Application For Correction Of Property Tax Assessment

Description

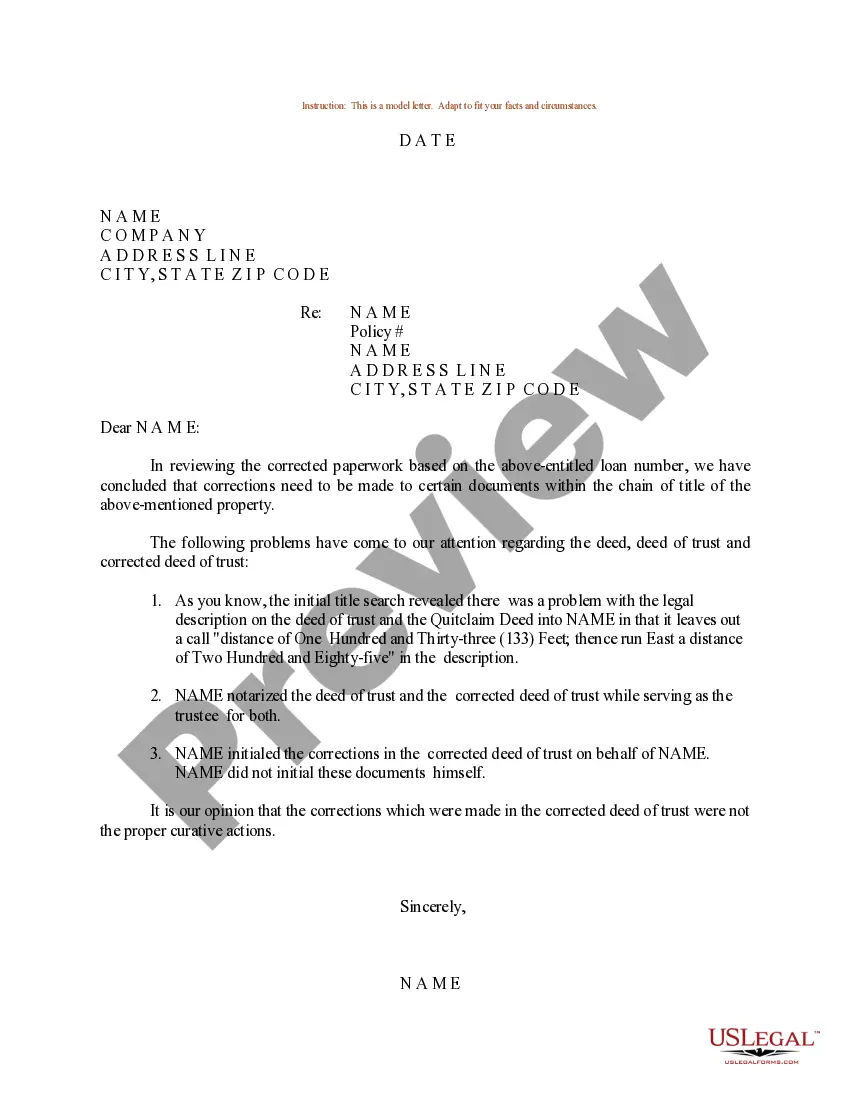

How to fill out Sample Letter For Correction To Sale Of Property?

Obtaining legal templates that meet the federal and regional regulations is crucial, and the internet offers many options to pick from. But what’s the point in wasting time looking for the correctly drafted Application For Correction Of Property Tax Assessment sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the biggest online legal library with over 85,000 fillable templates drafted by lawyers for any business and life situation. They are easy to browse with all files organized by state and purpose of use. Our specialists keep up with legislative updates, so you can always be confident your paperwork is up to date and compliant when acquiring a Application For Correction Of Property Tax Assessment from our website.

Obtaining a Application For Correction Of Property Tax Assessment is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the right format. If you are new to our website, follow the guidelines below:

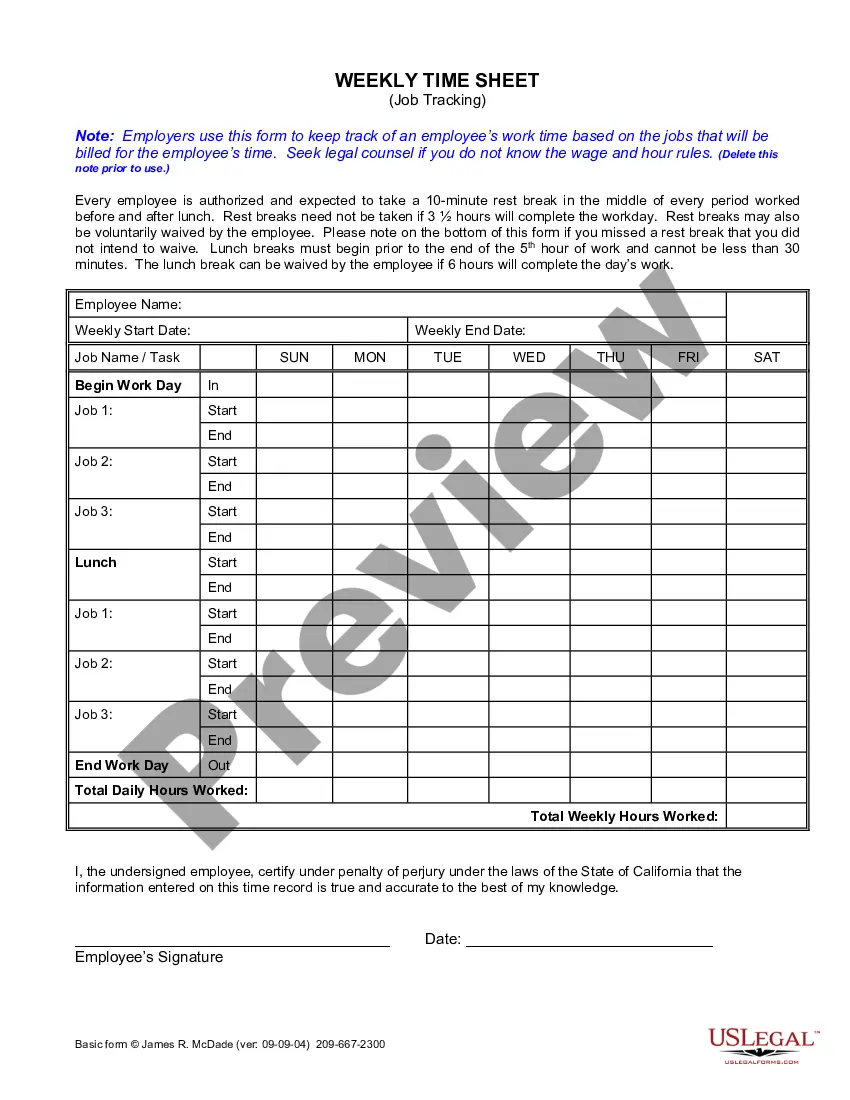

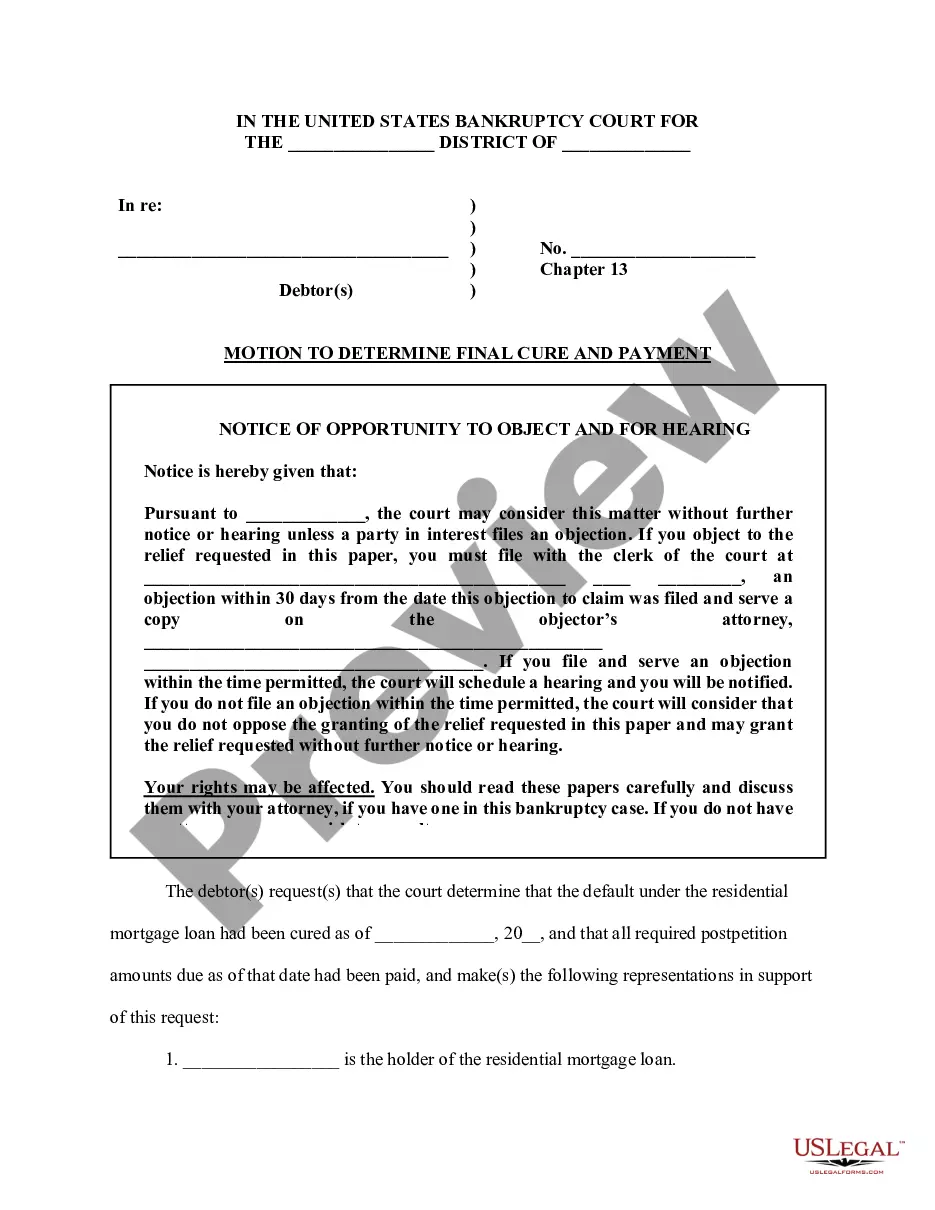

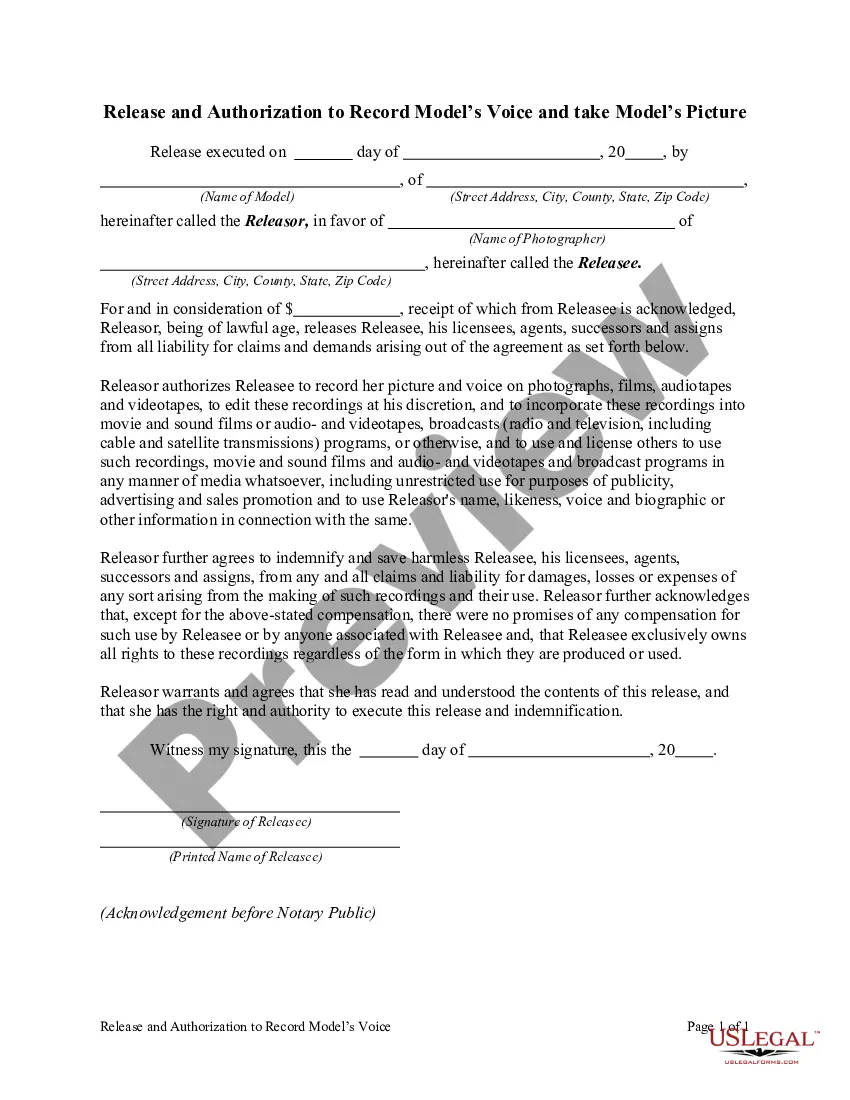

- Take a look at the template using the Preview feature or via the text description to ensure it fits your needs.

- Locate another sample using the search tool at the top of the page if needed.

- Click Buy Now when you’ve found the right form and opt for a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Application For Correction Of Property Tax Assessment and download it.

All documents you find through US Legal Forms are reusable. To re-download and complete earlier obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

If you disagree with the assessed value of your personal property, you can discuss it with the Assessor's Office Auditor Appraisal Staff at (916) 875-0730. Appeal. This may lead to a hearing before the Assessment Appeals Board where both opinions will be heard.

If you own a home and occupy it as your principal place of residence, you may apply for a Homeowners' Exemption. This exemption will reduce your annual assessed value by $7,000. Exemption becomes ineligible for the exemption.

State the reason(s) for protesting. Common reasons for protests are that a property has been assessed more than once (called a double assessment), an assessed location has been recently closed, or the stated value is too high.

You can file an appeal with the Board of Assessment Appeals, or file a Petition with the District Court, or you can submit your case to arbitration. 2. Submit your case to arbitration: To pursue arbitration, you must notify the County Board of Equalization of your intent.

You must file an Assessment Appeal Application, form BOE-305-AH, obtained from the clerk of the board of the county where your property is located. Some counties have this form available on the website of either the clerk of the board or the county assessor, or both.