Trust Agreement Form With A Trust

Description

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

- Start by visiting the US Legal Forms website and log in to your account if you're a returning user. Ensure your subscription is valid to access the form library.

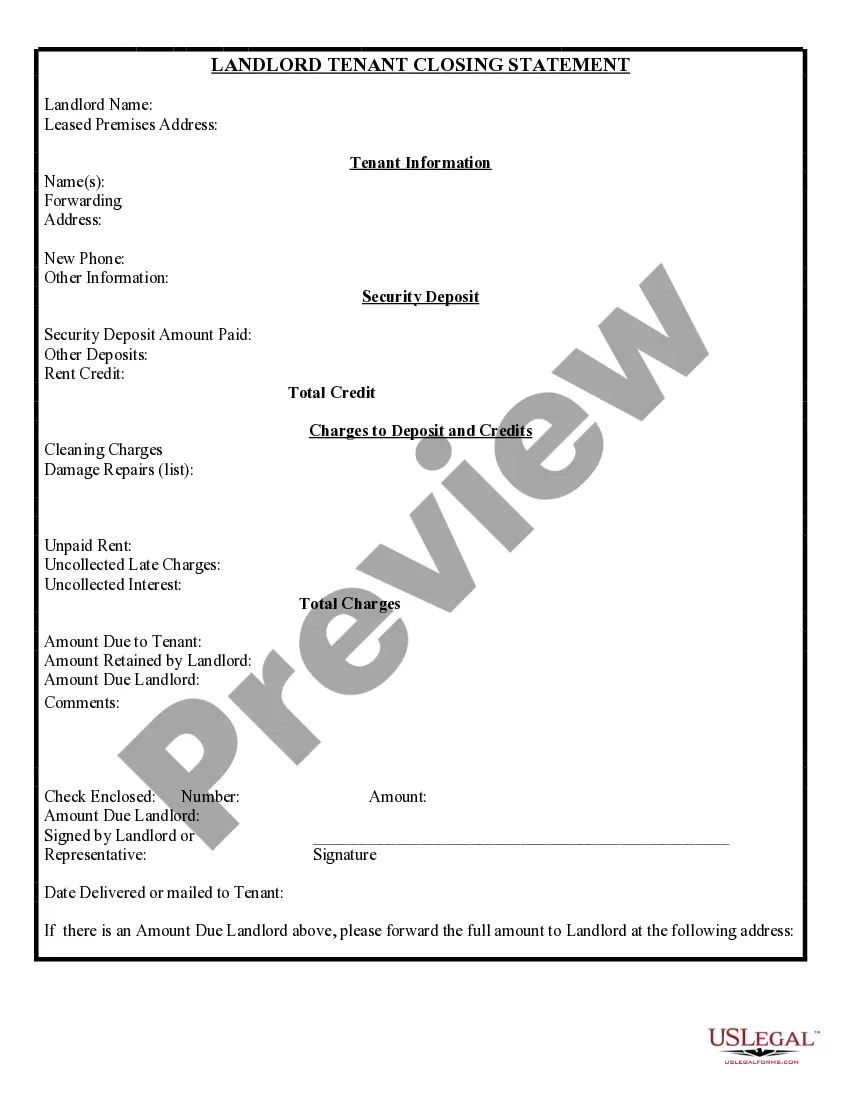

- If you're new to US Legal Forms, begin by checking the Preview mode and form description to choose the correct trust agreement form that meets your local jurisdiction requirements.

- If needed, use the Search tab to explore alternative templates. Finding the right form is essential for compliance with legal standards.

- Select the form by clicking the Buy Now button. Choose a subscription plan that fits your needs and create an account to access the collection.

- Complete your purchase using credit card or PayPal, ensuring you secure your subscription for future access.

- Once the transaction is complete, download your trust agreement form with a trust directly to your device for easy completion.

Finalizing a trust agreement doesn’t have to be overwhelming. By following these steps with US Legal Forms, you can efficiently secure the necessary documentation with the support of legal experts if needed.

Take control of your legal needs today and explore the vast library at US Legal Forms for an effective experience!

Form popularity

FAQ

Deciding whether to put bank accounts in a trust agreement form with a trust requires consideration of several factors. On one hand, transferring your bank accounts into a trust can protect your assets from probate and offer privacy. On the other hand, you should consider the logistics and access to funds. Consulting with a professional can help clarify the best path for your financial situation.

Certain assets typically do not go into a trust agreement form with a trust. For instance, life insurance policies often remain outside trusts unless specifically designed to be included. Moreover, some jointly held properties can lead to issues if placed in a trust, as they may need to be retitled. It's important to evaluate each asset's implications carefully.

Some assets are generally not recommended for inclusion in a trust agreement form with a trust. Common examples include retirement accounts, like 401(k)s or IRAs, since they can lose tax benefits. Additionally, personal property that may require frequent transactions can lead to complications in management. Ensuring you know what to include and exclude is vital for effective asset management.

When you use a trust agreement form with a trust, you may face certain risks. One concern is losing control over your assets, as the trustee manages them on your behalf. Additionally, if the trust is improperly structured, it could lead to unexpected tax liabilities. It's essential to consult with legal professionals to mitigate these risks.

You can obtain a trust amendment form through various legal resources, including online platforms. US Legal Forms offers a comprehensive solution where you can find a suitable trust amendment form to modify your existing trust agreement. By using a trustworthy provider, you ensure your changes are legally compliant and documented correctly. This gives you peace of mind while managing your trust effectively.

To obtain proof of a trust, you typically need to request a copy of the trust agreement from the trustee. This document will demonstrate the existence of the trust and outline its terms. Additionally, you can use tools provided by platforms like US Legal Forms to create and store your trust agreement form with a trust, ensuring easy access to proof when required. Keeping this information organized can simplify accessing your trust details when necessary.

Yes, a trust agreement typically supersedes a will in terms of asset distribution. When you establish a trust, the assets placed within the trust are governed by the terms outlined in the trust agreement. This means that the provisions in your trust will take precedence over the instructions in your will regarding those assets. To ensure clarity and alignment in estate planning, utilizing a trust agreement form with a trust is essential.

A declaration of trust is not exactly the same as a trust agreement. While both documents serve similar purposes in defining how assets are handled in a trust, a declaration of trust often serves as a public record of the trust's existence. In contrast, a trust agreement lays out the specific terms and conditions for managing and distributing the assets in a trust. When establishing a trust, using a trust agreement form with a trust ensures all details are clearly outlined and legally recognized.

A trust agreement document is a legal paper that establishes the terms of a trust. It details how assets will be managed, who the beneficiaries are, and the duties of the trustee. By using a trust agreement form with a trust from platforms like US Legal Forms, you can ensure that your document is comprehensive and legally sound.

The agreement to hold in a trust specifies the terms under which the trust assets are managed. It outlines the responsibilities of the trustee and the rights of the beneficiaries. This agreement is crucial for establishing trust and affording protection to all parties involved, making the trust agreement form with a trust an essential component.