Special Needs Trust Fidelity

Description

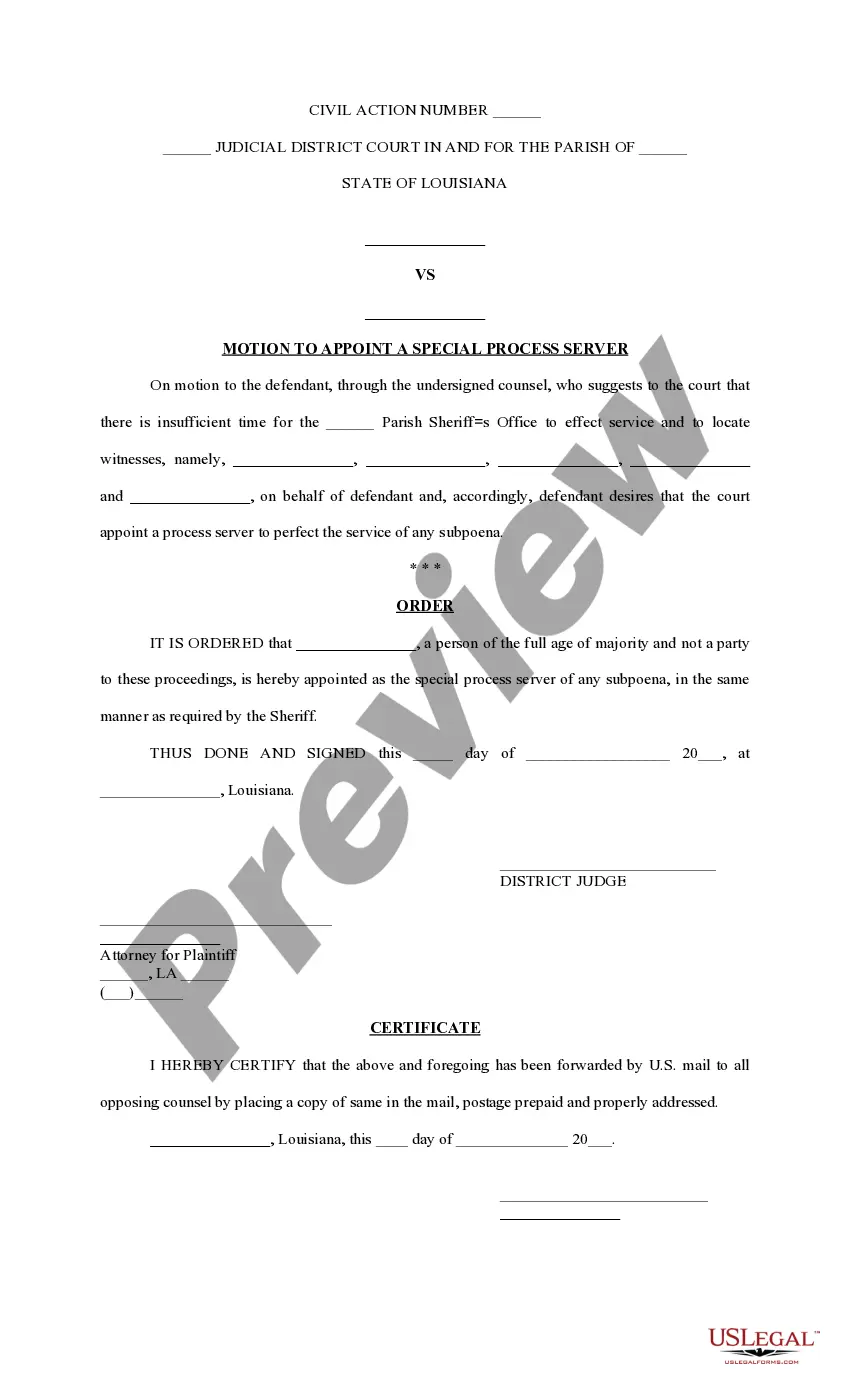

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

- Log in to your US Legal Forms account if you are a returning user. Ensure your subscription is active to proceed with ease.

- If you are new to the service, start by viewing the preview and description of the special needs trust form to confirm it meets your specific needs and complies with local regulations.

- Should you need a different template, utilize the Search feature to find the most appropriate form.

- Once you have selected the correct document, click on the 'Buy Now' button and select your subscription plan. You will need to create an account to access the full library.

- Complete your purchase by entering your payment details, either through a credit card or PayPal.

- After your purchase, download the form to your device. You can also find it later in the 'My Forms' section of your account.

In conclusion, US Legal Forms simplifies the process of establishing a special needs trust fidelity. With their extensive library and support from premium experts, you can ensure that your documents are accurate and compliant.

Start your journey today by visiting US Legal Forms and empower yourself with the tools to protect your loved ones.

Form popularity

FAQ

In a special needs trust, the trust itself is considered the legal owner of the assets, not the beneficiary. This means that the assets held in the trust are managed by a trustee for the benefit of the individual with special needs. This arrangement helps safeguard the beneficiary’s eligibility for government assistance, ensuring they can enjoy the benefits of additional resources while maintaining essential assistance. Utilizing a service like USLegalForms can simplify the creation of a compliant special needs trust fidelity that effectively serves the needs of your loved ones.

The primary difference lies in their respective goals. A standard trust generally facilitates asset management and distribution based on the grantor's wishes. In contrast, a special needs trust is designed with unique provisions to protect and care for beneficiaries with disabilities, ensuring they can receive support without losing crucial public assistance. Knowing the difference can guide you in choosing the right structure, and platforms like USLegalForms can help in creating a compliant and effective special needs trust fidelity.

A standard trust serves a general purpose of managing assets, while a special needs trust specifically benefits individuals with disabilities without jeopardizing their eligibility for government assistance. The special needs trust fidelity includes specific provisions that tailor asset distributions to enhance the beneficiary's quality of life without affecting their eligibility for vital benefits. This distinction is key for families who want to secure a financial future for loved ones with special needs.

One potential disadvantage of a special needs trust is the complexity involved in setting it up and managing it. These trusts require careful drafting to ensure compliance with regulations, which can be time-consuming and may require professional assistance. Additionally, if not properly managed, there might be a risk of losing government benefits, which could significantly impact the beneficiary’s financial situation. Understanding these issues is crucial when considering a special needs trust fidelity.

Filing taxes for a special needs trust involves specific rules that differ from personal income tax filings. Trusts are typically required to file their own tax returns using IRS Form 1041. It's wise to seek guidance from tax professionals familiar with special needs trust fidelity to ensure compliance and optimize tax outcomes.

A special needs trust can act as a qualified disability trust under specific conditions. This type of trust allows beneficiaries to maintain eligibility for government benefits, while still enjoying trust assets. Understanding the nuances of special needs trust fidelity can help you navigate these regulations effectively.

Setting up a trust for your special needs child involves several key steps. Start by consulting a qualified attorney who specializes in estate planning and special needs trust fidelity. They can help you design a trust that meets all legal requirements and properly addresses your child’s future needs.

Yes, individuals can create a special needs trust for their own benefit, but it's vital to follow legal protocols. A self-created trust can help manage assets while preserving your eligibility for vital public benefits. Consult specialists in special needs trust fidelity to ensure compliance with legal requirements.

Absolutely, you can fund your own special needs trust, but you need to adhere to specific legal guidelines. This type of trust is designed to enhance the quality of life for individuals with disabilities without jeopardizing their eligibility for government benefits. Be sure to explore the aspects of special needs trust fidelity to maximize your funding strategy.

Yes, individuals can establish a trust fund for their own benefit, but it's crucial to consult with an expert. Setting up a personal trust allows for greater control over assets and supports future planning. Ensure that you consider the unique features of special needs trust fidelity, especially if you plan to provide for others.