Special Needs Trust Planning For Medicaid

Description

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

Obtaining legal document examples that comply with federal and local regulations is essential, and the internet provides numerous alternatives to select from.

However, what is the purpose of spending time searching for the appropriately drafted Special Needs Trust Planning For Medicaid example online if the US Legal Forms digital library already consolidates such templates in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by attorneys for any professional and personal circumstance. They are easy to navigate with all documents categorized by state and intended use. Our specialists stay informed about legislative updates, ensuring your documents are current and compliant when obtaining a Special Needs Trust Planning For Medicaid from our platform.

Click Buy Now when you’ve found the right form and choose a subscription plan. Create an account or Log In and process payment via PayPal or a credit card. Choose the optimal format for your Special Needs Trust Planning For Medicaid and download it. All documents you find through US Legal Forms are reusable. To re-download and complete previously saved forms, access the My documents tab in your account. Take advantage of the most comprehensive and user-friendly legal document service!

- Acquiring a Special Needs Trust Planning For Medicaid is quick and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you need in the appropriate format.

- If you are visiting our site for the first time, follow these steps.

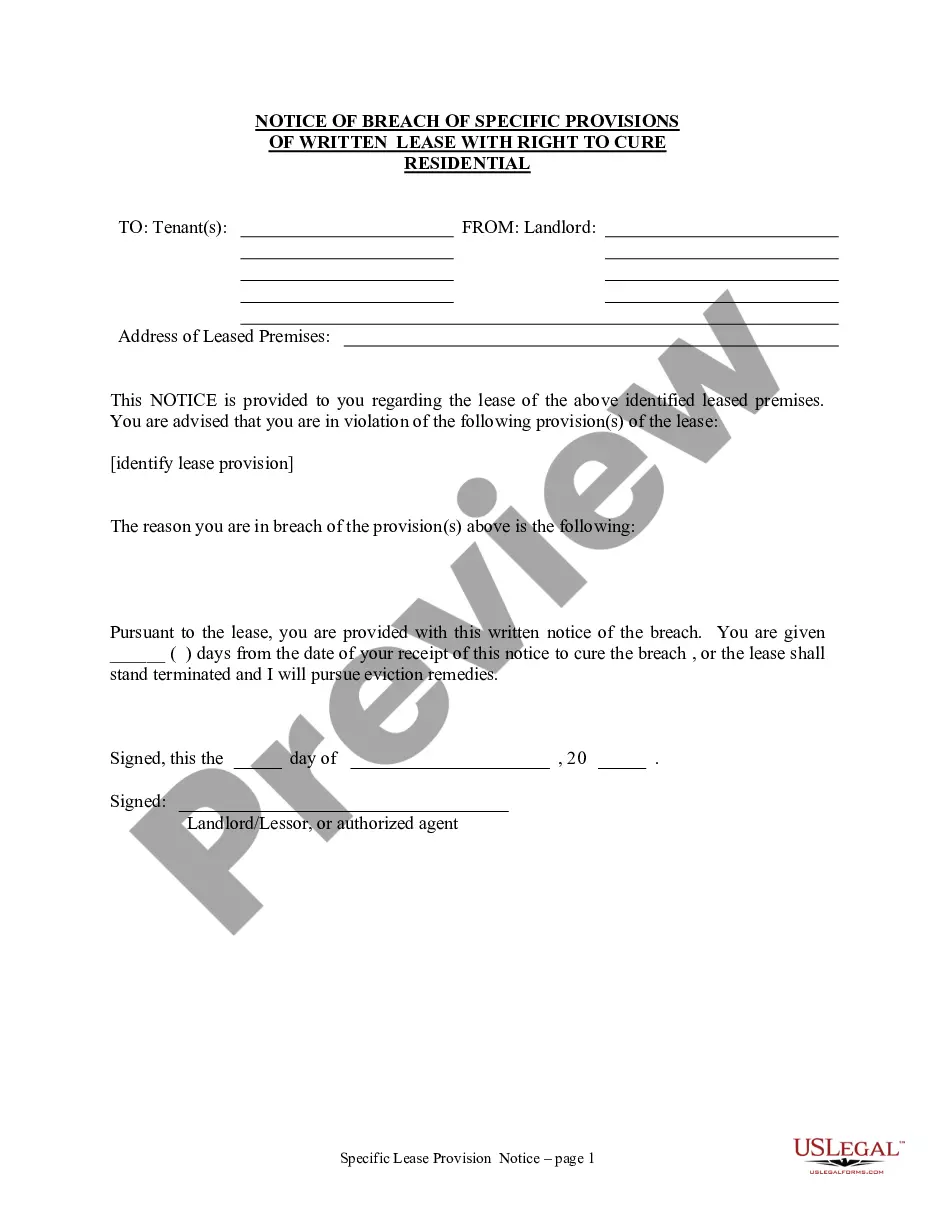

- Review the template using the Preview feature or through the text outline to ensure it suits your requirements.

- Search for another template using the search function at the top of the page if needed.

Form popularity

FAQ

Different names for first-party special needs trusts you may hear include: Payback special needs trust. Litigation special needs trust. Miller trust. (d)(4)(A) SNT. (d)(4)(C) SNT.

The trustee works in very close contact with the beneficiary and/or their caregiver to manage the trust and its financial distributions to pay for these things. The main takeaway regarding distribution of SNT funds is this: The beneficiary never sees the money directly, but the money is used to pay for their needs.

Typically, a third party special needs trust is set up by the family of the disabled person. The family then gifts money to the trust, rather than the disabled person, so the gifts do not interfere with the disabled persons Supplemental Security Income (SSI), Medicaid, vocational rehabilitation, and subsidized housing.

What are the main benefits of an SDT? The asset value limit of $781,250 (indexed annually on 1 July) and income from the trust may be disregarded for the purposes of the principal beneficiary's income support payment. Assets above that limit are added to the assessable assets of the principal beneficiary.

Cons of Special Needs Trusts The trust must be maintained, and yearly management costs can be high. Depending on who manages the fund, there may be a minimum amount required to set up the trust. It may be financially difficult for the settlor to actually establish the trust, depending upon their circumstances.