Special Trust Disabled Complete For This

Description

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

- If you're a returning user, log in to your account and download the desired form template by clicking the Download button. Ensure your subscription is active; if not, renew it according to your payment plan.

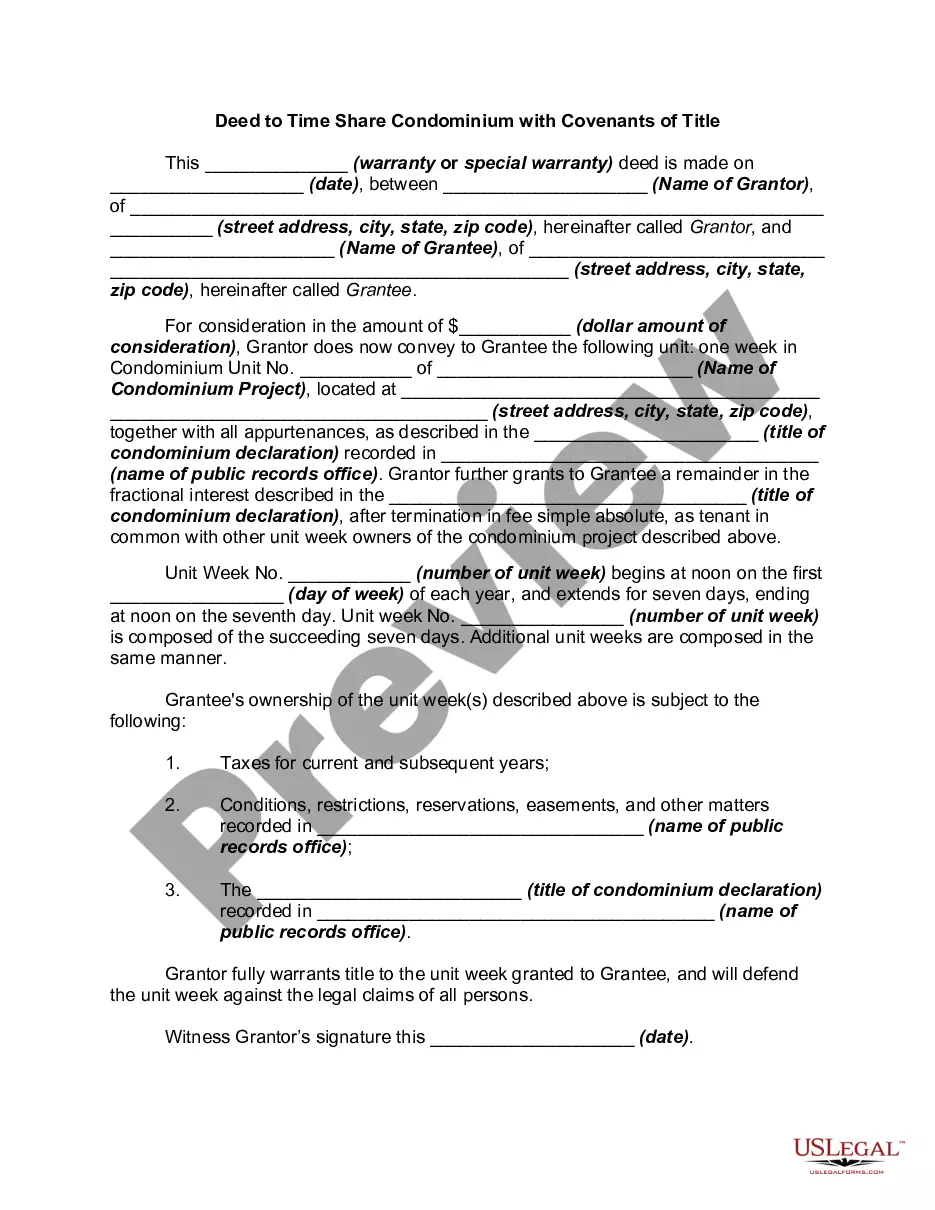

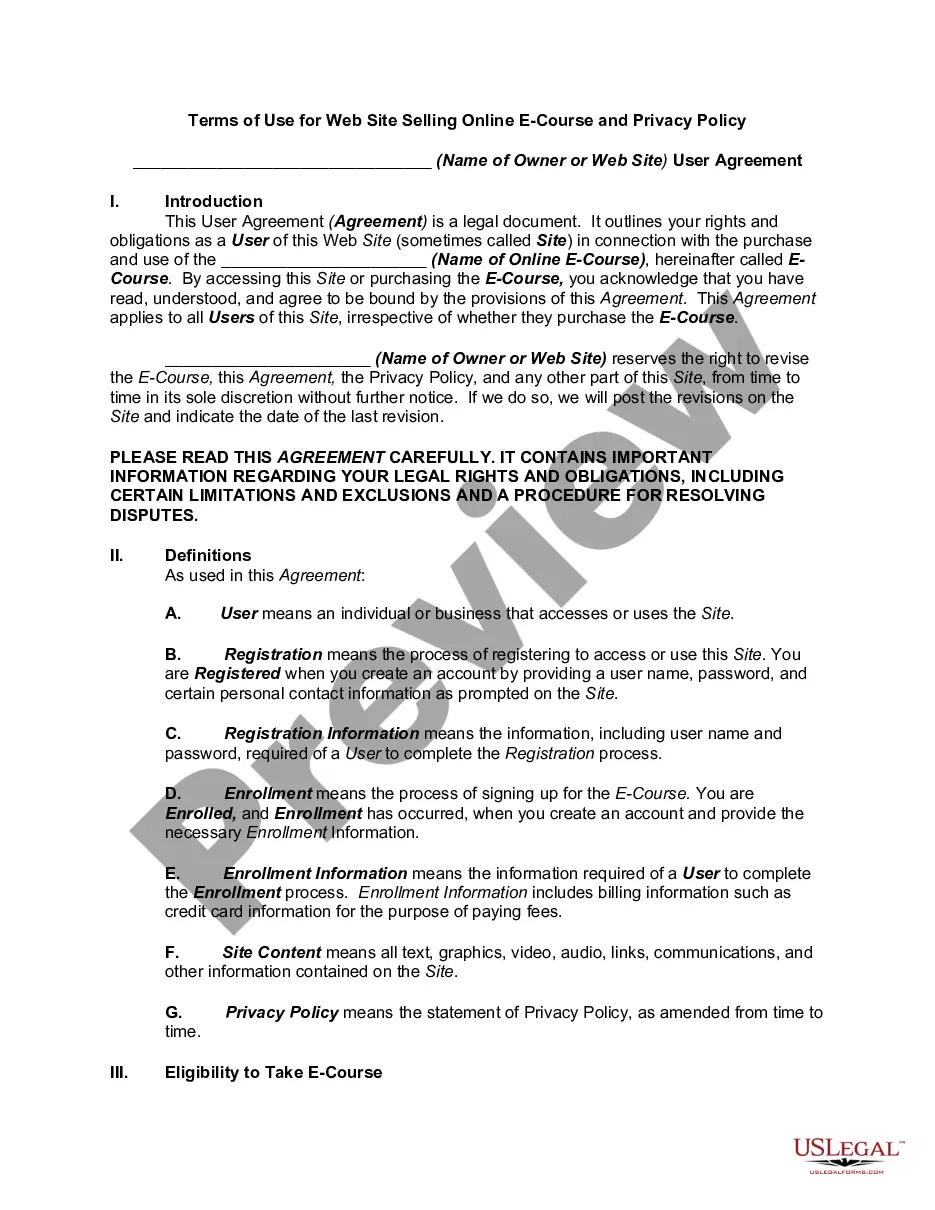

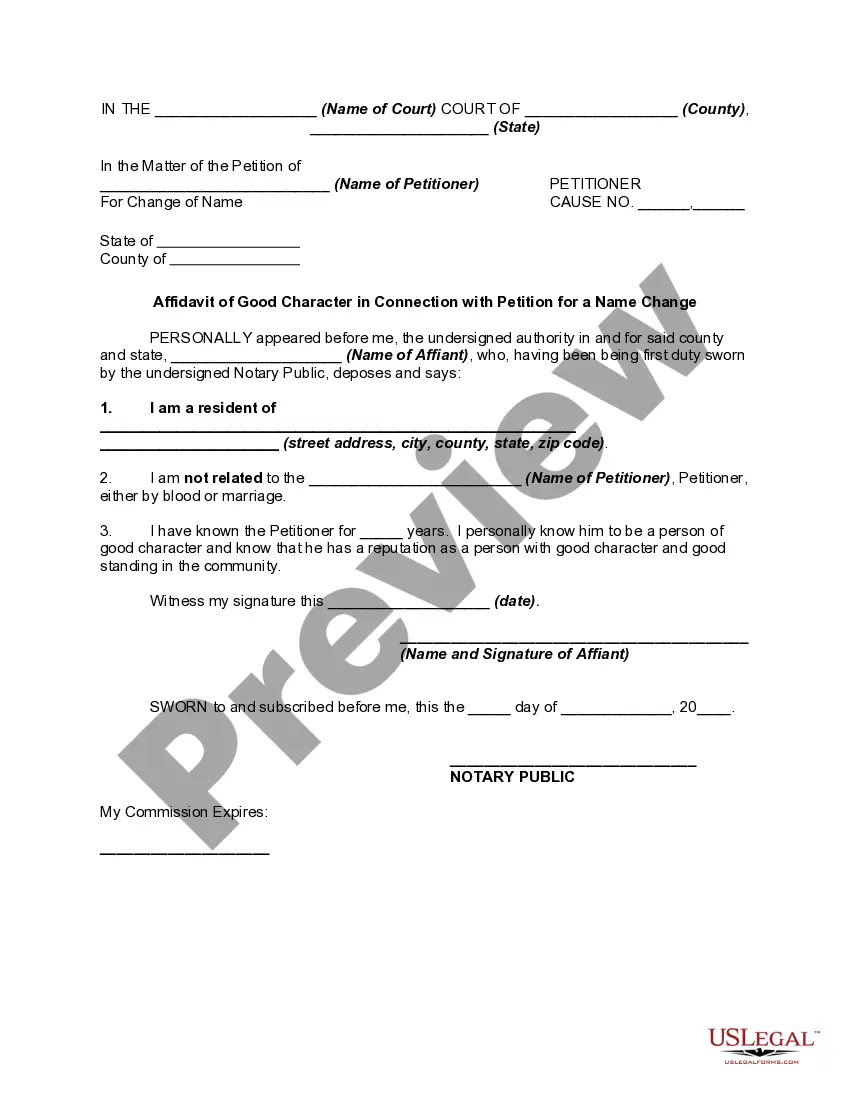

- For first-time users, start by exploring the Preview mode and reading the form description to confirm it meets your requirements and complies with local jurisdiction.

- If you notice any discrepancies or need a different template, utilize the Search tab to find a suitable form.

- To purchase the document, click on the Buy Now button and select your preferred subscription plan. You'll need to create an account to access the document library.

- Finish your purchase by providing your credit card information or using your PayPal account to secure your subscription.

- Finally, download the chosen form and save it to your device. You can access it anytime through the My Forms section in your profile.

US Legal Forms not only offers a wide array of documents but also empowers users with the ability to connect with premium experts for assistance, ensuring every document is accurate and legally valid.

Unlock the potential of hassle-free legal documentation by starting your journey with US Legal Forms today!

Form popularity

FAQ

The best place for a person on disability to live often depends on their individual needs and circumstances. Many find supportive housing with access to essential services ensuring they remain independent. A special trust disabled complete for this can provide financial security to afford such housing while maintaining necessary resources.

While a special needs trust offers significant advantages, there are some disadvantages worth considering. For instance, funds in the trust cannot be used for specific expenses without affecting benefits. Understanding how a special trust disabled complete for this functions can help avoid pitfalls and maximize its benefits.

To qualify for a qualified disability trust, you must meet specific criteria that typically include having a disability and being under age 65 at the time the trust is created. The trust must also comply with IRS regulations, which can be complex. A special trust disabled complete for this can assist you in navigating these rules effectively.

Setting up a trust for a disabled person requires careful planning and documentation. Start by deciding on the trust type, often leaning towards a special needs trust to protect eligibility for assistance programs. Engaging with a legal expert can clarify your options, and USLegalForms offers templates that streamline creating a special trust disabled complete for this.

Filling out a trust fund involves completing several essential forms that outline the details of the trust. You will need to provide information about the trust creator, the beneficiaries, and the terms of the trust. For a special trust disabled complete for this, using a reliable platform like USLegalForms can simplify the process and ensure all legal requirements are met.

The best trust for a disabled person is often a special needs trust. This trust allows the individual to maintain their eligibility for government benefits while still having assets and funds for additional support. A special trust disabled complete for this purpose ensures that resources are managed wisely, without jeopardizing their vital services.

Eligibility for a disability trust typically includes individuals who have a confirmed disability that affects their ability to manage personal affairs. This may encompass those receiving government benefits or individuals who require assistance in daily living. Each state may have specific criteria, so it is important to review those details closely. To make this process seamless, consider using uslegalforms to determine qualification and navigate the requirements.

The timeline for establishing a special needs trust varies depending on several factors, including legal complexities and documentation. Generally, once you gather the necessary information, the process could take a few weeks to a few months. It's crucial to work with professionals who specialize in disability trusts to ensure you complete the process timely. A comprehensive approach will help create a special trust disabled complete for your needs.

To establish a disability trust, you typically need to provide documentation of the beneficiary's disability. The trust must serve the specific purpose of providing for the disabled individual without jeopardizing their eligibility for government assistance. Additionally, you may need to outline the trust's provisions clearly to comply with legal standards. Utilizing platforms like uslegalforms can guide you through these requirements effectively.

One downside of a special needs trust is the potential complexity involved in setting it up. If not structured properly, it may limit the disabled individual’s access to certain government benefits. Additionally, managing the trust can entail ongoing administrative responsibilities and costs. It’s essential to consult with a legal expert to ensure that the special trust disabled complete for this scenario functions as intended.