Interest Exemption For Non-residents

Description

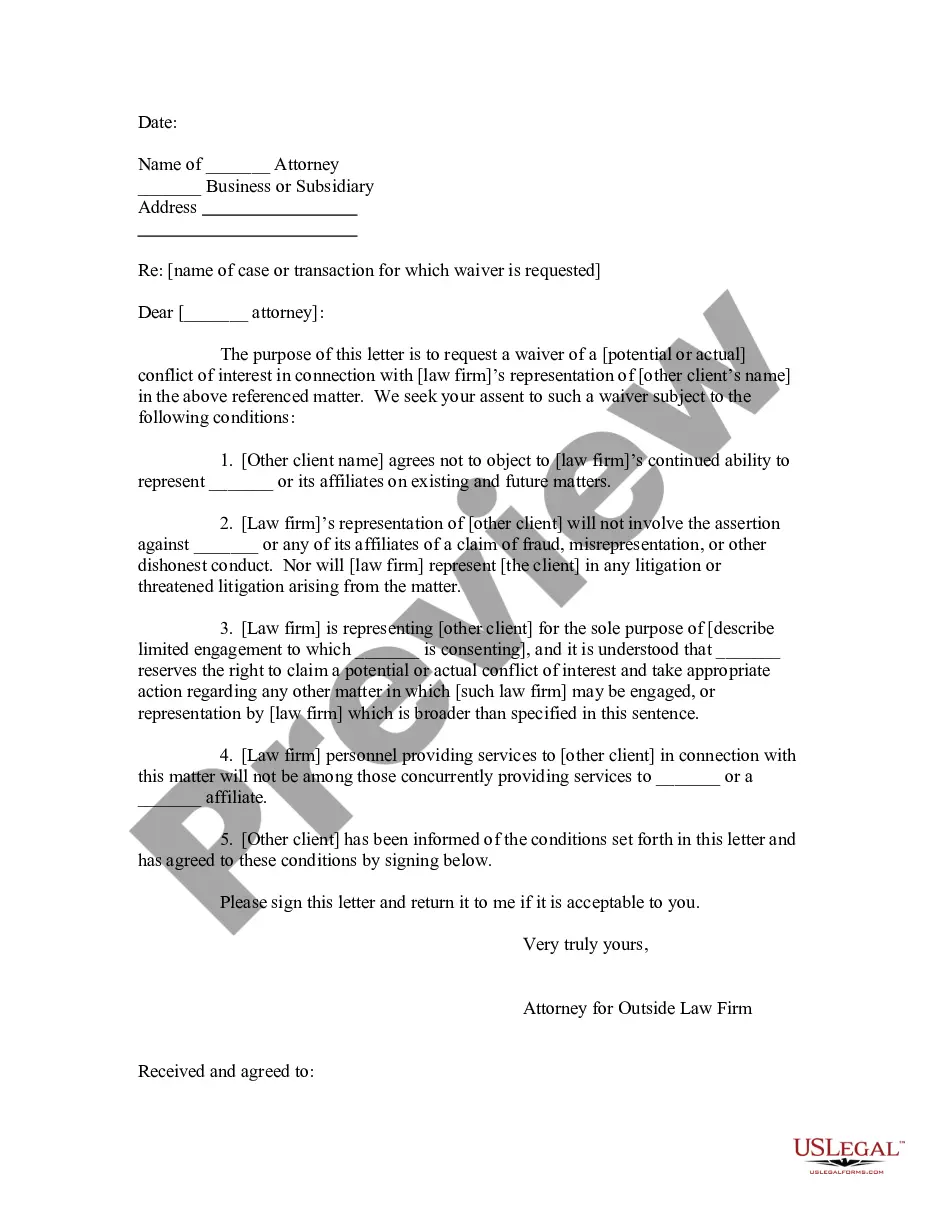

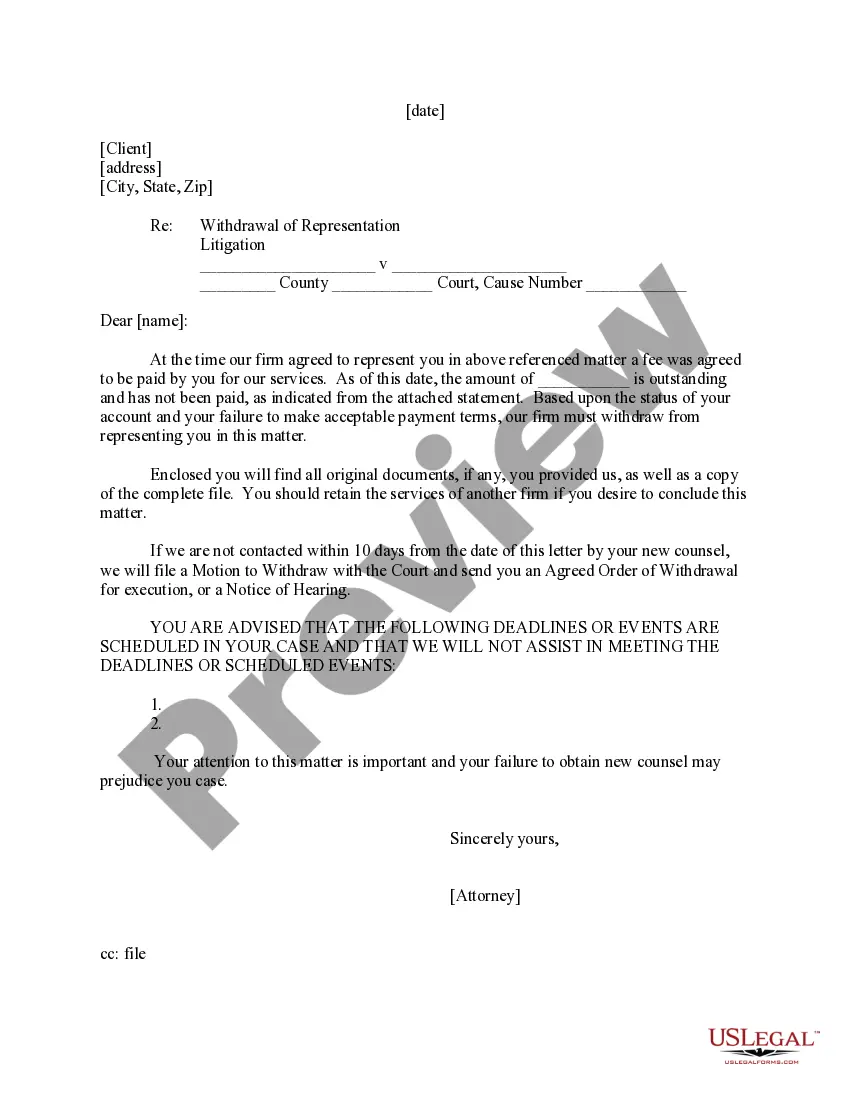

How to fill out Sample Attorney Conflict Of Interest Waiver Letter?

Managing legal paperwork can be daunting, even for the most experienced professionals.

When you seek an Interest Exemption for Non-residents and do not have the opportunity to search for the right and current version, the processes can be stressful.

Gain access to a valuable repository of articles, guides, and manuals related to your situation and needs.

Save time and effort finding the documents you require and use US Legal Forms' sophisticated search and Review feature to find your Interest Exemption for Non-residents and download it.

Leverage the US Legal Forms online library, supported by 25 years of expertise and dependability. Revolutionize your everyday document management into a seamless and user-friendly experience today.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents section to see the documents you have saved and to organize your folders as you wish.

- If this is your first experience with US Legal Forms, create an account to gain unlimited access to all resources of the library.

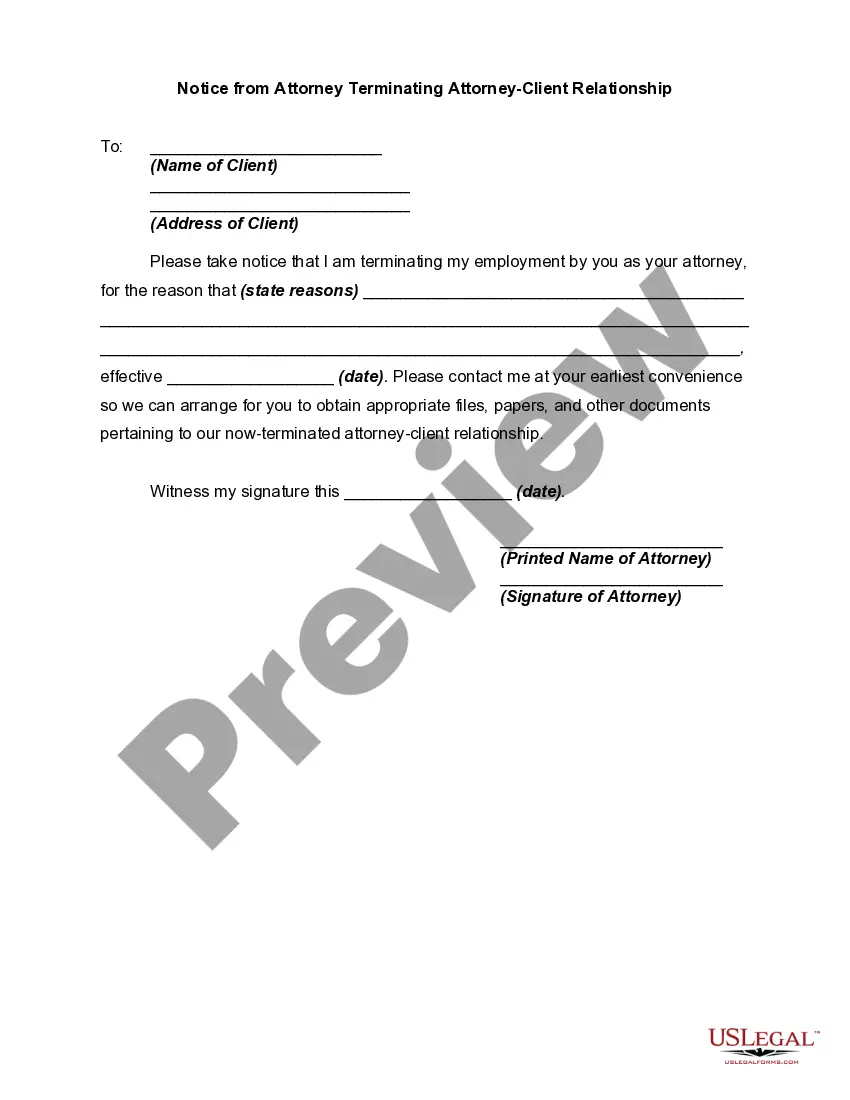

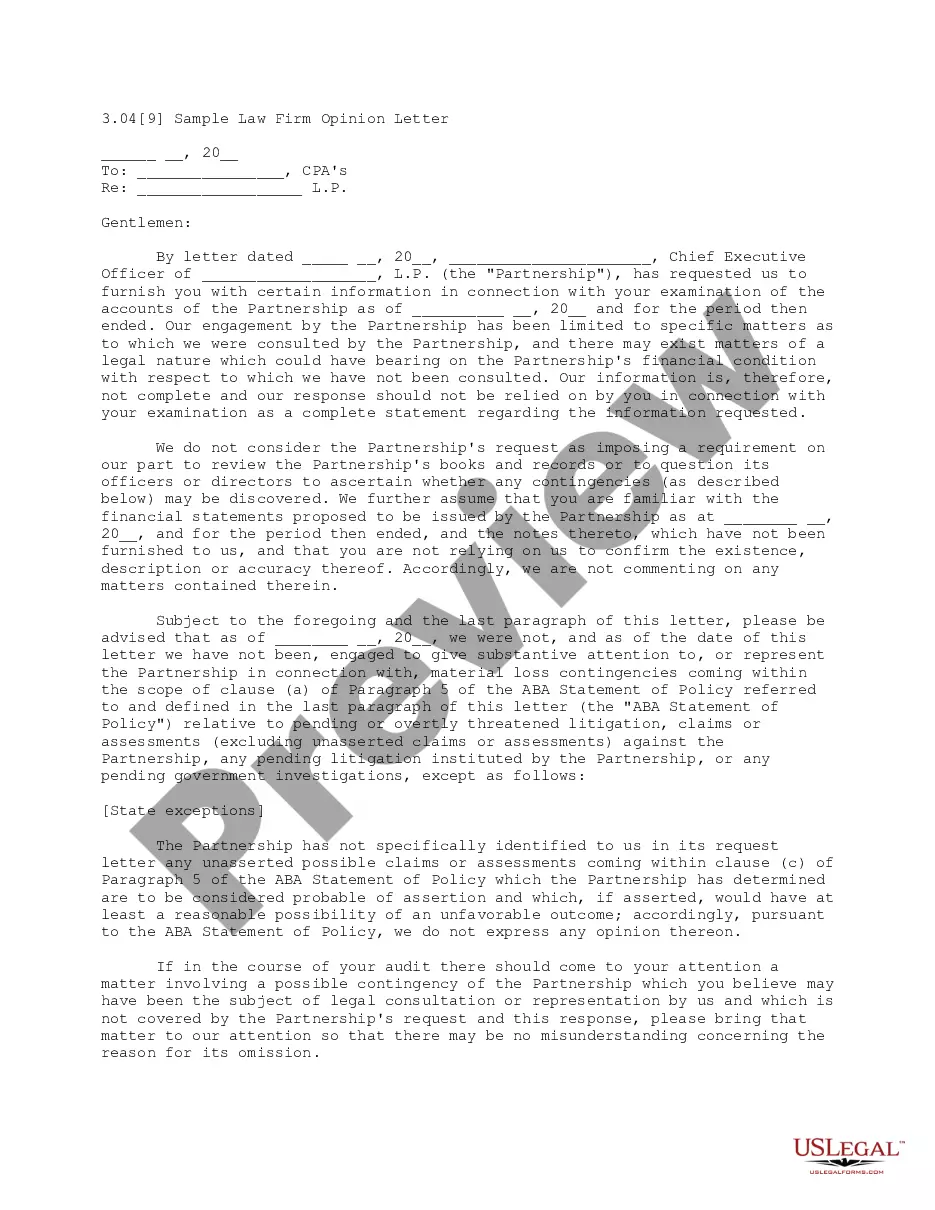

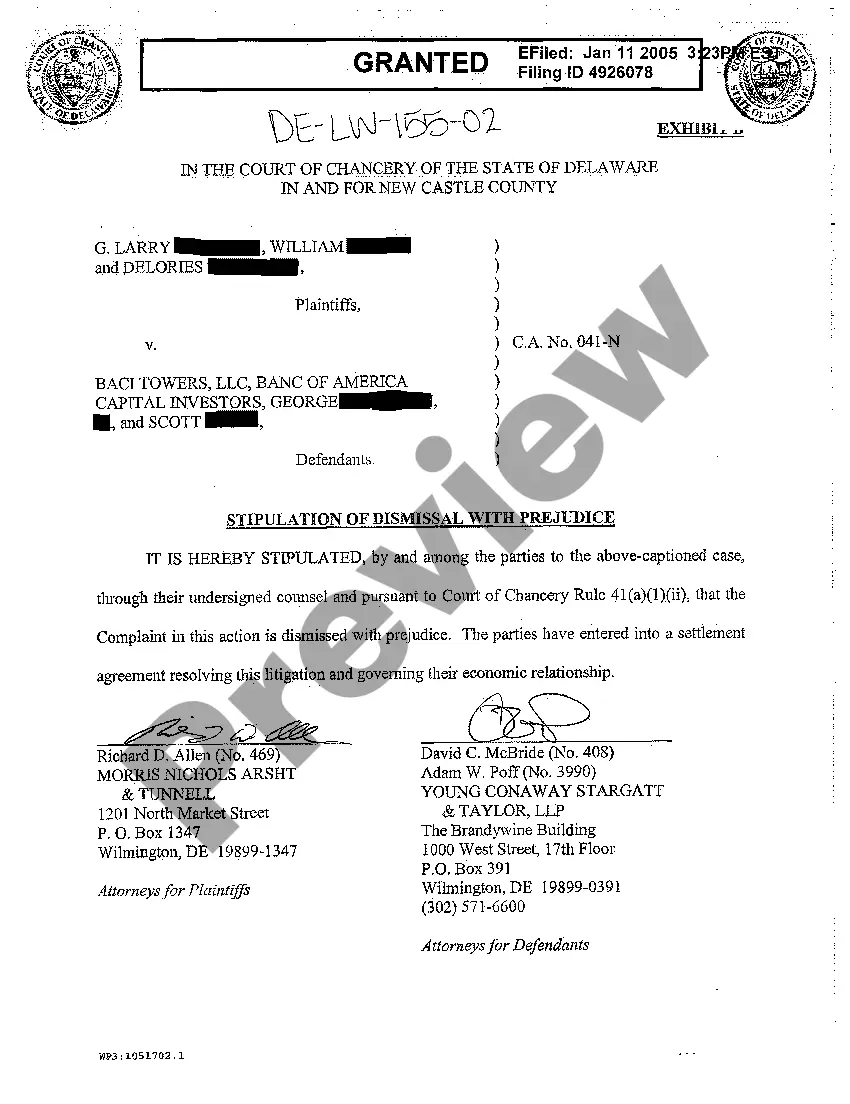

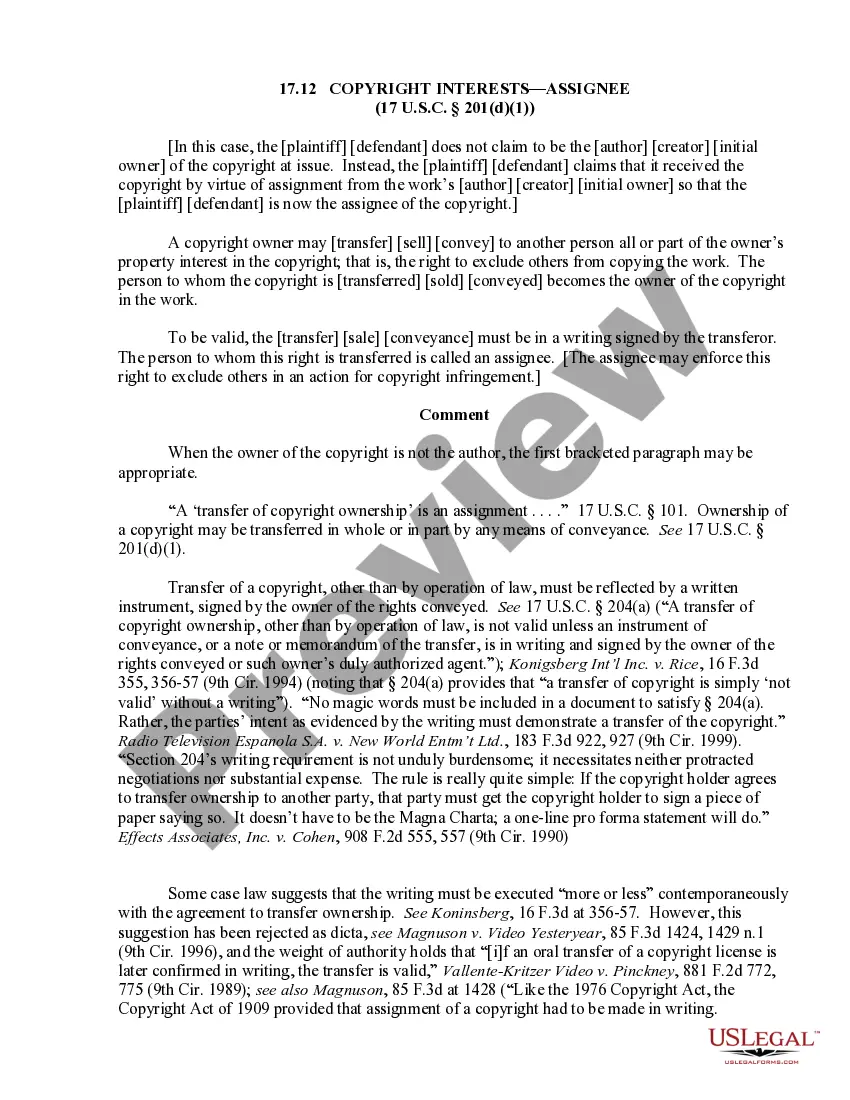

- After downloading the required form, confirm it is the correct version by previewing and reviewing its details.

- Verify that the form is authorized in your state or county.

- Click Buy Now when you are prepared.

- Select a monthly subscription option.

- Choose the format you would like, and Download, fill out, eSign, print, and dispatch your document.

- Access state- or county-specific legal and business documents.

- US Legal Forms meets any requirements you may have, whether personal or professional, all in one location.

- Utilize advanced tools to complete and handle your Interest Exemption for Non-residents.

Form popularity

FAQ

Internal Revenue Code § 121 provides taxpayers with an income tax exclusion from the gain of taxpayer selling a primary residence. The exclusion amount for a single up to $250,000 and married couples will raise to $500,000.

The basic exemption of Rs 3 lakh and Rs 5 lakh is available only for resident senior citizens and resident super senior citizens in the old tax regime. Hence, as an NRI, even if you are a senior citizen, when your income in India exceeds Rs 2.5 lakh, you will be liable to file your return of income in India.

Nonresident aliens who receive interest income from deposits with a U.S. bank, savings & loan institution, credit union, or insurance company, or who receive portfolio interest are exempt from taxation on such interest income as long as such interest income is not effectively connected with a United States trade or ...

Nonresident aliens are generally subject to U.S. income tax only on their U.S. source income. They are subject to two different tax rates, one for effectively connected income, and one for fixed or determinable, annual, or periodic (FDAP) income that is non-effectively connected income.

Home mortgage interest is not deductible by a nonresident; however, interest related to debt to finance a U.S. rental property is generally fully deductible.