Westpac Deceased Estate Closure Form

Description

How to fill out Sample Letter For Closure Of Estate - Expiration Of Probating Claims?

Whether you handle documents frequently or occasionally need to submit a legal form, it is crucial to have a source where all the samples are pertinent and current.

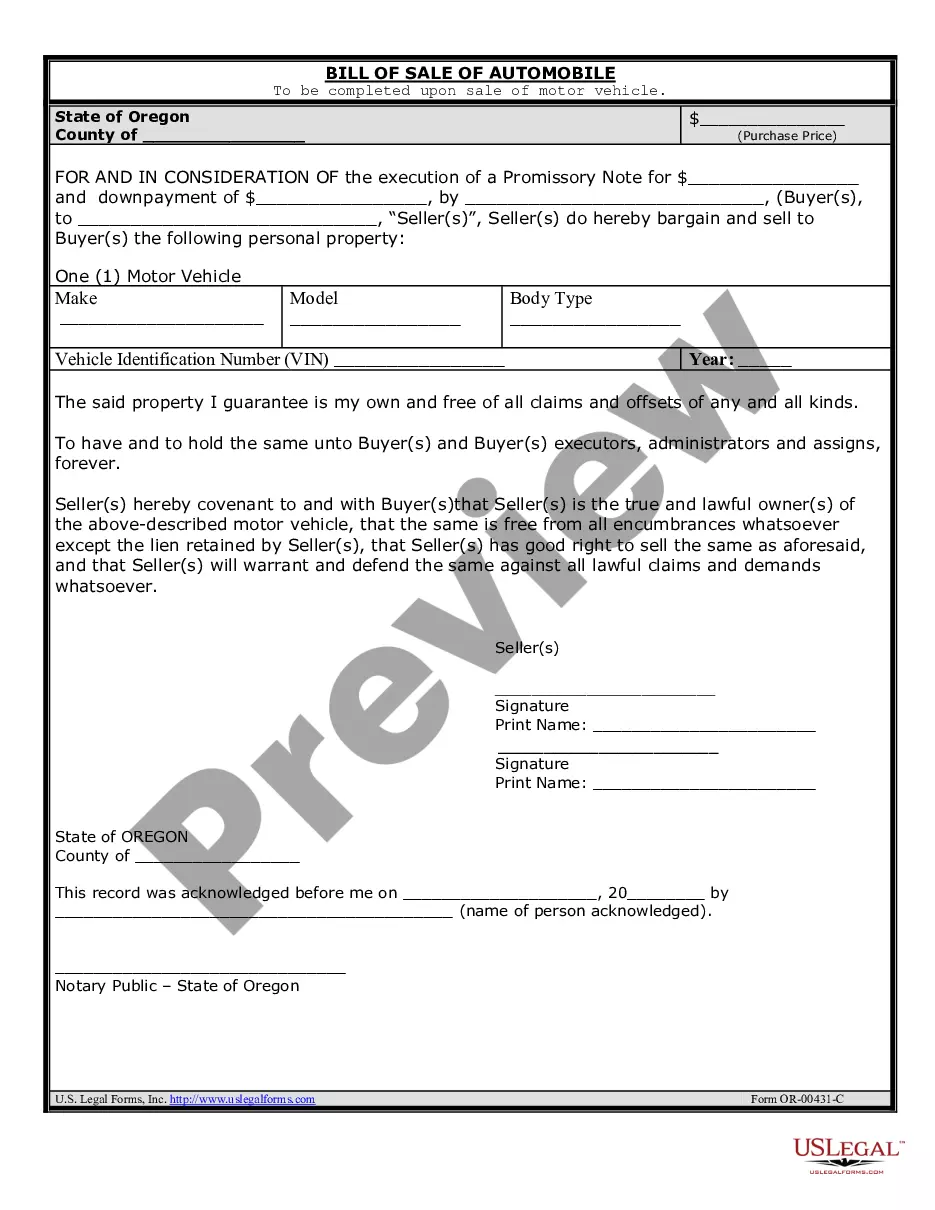

The first step you need to take with a Westpac Deceased Estate Closure Form is to ensure that it is indeed the latest version since it determines its ability for submission.

If you wish to make your search for the most recent document samples easier, look for them on US Legal Forms.

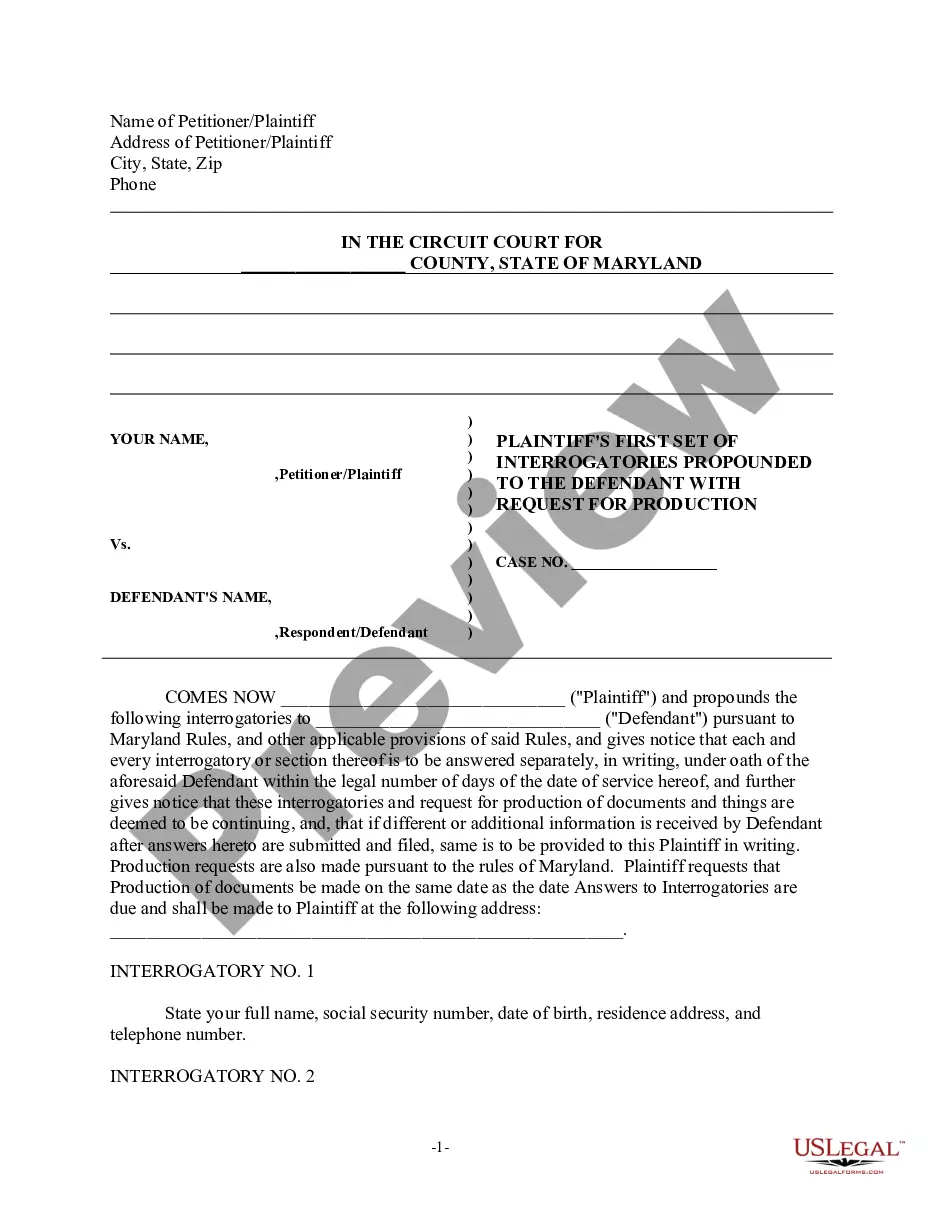

To acquire a form without an account, follow these steps: Use the search feature to locate the form you desire. Review the preview and details of the Westpac Deceased Estate Closure Form to confirm it is indeed the one you seek. After verifying the form, simply click Buy Now. Choose a subscription plan that suits you. Create an account or Log In to your existing one. Use your credit card information or PayPal account to complete the purchase. Choose the file format for download and confirm it. Eliminate confusion when dealing with legal documents; all your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents that includes nearly every document sample you could require.

- Search for the templates you need, assess their relevance immediately, and discover more about their application.

- With US Legal Forms, you have access to approximately 85,000 document templates across various fields.

- Obtain the Westpac Deceased Estate Closure Form samples in just a few clicks and save them at any time in your account.

- Having a US Legal Forms account will facilitate your access to all the samples you need with greater ease and fewer hassles.

- Simply click Log In in the header of the site and navigate to the My documents section, where all the forms you need will be conveniently available.

- You will not have to spend time searching for the appropriate template or verifying its validity.

Form popularity

FAQ

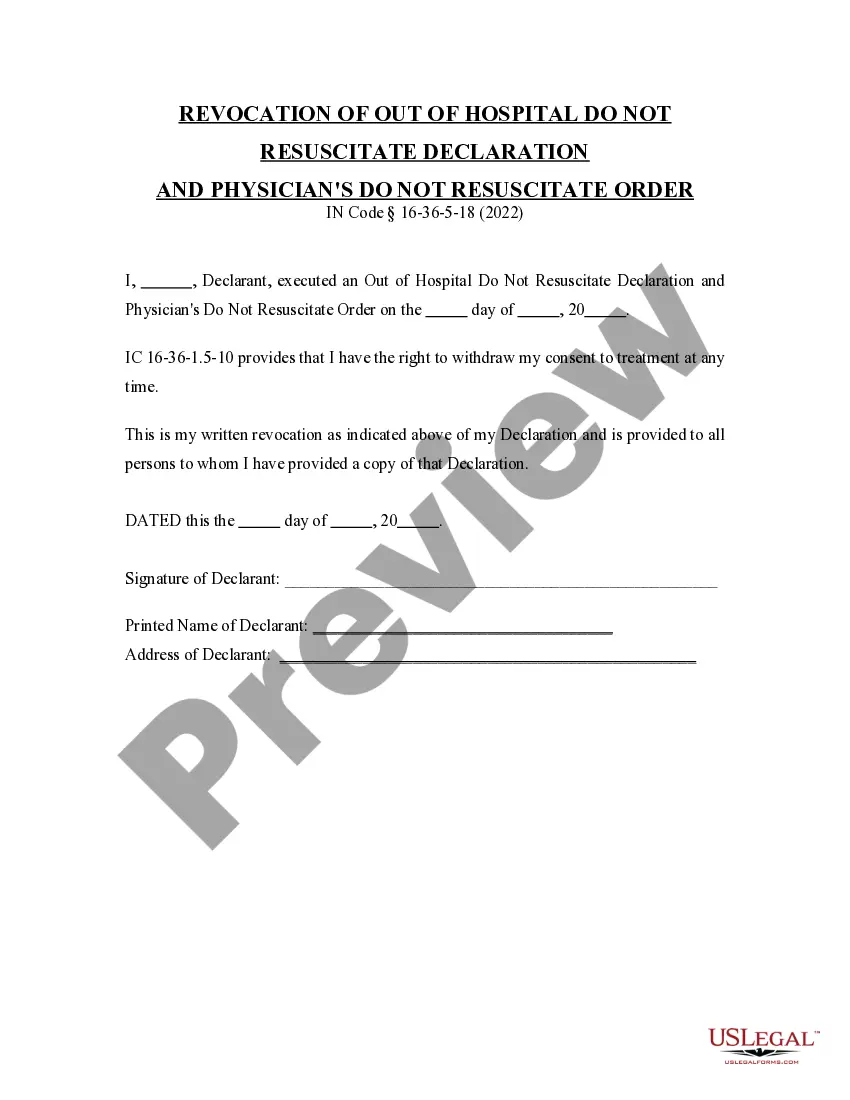

A deceased bank account can remain open for a limited time until all obligations are settled. Typically, accounts should be closed within a reasonable period following the completion of estate settlement activities. To ensure closure, you will need to fill out the Westpac deceased estate closure form accurately.

You can keep an estate account open for as long as necessary to handle debts and manage assets. This period can extend up to several years, depending on the estate's financial situation. To finalize the account, complete the Westpac deceased estate closure form and follow the required legal procedures.

The 3-year rule refers to the general time frame in which a deceased estate must be settled. Beneficiaries often expect distribution within this period, which can include filing tax returns and settling creditors. Be sure to complete the Westpac deceased estate closure form promptly to adhere to this timeline.

An estate account typically remains open until all debts are settled and assets are distributed. Generally, you can keep it open for several months to a few years, depending on the estate's complexity. When preparing to close the account, you'll need to complete the Westpac deceased estate closure form as part of this process.

Closing a deceased estate involves gathering all necessary documents, including the will and any relevant financial information. You will need to notify all beneficiaries and creditors before completing the Westpac deceased estate closure form. It's essential to follow legal procedures to ensure a smooth transition.

To contact Westpac bank regarding deceased estates, you can visit their official website for specific instructions. Alternatively, you can reach their customer service by calling their dedicated hotline for estate matters. They provide guidance on the necessary steps, including how to complete the Westpac deceased estate closure form.

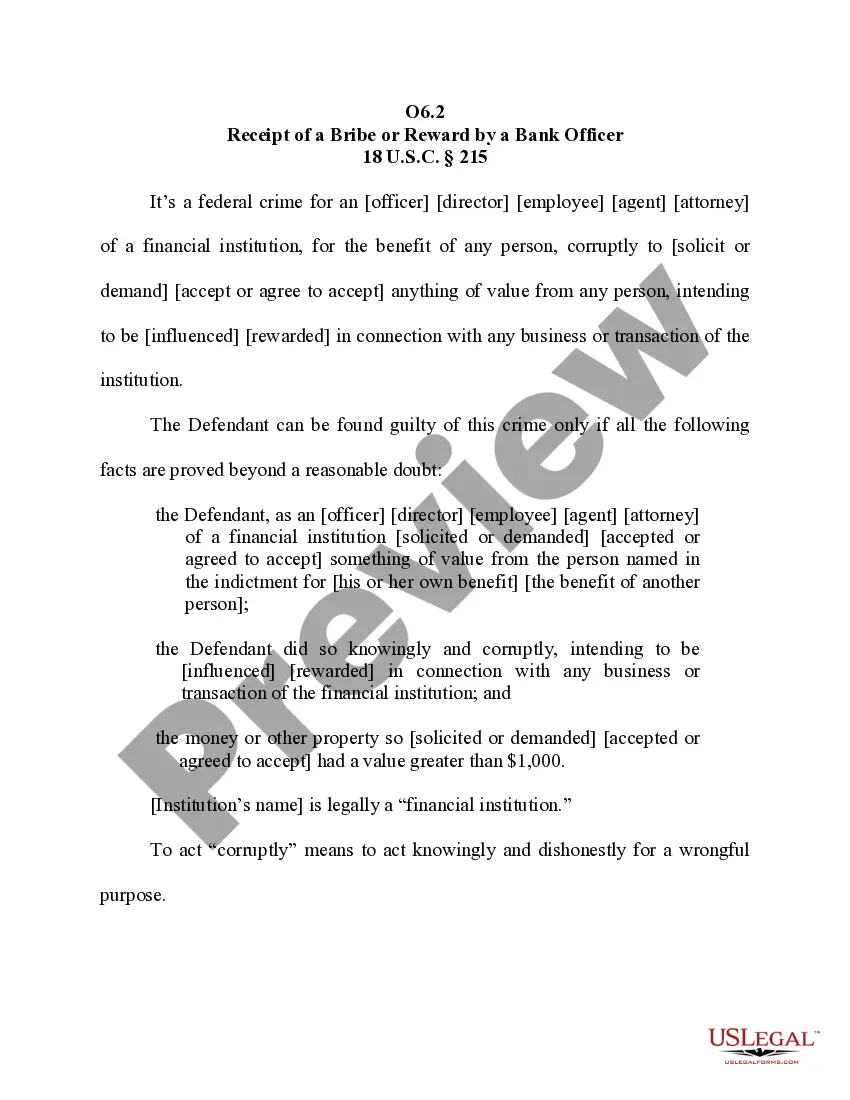

The 3-year rule means that any gifts made within three years before the death of an individual may be subject to estate considerations. Essentially, if the deceased made substantial gifts during this time, it could impact their estate's taxable value. For those managing a Westpac deceased estate, understanding the nuances of this rule can be crucial in preparing the estate for settlement. Consulting a legal expert can aid in clarifying any questions related to this rule.

To close a deceased person's Westpac account, you will need to complete the Westpac deceased estate closure form. This form requires details about the deceased and the account, along with relevant documentation such as the death certificate and proof of your role as an executor or administrator. Ensuring that all required documents are submitted accurately will facilitate a smooth account closure process and help manage the estate efficiently.

The 3-year rule applies to gifts made within three years prior to a person's death. This rule is particularly relevant to the tax implications for the deceased estate. If you are handling a Westpac deceased estate, it’s important to be aware of any gifts made during this period, as they may affect the overall settlement. Consulting with a financial advisor can help you navigate the complexities of this rule.

Typically, you have up to 12 months to settle a deceased estate, although this period may vary based on specific circumstances. If complications arise, such as disputes among beneficiaries, it may take longer to finalize everything. Timely submission of the Westpac deceased estate closure form is essential in ensuring that financial accounts are resolved without unnecessary delays. It’s always best to start as soon as possible to maintain clarity and avoid stress.