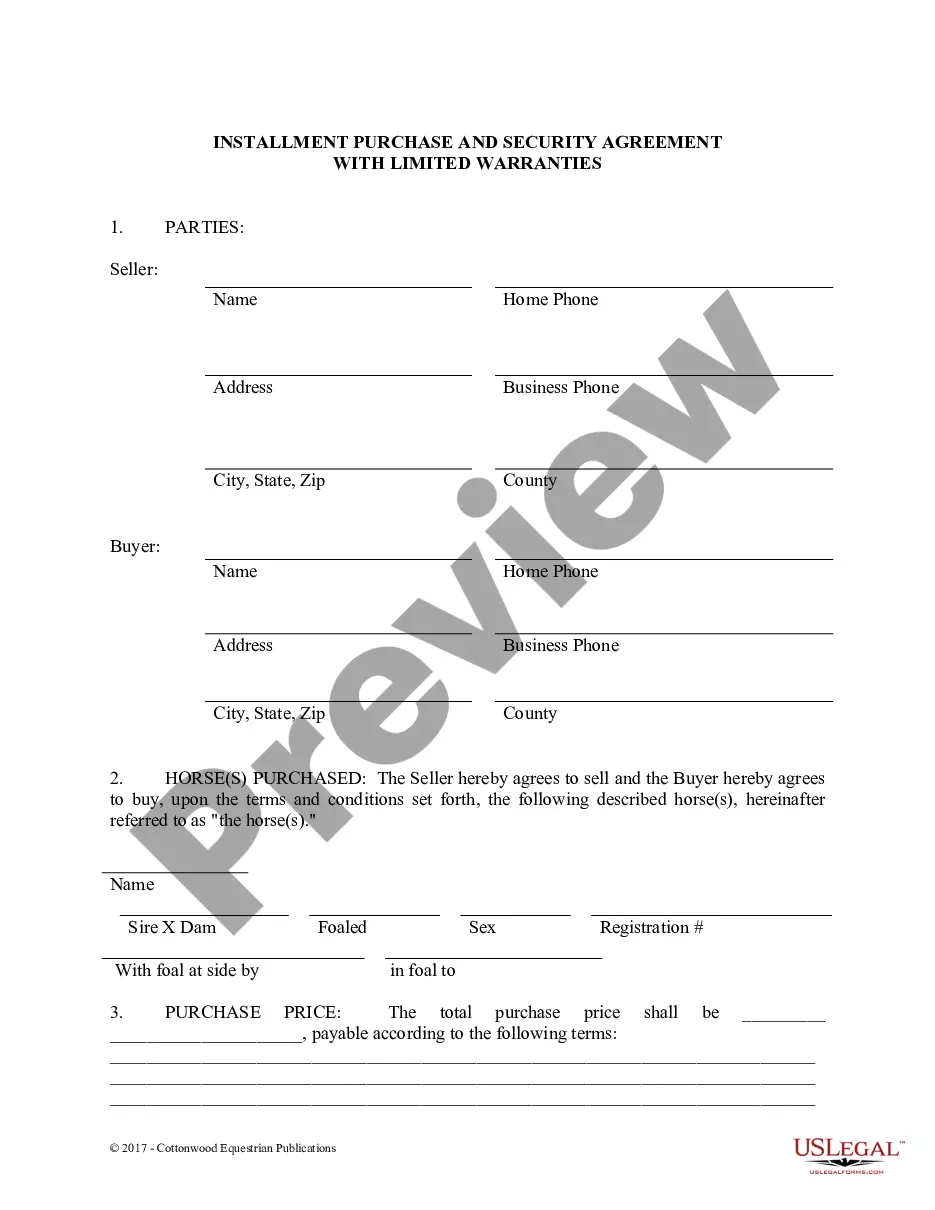

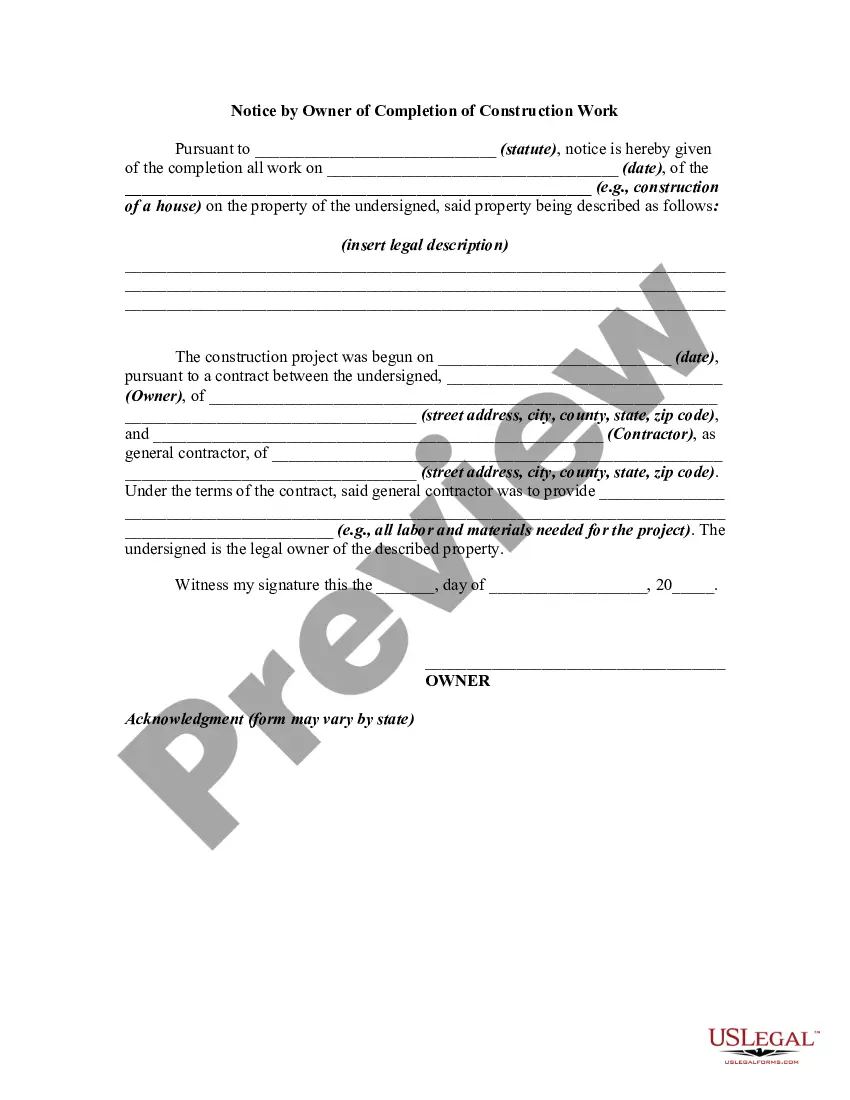

- For first-time users, begin by checking the Preview mode and form description to ensure you have selected the correct template that aligns with your jurisdiction's requirements.

- Use the Search tab to find alternate templates if needed. If you discover inconsistencies, take the time to locate a suitable option.

- To proceed, click the Buy Now button and select your preferred subscription plan. You will need to create an account to gain access to the library's extensive resources.

- Enter your payment information, either via credit card or PayPal, to complete the purchase.

- Finally, download the form to your device for easy access, or find it in the My documents section of your profile whenever needed.

By using US Legal Forms, you can take advantage of an extensive library of over 85,000 legal documents. This ensures you have more options than competitors at a similar cost, alongside access to premium experts for assistance.

Don't let the stress of bank insolvency overwhelm you; leverage US Legal Forms today to secure the documents you need efficiently. Take the first step towards resolution.

Form popularity

FAQ

When insolvency occurs, a series of legal and administrative steps are taken to address the bank's financial issues. This may include appointing a receiver or undergoing a bankruptcy process. Understanding the nuances of bank insolvency can help individuals prepare and respond effectively.

Yes, banks can be at risk of collapse, especially during economic downturns or due to poor financial management. Factors like high levels of bad debts can drive a bank toward insolvency. However, regulatory safeguards often exist to intervene before a complete failure occurs.

Going into bank insolvency initiates a formal evaluation of the bank’s financial health. During this process, the bank may reorganize its liabilities and negotiate with creditors. Ultimately, the goal is to stabilize operations and ensure that depositors are protected.

Banking insolvency refers to a situation where a bank’s liabilities exceed its assets. This financial condition can trigger regulatory actions to protect depositors and maintain confidence in the banking system. Identifying banking insolvency early can help stakeholders make informed decisions.

Bank insolvency can have both positive and negative implications. While it may signal financial distress, it also allows for a fresh start through restructuring. Understanding the context of bank insolvency is crucial, as it can protect depositors while promoting a more stable financial environment.

When you claim bank insolvency, a formal process begins to assess the financial status of the bank. This could lead to restructuring debt, selling off assets, or seeking assistance from regulatory bodies. Claiming insolvency aims to protect both the bank's assets and the interests of its clients.

To file for bank insolvency, you must complete the required forms and submit them to the court. This includes providing a detailed overview of your debts, assets, and income. Using US Legal Forms can ease this process, as they provide clear instructions and templates to help you file accurately and efficiently.

The steps of the bank insolvency procedure typically include assessing your financial situation, submitting an insolvency petition, attending creditors' meetings, and following through with a repayment plan if applicable. Each step requires careful attention to detail to ensure compliance. US Legal Forms can offer support by providing templates and guidance throughout this process.

Certain factors can disqualify you from filing for bank insolvency, such as having previously filed bankruptcy without meeting the waiting period. Additionally, if you fail to complete credit counseling or commit any fraudulent activities, your application could be rejected. Understanding these criteria helps ensure a smoother application process.

Starting bank insolvency proceedings involves several key steps. First, evaluate your financial position and identify all creditors. Next, prepare and submit the necessary documentation, including a petition for insolvency, to the court. Platforms like US Legal Forms are available to help you understand the paperwork you need and ensure compliance with local laws.