Right Inheritance Wife Forum

Description

How to fill out Agreement Waiving Right Of Inheritance Between Husband And Wife In Favor Of Children By Prior Marriages?

It’s well-known that becoming a legal authority overnight is impossible, nor can you swiftly master how to prepare the Right Inheritance Wife Forum without possessing a distinct set of expertise.

Creating legal documents is a lengthy process that demands specialized education and abilities. Therefore, why not entrust the development of the Right Inheritance Wife Forum to the experts.

With US Legal Forms, one of the most comprehensive legal template collections, you can obtain everything from legal court documents to forms for in-office correspondence.

You can regain access to your documents from the My documents section at any time. If you’re already a client, you can simply Log In and find and download the template from the same section.

Regardless of the aim of your documents—whether they are financial, legal, or personal—our website has you covered. Experience US Legal Forms today!

- Locate the document you require using the search bar at the page's top.

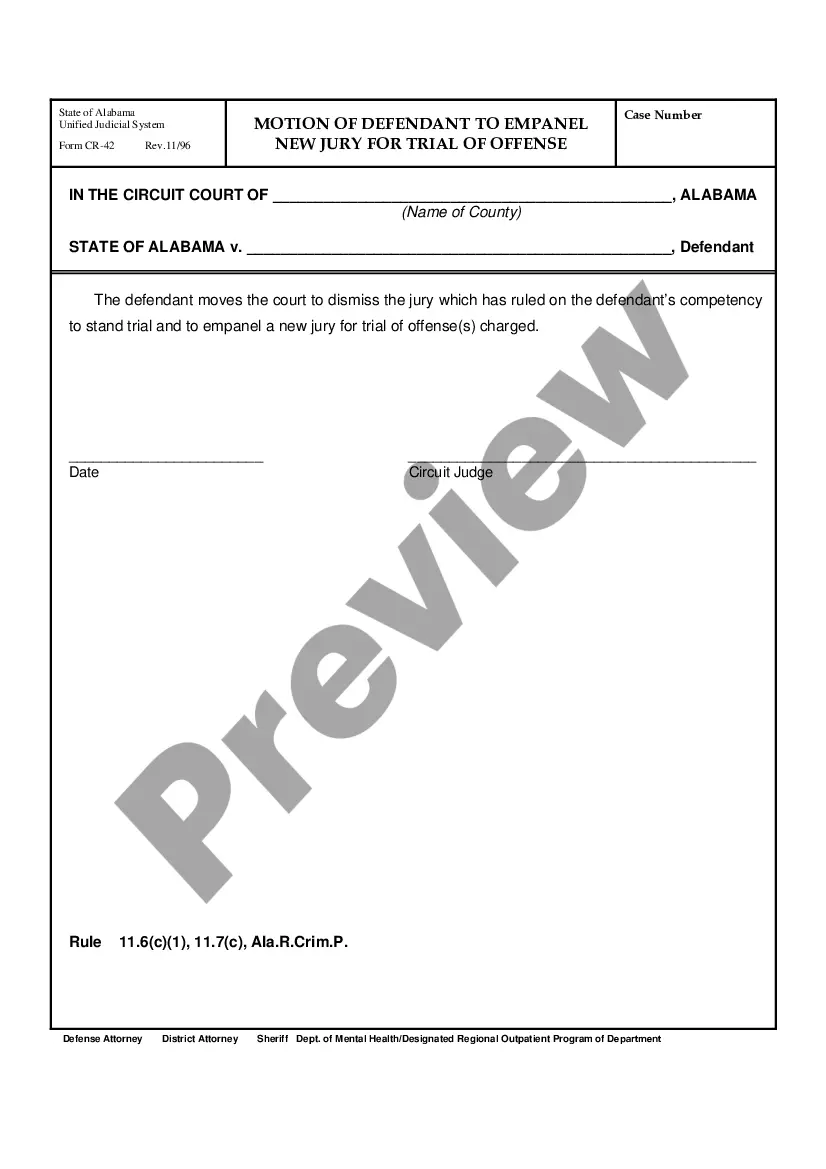

- Preview it (if this feature is available) and review the accompanying description to determine if the Right Inheritance Wife Forum meets your needs.

- Begin your search anew if you require an alternative template.

- Sign up for a complimentary account and select a subscription plan to acquire the template.

- Click Buy now. After the payment is completed, you can download the Right Inheritance Wife Forum, complete it, print it, and send it to the required individuals or organizations.

Form popularity

FAQ

This is regardless of whether you receive your inheritance before, during or after a marriage, and it's even true if you live in a community property state. As long as you keep your inheritance as legally separate property, you won't ever be required to share it with your spouse, even if you end up divorcing.

How Can I Protect My Inheritance During Marriage? A pre- or post-nuptial agreement can record which assets are matrimonial or non-matrimonial. ... If you are due to inherit ? keep your inheritance separate to the marriage and do not use it for the benefit of the marriage; or. Consider placing the inheritance into a trust.

In most cases, a person who receives an inheritance is under no obligations to share it with his or her spouse. However, there are some instances in which the inheritance must be shared. Primarily, the inheritance must be kept separate from the couple's shared bank accounts.

If you receive your inheritance after you get married, you can protect it with a postnuptial agreement. A postnuptial agreement is an agreement you make about what will happen in the event of a divorce.

In most states, an inheritance is considered separate property, whether you receive an inheritance before, during or after your marriage. Your spouse is not entitled to use or spend your separate property.