Special Needs Trust Irrevocable For A Given Period

Description

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

Drafting legal documents from scratch can sometimes be a little overwhelming. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for a simpler and more affordable way of creating Special Needs Trust Irrevocable For A Given Period or any other documents without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual catalog of more than 85,000 up-to-date legal documents covers virtually every element of your financial, legal, and personal matters. With just a few clicks, you can instantly access state- and county-specific forms diligently put together for you by our legal experts.

Use our platform whenever you need a trustworthy and reliable services through which you can quickly locate and download the Special Needs Trust Irrevocable For A Given Period. If you’re not new to our services and have previously created an account with us, simply log in to your account, locate the form and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No worries. It takes little to no time to set it up and navigate the catalog. But before jumping straight to downloading Special Needs Trust Irrevocable For A Given Period, follow these tips:

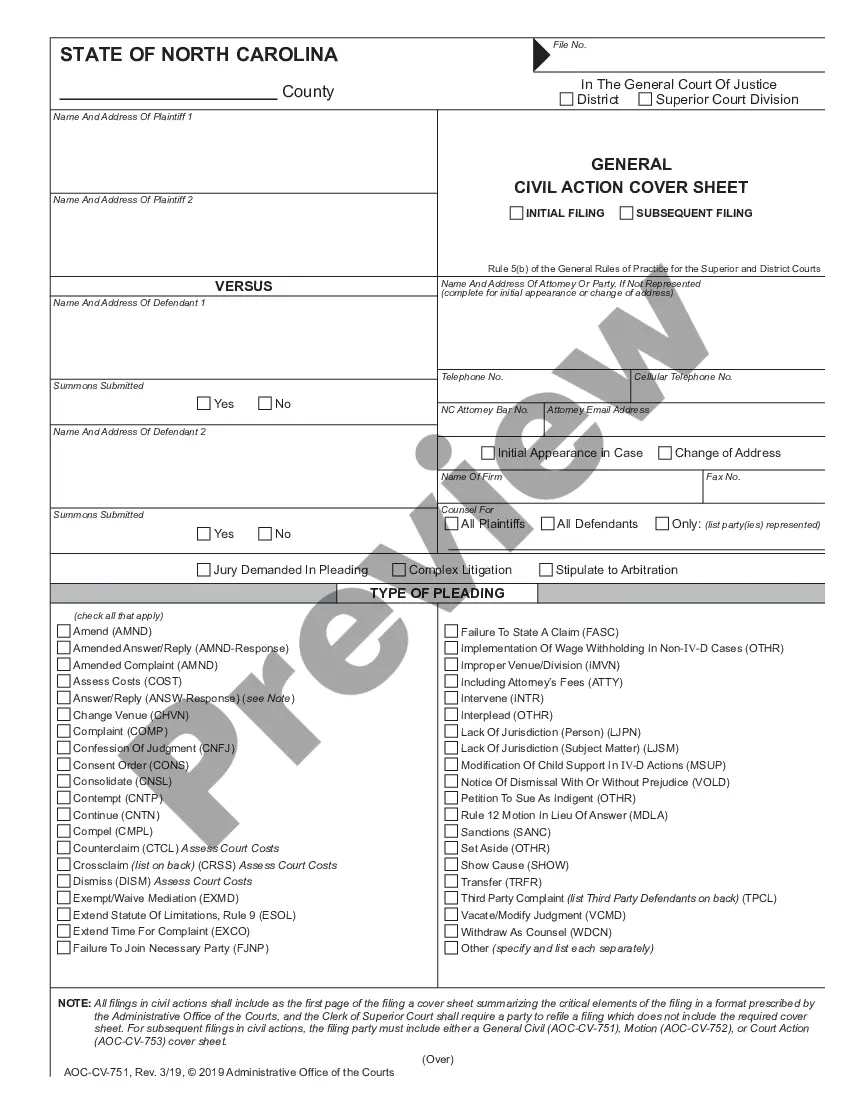

- Check the form preview and descriptions to make sure you have found the document you are looking for.

- Make sure the template you select complies with the regulations and laws of your state and county.

- Pick the best-suited subscription option to buy the Special Needs Trust Irrevocable For A Given Period.

- Download the file. Then complete, sign, and print it out.

US Legal Forms has a good reputation and over 25 years of expertise. Join us today and transform form completion into something simple and streamlined!

Form popularity

FAQ

In these circumstances, the Form 1041 is very simple to complete. The trustee will check the box on Form 1041 indicating that the trust is a grantor trust and provide some general information about the trust (name, address, tax identification number, and the date the trust was established).

A Special Needs Trust (SNT) allows for a disabled person to maintain his or her eligibility for public assistance benefits, despite having assets that would otherwise make the person ineligible for those benefits.

A Special Needs Trust must have its own Federal Identification Number (also called an Employer Identification Number, EIN, Tax Identification Number, or TIN) to be valid. This unique number means that the Trust is its own entity, and that it does not belong to anyone but itself.

Irrevocable trust: If a trust is not a grantor trust, it is considered a separate taxpayer. Taxable income retained by the trust is taxed to the trust. Distributed income is taxed to the beneficiary who receives it.

A Special Needs Trust (SNT) allows for a disabled person to maintain his or her eligibility for public assistance benefits, despite having assets that would otherwise make the person ineligible for those benefits. There are two types of SNTs: First Party and Third Party funded.